DSCR Loan

What Is a DSCR Loan?

A DSCR loan is a type of commercial loan that is based on the Debt Service Coverage Ratio (DSCR).

The DSCR is a financial ratio that is used to determine a company’s ability to repay its debt obligations. The DSCR loan is typically used by businesses that are looking to finance their expansion or growth and is especially common in commercial real estate.

The DSCR loan is calculated by dividing a company’s net operating income by its total debt payments.

The resulting number is then multiplied by 100 to get the DSCR percentage. A company with a DSCR of 1.0 or higher is generally considered to be capable of repaying its debts, as income at least matches the debt.

What Is the Debt-Service Coverage Ratio (DSCR)?

The debt-service coverage ratio (DSCR) is a financial metric used to assess a company’s ability to service its debt obligations. The ratio is calculated by dividing a company’s annual cash flow from operations by its total debt payments.

A high DSCR indicates that the company has enough cash flow to comfortably make its debt payments, while a low DSCR may indicate that the company is struggling to meet its debt obligations.

The DSCR is an important metric for lenders and investors, as it provides insight into a company’s ability to repay its debts.

A high DSCR indicates that the company is in good financial health and has a lower risk of defaulting on its debt obligations.

A low DSCR, on the other hand, may indicate that the company is struggling to generate enough cash flow to meet its debt obligations, and may be at a higher risk of default.

When assessing a company’s DSCR, it is important to compare it to other companies in the same industry. This will give you a better idea of how the company’s DSCR stacks up against its peers.

A company with a high DSCR relative to its peers may be considered more creditworthy than a company with a low DSCR.

The DSCR is just one factor that lenders and investors will consider when assessing a company’s creditworthiness.

Other factors include the company’s history of profitability, its ability to generate cash flow, and its overall financial health.

Advantages of a DSCR Loan

One of the main advantages of a DSCR loan is that it can help a company to obtain financing when it might not otherwise be able to do so.

This is because the DSCR loan is based on a company’s ability to repay its debts, rather than its credit score.

The DSCR loan is based on net operating income, rather than just revenue (what some call gross income).

Overall, the advantages of a DSCR loan include:

- A DSCR loan provides access to capital that might otherwise be unavailable.

- They can help improve cash flow by providing funds when they are needed most.

- DSCR loans can help improve the efficiency of a company’s operations by providing working capital to finance growth or expand inventory.

Disadvantages of a DSCR Loan

One of the disadvantages of a DSCR loan is that it can be difficult to obtain financing if a company’s DSCR is low.

This is because lenders may view a low DSCR as an indication that a company is not capable of repaying its debts.

Another disadvantage of a DSCR loan is that it can be expensive. This is because the interest rate on a DSCR loan is typically higher than the interest rate on a traditional loan.

Overall, the disadvantages of a DSCR loan include:

- High interest rates

- DSCR loans can be difficult to obtain if used to finance something that doesn’t cash flow immediately

- Can be expensive to obtain when including fees

Can an Individual Get a DSCR Loan?

Yes, DSCR loans are available to individuals. However, they are typically used by businesses. (Individuals can structure themselves as a business.)

Nonetheless, DSCR loans are often used by members of single-member LLCs (and analogous legal entities outside the United States) when their adjusted gross income (AGI) is too low and prevents them from getting a traditional mortgage or other types of loans.

Many LLCs write their income down to lower levels by recognizing expenses, which may preclude them from getting a loan in the same way a salaried employee (with few write-off opportunities) might more easily qualify.

A DSCR loan basically ignores traditional gross income and instead focuses on the ability to service debt.

For example, in the case of a mortgage, if an individual who owns an LLC needs to borrow such that payments come out to $2,000 per month and comparable units rent for $2,200 per month, then he or she could potentially get approved for a DSCR loan given the cash flow from the rent could cover the monthly mortgage payments.

How to Get a DSCR Loan

There are a few different ways to get a DSCR loan. One way is to work with a lender that specializes in DSCR loans. Another way is to work with a traditional lender, such as a bank, and simply request a DSCR loan.

It is also possible to get a DSCR loan through the Small Business Administration (SBA). The SBA offers several different programs that can help small businesses obtain financing.

One of these programs is the 7(a) Loan Program. This program provides loans of up to $5 million for businesses that meet certain eligibility requirements.

Overall, to qualify for a DSCR loan, borrowers must have a strong credit history and a healthy cash flow. Borrowers must also have a down payment of at least 20 percent.

DSCR loans are available from a variety of lenders, including banks, credit unions, and online lenders. Borrowers should shop around to find the best interest rate and terms for their loan.

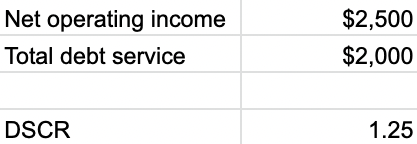

Formula and Calculation for Debt-Service Coverage Ratio (DSCR)

DSCR is a calculation of net operating income minus certain operating expenses, then divided by the total debt service.

DSCR = Net operating income / Total debt service

Net operating income is a company’s revenue minus certain operating expenses, not including taxes and interest payments. This is often considered the equivalent of EBIT.

Total debt service includes all interest payments, principle payments, and lease payments.

Total Debt Service = (Interest × (1−Tax Rate)) + Principal

Why is the DSCR calculation important?

The DSCR calculation is important for two primary reasons.

First, it’s a key financial ratio that lenders look at when considering whether or not to give a company a loan.

Second, it’s used in the underwriting process for commercial real estate loans.

When lenders are considering whether or not to give a company a loan, one of the things they’re looking at is the DSCR. The DSCR gives them an idea of how well the company is able to cover its debt obligations.

A higher DSCR means that the company has more income available to cover its debt obligations.

This is generally seen as being more favorable from a lending perspective.

Conversely, a lower DSCR indicates that the company has less income available to cover its debt obligations. This is generally seen as being less favorable from a lending perspective.

For this reason, it’s important for companies to have a strong DSCR if they’re looking to get a loan.

In the underwriting process for commercial real estate loans, DSCR is used as one of the key financial ratios that lenders look at.

This is because DSCR can give lenders an idea of how well the property will be able to generate enough income to cover the loan payments.

A higher DSCR means that the property is more likely to generate enough income to cover the loan payments. This is generally seen as being more favorable from a lending perspective.

Conversely, a lower DSCR means that the property is less likely to generate enough income to cover the loan payments. This is generally seen as being less favorable from a lending perspective.

For this reason, it’s important for properties to have a strong DSCR if they’re looking to get a loan.

How to Calculate DSCR Using Excel

To calculate DSCR in Excel, find what net operating income is and have that placed in one cell.

Then find what total debt service is and put that in another.

Make sure units match up. For example, if using monthly figures, use monthly net operating income and compare that against monthly debt service.

Then divide the two to find the DSCR ratio.

How to Improve DSCR

There are a few different ways to improve your DSCR.

One way is to increase your net operating income. This can be done by increasing revenue or decreasing expenses.

Another way is to decrease your total debt service. This can be done by paying off some of your outstanding loans or by renegotiating the terms of your loans.

Finally, you can also improve your DSCR by increasing the value of your assets. This can be done by investing in capital improvements or by selling some of your assets.

No matter which method you choose, improving your DSCR is an important step in securing financing for your business.

What Debt-Service Coverage Ratio (DSCR) Tells You

Your DSCR is a financial ratio that measures your ability to repay debt.

To calculate your DSCR, divide your annual net operating income by your annual debt payments.

A high DSCR indicates that you have plenty of income to make your debt payments, while a low DSCR suggests that you may have difficulty affording your debt payments.

Lenders typically like to see a DSCR of 1.5 or higher, which means that you have 50 percent more income than you need to make your annual debt payments.

Although a high DSCR is usually a good thing, it’s important to remember that it’s only one factor that lenders will consider when determining whether or not to give you a loan.

Other factors that lenders may take into account include your credit score, income, and employment history.

If you’re thinking about taking out a loan, it’s a good idea to check your DSCR beforehand to see if you’re likely to be approved.

Real-World DSCR Example

Assume a real estate developer wanted to buy a property for $1,000,000.

The developer projects that the property will generate $120,000 in net operating income each year. The developer also has a loan of $800,000 ($200,000 down) with an interest rate of 5 percent and a term of 30 years.

To calculate the DSCR, we would divide the projected annual net operating income by the annual debt payments. In this case, the debt payments would be about $51,600 per year. This gives us a DSCR of 2.3 ($120,000 / $51,600).

A DSCR of 2.3 means that the property is expected to generate 2.3 times more income than what is needed to make the annual debt payments. This is generally seen as being a very strong DSCR and would likely be viewed favorably by lenders.

Interest Coverage Ratio vs. DSCR

It’s important to note that the DSCR is not the same as the interest coverage ratio (ICR).

The ICR measures your ability to make the interest payments on your debt, while the DSCR measures your ability to make all of your debt payments (interest and principal).

The ICR is calculated by dividing your net operating income by your interest expenses.

A high ICR indicates that you have plenty of income to cover your interest payments, while a low ICR suggests that you may have difficulty affording your interest payments.

Lenders typically like to see an ICR of 3 or higher, which means that you have 3 times more income than you need to make your annual interest payments.

While the DSCR and ICR are similar, they are not the same. The DSCR is a more comprehensive measure of your ability to repay debt as it includes principal as well as interest, which is why it’s usually given more weight by lenders.

Is a DSCR Loan a Commercial Real Estate Loan?

DSCR loans are often used in commercial real estate transactions, but they can also be used for other purposes.

A DSCR loan is a type of loan that is based on the cash flow of the borrower.

This means that the lender will look at the borrower’s ability to make payments on the loan and will use this information to determine whether or not to approve the loan.

The lender will also look at the property’s value and the borrower’s credit history when making a decision on whether or not to approve the loan.

DSCR vs. CADS (Cash Available For Debt Service)

CADS refers to the cash flow that is available to make debt payments. This is different from DSCR, which only looks at the cash flow of the borrower.

CADS loans are typically used for investment properties and businesses.

The lender will look at the property’s value, the borrower’s credit history, and the property’s cash flow when making a decision on whether or not to approve the loan.

DSCR vs. LTV (Loan To Value)

LTV is a ratio that is used to determine how much money can be borrowed against a property.

The higher the LTV, the more money that can be borrowed.

The lender will look at the property’s value as well as the borrower’s credit history when determining whether to approve the loan.

DSCR Pros and Cons

There are both pros and cons to using a DSCR loan.

Pros

Some of the pros include:

- The borrower can get approved for a loan even if they have bad credit.

- The borrower can get a lower interest rate if they have good credit.

- The loan is based on the cash flow of the borrower, so it is easier to qualify for than other loans.

Cons

Some of the cons of using a DSCR loan include:

- The borrower may have to put down a larger down payment than with other loans.

- The borrower may have to pay a higher interest rate if they have bad credit.

DSCR Loan – FAQs

What is DSCR?

DSCR stands for debt-service coverage ratio.

It is a financial ratio used to determine whether a borrower has enough income to make their loan payments.

What is a good DSCR?

There is no hard and fast rule, but generally speaking, a DSCR of 1.2 or higher is considered good, though some will also throw out figures of 1.5 or just 1.0.

This means that the borrower has enough income to cover their debt payments, with some wiggle room for unexpected expenses when above 1.0.

A DSCR of 2.0 would be considered very good and quite conservative if a lender required it.

How do I find DSCR? How is DSCR calculated?

DSCR is calculated by dividing a borrower’s annual net operating income (NOI) by their total annual debt payments.

Why is DSCR important?

DSCR is important because it gives lenders an idea of a borrower’s ability to repay their loan.

A high DSCR indicates that the borrower is able to comfortably make their debt payments, while a low DSCR indicates that they may struggle to do so.

What are the consequences of a low DSCR?

A low DSCR can lead to higher interest rates, bigger down payments, or even a denial of financing altogether.

Lenders want to see a high DSCR because it means that the borrower is less likely to default on their loan.

How can I improve my DSCR?

There are a few ways you can improve your DSCR:

1) Increase your income: This can be done by finding a new job, more work, or by getting a raise at your current job.

2) Decrease your expenses: This can be done by cutting back on discretionary spending or finding ways to save money on your fixed expenses.

3) Pay down your debt: This will lower your annual debt payments and, as a result, improve your DSCR.

4) Refinance your debt: This can help you get a lower interest rate and/or extend the terms of your loan, which will lower your monthly payments and improve your DSCR.

Summary – DSCR Loan

The DSCR is a financial ratio that measures your ability to repay debt.

To calculate your DSCR, divide your annual net operating income by your annual debt payments.

A high DSCR indicates that you have plenty of income to make your debt payments, while a low DSCR suggests that you may have difficulty affording your debt payments.

Lenders typically like to see a DSCR of 1.5 or higher, which means that you have 50 percent more income than you need to service your annual debt payments.

Even though a high DSCR is usually a good thing, it’s important to remember that it’s only one factor that lenders will consider when determining whether or not to give you a loan.

A DSCR loan can be a good option for businesses that are looking to finance their expansion or growth.

This is because the DSCR loan is based on a company’s ability to repay its debts, rather than net income or its credit rating (or credit score in the case of a person).

However, there are some disadvantages of a DSCR loan, such as the fact that it can be difficult to obtain financing if a company’s DSCR is low.

Additionally, the interest rate on a DSCR loan is typically higher than the interest rate on a traditional loan.

If you are thinking about getting a DSCR loan, be sure to talk to a financial advisor to see if it is the right option for you.

Related