DCFX Review 2024

Awards

- Best Trade Execution 2020 - Global Forex Awards

Pros

- The broker offers raw spread accounts with forex spreads from 0.0 pips, high leverage for experienced investors and zero commission trading available

- UK traders will benefit from top-tier FCA regulation, with access to the Financial Services Compensation Scheme and negative balance protection

- The news section at DCFX is comprehensive, with a real-time feed featuring articles and videos from top-tier sources including Bloomberg and Yahoo Finance, as well as an economic calendar

Cons

- It’s a shame that the broker’s overall market coverage is quite narrow for global clients, with even fewer assets available for UK clients

- I’m disappointed that the global branch is unregulated, meaning clients won’t have the same financial protections as those registering with the FCA-regulated branch

- Raw spreads are only accessible to experienced or professional clients who can afford the higher minimum deposit requirements

DCFX Review

DCFX, formerly KVB Prime, is a forex and CFD broker. The brand offers 80+ instruments on the MetaTrader 5 platform and proprietary mobile app. This review will cover how to register for a DCFX account, service charges, payment methods, customer care helpline numbers, no-deposit bonuses, and more.

Key Takeaways

- DCFX Europe is regulated by the FCA, which is a promising sign. However, DCFX Global is unregulated

- The brokerage offers trading on MetaTrader 5 alongside a user-friendly proprietary app

- The range of instruments and trading fees are not as competitive as some alternatives

Company Details

KVB Prime was established in 2014 and has headquarters in Manchester, UK. However, in 2023, the firm rebranded as DCFX Europe Limited and began introducing new trading tools and innovative products to suit retail investors of all experience levels. The new owners also have plans to introduce a fresh liquidity provider to bolster its offering.

The broker specializes in leveraged CFD and currency trading with innovative technology and professional investment services.

DCFX Europe Limited is regulated by the UK Financial Conduct Authority (FRN 622574).

Trading Platforms

MetaTrader 5

The broker offers MetaTrader 5. Traders can download MT5 to a desktop device or use it directly through major web browsers. All you need is a stable internet connection.

Used by millions of retail investors each day, the platform supports traders of all skill levels with technical analysis tools, access to expert advisors (EAs), and live signals.

MT5 also offers a user-friendly interface meaning you can view all features within one screen. This includes real-time price quotes, dozens of graphical objects, and various technical indicators.

How To Place A Trade

- Open the MT5 platform

- Select ‘tools’ from the menu along the top and then ‘new order’

- A pop-out window will then appear

- Select the symbol of the asset you want to trade from the drop-down list

- Select the type of order – pending order or instant execution

- Add the order volume

- Add stop-loss or take-profit risk management parameters

- Input any additional trade comments

Assets & Markets

DCFX offers 80+ instruments:

- 7 global index CFDs such as FTSE 100, NASDAQ 100, and S&P 500

- 25+ major and minor currency pairs including EUR/USD, GBP/JPY, and USD/CAD

- Take positions on Gold, Silver and Crude Oil prices

Cryptocurrency trading and stocks are also available to global traders.

Spreads & Fees

Day traders can expect fixed or floating spreads depending on account type. These vary by instrument and will fluctuate, particularly during times of volatility.

Spreads generally start from 1.2 pips with the Standard account. However, when we used DCFX, we were offered spreads of 0.5 pips on the EUR/GBP currency pair and 0.8 pips on the USD/SGD pair. The FTSE 100 and NASDAQ 100 were both offered at 2.2 points.

Traders who qualify for the Zero account can also access 0.0 pip spreads. Note, account access may vary depending on your location.

Swap fees are also charged for overnight positions.

DCFX Leverage

Leverage varies between instruments and trading entities.

Day traders using the services of DCFX can access leverage up to 1:30. This is in line with the FCA’s restrictions that protect retail customers against significant losses.

DCFX global offers higher leverage, with up to 1:1000 available for major currency pairs.

- Cryptocurrencies – Up to 1:10

- Shares – Up to 1:40

- Indices – Up to 1:100

- Commodities – Up to 1:500

- Currency Pairs – Up to 1:1000

Mobile App Review

DCFX offers a proprietary mobile app, available to download on Android and iOS devices.

Day traders can open and close positions, manage their account and view market analysis while on the go. Users can also access customer support, the latest market news, and an in-built economic calendar. Other features include:

- One-click trading

- Customizable charts

- Price notification alerts

- View full trading history

When we tested the mobile app on an iOS device, we were disappointed with the load speed and broken links. We were presented with several server errors, meaning it was difficult to navigate and explore trading instruments.

The MetaTrader 5 terminal is also available as a mobile application. It offers access to all the trading features offered on the desktop platform including technical indicators, customizable charts, and real-time price quotes.

Payment Methods

Deposits

You can deposit to a DCFX live trading account with e-wallet solutions, bank wire transfers, and credit/debit cards. You can also link a bank account for quicker and easier subsequent funding.

The broker accepts deposits in USD, EUR, or GBP currencies though all account activities will be operated in US Dollars. DCFX does not charge any fees for deposits, however, currency conversion charges will apply for payments made in currencies other than US Dollars.

Most payment methods offer same-day funding.

There is a $100 minimum deposit requirement. However, UK traders will need to make a $2000 minimum payment which is high vs competitors.

Withdrawals

There are no fees imposed by the broker to remove funds from a live trading account, however, third-party charges may apply.

DCFX has a minimum withdrawal limit of $100, but any withdrawal requests below this amount can be requested on the 10th of each month.

Withdrawals take between three to five working days to be processed. Next-day payments can also be requested, though a $50 fee applies.

Demo Account

The broker offers a demo account for prospective clients to test the services offered.

You will need to create an account with DCFX to access the demo account. Register using an email address and phone number. From the client dashboard, you can then open the paper trading profile.

The DCFX demo account is active for one month after registration.

Deals & Promotions

DCFX Europe does not offer bonus incentives to new or existing day traders. This includes no-deposit bonuses.

The Financial Conduct Authority does not permit brokerage firms to use financial rewards to entice retail customers.

For clients registering with the global entity, there is a 50% welcome bonus for all deposits above $200 within 7 days from your first deposit.

Regulation & Licensing

DCFX Europe Limited is registered in the United Kingdom. The broker is authorized and regulated by the Financial Conduct Authority (FCA) with firm reference number 622574.

The FCA is a highly-regarded financial institution, with stringent rules for all firms. Customers benefit from segregated client funds and negative balance protection. AML and KYC compliance is also adhered to so you will need to provide identity verification documents.

The global entity; KVB Prime Limited, is incorporated in Samoa. There is no regulatory oversight for this subsidiary, therefore, the levels of customer protection and access to compensation schemes will be limited vs the UK subsidiary. Note, the global entity is also being merged with DCFX, so registration details may change.

Additional Features

Educational materials are available, however they are limited to a basic forex glossary of key terms and trading guides for beginners, including how to understand forex charts and what are technical indicators. There is limited content for more experienced investors.

On a positive note, the broker offers an excellent market news section with live updates via articles and videos from Bloombery and Yahoo Finance. There’s also an economic calendar.

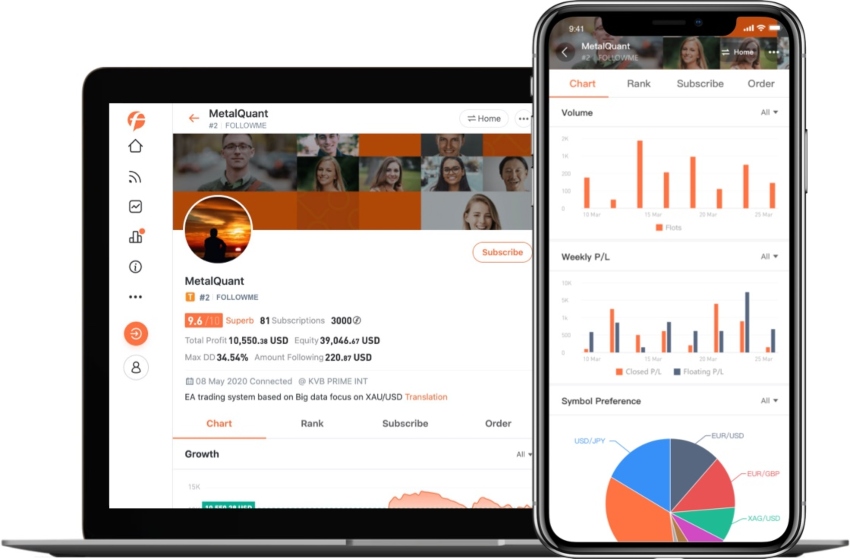

DCFX also offers copy trading. Users can view the growth, volume and profit and loss of potential investors. Traders can then subscribe to copy the signals and strategies of other clients. Note, access to copy trading may vary based on your location.

Accounts

UK traders can sign up for the Standard account or Zero account. Both accounts have a $2000 minimum deposit, market execution and on-hand customer support. However, the Standard account offers pips from 1.2 pips and 1:30 leverage while the Zero profile has spreads from 0.0 pips and 1:100 leverage.

DCFX offers one live account for retail traders signed up with the global brand. The profile offers floating spreads, market execution, a minimum trade size of 0.01 lots, and leverage up to 1:1000 (global entity only). The minimum deposit requirement is $30, which is suitable for beginners. The broker only accepts US Dollar account denominations.

KVB Prime also offers an ECN account, however this is aimed at professional investors and has a minimum deposit requirement of $3000.

How To Open An Account

To register for a new DCFX account, follow the ‘Visit’ link at the top or bottom of this review. Alternatively, download the proprietary app.

Complete the required details including country of residency and email address. You will then need to verify your account using a code sent to your registered email address.

Once you have logged in, open a live trading account from the client dashboard.

Trading Hours

According to the broker’s schedule, currency pairs can be traded Monday to Friday from 6:01 AM to 5:59 AM (GMT +8). UK Oil, on the other hand, can be traded from 8:06 AM to 4:59 AM Monday to Friday (GMT +8).

The DCFX server time operates on GMT + 8. You can view the published trading hours via the product tab on the broker’s website/mobile app.

Customer Service

DCFX offers a 24/5 live chat service, although there is no telephone number. Additionally, day traders can email the broker at: cs@dcfx.com, support@kvbprime.com, or use the online contact form via the website.

The FAQ section is relatively limited and the help center does not offer working links to step-by-step account opening guides, how to activate accounts, or support for why the app is not working.

Security & Safety

We did not come across any additional security measures when we used the broker’s trading platform. This includes biometric logins or two-factor authentication (2FA).

The MetaTrader brand, however, does take user safety seriously. All data exchanges between the client terminal and the MT5 platform are encrypted. The platform also supports the use of RSA digital signatures which is a suite of algorithms used to secure sensitive information.

DCFX Verdict

DCFX offers several asset classes through a straightforward live account. Regulation of the UK entity is also reassuring.

However, there are downsides to trading with DCFX. The limited educational materials and advanced tools are one drawback. The range of assets is also a lot smaller than most competitors.

FAQs

Is DCFX Regulated?

DCFX is authorized and regulated by the UK Financial Conduct Authority (FCA). The global entity, KVB Prime Limited, is registered in Samoa but is not currently regulated by a reputable financial body.

Does DCFX Have A Mobile App?

Yes, DCFX has a proprietary mobile app available for free download to iOS and Android devices. Day traders can access all the features of the web trader terminal from a handy app anytime, anywhere.

How Can I Contact DCFX For Trading Account Queries?

DCFX offers an email address (cs@dcfx.com or support@kvbprime.com) and an online contact form. Additionally, the broker has a live chat service that can be accessed via the website or on the mobile app. There is no telephone helpline number.

What Account Currencies Does DCFX Accept?

Clients can trade in US Dollars only. DCFX accepts deposits in USD, EUR and GBP, however you may be liable for currency conversion fees.

Does DCFX/KVB Prime Offer Global Trading Services?

DCFX/KVB Prime does not offer services to residents of the US, Canada, the European Union, Hong Kong, Australia, or Japan. Traders in Asian countries including Vietnam, Malaysia, and Thailand, however can sign up.

Head to our full review of DCFX, formerly KVB Prime, for accepted and restricted countries.

Top 3 Alternatives to DCFX

Compare DCFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

DCFX Comparison Table

| DCFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Commodities, Shares, Indices, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $30 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (UK Standard), 1:100 (UK Zero), 1:1000 (Global) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by DCFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| DCFX | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

DCFX vs Other Brokers

Compare DCFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of DCFX yet, will you be the first to help fellow traders decide if they should trade with DCFX or not?