Day Trading Simulator: Try2BFunded Stock Trading

Some day trading simulator products on the market combine demo trading with the upside of being granted your own trading capital if you are able to profit while managing risk at the same time within their system.

If you want to learn how to trade, or do have experience but want to try a new system or strategy that hasn’t been well stress-tested, it’s best to try in a simulated environment. You might feel inclined to dive in head first, but it’s a bad idea. You will make a lot of mistakes and you don’t want to lose a lot of money trading your own capital during this process.

For a relatively small fee, you will get trading experience and could obtain the opportunity to trade somebody else’s money if you can prove yourself in a simulated environment.

Let’s take a look at one popular stock trading simulator product on the market currently.

Try2BFunded

As the name implies, Try2BFunded is a trading simulator where traders work through a demo trading environment to try to become funded with external capital.

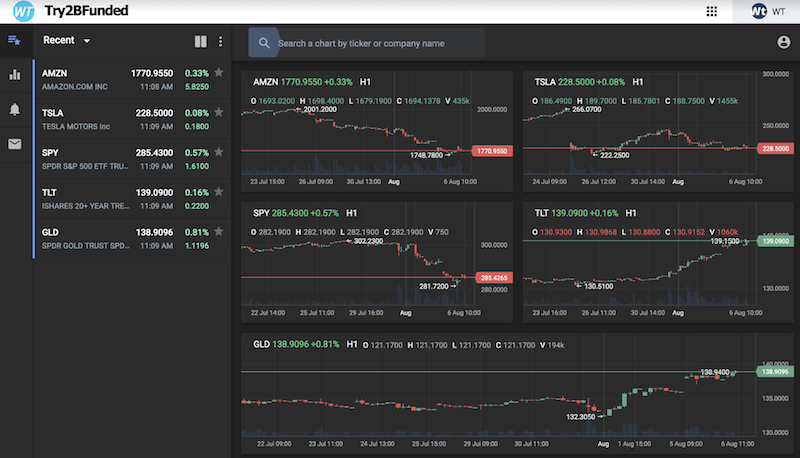

Try2BFunded is sponsored by Just2Trade Online Ltd, and gives access to stocks, exchange-traded funds (ETFs), and ADRs on the US, UK, and German exchanges. It was launched in August 2019.

If you pass both official demo stages, you will have a funded, real-money account to trade.

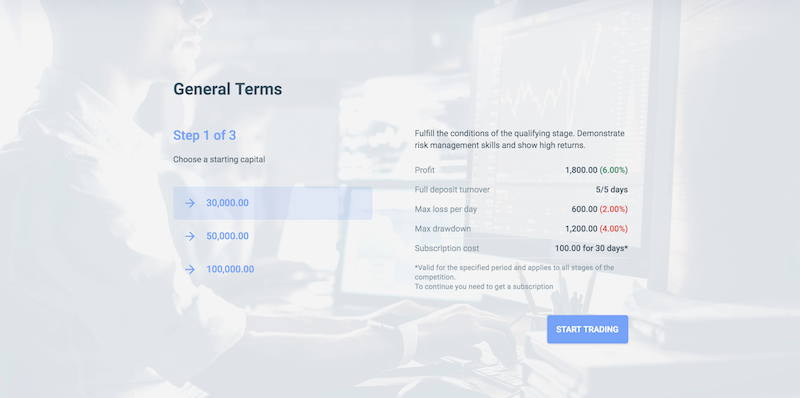

From the beginning of the program, there is a two-week free trial called “Stage 0”. This allows you to select an account size – USD$30,000, $50,000 or $100,000 and try out the program to decide if it’s right for you.

The Process

1. You can sign up through the Try2BFunded intro page by selecting a starting account size.

On this page, it’ll give a list of requirements for each stage. This includes profit needed, number of days of starting account balance turnover, maximum loss per day, maximum drawdown, and the cost of the subscription.

2. It’s required that you pass two demo (“paper trading”) stages.

3. Get access to the funded, real-money account. The amount of money given to a trader will be equal to the amount chosen to participate during Stage 2.

The Rules

The stages have profit and drawdown requirements.

1. Must meet a 6 percent profit target in each stage. There is no time limit.

2. On the qualifying stages, one cannot have more than a 2 percent daily loss (based on the previous day’s close), 2 percent weekly loss, or 4 percent maximum drawdown from the starting capital balance.

On the real-money account, the single risk parameter is a 4 percent overall loss relative to the starting capital balance.

3. Must turnover one’s account balance once per day for five days on Stage 1 and the same for ten days on Stage 2.

That means for Stage 1, if you are on a $100k account, you must trade in $100k of volume in five different days – buying and selling at least $100k worth of securities each day. This requirement increases to $100k of trade volume in ten different days for Stage 2.

There is no subsequent turnover requirement for the real-money accounts. But this also means that it requires a minimum of at least 15 trading days to qualify for a funded account.

4. If you are stopped out of a stage or real-money account by exceeding the maximum drawdown or daily/weekly loss threshold, the program will return to the beginning of Stage 1.

Getting access to the real-money account requires not just making a profit, but also closely managing risk and avoiding significant drawdowns.

Pros and Cons of Try2BFunded

Pros

1. You do not risk your own money or savings during the qualifying stages.

Instead, there is a subscription fee to the program, which is charged monthly (technically, every 30 days). This covers data fees, support and internal costs, and the benefits of getting to use external capital at no risk to the trader if one advances to a funded account.

This applies to both the qualifying stages and funded, real-money account. It also covers all movement between stages; there is no extra fee for advancing a stage or being reset back to Stage 1. It is always good for 30 days.

The subscription model is as follows:

– $100 per month for the $30,000 account

– $150 per month for the $50,000 account

– $300 per month for the $100,000 account

2. It is solely based upon your performance. Anyone can be accepted into the program. There is no screening, filtering, or interview process as there would be for prop trading firms. You simply have to pass the two stages to get to the real-money account.

3. Provides access to a professional trading platform with real price quotes.

4. Trading statistics to track your performance are available at any point in time.

5. No capital contributions are required by the trader, unlike what is relatively common if one were to trade through a prop trading firm.

Cons

1. Account sizes go up to only $100k. But it’s relative. $100k might be a lot or sufficient for some but not much for others.

2. Does not include commodities, currencies, fixed income, rates, or non-US/UK/German equities unless you want to trade the ETF equivalents (in cases where they exist).

3. Some stocks are not available to trade on the platform. These are predominantly smaller, speculative stocks. With the incentives being what they are – the trader has all the upside while the sponsoring broker bears the capital risk – certain stocks are excluded from the platform due to this asymmetry. This avoids the risk of traders placing rogue bets that would represent a large potential liability to the broker.

Economics of the program for the trader

There is a 60 percent / 40 percent trading profit split in favor of the trader. (This is better than most trading fee structures where the trader often earns only 10-30 percent of the profits made, and may include a hurdle rate, while the entity providing the external capital retains 70-90 percent.)

In other words, upon a withdrawal request, for every $1,000 in profit made by the trader on the funded, real-money account, $600 would be distributed to the trader and $400 retained by Try2BFunded.

Accordingly, the economics of the program for the trader are as follows:

Profit (annual) = [Account size * (1 + percent annual return)) – account size] * 0.6 – (12 * monthly fee) – monthly fees incurred during qualifying stages – transaction costs from funded account

Off a $30k account, if you get to the funded stage, the per-month fee comes to an annual rate of 4 percent of the starting capital balance (12 months * $100 per month divided by $30,000).

Off $50k and $100k, the per-month comes to 3.6 percent of the starting capital balance as an annual rate.

The annual breakeven return for the trader on the $30k account is 6.7 percent (4 percent divided by 0.6, given 60 percent is kept by the trader and 40 percent is retained by Try2BFunded), excluding trading commissions associated with the funded account.

The annual breakeven for the trader on the $50k and $100k accounts is 6.0 percent.

Do they offer discounts?

At this time, no.

With the economics of the program as they are, if you can generate 6 percent or more in profits each year, you will do breakeven or better.

For example, if you make 25 percent per year, keeping 60 percent of the profits based on the split shared with Try2BFunded, that’s 15 percent, or $15,000 off a $100,000 account. Based on the total monthly fees paid in – $3,600 based on 12 x $300 – that’s a 4.2x return on your money.

If you were to do that with your own money, that 25 percent return would be only a 0.25x return on your money, or a relatively small fraction of what you might have made otherwise. This illustrates the effects of leveraging external capital to help you achieve your goals and make more than you might be able to independently.

Moreover, using your own capital you would bear all the risk, whereas using outside capital, another entity is effectively bearing your risk for you.

Conclusion

Try2BFunded is day trading simulator. It’s a program where you start out trading in a simulated environment. If you trade well enough, you trade somebody else’s capital. This gives upside beyond basic paper trading, with the possibility of earning up to $100,000 in outside capital.

For a trader that passes both qualifying stages, they pay a relatively small fee relative to the amount of capital they’re getting to trade. It comes to around 0.3 percent per month of the amount they would receive if they were to obtain a funded, real-money account.

One way to think of it is like a 6.0-6.7 percent fixed-rate loan to trade with if you tabulate the annualized fees and split of the profits you get to keep. But the difference is that you don’t have to pay back the principal like you would with a normal loan. The trader is provided a lot upside through this format.

The program would appeal most to traders who focus on trading equities. Those looking for commodities, fixed income, and FX would need to trade the ETF equivalents.