CMC Markets Introduces Options Trading In 150+ Countries

CMC Markets is rolling out commission-free trading on both full and fractional options in select regions. This follows the successful launch of options trading in the UK in 2024.

CMC has also followed brokers like IG and eToro in providing TipRanks analysis, featuring insights, stock ratings and premium research spanning thousands of stocks and ETFs.

Key Takeaways

- Users in over 150 countries, including India, Hong Kong and Kenya, will soon be able to trade CFD options at CMC Markets.

- Options trading will be available with spreads from 0.0 pips, leverage up to 1:200, and 24/5 support.

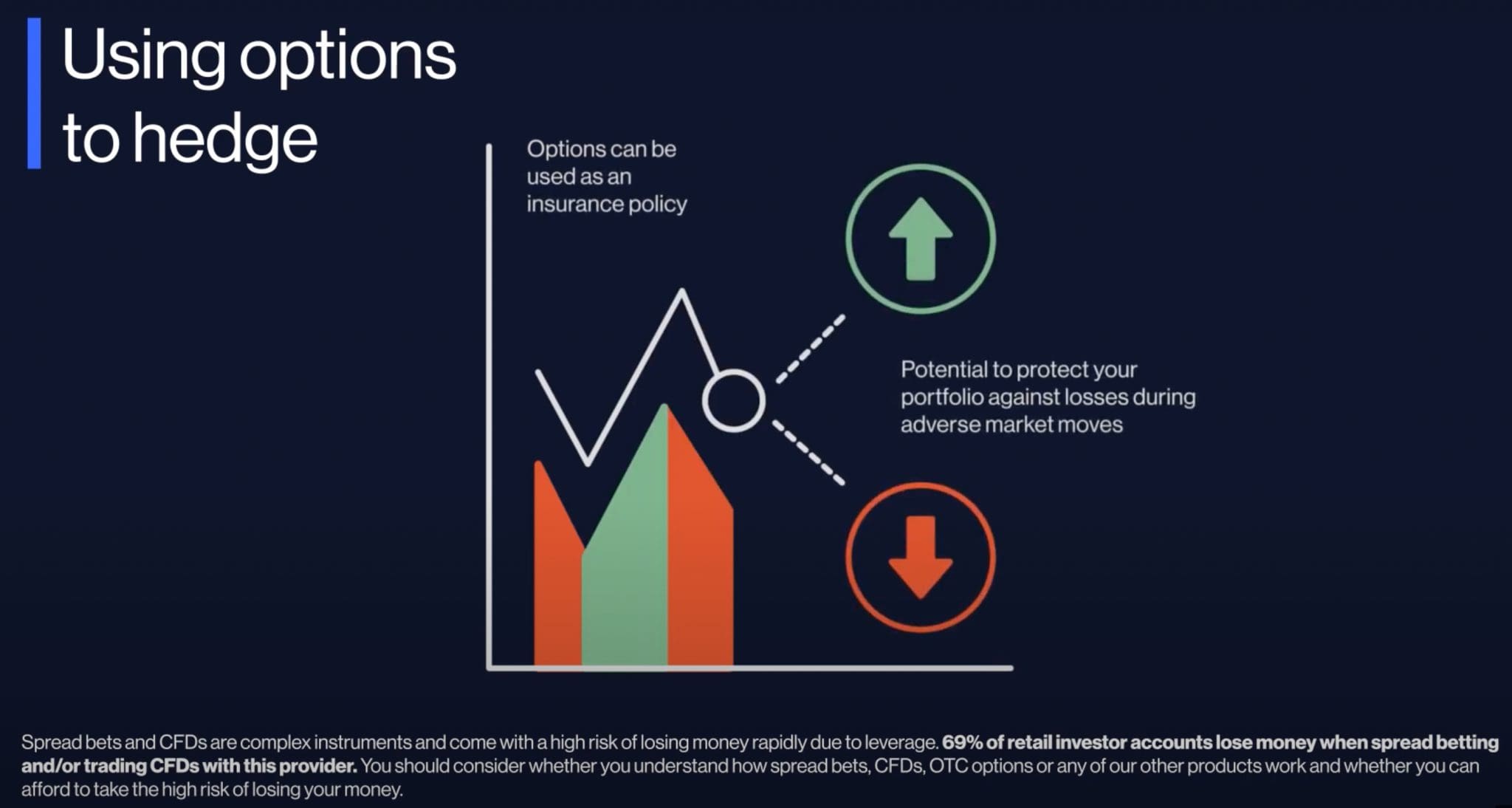

- Options provide flexibility, from hedging against adverse market fluctuations to managing risk with losses capped to the premium.

What Is An Option CFD?

Option CFDs (contracts for difference on options) are a type of derivative that lets you speculate on the price movements of options without owning the underlying option contract.

Here’s a breakdown:

- A CFD is a contract between you and a broker to exchange the difference in the value of an asset (in this case, an option) from when the trade is opened to when it’s closed.

- With option CFDs, you’re trading on the price movements of call or put options (usually on stocks, indices, or other assets), but you don’t own the actual option itself.

About CMC Markets

Founded in 1989 and listed on the London Stock Exchange (LON: CMCX), CMC Markets is a global broker trusted by over 300,000 traders, with oversight from top-tier regulators including the FCA (UK), ASIC (Australia), and CIRO (Canada).

The broker offers access to 12,000+ instruments across CFDs, forex, indices, commodities, ETFs, and now options, with trading via user-friendly platforms like its award-winning web terminal, MT4, and TradingView (added in 2025).

CMC has earned multiple accolades over the years, including DayTrading.com’s Best Trading App 2023.

New traders can open a CMC account with no minimum deposit.