Best Forex Brokers With VPS Services 2024

Brokers with virtual private server (VPS) hosting provide low-latency connectivity with increased speed and reliability, helping you capitalize on trading opportunities. We understand the significance of this edge, and have ranked the best forex brokers offering VPS services, taking into account:

- The required trading volume and balance for free access

- The latency and speed

- The uptime and stability

- The performance

List of Best Forex VPS Brokers

We have reviewed the VPS packages at over 20 brokers and these 5 offer the best solutions:

Best Forex Brokers With VPS Services 2024 Comparison

| Broker | VPS Rating | Platforms | Instruments | Visit |

|---|---|---|---|---|

|

4.8 / 5 |

MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade | CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting | Visit |

|

4.4 / 5 |

MT4, MT5 | Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures | Visit |

|

4.8 / 5 |

MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto | Visit |

|

4.6 / 5 |

MT4, MT5, TradingView | CFDs, Forex, Stocks, Indices, Commodities | Visit |

|

4.2 / 5 |

Exness Trade App, MT4, MT5, TradingCentral | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Visit |

|

4.5 / 5 |

MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral | CFDs, Forex, Stocks, Cryptos, Futures, Options, Commodities | Visit |

|

4.5 / 5 |

R StocksTrader, MT4, MT5, TradingView | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures | Visit |

|

3.7 / 5 |

MT4, MT5 | CFDs, Forex, Stocks, ETFs, Cryptos, Futures, Commodities | Visit |

|

4.4 / 5 |

Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Visit |

|

3.7 / 5 |

MT4, MT5, cTrader, TradingView, AutoChartist | Forex, CFDs, stocks, indices, energies, metals, commodities, cryptos | Visit |

|

4.7 / 5 |

ProTrader, MT4, MT5, TradingView, DupliTrade | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds | Visit |

|

4.7 / 5 |

Web, MT4 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Treasuries, Custom Indices, Spread Betting | Visit |

|

4.5 / 5 |

MT4 | CFDs, Forex, Indices, Commodities, Crypto | Visit |

|

4.5 / 5 |

MT4, MT5, cTrader, TradingView, DupliTrade | CFDs, Forex, Stocks, Indices, Commodities, Crypto | Visit |

|

3 / 5 |

MT4, MT5, TradingView | CFDs, Forex, Stocks, Cryptos, Commodities | Visit |

#1 - Pepperstone

Why We Chose Pepperstone

Pepperstone continues to offer a compelling VPS package for serious traders. Clients get a 25% discount on ForexVPS, offering MT4 integration, 1ms ultra-low latency, 100% uptime guarantee, Expert Advisor installation, and 24/7 support. The broker has also teamed up with New York City Servers to provide a tailored low latency solution for continuous operation, again with a 25% discount for clients.

"Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support."

- DayTrading Review Team

- Instruments: CFDs, Forex, Currency Indices, Stocks, Indices, Commodities, ETFs, Crypto, Spread Betting

- Regulator: FCA, ASIC, CySEC, DFSA, CMA, BaFin, SCB

- Platforms: MT4, MT5, cTrader, TradingView, AutoChartist, DupliTrade

- Minimum Deposit: $0

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (Retail), 1:500 (Pro)

About Pepperstone

Established in Australia in 2010, Pepperstone is a top-rated forex and CFD broker with over 400,000 clients worldwide. It offers access to 1,300+ instruments on leading platforms MT4, MT5, cTrader and TradingView, maintaining low, transparent fees. Pepperstone is also regulated by trusted authorities like the FCA, ASIC, and CySEC, ensuring a secure environment for day traders at all levels.

Pros

- Award-winning customer support is available via telephone, email or live chat with response times of <5 minutes during testing.

- There’s support for a range of industry-leading charting platforms including MT4, MT5, TradingView, and cTrader, catering to various short-term trading styles, including algo trading.

- Now offering spread betting through TradingView, Pepperstone provides a seamless, tax-efficient trading experience with advanced analysis tools.

Cons

- Pepperstone does not support cTrader Copy, a popular copy trading feature built into the excellent cTrader platform and available at alternatives like IC Markets.

- Despite enhancements to its range of markets, crypto offerings are relatively limited compared to other brokers such as eToro, with no option to invest in real coins.

- There’s no simplified proprietary trading platform, nor are there any social trading features, which could be a disadvantage if you are new to day trading.

#2 - XM

Why We Chose XM

XM maintains a top 5 position for its MT4 and MT5 VPS service. For a $28 monthly fee, traders using Expert Advisors (EAs) can enjoy 24/7 uninterrupted connectivity with 2.5GB RAM, 30GB of hard drive capacity and 1vCPU. You can easily connect to the server in 4 quick steps after requesting the IP address from the members' area.

"XM is one of the best forex and CFD brokers we have tested. The flexible account types will suit a variety of short-term trading styles while the $5 minimum deposit and smooth sign-up process make it easy to start trading."

- DayTrading Review Team

- Instruments: Forex, Stock CFDs, Turbo Stocks, Indices, Commodities, Precious Metals, Energies, Shares, Crypto, Futures

- Regulator: ASIC, CySEC, DFSA, FSC, FSCA

- Platforms: MT4, MT5

- Minimum Deposit: $5

- Minimum Trade: 0.01 Lots

About XM

XM is a globally recognized forex and CFD broker with 10+ million clients in 190+ countries. Since 2009, this trusted broker has been known for its low fees on 1000+ instruments. XM is regulated by multiple financial bodies, including the ASIC and CySEC.

Pros

- XM continues to deliver diverse and multilingual educational materials and offers a useful live education schedule for its webinars and insights

- The broker offers premium research including market sentiment, fundamental insights and strategy builders

- Powerful MT4 and MT5 platforms are available with 60+ and 80+ technical charting tools

Cons

- There's $5 inactivity fee after only 3 months, though this won't affect active traders

- PayPal deposits are not supported

- There is weak regulatory oversight through the global entity

#3 - IC Markets

Why We Chose IC Markets

IC Markets offers a superb VPS package for active clients who trade at least 15 lots per month. Day traders can choose between the IC VPS or ForexVPS, which delivers a 100% uptime guarantee with the broker’s live servers in Equinix NY4. Additionally, the 1-millisecond average latency is faster than many competitors.

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto

- Regulator: ASIC, CySEC, FSA

- Platforms: MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade

- Minimum Deposit: $200

- Minimum Trade: 0.01 Lots

- Leverage: 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global)

About IC Markets

IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

#4 - Eightcap

Why We Chose Eightcap

Eightcap offers the high-performance ForexVPS already pre-installed with MT4, so traders can get started straight away. The ForexVPS delivers ultra-fast execution speeds with no downtime to eligible traders who deposit $1000 and trade 5 lots per month thereafter. It takes seconds to fill out the registration form on the broker’s website.

"Eightcap delivers in every area for day traders with a growing selection of charting platforms and AI-powered tools. Now sporting 250+ crypto CFDs and the Crypto Crusher market scanner, it's also become a stand-out choice for crypto trading, winning our 'Best Crypto Broker' award two years in a row."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities

- Regulator: ASIC, FCA, xCySEC, SCB

- Platforms: MT4, MT5, TradingView

- Minimum Deposit: $100

- Minimum Trade: 0.01 Lots

Pros

- With tight spreads from 0 pips, low commission fees, and high leverage up to 1:500 for certain clients, Eightcap provides cost-effective and flexible trading conditions that can accommodate an array of strategies, including day trading and scalping.

- Eightcap stands out with a selection of powerful trading tools, including MT4 and MT5, the innovative algorithmic trading platform Capitalise.ai, and more recently the 50-million strong social trading network TradingView.

- Having excelled across all key areas for day traders, Eightcap outperformed more than 490 competitors to win our 'Best Overall Broker' award for 2024, also securing our 'Best Crypto Broker' title.

Cons

- Despite a useful library of educational guides and e-books, Eightcap still trails IG’s comprehensive toolkit for aspiring traders with its dedicated IG Academy app and 18 course categories.

- The demo account expires after 30 days and can only be extended upon request - a notable inconvenience compared to the likes of XM with its unlimited demo mode.

- Eightcap needs to continue bolstering its suite of instruments to match category leaders like Blackbull Markets with its 26,000+ assets, featuring a particularly weak selection of commodities.

#5 - Exness

Why We Chose Exness

Exness continues to offer a robust VPS solution for MT4 and MT5 users. Minimum balance and volume requirements vary by jurisdiction, but clients will get 2GB RAM, 50GB of disk space and 2 CPUs - ideal for active algo traders running multiple programs. For guidance, the broker’s VPS help centre is very comprehensive.

"Exness remains an accessible broker for all experience levels, though experienced day traders will particularly appreciate the ultra-low commission rates, fast withdrawals and high-quality charting software."

- DayTrading Review Team

- Instruments: CFDs, Forex, Stocks, Indices, Commodities, Crypto

- Regulator: FSA, CySEC, FCA, FSCA, FSC, CBCS

- Platforms: Exness Trade App, MT4, MT5, TradingCentral

- Minimum Deposit: $10

- Minimum Trade: 0.01 Lots

- Leverage: 1:2000

About Exness

Exness is a Cyprus-based forex and CFD brokerage established in 2008. With over 260,000 clients, several awards and reputable licensing, the broker has maintained its position as a highly respected global brand. Active day traders can access the popular MT4 and MT5 platforms, raw spreads and multiple account types.

Pros

- Unlike many other brands, Exness doesn't charge any account maintenance or inactivity fees

- Top-tier licensing with the FCA and CySEC and a strong reputation with over 10 years in business

- There's a strong range of account types for all experience levels and requirements, including Cent, Pro and Raw spread solutions

Cons

- There are no promotional deals or loyalty schemes for high-volume day traders

- Unlike most competitors, Exness doesn't provide its own education section

- There are several regional restrictions for retail traders including the USA, Europe and the UK

How To Compare Forex VPS Brokers

There are several criteria we consider when comparing Forex VPS brokers, and you should too:

Required Trading Volume and Balance

Considering the minimum trading volume and balance requirements to qualify for free VPS hosting is key.

This is because most VPS providers are third-party enterprises that charge users for their services, and while you can find brokers partnered with free VPS providers, this normally comes at a cost that is factored into trading and account requirements.

Our ongoing assessments show that these conditions can vary, with required monthly trading volumes ranging from 0 lots to 30+ lots, and minimum balance requirements ranging from $0 to $5000+.

- Eightcap supports the ForexVPS for clients that deposit $1000 and trade 5 lots per month.

Latency and Speed

When selecting a VPS for trading, prioritizing latency and speed is crucial.

Latency represents the time gap between different points in trading infrastructure, such as your platform and your broker’s server. Opting for a VPS service situated in close proximity, or even co-located within your broker’s server, significantly reduces latency, facilitating faster trade executions.

Our research shows that leading forex VPS brokers offer an average latency of 1 millisecond or less.

- Pepperstone’s VPS package delivers ultra-low latency of approximately 1 millisecond.

Uptime and Stability

Prioritizing uptime and stability is paramount. In markets like forex, where volatility is high, uninterrupted access to your trading account is crucial to avoid potential losses stemming from slippage, power outages, or internet disconnections.

Our analysis underscores that the top forex brokers offering free VPS services ensure an uptime of at least 99.9%, safeguarding against disruptions.

- IC Markets stands out with its VPS package, boasting a 100% uptime guarantee facilitated by the broker’s live servers in Equinix NY4.

Performance

It’s also important to consider performance factors influenced by the technology employed by VPS providers. Virtualization technology splits their resources among several users. If one user has a particularly high workload, this may affect the performance for other users.

To identify VPS brokers with optimal performance, compare factors such as available CPU, RAM, and memory. For those intending to run multiple accounts, prioritizing high CPU and RAM is essential.

Our findings indicate that reputable VPS brokers typically offer a minimum of 1 CPU, 1 GB RAM, and 25 GB HDD.

- IG excels with its VPS service that offers 2.5 GB RAM and 30 GB of disk space.

How To Start Using A VPS

Once you have made your choice, you can get started by following these steps:

- Request approval from your chosen broker to access the VPS service.

- Once the request has been approved, you will receive a username and password that will allow you to connect to the server using a remote desktop application.

- When the connection to the VPS has been secured, you will be directed to a desktop environment entirely like your local computer.

- Log in to your trading platform and execute trades.

Tip: Getting started with a VPS can be daunting. To ensure you are never left in a difficult or financially detrimental position, check the provider offers around-the-clock technical support.

Bottom Line

The rise of online trading and automated strategies has increased the demand for brokers with free VPS services. However, with intense competition, finding the best providers can be challenging.

Start with our list of the cheapest VPS brokers; our experts have evaluated and ranked them, saving you the effort.

FAQ

What Is A VPS?

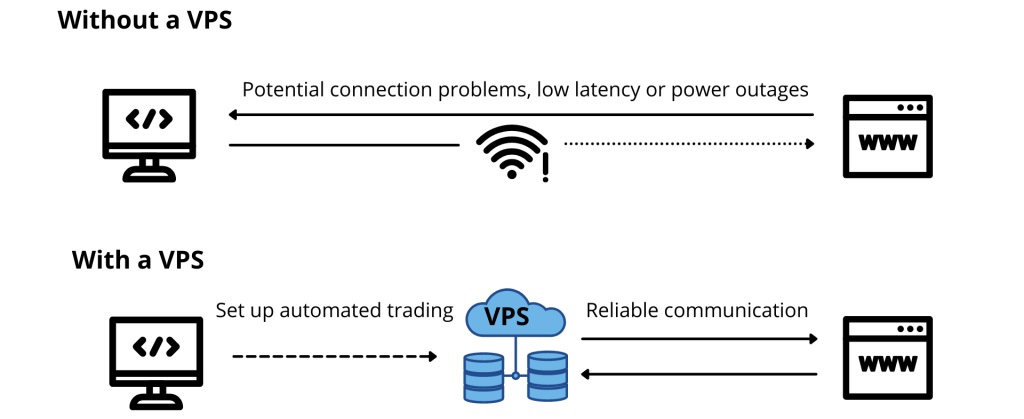

A virtual private server (VPS) is essentially a cloud-based computer located in a data centre somewhere in the world. Along with shared and dedicated hosting, a VPS is one of three types of web hosting.

Using a VPS for trading gives you many of the same benefits as a dedicated server, including your own operating system, dedicated storage, powerful computer processing, scalable RAM and unlimited bandwidth.

Other websites may be hosted on the same server as yours, but you will be allocated your own virtual compartment.

What Type Of Trader Needs VPS Hosting?

Your need for a broker with VPS hosting will depend on your trading strategy. Long-term investing doesn’t generally require it, but if your strategy consists of moving in and out of positions quickly using automation, for example in day trading, a broker with VPS capabilities can be valuable.

A VPS safeguards against viruses, power cuts, and connection failures, critical during market volatility.

Can I Have Multiple Accounts With A VPS Broker?

VPS services are good if you want to host several accounts with one broker. Doing this on your local computer could put immense pressure on its CPU. However, using VPS servers will remove the chance of overloading your local system.

Which Is The Best Forex Broker With Free VPS Hosting?

We’ve compiled a list of the best forex brokers with free or low-cost VPS hosting. To find the best providers, we considered: the required trading volume and account balance for free services, latency and speed, uptime and stability, and performance.

How Much Do Brokers Charge For VPS Services?

Several brokers provide a free VPS with a minimum monthly trade volume or account balance requirement. Note that higher CPU and RAM needs may result in increased costs and requirements.

Are Brokers With VPS Hosting Secure?

The best VPS systems ensure high levels of security. These include firewalls, robust passwords and distributed denial-of-service (DDoS) mitigation procedures to prevent attacks that attempt to disrupt the normal traffic of a targeted server.

To protect your capital, you should also choose a trusted and regulated VPS broker.

Can I Use Any Trading Platform With A VPS?

The top forex brokers with a VPS will allow integration with a range of trading software and applications. These can include MetaTrader 4 (MT4), MetaTrader 5 (MT5) and cTrader.

It’s also important to check that the VPS service is available on your chosen operating system, be that Windows, Mac or Linux.