Brokers With BRL Accounts

BRL accounts allow you to manage a trading account denominated in Brazilian real. Often used by Brazilian residents, these accounts allow you to avoid conversion fees and enjoy faster transaction times with local payment methods, such as Boleto.

Explore the best brokers with BRL accounts, personally evaluated by our experts.

Best Brokers With BRL Accounts

Our tests show these are the top 3 trading platforms accepting BRL accounts:

This is why we think these brokers are the best in this category in 2026:

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- Moneta Markets - Founded in 2019 and headquartered in Johannesburg, South Africa, Moneta Markets offers over 1000 instruments for short-term trading. New traders can choose between STP and ECN accounts while the smooth sign-up process has helped attract 70,000 registered traders.

- 4xCube - 4xCube is an online forex and CFD broker registered and licensed in the Cook Islands. Clients can trade on popular financial markets and choose between three accounts based on their capital and trading strategy.

Brokers With BRL Accounts Comparison

| Broker | BRL Account | Minimum Deposit | Markets | Regulator |

|---|---|---|---|---|

| Exness | ✔ | Varies based on the payment system | CFDs on Forex, Stocks, Indices, Commodities, Crypto | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Moneta Markets | ✔ | $50 | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto | FCA, ASIC, FSCA, FSA |

| 4xCube | ✔ | $10 | Forex, CFDs, metals, indices, cryptocurrencies | FSC Cook Islands |

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Excellent range of account types for all experience levels, including Cent, Pro plus the introduction of Raw Spread, ideal for day traders.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

Moneta Markets

"With ECN pricing featuring spreads from 0 and commissions from $1, high leverage of up to 1:1000, and the terrific charting platforms, Moneta Markets is an excellent broker for experienced day traders."

Christian Harris, Reviewer

Moneta Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Crypto |

| Regulator | FCA, ASIC, FSCA, FSA |

| Platforms | AppTrader, MT4, MT5, TradingCentral |

| Minimum Deposit | $50 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

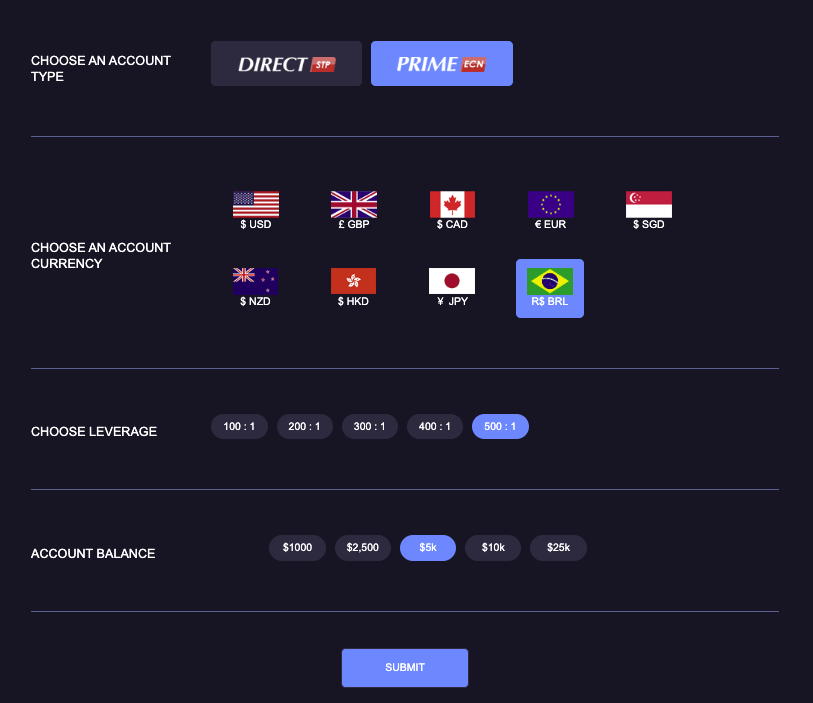

| Account Currencies | USD, EUR, GBP, CAD, NZD, JPY, HKD, SGD, BRL |

Pros

- Moneta Markets makes account funding a breeze, with plenty of account currencies, zero transfer fees and a wide selection of traditional, digital and now crypto-backed payment methods.

- Registering for an account with Moneta Markets is quick and easy through the digital sign-up process, taking just a few minutes with an accessible $50 minimum deposit.

- Moneta Markets supports a growing suite of 1000+ tradable assets, with a particularly strong selection of commodities and more recently fresh index CFDs.

Cons

- While trading costs are generally competitive, index CFDs feature fairly high spreads especially on US products like the S&P 500, trailing IC Markets during testing.

- Clients need an account balance of at least $500 to access educational materials, a serious drawback for beginners who can get free materials from brokers like IG and eToro.

- Whilst TradingView-backed ProTrader is intuitive, its time frames lacked seconds or ranges, and community scripts couldn't be added. The platform has been discontinued, and we're waiting to test ProTrader V2 when it's fully operational.

4xCube

"4xCube is a great option for traders familiar with the MetaTrader suite and those interested in copy trading."

William Berg, Reviewer

4xCube Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, CFDs, metals, indices, cryptocurrencies |

| Regulator | FSC Cook Islands |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:400 |

| Account Currencies | USD, BRL |

Pros

- Wide selection of payment methods including bank cards

- Large trading community on Discord

- Industry-leading MetaTrader 4 and MetaTrader 5 platforms are available

Cons

- The broker is not regulated by a trusted authority

- High fees for some payment methods

- US clients are not accepted

How Did We Choose The Best Brokers?

To identify the top brokers with BRL accounts we:

- Scanned our database of 139 brokers and trading platforms

- Pinpointed those that offer an account based in Brazilian real

- Ranked them by their overall rating, using 100+ data points and our own observations

What Is A BRL Account?

A BRL account is one in which the trading balance and transactions (including deposits and withdrawals) are denominated in the Brazilian real.

This offers more convenience for Brazilian traders who want to view their account details, such as profit and loss, in their local currency. The securities you choose to day trade will also normally be denominated in BRL.

Below is an example where I opened a BRL account with Moneta Markets:

Do I Need A BRL Trading Account?

A BRL account might be a good option for you if:

- You live in Brazil and earn in BRL because it’s economical to hold an account in the same currency.

- You trade regional markets such as South American stocks or exotic currency pairs that include the BRL, notably the USD/BRL.

- You are an overseas trader looking to diversify your portfolio by trading securities in an emerging economy and currency, driven by its agriculture, mining and manufacturing sectors.

How Can I Check If A Broker Offers An Account In Brazilian Real?

We recommend you follow these 3 simple steps to ensure a trading platform offers a BRL account:

- Head to the account details page on the broker’s website to find the list of accepted base currencies.

- Verify that ‘BRL’ is listed as a supported base currency in Brazil.

- Register for a live or demo account and select ‘BRL’ as your base currency.

Pros & Cons Of BRL Trading Accounts

Pros

- BRL accounts typically reduce or eliminate currency conversion fees on deposited funds which is a key draw for active traders making frequent transactions in BRL. As an example, at IG, you can expect to pay a 0.8% FX fee if you need to deposit BRL to a trading account based in USD because BRL accounts are not supported.

- We’ve found brokers with BRL accounts are more likely to provide tailored services for Brazilian traders, such as website and customer support in Portuguese, available at Moneta Markets for instance.

- For Brazilian traders, handling a trading account in BRL simply makes it more convenient to view profit/loss statements and place trades in a familiar currency.

Cons

- Despite ranking as the world’s 9th largest economy in 2023, Brazil often experiences economic and political challenges, which in turn causes volatility in the BRL, and thus increases the risks of holding your balance in BRL.

- BRL accounts remain uncommon, accounting for less than 2% of the brokers we’ve evaluated, so short-term traders have limited options when choosing a day trading broker.

- Our tests have shown that regional markets such as Brazilian stocks are not widely offered at brokers, which is a drawback for Brazilian traders looking to avoid associated fees when trading securities based in another currency.

FAQ

Which Is The Best Broker With A BRL Account?

We’ve rigorously tested the best brokers with BRL accounts. You can refer to our list to find the best trading platform for you.

How Much Does It Cost To Open A Trading Account Based In Brazilian Reals?

You will likely need up to 250 USD (around 1,275 BRL) to open a trading account at most brokers, based on our tests.

However, some brokers allow you to start with much less, including Moneta Markets which only requires 50 USD (around 255 BRL). It also offers some of the best charting and research tools I’ve seen, tailored to both novices and seasoned investors.

Article Sources

- Brazilian Real (BRL) Currency Information - OANDA

- Brazil Becomes Ninth Largest Economy - Agência Brasil

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com