Bamboo Review 2024

Pros

- Earn up to 8% with the fixed return scheme

- Hassle-free access to US stocks and ETFs for regional investors

- Easy-to-use, streamlined mobile and laptop apps make investing straightforward

Cons

- 1.5% commission on buying and selling US stocks can add up if you trade large amounts

- Only supported in certain areas – investors outside Nigeria and Ghana may not be able to sign up

- More experienced users may find the app is simplistic and lacks advanced analysis tools

Bamboo Review

The retail trading market in the African continent is booming and many traders from the region use the Invest Bamboo app to trade US and Nigerian stocks. This review will give traders all the information they need to get started with the financial investment app, including account opening requirements and details on how to trade stocks. Our experts also look at the pros and cons of Bamboo, from customer service options to fees and regulatory oversight.

Company Details

Since it was established by co-founders Richmond Bassey and Yanmo Omorogbe in Lagos, Nigeria in 2019, Invest Bamboo has become one of the leading online brokerages and trading apps in Africa.

The company has generated significant buzz on Nigerian news and social media since its launch, with celebrities and influencers frequently referring to their Bamboo accounts. In fact, the enthusiasm around this streamlined investment app was so great that when the brand announced its launch in Ghana in 2022, some 50,000 Ghanaians signed the waiting list.

The secret to Bamboo’s success is it is one of the few local companies to provide easy access to fractional stocks on US and Nigerian equity markets as well as fixed returns on investing lump sums.

It does this through partnerships with US-based brokers, which make a selection of stocks and ETFs traded on leading exchanges available—mainly of large companies with a market capitalization above $1 billion. It also has the benefit of providing insurance for stock accounts of up to $500,000 through the US Security Investors Protection Corporation (SIPC).

Assets & Markets

Bamboo users have access to a good selection of blue chip US companies, as well as other firms and ETFs traded on US stock exchanges that meet certain criteria. In total, 3,500+ assets are available.

To be traded on Bamboo, a stock or ETF must:

- Be US exchange-listed (Bamboo does not list OTC securities)

- Have a market capitalization of over $1 billion

- If it does not have a market cap above $1 billion, the company must have an average daily trading volume over the past three months of $0.5 million

- Bamboo only offers non-leveraged ETFs

This leaves a good selection of renowned companies that will satisfy most retail investors. It also removes some of the risk inherent in penny stocks and leveraged ETFs.

However, some traders may find the selection limiting, since there is more upside to leveraged funds and smaller companies, and large leveraged ETFs such as ProShares UltraPro Short (SQQQ) are useful if you want to adopt a short position on an exchange or hedge against the risk of a market downturn.

Fixed Returns

Traders in Nigeria can also access Invest Bamboo’s fixed returns scheme, which offers returns of up to 8% on US dollar deposits.

The per annum rate of this scheme depends on the length of time you lock in your savings, with periods from three months to one year.

Fixed returns investments are made through a tab on the homepage in a process that simply asks the trader to input the amount they want to invest (from $10), and then choose the maturation period.

- A 90-day investment nets 4.5% pa

- 180 days brings 5.5% pa

- 270 days brings 6.5% pa

- 364 days brings 8%

This provides a stable rate of return on your investment, but cannot be liquidated early.

Note, Bamboo’s fixed returns investments are only available to investors in Nigeria.

Fees & Costs

Invest Bamboo traders must pay a 1.5% commission on every US stock bought or sold through the app.

A percentage-based commission is sometimes preferable to active traders, but bear in mind that you will need to pay the 1.5% commission twice—first when you buy the stock, then when you eventually sell it.

The minimum withdrawal amount for Invest Bamboo traders for foreign securities is $500. Traders who withdraw to a Nigerian naira account must pay 45 naira ($0.10) for each withdrawal. However, withdrawals to foreign accounts will rack up a hefty $45 per transaction.

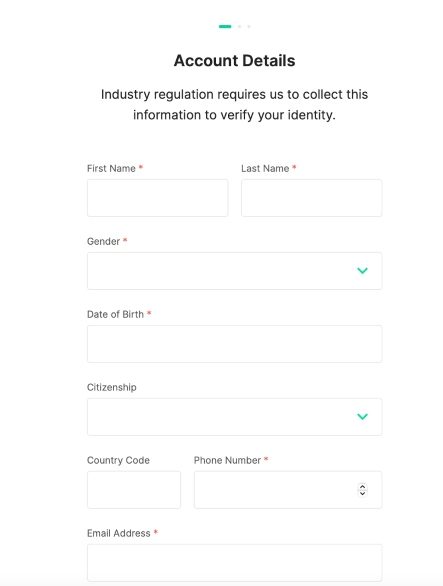

How To Register

Investors will need to complete a form with their personal information and provide government-approved identification to sign up with Bamboo.

The brokerage is primarily aimed at the African retail investor market, and most specifically at traders in its home country of Nigeria. With that said, investors from some neighbouring countries can also join the Bamboo trading platform, including Ghana.

How To Invest With Bamboo

Invest Bamboo offers a streamlined way to earn money from US and Nigerian stock markets.

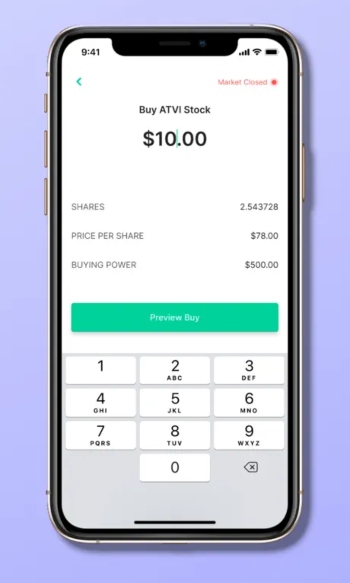

Once you are signed up and have accessed the app on your Windows or macOS laptop or Android or iOS mobile device, all you have to do is deposit funds and look up the stocks you would like to buy. This is as simple as scrolling through the list of available stocks or using the search function.

Once you have selected a stock, you can buy at the current market value or choose to buy either when the stock price falls or rises. This is as simple as a few clicks of the mouse or taps of the touchscreen.

The app is also equipped with some basic functions allowing users to compare the relative performance of different stocks or set alerts when an asset reaches a certain price.

Additionally, since Bamboo offers fractional shares, users can gain exposure with stock market giants—Berkshire Hathaway, Apple, Uber—within minutes of signing up, regardless of their starting capital.

Altogether this is a system that is geared toward casual retail investors who are looking for a quick and easy way to gain exposure to popular stock markets.

The drawback to this is that traders and investors who prefer a deeper experience when planning and executing trades may be disappointed by the simplistic interface.

The Bamboo app also lacks technical indicators, chart configurations and other features used by keen amateur or professional traders to fine-tune their trades.

Security & Safety

Invest Bamboo’s app has ‘bank-level security’, including two-factor authentication and state-of-the-art data encryption. Its Flutterwave payment processor is PADSS & PCI DSS compliant, which satisfies the top level of security audits.

Most importantly, Invest Bamboo’s partnership with the US-regulated DriveWealth LLC brings customer protection in the form of $500,000 insurance on clients’ accounts, including $250,000 for cash claims.

The Bamboo investment app is also well-received on the Google Play Store, with more than 1 million downloads and a 4.1 rating. Its rating on Apple’s App Store clocks in at 4.2.

On the downside, the Bamboo finance platform is less transparent about issues such as dispute procedures.

Customer Service Reviews

The homepage lacks a live chat feature or contact number to provide instant access to customer support, instead directing users to a chatbot or the support@investbamboo.com email address.

This is a downside vs competitors and may deter prospective investors, especially beginners that need on-hand support.

Invest Bamboo Verdict

The platform’s ease of use is one of its main benefits, since it allows almost anyone in the locale with a little money to quickly start buying and selling US stocks and ETFs. However, the simple design could also be seen as a drawback, and if your main account is not based in Nigerian nairas, you may need to pay a hefty withdrawal fee when you take your profits.

Nevertheless, for traders in the area, Invest Bamboo is a great local option with the added benefit of regulation and insurance by reliable US bodies.

FAQs

Is Invest Bamboo Legit?

Invest Bamboo is a legitimate and popular Nigerian online brokerage. The firm also benefits from regulation and insurance through its US partner, DriveWealth LLC.

As one of the few companies that provide widespread access to US stocks and ETFs, Invest Bamboo has successfully launched onto the mainstream in its native country and also recently expanded to Ghana.

How Do You Buy Stocks On Invest Bamboo?

Invest Bamboo’s app has a simple, streamlined interface that allows you to buy stocks with a few easy taps of the touchscreen. Once you have registered with Invest Bamboo and deposited funds, just search for the asset you want to trade, enter the amount you would like to buy, and select whether you want to purchase it immediately or wait until the price rises or falls. The procedure for selling stocks on Invest Bamboo is equally straightforward.

Is The Bamboo Investment Broker Real?

Invest Bamboo is an online brokerage providing Africans with access to global financial markets. With over 500,000 users and more than 750,000 unique trades, it is safe to say that it is a real, legitimate broker.

Is The Bamboo Investment App Safe?

The Invest Bamboo trading app and payment processing system uses high-tech security systems to protect customers’ data.

Most importantly, the oversight by US regulators, and membership through its US partner broker DriveWealth LLC of the SIPC, means that customers’ accounts are protected up to $500,000 if an issue arises.

How Do I Login To Invest Bamboo?

Traders can log in to the Invest Bamboo app using the login details they signed up with. Alternatively, navigate to Invest Bamboo’s main homepage on your web browser and sign in using your registered phone number and password.

Top 3 Alternatives to Bamboo

Compare Bamboo with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

Bamboo Comparison Table

| Bamboo | Interactive Brokers | IG | eToro USA | |

|---|---|---|---|---|

| Rating | 2.6 | 4.3 | 4.4 | 4.1 |

| Markets | Stocks, ETFs, Fixed Returns | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, ETFs, Crypto |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $10 |

| Minimum Trade | $1 | $100 | 0.01 Lots | $10 |

| Regulators | SEC & FINRA via US partner brokers | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | SEC, FINRA |

| Bonus | – | – | – | Invest $100 and get $10 |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | eToro Trading Platform & CopyTrader |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | – |

| Payment Methods | 3 | 6 | 6 | 4 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

eToro USA Review |

Compare Trading Instruments

Compare the markets and instruments offered by Bamboo and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Bamboo | Interactive Brokers | IG | eToro USA | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | No |

| Oil | No | No | Yes | No |

| Gold | No | Yes | Yes | No |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | Yes |

Bamboo vs Other Brokers

Compare Bamboo with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Bamboo yet, will you be the first to help fellow traders decide if they should trade with Bamboo or not?