Axofa Review 2026

Pros

- There's a proprietary social/copy trading service for beginners looking to follow successful strategies and for experienced traders looking to sell their strategies

- The $1 minimum deposit across all 3 accounts will appeal to novices and those on a budget

- Axofa offers the MetaTrader 5 platform which will particularly serve intermediate to experienced traders looking for advanced charting tools

Cons

- There is limited verifiable information about the broker’s owners and background

- Our team found inconsistencies between international subsidiaries and website information

- The offshore operations and lack of any regulatory oversight is a major concern

Axofa Review

Axofa is an international forex broker that offers the MT5 platform, low starting deposits and high leverage. But is the broker legit or a scam? In this review of Axofa, our experts uncover spreads and commissions, live account options, accepted payment methods, and joining bonuses. We also look at the broker’s regulatory status.

Company Details

Axofa Markets LLC is based in St. Vincent and the Grenadines with an additional office in London, United Kingdom.

The brokerage offers multi-asset trading on forex, stocks, indices and commodities. Clients can access the financial markets using the MetaTrader 5 platform or the broker’s in-house mobile app.

Axofa is not a particularly well-known broker, with less than 100 YouTube subscribers and Instagram followers. There is also limited publicly available information about the history of the brand and its founders, which may be a red flag.

The broker holds a license with the St Vincent and the Grenadines Financial Services Authority (FSA-859/2022).

Trading Platform

The forex broker offers the MetaTrader 5 (MT5) platform, which can be downloaded to Windows, Mac, and Android devices.

MT5 offers sophisticated tools and features to help clients analyze assets and make trades confidently. Functionality includes:

- 21 timeframes

- One-click trading

- Live streaming financial news

- Integrated economic calendar

- Advanced Market Depth feature

- Real-time signals for copy trading

- MQL5 wizard to create auto-trading bots

- Up to 100 charts can be opened at any time

- 80+ in-built technical indicators and analysis tools

With data encryption between servers and the platform, as well as one-time passwords for mobile devices, MetaTrader 5 is also a secure terminal.

How To Trade

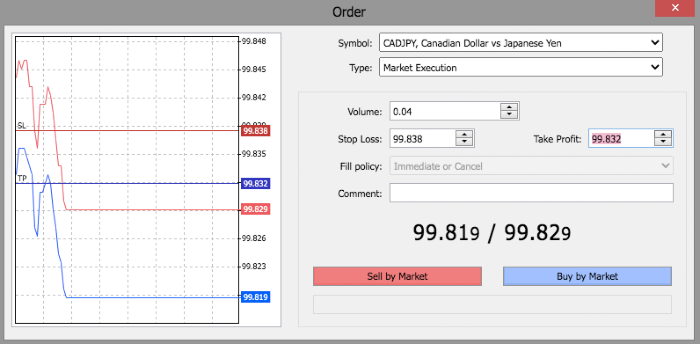

MT5 is a globally recognized platform, so making trades is straightforward:

- Open the MT5 WebTrader or download the desktop client

- Make a deposit into your Axofa trading account

- Select the asset you wish to trade using the search bar

- Select ‘new order’ from the top menu bar

- Input the order details, including asset symbol, order type, volume, stop loss and take profit options, plus any comments

- Confirm the position

Assets & Markets

Axofa offers major and minor forex pairs (including EUR/USD, USD/JPY, and USD/AUD), metals (including XAU/USD, XAU/EUR, XAU/AUD, XAG/EUR, XAG/USD, XPD/USD, and XPT/USD), indices, and commodities (including energy futures, energy spots, and softs).

On the downside, the broker does not offer trading on cryptocurrencies.

Axofa is an STP and ECN broker. This means that when trading, you are guaranteed the best price. Straight Through Processing (STP) brokers essentially eliminate the middleman and ensure traders’ orders are received directly by liquidity providers, reducing slippage.

Electronic Communication Network (ECN) brokers allow traders to place their orders, after which, liquidity providers bid for the order, meaning that the trader gets the best price out of a series of options.

Spreads & Fees

The Pelow account offers raw market spreads from 0.0 pips, with a commission of $3.50 per lot. The Cent and BiMax profiles do not charge any commission fees and instead apply spreads from 1.6 pips.

However, it’s worth noting that Axofa is not particularly transparent when it comes to trading fees. The broker does not publish details of any payment charges or dormancy penalties.

Axofa Leverage

Axofa offers high leverage up to 1:1000. This means a $100 deposit would provide $100,000 in buying power.

All accounts have a 100% margin call and a 20% stop-out level.

Leverage can be amended within the client area.

Mobile App

Axofa offers a proprietary mobile app available for free download to iOS and Android devices. You can open an account, deposit/withdraw, restore passwords and view transaction history from the application. Users can also access bonuses and contest statistics.

There are 16 videos on the brand’s YouTube account detailing how to trade on the Axofa mobile app, however, all of the videos are in Indonesian. The Axofa application is currently only available to customers in Indonesia.

Additionally, the MetaTrader 5 (MT5) terminal is available as a mobile application. You can manage your account, open and close positions, and customize charts while on the go. Traders can also apply technical indicators and view graphical objects on mobile or tablet devices.

Payment Methods

The broker accepts credit/debit cards including Visa and Mastercard, e-wallets such as Neteller and Skrill, plus cryptocurrencies.

However, when we used Axofa’s client dashboard, we were only offered direct bank transfers from the Indonesian Bank of CIMB Niaga or cryptos/stablecoins to fund an account in US Dollars.

Funds can take between one to three days working days to appear in your trading account, and withdrawals can take up to seven days, depending on the withdrawal method. Identity verification is also required before you can request a withdrawal.

There are no fees charged by the broker, however, third-party fees may apply. Currency conversion fees may also apply for deposits made in a currency other than your account denomination.

Demo Account Review

Axofa offers a demo account service with $100,000 in virtual funds and flexible leverage up to 1:1000.

The practice profile is only available on the Pelow (raw spread) account. Still, it is a popular solution for beginners allowing them to practice trading risk-free.

Although there is no information regarding time constraints, you can open as many demo accounts as required.

Deals & Promotions

Axofa offers new and existing clients a 10% deposit bonus. This means you will receive an additional 10% each time you deposit into a real account.

The bonus only applies to forex, metals, indices, and commodities trading. Rewards are also canceled when you make a withdrawal and are not applicable if your total equity falls below the total credit in your account (your account is checked every 5 minutes for this).

While using Axofa, we were not offered access to any trading contests or reward schemes.

Regulation & Licensing

Our experts are skeptical of the legitimacy of Axofa. The global entity is registered under the trading name Axofa Markets LLC in St. Vincent and the Grenadines, company number 1976. The Asian subsidiary claims to be registered in England and Wales under Axofa Ltd, company number 13744360.

Neither subsidiary is regulated by a trusted financial body so they may not provide adequate protection vs brokers with licenses from the UK Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC), for example.

Having said that, the broker does provide negative balance protection for all retail customers.

Additional Features

It was disappointing not to be offered any educational content besides the broker’s YouTube content. There are no step-by-step user guides or basic trading information for beginners.

The lack of additional trading tools and educational materials is a serious drawback vs competitors.

Axofa Accounts

Axofa offers three accounts; Cent, BiMax, and Pelow. All profiles provide access to flexible leverage up to 1:1000, have a minimum deposit requirement of $1, and facilitate trading on all instruments.

The Cent and BiMax profiles offer spreads from 1.6 pips and $0 commissions. There is no significant difference between these two accounts. The Pelow account offers raw spreads with a commission of $3.50 per lot.

How To Open An Account

- Select ‘SIGNUP’ found on the top right of each webpage

- Complete the online registration form (email and contact number)

- Verify your registration with a unique PIN sent via email

- Select ‘MT5’ from the navigation bar in the left-hand menu

- Open a demo or live account by entering the requirements (account type and leverage)

- Select ‘Open Account’

Trading Hours

Axofa trading hours vary by instrument. The forex market, for example, is available to trade 24 hours per day between Sunday to Friday.

The MT5 terminal will reflect all market closures and upcoming public holiday dates.

Customer Service

Axofa has a UL-based phone line and a customer service email linked on its website. Alternatively, a live chat service is available, though we struggled to receive a response upon testing. Additionally, when attempting to call the phone number, it was declined.

Security & Safety

Axofa complies with anti-money laundering and know-your-customer protocols.

The MetaTrader 5 platform is also secure with encrypted data exchanges between servers and client portals.

Axofa Verdict

Axofa offers the basics; a MetaTrader platform, a modest selection of forex assets, and a free demo account. However, unreliable customer service options and weak regulatory oversight are concerns. In addition, the lack of transparency around fees and unverifiable company background means we would sign up with alternative brokers.

FAQs

Is Axofa Legit?

Axofa has qualities that suggest it may be a scam broker. There is limited information about the fees charged, the differences between account types, as well as inconsistencies about the company’s registration details. High leverage and enticing joining bonuses may also lure in unsuspecting traders.

While it may well be a legitimate broker, there are alternative forex brokers that are less risky to trade with.

Does Axofa Charge Withdrawal Fees?

Axofa does not provide information about payment charges. Our experts tested the broker and also reviewed the T&Cs and social media pages. As a result, the broker may try to levy withdrawal fees if traders try to remove profits.

Who Founded Axofa?

This is not stated anywhere online. However, the name of the person making the YouTube content for Axofa is Budi.

Is Axofa Regulated?

Axofa holds a license with the St. Vincent and the Grenadines Financial Services Authority (FSA-859/2022). However, this is not a well-regarded financial regulator and traders may receive limited legal protections in the case of disputes.

Best Alternatives to Axofa

Compare Axofa with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

Axofa Comparison Table

| Axofa | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 3 | 4.3 | 3.9 |

| Markets | Forex, CFDs, Stocks, Indices, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | 10% Deposit Bonus | – | $100 No Deposit Bonus |

| Platforms | MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:1000 | 1:50 | 1:1000 |

| Payment Methods | 8 | 6 | 12 |

| Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by Axofa and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Axofa | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | Yes | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

Axofa vs Other Brokers

Compare Axofa with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Axofa yet, will you be the first to help fellow traders decide if they should trade with Axofa or not?