ATFX Review 2024

Awards

- Best Trading Experience - Forex Brokers Awards 2021 - Fxdailyinfo

- Best Fintech Forex Broker - Forex Brokers Awards 2021 - Fxdailyinfo

- Top 10 Hot Brands of the year 2021 - The CEO Views

- Best Forex MT4 Broker - Global - Global Forex Awards 2021 Retail - Holiston Media

- Best Forex - Fintech Broker Global - Global Forex Awards 2021 Retail - Holiston Media

- 10 Most Influential Companies of the Year 2021 - The Chief’s Digest

- The Most Trusted Brand of the Year 2021 - The Business Fame

- Best Forex MT4 Broker, Asia - Forex Brokers Awards 2021 - Fxdailyinfo

- Best Institutional Forex Broker - Global Forex Awards 2021 - Holiston Media

- Best Forex MT4 Broker, Asia - Global Brands Magazine Awards 2021 - Global Brands Magazine

- Institutional Forex Broker of the Year 2021 - Fintech Awards 2021 - Wealth & Finance International

- Best Trading Service in Vietnam - Traders Awards 2021 - Trader’s Fair

- Best Institutional Forex Broker - Global Forex Awards 2021 - Holiston Media

- Institutional Forex Broker of the Year 2021 - Fintech Awards 2021 - Wealth & Finance International

- Best LATAM Region Broker - ADVFN International Financial Awards 2021 - ADVFN

- Best Institutional Forex Broker - Global Forex Awards 2021 - Holiston Media

- Best Forex Introducing Broker Programme, Middle East - Global Forex Awards 2021, Retail - Holiston Media

- Institutional Forex Broker of the Year 2021 - Fintech Awards 2021 - Wealth & Finance International

Pros

- Strong FCA and CySEC regulation with excellent reputation and industry accreditations

- Unrestricted trading in the MT4 platform with hedging and EAs permitted and no requotes

- Prime execution and tailored liquidity for professional clients

Cons

- Fewer assets than many alternatives

- Retail clients not supported

- Only one platform available

ATFX Review

ATFX is an award-winning online broker offering forex trading, CFDs, and spread betting to professional investors. This 2024 review covers everything from the MetaTrader 4 (MT4) trading platform and account safety and security to leverage rates.

About ATFX

Regulated in the UK, the ATFX group grew quickly, focussing on customer service and keeping trading costs low.

The broker provides its professional clients with the ability to invest in a range of assets via the company’s user-friendly platform that supports the MetaTrader 4 software. ATFX offers competitive pricing and delivers a state-of-the-art client portal protected by leading encryption security systems.

The most up-to-date bridging technologies are used on the site to secure the best rates from its liquidity providers. Account opening is quick and easy, enabling users to begin trading immediately, and there is a free demo account for those who want to undertake system and strategy testing.

ATFX also has super-fast deposit and withdrawal payment systems. In addition, the company offers a mobile application, giving users the convenience of trading on the go. Clients also enjoy 24/5 customer service from a team of experienced experts.

History

ATFX UK was founded in 2017. Its current location is in Cornhill, the heart of the City of London.

The platform and range of trading media available are aimed at professional, experienced day traders.

That said, there are plenty of learning and support features included on the website that provide beginners with a clear insight into the world of trading and spread betting.

Professional Trader Criteria

To open a new account and invest with ATFX you must meet the professional trader requirements:

- Do you or have you worked in financial services in a professional position for a minimum of one year and have knowledge of derivatives trading?

- Have you made at least ten significantly sized trades per quarter over the last year?

- Do you have an investment portfolio, including cash deposits, of more than €500,000?

To register for a professional account, contact cs.uk@atfx.com.

Trading Platform

Trading is carried out via the MetaTrader 4 platform. The ATFX MT4 download supports all forms of mobile devices and the Windows version offers multilingual and multi-currency trading support to users.

A VPS service is available for continuous daily connectivity the and MT4 desktop provides customizable libraries, custom indicators and scripts, allowing it to meet a variety of trading styles. In total, there are over 2000 indicators and 30 chart analysis tools. Users can set their preferred display methods and parameters for every type of chart and indicator. Automated trading strategies are available via EAs (Expert Advisors). The MT4 application also allows enhanced trading speeds and is renowned for its stability and robustness.

Although ATFX doesn’t have MT5, the MT4 platform offers users a convenient WebTrader plugin that’s optimized for maximizing web-based performance, including one-click trading, real-time information, and advanced charting.

Trading Central

The company’s Trading Central facility is a top-tier technical analysis resource available for professional clients. Trading Central is well-respected among smart traders worldwide, conducting research for over 200 investment banks, brokers, fund managers, and professional dealers.

Trading Central is used in 45 countries and is free to access for all platform users.

It provides professional analysis and technical strategies for assets, including precious metals, commodities, and currencies.

For enhanced trader confidence, Trading Central is part of three associations for Independent Research Providers, including Investorside Research, Euro IRP, and Asia IRP. Trader Central is also a Registered Investment Advisor with the SFC (Hong Kong) and SEC (US).

Assets & Markets

Clients of ATFX can speculate on:

- Oil – Crude oil and commodity-based oil ETFs

- Forex – 44 different pairs including exotics, minors, and majors. The forex market on ATFX is available 24/5

- Share CFDs – The ATFX viewer also supports more than 170 major shares CFDs from Germany, Spain, the UK, and the US

- Spread betting – A way for customers to speculate on the price fluctuations of a variety of assets, including foreign exchange and metals

- Cryptocurrency CFDs – Bitcoin, Bitcoin Cash, Binance, Cardano, Chainlink, Dogecoin, Ethereum, Litecoin, Polkadot, Stellar, and Uniswap.

- Indices – 13 variations of share indices are available from the US, Europe, and Asia. The spot indices on the platform have low spreads and low margin requirements. Trading this asset starts with a 0.01 lot size

- Precious metals – London Silver or London Gold, both of which are on a spot contract. That market is open 23/5. ATFX UK offers sell-short or buy-long positions. Day traders can use leverage as high as 1:20

ATFX UK operates a “no dealing desk” policy, reducing broker intervention and improving the transparency of trading conditions and the trading environment.

Spreads & Commission

Spread betting with ATFX attracts no UK stamp duty or capital gains tax. Also, there are no commissions, and spreads are competitive at just 0.6 pips. Traders can speculate on falling or rising markets using the maximum margin of 1:30. MT4 allows users to set stop-loss limit orders and balance protection.

The minimum deposit for spread betting accounts is £100 with a stop-out of 0.5. There are no rejections or requotes while EAs and hedging is permitted. The company’s terms on spreads also make them one of the most competitive platforms available for professional investors.

ATFX offers market order execution. Market orders are forwarded to the market, and then executed at the market’s tradeable price. After execution, information regarding transactions is sent to the MT4 platform. The execution price is influenced by the liquidity from banks and whether that is sufficient.

The platform provides a range of order types with pending order options, including Sell Stop, Sell Limit, Buy Stop, and Buy Limit, which are connected to company instructions residing within the server. A Stop Loss or Take Profit closes any pending orders. Pending orders are triggered, transacted, and executed as a market order. This occurs when the market price reaches the set point.

The firm does not charge commissions to traders and offers highly competitive spreads, reducing the costs of opening and trading positions.

Leverage

ATFX provides a list of default leverages for clients that can be found in its Trading FAQ section.

The default leverage levels are:

- Oil – 1:100

- FX (forex) – 1:50

- Shares CFDs – 1:20

- Silver and gold – 1:200

- Cryptocurrencies – 1:5

- Indices – 1:100 or 1:50 for USDX

Mobile Apps

ATFX offers mobile trading platforms that are versions of MetaTrader 4. Users can download an app for either Apple or Android devices, enabling on-the-go trading.

The MT4 iPhone app includes the most useful features, such as customizable indicators and EAs, and the same applies to the Android application. Both mobile versions have full functionality. Multi-language support is available 24/5, and real-time information is included that helps the user with the decision-making process.

The MT4 free download for Android or iOS includes advanced charting, such as rapid analysis and customization, providing users with the flexibility to adapt their trading strategy.

Deposits & Withdrawals

ATFX does not charge fees on deposits. Users can deposit funds using debit or credit cards, e-wallets, or bank transfers. Currencies accepted are EUR, GBP, and USD. Payments made by bank transfer take up to one working day to process, while all other deposit methods are processed within 30 minutes.

Clients using non-UK debit or credit cards may be charged a fee by their provider, although this can be refunded to the client’s trading account upon receipt of proof of charges.

No fees are charged for withdrawals, and monies can be paid into debit or credit cards, e-wallets, or bank accounts. Withdrawal requests are processed within one working day.

Bank wire transfers can take around two to five working days to process. Trading accounts will not be credited until the funds have cleared.

The user’s bank account must be fully verified before a withdrawal can be made. All funds are returned to the original payment source that was used to make the deposit.

ATFX UK does not accept any third-party payments and deposits must be from the client’s personal account.

Demo Account

ATFX does offer a demo account that allows traders to get a feel for the platform and what’s on offer. The paper trading account is also useful for professionals who want to test new strategies.

Deals & Promotions

Citizens of Taiwan, the Philippines, Malaysia, Thailand, Vietnam, South Korea, Cambodia, and Myanmar can use a rebate promotion. Investors earn $2 per lot with a maximum rebate of $10,000, providing they deposit $1,000 each month.

There are no deals, promotions, or welcome bonuses for other countries because they are prohibited by the FCA or other regulatory bodies. However, ATFX does offer various educational services to its professional clients.

Additional Features

Webinars

On the broker’s website, there are webinars provided. Mr. Alejandro Zambrano who has over 12 years of experience as a professional trader and has been recognized by CNBC, Reuters, and Bloomberg. His specialism lies in both technical and fundamental analysis, and the strategies he teaches aim to enable clients to navigate the financial markets while minimizing risk.

Market Strategists do not provide personal recommendations on specific investments nor consider the suitability of investments based on a client’s personal circumstances or objectives, and should therefore not be interpreted as financial, investment or other advice, or relied upon as such. You should seek independent advice before making investment decisions. Any opinions expressed do not reflect those of ATFX.

You can employ the advice of a CPA (Certified Public Accountant) to help you plan your financial goals.

Forex Education Center

ATFX has opened a forex education center that can be accessed by clients on the company website. It contains in-depth eBooks and several training courses. The courses include subject matter on MetaTrader 4, economics, cryptocurrencies, social trading, trading strategies, capital management, and more.

Users who open a Premium account also receive a number of exclusive benefits, including premium videos and tutorials, plus full access to Trading Central. The idea of the Premium education feature is to complement the free raw spreads and VPS offered by this type of account.

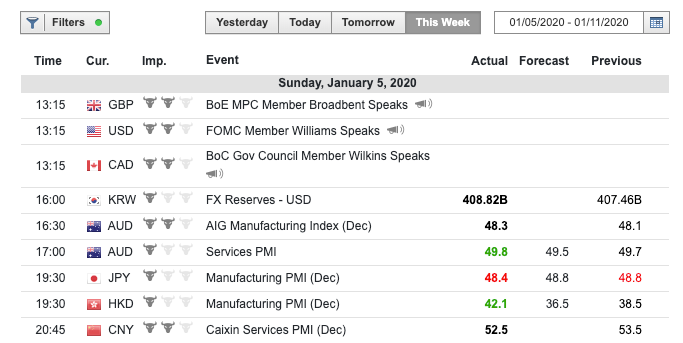

Event Calendar

As a further bonus, traders are provided with the most up-to-date financial market news and overviews of their most popular products, including oil, precious metals, indices, and commodities.

Regulation & Licensing

ATFX UK is regulated by the Financial Conduct Authority (FCA). Also, the company holds client funds in segregated accounts that are kept separately from the company’s own capital. The firm is also regulated in North America and the Middle East. Due to this global approach, the broker is popular in regions such as Malaysia, the Philippines, and Thailand, where traders often look for both local and European regulation.

ATFX Global Markets (CY) Ltd operates from Limassol, Cyprus. That division of ATFX is regulated by CySEC, the Cyprus Securities and Exchanges Commission. CySEC regulation provides brokers with access to EEA and EU countries. Also, the Middle East and Switzerland have access to ATFX UK via CySEC regulation.

ATFX UK is also MiFID-compliant – the Directive on Markets in Financial Instruments. MiFID regulates financial institutions that provide investment services and activities, specifically in the European Economic Area. The EEA includes Liechtenstein, Norway, Iceland, and other EU member states.

On the website, users can read and download documents related to regulation and compliance, including CFDs and spread betting. All the company’s terms and conditions relating to their specific products and services can be found here.

Account types

ATFX offers three account types: Standard, Edge, and Premium.

- Standard – must have a balance of at least £$€500 with a benchmark spread currency pair of 1.0 pips

- Edge – must have a balance of at least £$€5,000 with a benchmark spread currency pair of 0.6 pips

- Premium – must have a balance of at least £$€10,000 with a benchmark spread currency pair of 0.0 pips. Customers can use this account to invest with higher leverage on all instruments, as long as they qualify as professional traders. Evidence must be provided on application.

Note, ATFX only accepts professional traders so just the Premium account is now available.

Trading Hours

The site operates 24/7, but markets are open for trading in line with the assets. For example, the FTSE can be traded when the London Stock Exchange is open.

Customer Support

ATFX received an ADVFN award for Best Customer Service in 2019. The company offers a highly customer-centric multilingual service, a live chatbot (logo located in the bottom right corner of the website), international phone lines that are open Monday to Friday, 9 am to 5 pm, and a support email.

All customer service details are country-specific and can be found on the broker’s website.

Customer Security

ATFX UK uses “leading data encryption technology” to create a safe and reliable trading environment for its clients. All data management is carried out following the UK regulation. ATFX is FCA registered.

Client funds are held in segregated accounts that are separate from the company monies. This means in the event of insolvency, client funds cannot be used to reimburse creditors. Also, AT Global Markets (UK) Limited is a member of the FSCS. Under the scheme, investments up to £85,000 per person are protected.

ATFX Verdict

ATFX has headquarters in London, UK. The broker offers trading on various assets, including forex, commodities, and CFDs. Several types of accounts are available, though the brand now focusses on professional clients. Competitive spreads are offered and no commissions are payable. All trading takes place over a secure and user-friendly platform, MetaTrader 4, which supports mobile and desktop devices. Customer support is available 24/5.

FAQ

What Is The ATFX Hong Kong Office Address?

The broker doesn’t have an office in Hong Kong at the moment. ATFX is restricted in Hong Kong, this means you aren’t able to trade using the platform.

From Where Can ATFX Be Accessed?

The ATFX global markets can be accessed from the UAE, Dubai, Mexico, Kenya, Abu Dhabi, Africa, China, and many other regions. Some websites from the Philippines and Malaysia even provide country-specific reviews. However, you won’t be able to use the platform if you are from Egypt.

Is ATFX Legit?

The broker is registered with many official institutions, such as the Abu Dhabi Global Market (ADGM), the UK Financial Conduct Authority (FCA) and Financial Services Compensation Scheme (FSCS), plus the Cyprus Securities and Exchange Commission (CySEC).

How Do I Access The ATFX GM 1-Live?

You must first sign up with ATFX, then use the member login to access the Global Markets (GM) login page.

Where Can I Find More Information About AFTX?

You can use ATFX’s socials media channels (Facebook, YouTube, Twitter) to keep up with the latest news, events, scam alerts, or even connect with various company partners such as the Chief Analyst of Asia Pacific – Martin Lam. More useful information about the broker can be found under trader forums.

Top 3 Alternatives to ATFX

Compare ATFX with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

ATFX Comparison Table

| ATFX | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 2.9 | 4.4 | 4.3 | 3.4 |

| Markets | Forex, CFDs, indices, commodities, cryptos, spread betting | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5000 | $0 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FCA, CySEC, ADGM | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | VFSC |

| Bonus | – | – | – | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, AutoChartist | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 8 | 6 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by ATFX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ATFX | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | Yes | Yes | No | No |

| Volatility Index | No | Yes | No | No |

ATFX vs Other Brokers

Compare ATFX with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of ATFX yet, will you be the first to help fellow traders decide if they should trade with ATFX or not?