AMP Global Review 2024

Pros

- 1:100 leverage

- Demo account

- Top-tier regulation

Cons

- No MT4 download

- No proprietary mobile app

- Deposit and withdrawal fees

AMP Global Review

AMP Global offers multi-asset trading with a range of data feeds and low fees. The European entity offers seven asset classes whilst the US clearing subsidiary focuses on futures trading. The brokerage combines cutting-edge technology with a competitive price match promise.

This AMP Global 2024 broker review will cover login security, account funding methods, MT5 trading platforms, supported strategies, and more. Find out whether you should register for a live trading account.

Company Details

The AMP Global Group was established in 2010 and operates through two entities:

- AMP Global Ltd (Europe) – Regulatory oversight from the Cyprus Securities and Exchange Commission (CySEC)

- AMP Clearing LLC (USA) – Regulatory oversight from the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC)

AMP Global Clearing LLC offers futures trading on popular exchanges, including the Chicago Mercantile Exchange (CME), the Intercontinental Exchange (ICE), and the New York Mercantile Exchange (NYMEX).

Non-US citizens can trade forex and CFDs alongside exchange-traded futures. The broker’s aim was to introduce popular US trading technologies and infrastructure to European traders.

AMP Global’s head offices are located in Limassol, Cyprus, and Chicago, USA.

Trading Platform

Retail customers can trade on MetaTrader 5 (MT5). MT5 is available for free download to desktop devices or it can be used directly through major web browsers.

The industry-recognized platform is built for multi-asset trading. MT5 offers various trading and analysis tools, customizable charting, and integrated robots. Key features include:

- 21 timeframes

- One-click trading

- Real-time signals

- Live financial news

- Integrated economic calendar

- Advanced Market Depth feature

- MQL5 Wizard to create auto-trading robots

- Up to 100 charts can be opened at any time

- 80+ in-built technical indicators and analysis tools

AMP Global clients also get free access to StereoTrader, an additional plug-in for the MT5 terminal. Functionality includes:

- Automation/API

- Algorithmic grid trading

- Real-time volume mapping

- Easy access scalping terminal

- Sophisticated trading statistics

- Advanced order types including Limit Pullback Order

- Automated exit strategies based on growth, equity or time

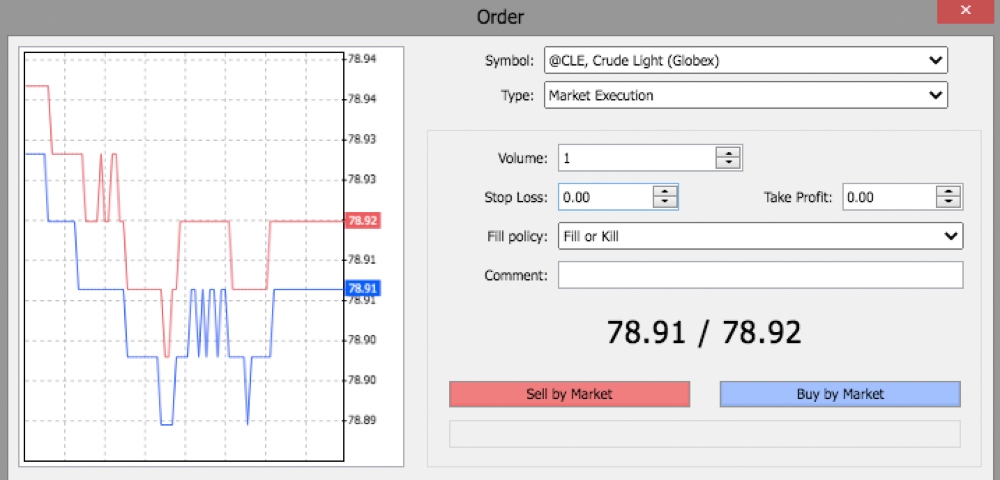

How To Place A Trade On MT5

- Log in to your AMP Global customer dashboard

- Download the MT5 platform or log in via the WebTrader

- Choose the asset you wish to trade using the drop-down menu or search bar

- Select ‘New Order’; the icon can be found second from the left in the top navigation bar

- A ‘New Order’ screen will pop out. Alternatively, execute a trade directly from the chart

- Enter the position details, including volume, order type, and any risk management

- Select ‘Buy’ or ‘Sell’

- Confirm the trade

Products & Markets

AMP Global is an online broker with a focus on exchange-traded futures. Traders can access:

- Singapore Exchange (SGX)

- CBOE Volatility Index (VIX)

- European Exchange (EUREX)

- Sydney Futures Exchange (ASX)

- Mini-Nikkei 225 Exchange (JPX)

- Chicago Mercantile Exchange (CME)

- Hong Kong Futures Exchange (HKEX)

- Comex Commodity Exchange (COMEX)

- New York Mercantile Exchange (NYMEX)

- Intercontinental Futures Exchange (ICE)

Note, exchange-traded futures can be enabled or disabled within your account. Exchange-traded futures are not offered as a default trading option. To enable:

- Login to your client dashboard

- Select your account number (highlighted in blue)

- Select ‘Modify Futures Feed’

- Choose the form relevant to the markets you wish to trade and submit the details

- Hit ‘Save’

- An email confirmation will be sent once the request has been completed and confirmed

You will incur a data feed fee as soon as you are connected. This charge will cover the remaining days in the month you signed up for. The fee will then be charged on the 1st of each month ongoing.

The brand also offers 100+ instruments across six alternative asset classes:

- Invest in precious metals and energies such as UK Brent Oil, Gold, and Silver

- Trade 10 major company stocks including Facebook, Apple, and Tesla

- Trade 70+ major and minor currency pairs including GBP/USD, EUR/USD, and CAD/JPY

- Trade on 11 of the world’s largest stock indices including the DJ 30, NASDAQ 100, and FTSE 100

- Speculate on four digital currency USD crosses including Bitcoin (BTC) and Ethereum (ETH)

Trading Fees

AMP Global’s standard account offers spreads from 1 pip alongside commissions. The broker has a price promise that it will match or beat any written commission quote.

Customers that enable ETF trading are liable for a monthly data feed fee. Examples include a $12 monthly fee to access CME market data and a $33 fee for access to all depth of market data.

AMP Global also provides a useful ‘All-In Cost Calculator’ that combines futures commissions, exchange fees, routing costs, and regulatory charges.

AMP Global Leverage

Retail investors can access leverage up to 1:100.

However, customers trading under the CySEC-regulated entity (AMP Global Ltd) will be subject to ESMA’s margins restrictions introduced in 2021. This means clients are only permitted to access leverage up to 1:30:

- 1:30 for major currency pairs

- 1:20 for minor currency pairs, indices, and Gold

- 1:10 for commodities and equity indices

- 1:5 for shares

- 1:2 for cryptos

The all-in-one account has a 100% margin call level and a 50% stop-out level.

ETF Margin

A maintenance margin call is set by the relevant futures exchange. These are the requirements to maintain a contract beyond the daily close.

Day trading margin is set by the broker. This is the value required to enter a position on an intraday day basis. You must close all open positions or meet the exchange maintenance margin five minutes before the daily close.

Margin examples include:

- Micro E-Mini Dow – Maintenance margin $750, day trading margin $50

- E-Mini NASDAQ – Maintenance margin $15,800, day trading margin $1000

- E-Mini Crude Oil – Maintenance margin $3750, day trading margin $937.50

- Micro E-Mini S&P 500 – Maintenance margin $1060, day trading margin $40

Mobile App Review

AMP Global does not offer a mobile trading app. Nonetheless, the MetaTrader 5 (MT5) terminal is available for free download to mobile and tablet devices.

You can manage your investment account, open and close positions, and customize charts while on the go. Other features include:

- In-built live chat

- Market-depth data

- Netting and hedging systems

- Full set of orders, pending and stop orders

- Alerts, price notifications, and live news streams

Payment Methods

Deposits

A minimum deposit requirement of $100 or equivalent currency applies. Accepted deposit and withdrawal currencies include USD, EUR, GBP, RUB, and PLN.

AMP Global offers various account funding methods. This includes bank wire transfers, credit/debit cards, and e-wallet services, unlike NinjaTrader which primarily accepts wire transfers.

Credit/debit card and e-wallet payments often provide instant account funding. Bank wire transfers can take up to five working days.

It is good to see that there are no deposit fees for EUR bank wire transfers below €1000, however fees apply for alternative methods:

- Credit/Debit Card – 3.23% fee

- E-Wallets (excluding Skill and Neteller) – 5.10% fee

- Skrill – 4.50% fee for EUR payments and up to 5.10% for other currencies

- Neteller – 4.80% fee for EUR payments and up to 5.35% for other currencies

- Bank Wire Transfer – Free for deposits under €1000, €5 for payments between €1001 and €10,000, €15 for deposits between €10,001 and €50,000, and €40 for payments above €50,000

Note, AMP Global Ltd/Clearing LLC provides useful account funding support on their website including step-by-step wire transfer instructions.

Withdrawals

Alongside fees to fund an AMP Global account, our experts found withdrawal charges apply. The fee varies depending on the withdrawal amount, currency and method. This includes a 2.72% charge for withdrawals via credit/debit cards and a 1% fee for Skrill withdrawals.

Processing times will vary by payment method. Same-day requests are possible but come with an additional 0.05% charge.

How To Request A Withdrawal

- Login to your AMP Global client dashboard

- Select ‘Transfers’

- Click on ‘Withdraw Funds’

- Select the account you wish to withdraw from

- Click on the payment method

- Review

- Select ‘Submit’

Demo Account

A free demo account is available at AMP Global. You can access all MetaTrader 5 functions with no asset restrictions.

The broker also offers a platform walk-through from their technical service operators, covering key details for new traders, such as technical indicators, graph features, and pricing displays.

For more experienced day traders, the paper trading profile provides an opportunity to back-test strategies and experiment with Expert Advisors (EAs).

Deals & Promotions

While using AMP Global, we were not offered any joining bonuses or monetary rewards. This is aligned with ESMA regulations that restrict the use of financial incentives for new and existing retail customers.

Still, the broker strives to be recognized as one of the lowest-cost futures trading brokers. With this, AMP Global offers a price promise to match or beat any written commission quotes offered by competitors.

Regulation & Licensing

AMP Global operates two main entities, both with top-tier regulatory oversight.

- AMP Global Clearing LLC – AMP Global (USA) is authorized as a Futures Clearing Merchant (FCM). Regulated by the National Futures Association and the Commodity Futures Trading Commission, registration number 0412490

- AMP Global Ltd – AMP Global (Europe) is authorized as a Cypriot Investment Firm (CIF). Regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 360/18. The broker is also compliant with the Market in Financial Instruments Directive (MiFID) which aims to increase transparency across EU financial markets

Traders registered under the AMP Global Europe subsidiary gain access to the Investor Compensation Fund. Investors benefit from up to €20,000 compensation in the case of business insolvency or failure. Client funds are also held in segregated accounts with top-rated European Banks.

Additionally, all activities are regularly monitored by third-party auditors.

Note, negative balance protection is available for CFD trading only.

Additional Features

Education

AMP Global’s educational content is comprehensive, with an in-built learning academy available on the official website. Resources are organized into asset classes with information suitable for both beginners and advanced traders.

There are also useful ‘how to’ videos, a blog forum, plus live and recorded webinars. A community support forum is also available, with conversations between retail investors. You can pick up tips and tricks, understand the latest market news or generate ideas for your next trade.

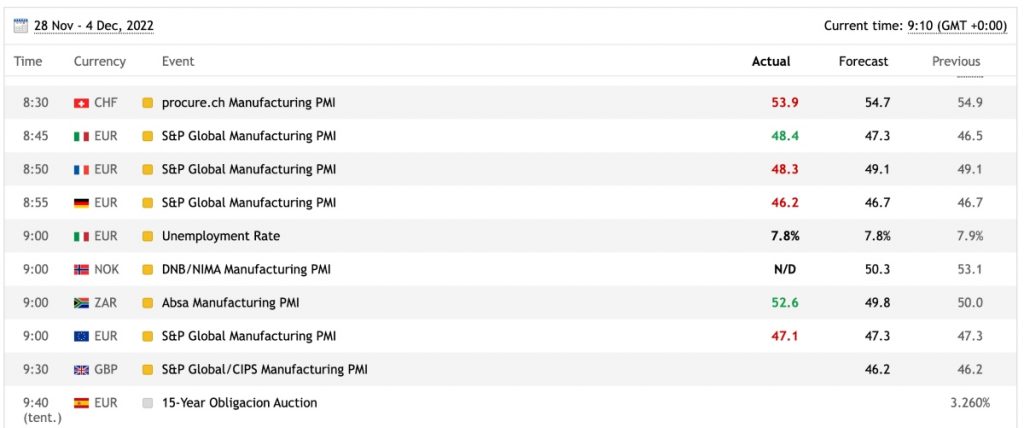

In addition, the broker offers a user-friendly economic calendar.

TradingView

AMP Global clients benefit from access to a free version of TradingView. This includes basic charting and trading tools. Simply use your existing AMP account credentials.

Note, you will not be required to pay for additional exchange data fees when using TradingView so long as futures trading is enabled in your client dashboard and the relevant exchange payments have been made within your live account.

How To Connect Your AMP Account To The TradingView Platform

- Visit www.tradingview.com

- From the homepage select ‘Start Free Trial’. The icon is located top right of the navigation bar

- Click ‘Sign In’ and enter your existing TradingView account credentials

- Select the ‘Chart’ icon in the middle of the top navigation bar

- Choose AMP Global from the list of brokers underneath the chart

- Select the ‘Connect’ button under ‘AMP Global’

- Enter your AMP Global live account credentials or choose a 14-day free trial

- Click ‘Connect’

Note, you will need a valid CQG connection and a TradingView account.

AMP Global Accounts

The broker offers one account type for all retail customers.

By default, all accounts are opened in EUR. Users will need to create a new ‘landing account’ to amend the account currency (USD, GBP, EUR, PLN and RUB accepted).

Minimum order sizes range from 0.01 lots to a maximum of 200 lots for currency pairs and 50 lots for CFD trades. Other account features include:

- Spreads from 1 pip

- Leverage up to 1:100

- Commissions applicable

- Unlimited open positions

- Minimum deposit requirement $100/£100/€100 or 6500 RUB

- Multiple trading strategies accepted (scalping, EAs and news trading)

An Islamic swap-free profile is also available.

Opening An Account

The registration requirements to open a new AMP Global live account are fairly complex. New users must complete six steps with various declarations, personal details, and economic profiling. This includes providing ID verification, previous investment experience, and employment history.

Trading Hours

AMP Global trading hours vary by instrument. For example, Micro E-Mini Futures Exchange-Traded Funds can be traded between 5 PM and 4 PM US Central time. On the other hand, forex can be traded from 5:05 PM to 5 PM US Central time (9:05 PM to 9 PM GMT).

Futures Exchanges also have their own market closures. The CME Group, for example, follows 11 US public holiday dates in which trading may be closed or trading hours amended. The broker also stipulates that ICE markets may announce market holiday closures particularly close to the closure date.

Keep an eye on the broker’s website and your trading platform for upcoming changes to standard trading times.

Customer Service

AMP Global offers 24-hour trade and tech telephone support available Sunday from 4:45 PM CST to Friday 5 PM CST. Local hotline numbers include London, Cyprus, Greece, and Australia.

Contact details:

- Email – support@ampglobal.com

- Live chat – Icon located at the bottom right of each webpage

- Telephone – UK +(44) 2038567788, Cyprus +(357) 22007182, Australia +(61) 291586177, Greece +(30) 2111986577, Spain +(34) 911237797 and Poland +(48) 221244800

- Office Broker/Clearing Address – AMP Global Clearing LLC, 221 N. LaSalle Street, 25th Floor, Chicago, IL 60601 USA or AMP Global Ltd, Kaminion Street 1, 2nd Floor, Agios Athanasios 4100, Limassol, Cyprus

The remote desktop connection service means the broker’s customer support representatives can access your personal computer to solve any issues or platform sticking points.

An FAQ section is also available on the broker’s website for quick self-help support.

Security & Safety

AMP Global’s regulatory oversight means that the broker should comply with industry-standard KYC, AML, and data privacy protocols.

The MetaTrader 5 platform is also secure. It offers fully encrypted data exchanges between servers and client portals. Additionally, the platform uses industry-standard firewalls and data privacy. Our experts recommend implementing two-factor authentication (2FA) for additional account protection.

AMP Global Verdict

AMP Global offers excellent access to the futures markets alongside forex and CFDs. When using the online broker, you can also be assured of a secure trading environment with tier-one regulatory oversight. Additionally, the MT5 trading platform offers advanced capabilities while the broker’s price match promise and low minimum deposit make it attractive to beginners and experienced traders alike.

FAQs

What Assets Does AMP Global Offer?

AMP Global offers forex, exchange-traded futures, and CFDs. This includes access to commodities, indices, stocks, cryptocurrencies, and more.

Note, US residents are only permitted to trade futures.

What Is AMP Global Clearing?

AMP Global Clearing LLC is the US subsidiary of the AMP Global Group. It is authorized as a Futures Clearing Merchant (FCM) and regulated by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC).

What Trading Platform Does AMP Global Offer?

AMP Global traders can use the MetaTrader 5 (MT5) platform. MT5 offers all the features and functionality required to successfully trade multiple assets, with over 80 indicators and drawing tools, one-click trading, real-time news, and support for automated trading.

AMP Global Vs AMP Futures – What Is The Difference?

AMP Futures is the trading name for AMP Global Clearing LLC, the US subsidiary of the AMP Global Group. AMP Global Ltd is the firm’s European entity.

Is There A Minimum Deposit Requirement To Open An AMP Global Account?

Yes – AMP Global clients must deposit at least $100/£100/€100 or 6500 RUB.

Top 3 Alternatives to AMP Global

Compare AMP Global with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

AMP Global Comparison Table

| AMP Global | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3.5 | 4.4 | 4.3 | 4.5 |

| Markets | Exchange-Traded Futures, Forex, Metals, Energies, Indices, Stocks, Crypto CFDs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | NFA, CFTC, CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | MT5, TradingView | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | 1:100 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 11 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by AMP Global and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| AMP Global | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | No | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | No |

AMP Global vs Other Brokers

Compare AMP Global with any other broker by selecting the other broker below.

The most popular AMP Global comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of AMP Global yet, will you be the first to help fellow traders decide if they should trade with AMP Global or not?