Admiral Markets Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Education & Training (Germany) - 2020

- Best Forex Broker (Spain) - 2020

- Best Forex Company - 2019

Pros

- Low minimum deposit from $100

- MetaTrader 4 platform and app integration

- The low minimum deposit, fractional shares and easy three-step account registration process will appeal to beginners

Cons

- Monthly inactivity fee

- The demo account expires after 30 days

- US traders not accepted

Admiral Markets Review

Admiral Markets is a top-rated forex and CFD broker with 5000+ trading instruments on the MT4 and MT5 platforms. A low minimum deposit, competitive spreads, and a suite of educational materials make it popular with both beginners and active traders. This Admiral Markets review will unpack trading fees, leverage, mobile apps, account types, plus the pros and cons of signing up.

Company Details

Admiral Markets was founded in 2001. Today, the company’s several hundred thousand active traders can be found in countries worldwide, from Germany to India.

The group’s headquarters are in Tallinn, Estonia, although the company has offices in several cities, including London and Zagreb.

Admiral Markets holds licenses with various regulatory bodies, including the UK Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

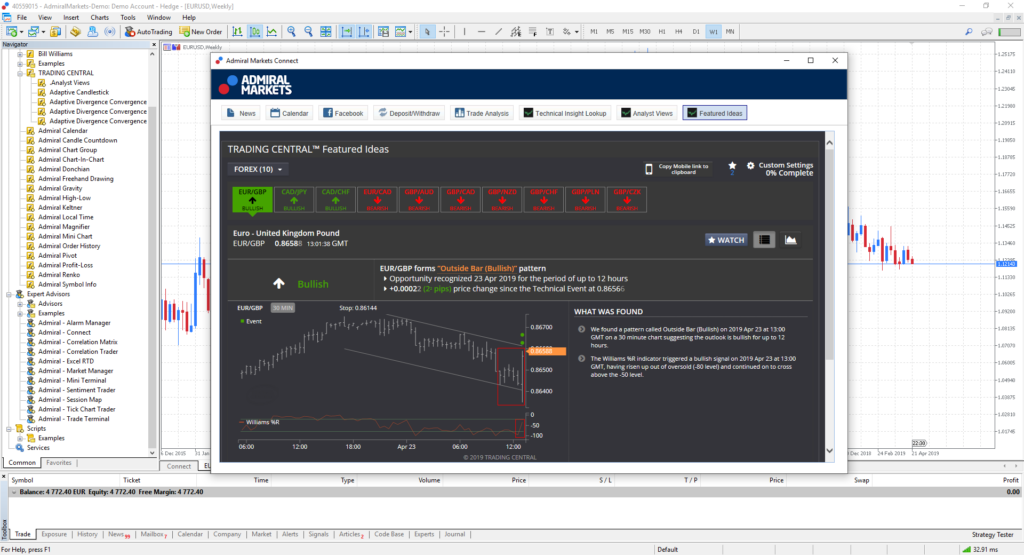

Trading Platforms

Admiral Markets has partnered up with MetaQuotes to offer the full suite of MetaTrader platforms, including MT4, MT5, MetaTrader WebTrader, and a MetaTrader Supreme Edition. Admirals also offers Parallels to help Mac traders seamlessly use the MetaTrader platforms on their Mac devices.

MT4

MetaTrader 4 is the world’s leading retail trading platform, particularly for forex and CFD trading. The software can be downloaded to Mac and Windows devices.

The MetaTrader 4 system is fast, reliable and comes with a range of useful features, including:

- Multiple time frames, from one minute up to one month

- Automated trading through APIs

- Customizable indicators

- Rich historical data

- Advanced charting

- One-click trading

How To Place A Trade On Admiral Markets MT4

- Choose an instrument from the Market Watch window, e.g. Dax 30

- Select ‘New Order’ from the top menu. Alternatively, you can activate one-click trading

- Input the relevant trade details, including order type, volume, plus and stops and limits

- Confirm the order by selecting ‘buy’ or ‘sell’

MT5

MetaTrader 5 is the latest evolution of the MT4 system and caters to more experienced traders. With a host of advanced technical analysis tools and a fully customizable interface, it’s a powerful all-round platform. Features include:

- Education market

- Free market data

- Live news feeds

- Level 2 pricing

- VPS support

MetaTrader Supreme Edition

For the veteran trader, the MetaTrader Supreme Edition has powerful tools to enhance trade operations. The platform offers sophisticated technical analysis indicators, award-winning pattern recognition technology, holding timeframes, and day trading strategies. Global Opinion widgets also allow for helpful add-ons to manage multiple currencies and orders.

MetaTrader WebTrader

WebTrader is an easy access web-based platform. Users can trade anywhere with just an internet connection. The WebTrader platform allows for price analysis and straightforward trade management. Users get access to a range of indicators, including pivot points and Bollinger Bands, plus an easy-to-use forex pip calculator.

WebTrader also facilitates popular strategies, such as 1-minute scalping and hedging. Finally, risk management tools, such as guaranteed stop out levels to minimise losses, can also be implemented.

StereoTrader

When we used Admiral Markets, we particularly liked the StereoTrader add-on for MetaTrader. Suitable for day trading and scalping, users benefit from one-click trading, over 30 types of orders, and a cross-functional investing panel.

For high-volume traders looking for lightning fast executions and advanced order management, StereoTrader is worth downloading.

Products & Markets

Our experts found that Admiral Markets offers over 5000 global assets through CFDs, including:

- 50+ forex pairs

- 3,000+ stocks & shares

- 30+ cryptocurrencies, including Bitcoin

- 25+ commodities, including gold and oil

- 40+ indices, including the US Dow Jones 30, S&P 500, Nasdaq, plus Germany’s Dax 40

Also available to trade are close to 400 ETFs and bonds. 700+ fractional shares, including blue chip dividend paying stocks, are also available. In addition, spread betting is available to account holders.

Importantly, Admirals provides a much wider range of instruments than most alternatives, though binary options are not provided. 90% of orders are also executed in under 150 milliseconds.

Spreads & Fees

Admiral Markets keep trading costs low. The online broker takes its fee from spreads, which start from zero pips. Average live spreads on major forex pairs, such as the EUR/USD and GBP/USD, are 0.6 pips and 1 pip respectively. Spreads on indices, such as the US Dow Jones, are around 1 pip.

There are some other costs to be aware of. For example, a $10 monthly inactivity fee is charged to accounts that have been dormant for two years. Also, swap rates, otherwise known as interest fees, are charged to clients that hold positions overnight. Details of swap fees can be found on the broker’s website.

Overall, if you take Admiral Markets vs well-known names, such as Plus500, Zulutrade, and XTB, the online broker comes in at a similar price.

Admiral Markets Leverage

For retail clients, leverage up to 1:30 is available:

- Forex – 1:30 maximum leverage

- Indices & commodities – 1:10 maximum leverage

- Stocks, ETFs & bonds – 1:5 maximum leverage

- Cryptocurrency – 1:2 maximum leverage

An easy-to-use margin calculator and details of the margin call process can be found on the broker’s website.

Clients of Admiral Markets Jordan, whether domestic, EU or non-EU, can access maximum leverage rates of up to 1:500.

Mobile App Review

A fully functional mobile app can be downloaded to iOS and Android devices. Admiral Markets have ensured mobile traders get access to a live price feed, three chart types, custom indicators, news releases, and a trading journal. The mobile platform interface can also be customized.

Payment Methods

Deposits

There is a wide range of deposit options at Admiral Markets:

- Bank transfer – up to three business days

- Visa & Mastercard – instant

- iBank&BankLink – instant

- Przelewy – up to one day

- Safety Pay – instant

- Neteller – instant

- Skrill – instant

- Klarna – instant

- PayPal – instant

- iDEAL – instant

The minimum deposit is $100 and all payment methods are free, except for e-wallets Skrill and Neteller, which charge 0.9% (minimum $1).

Withdrawals

Withdrawals can be made via bank transfer, PayPal, Skrill, and Neteller. All withdrawals are processed instantly aside from bank transfer, which can take up to three days. Admiral Markets provide the required bank codes when a withdrawal is requested.

Traders are eligible for two free withdrawals per month with a $1 minimum withdrawal.

Note, there may be additional bank currency conversion fees.

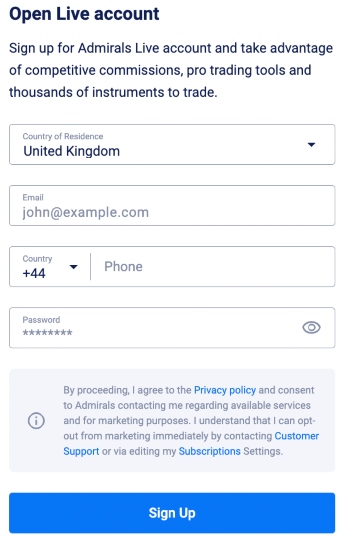

Admirals Demo Account

Admiral Markets offers a demo account with $10,000 in virtual funds. Users can select the practice account from the sign-up page. Once you’ve received your login credentials, you can test the MT4 and MT5 platforms, and try leveraged trading on a range of instruments. The demo account replicates real-time market data with a 15-minute delay.

How To Register For A Demo Account

- On the broker’s homepage, select ‘Get Demo Account’

- Choose your country of residence

- Enter your name and phone number

- Choose a password

- Click on ‘Sign Up’

Login details will be sent to the registered email address.

Deals & Promotions

Admiral Markets has been known to offer no deposit welcome bonuses and up to 50% sign-up deposit offers. However, there wasn’t any at the time of writing.

Bonus terms and conditions, plus availability, depend on the jurisdiction you are trading from. The EU, in particular, has toughened its stance on welcome offers.

Check the broker’s website for news of upcoming promotions.

Regulation & Licensing

Admiral Markets is a reputable global broker licensed in multiple jurisdictions. Admiral Markets UK Limited holds a license with the Financial Conduct Authority (FCA).

The group also holds licenses with the Estonian Financial Supervision Authority, the Cyprus Securities and Exchange Commission (CySEC), the Jordan Securities Commissions (JSC) plus the Australian Securities and Investments Commission (ASIC). The broker is also legally allowed to operate in many other countries, from France to Romania and Indonesia.

To comply with regulator conditions, Admirals keeps client capital segregated from the group’s assets in an EEA-regulated credit body.

Deposit guarantee schemes and financial services compensation schemes also ensure that clients’ funds are protected in the event the broker was to go bankrupt.

Overall, if you take Admiral Markets vs the likes of eToro, Pepperstone, and Interactive Brokers, the broker is equally respected and trustworthy.

Additional Features

Admiral Markets stands out amongst our forex broker reviews for its educational courses and trading tools. There are multiple webinars online covering CFDs and forex 101 lessons. Admiral also releases educational books in multiple languages and demos analytical tools.

Additionally, traders get access to Premium Analytics, Dow Jones News, Acuity Trading, plus Trading Central. All of these tools are designed to educate traders on investing strategies and judging market sentiment. The Traders Room can also be used to manage multiple Admiral accounts. A weekly trading podcast is also hosted by the broker, plus a wallet for managing multiple trading and investing accounts.

A virtual private server (VPS) is available with 24/7 terminal uptime, ultra-low latency, and access to Equinix data centres. This is a great tool for high-volume traders looking to run automated strategies from anywhere. No technical interruptions should interfere with your trading setup.

Account Types

When it comes to opening an account with Admiral Markets, there are Trade.MT4, Zero.MT4, Trade.MT5, and Zero.MT5 account options. As the names suggest, you get a choice between trading platforms and spreads.

Stocks, cryptocurrencies, bonds, and ETFs are not available with the zero spread accounts. Leverage up to 1:30 is available across all accounts but the zero spread accounts allow for greatest position sizes, up to 200 lots on forex vs 100 lots on the standard Trade accounts. The minimum deposit across all accounts is $100 and mobile trading is an option with all account types.

Admiral Markets also offers an Islamic swap-free account plus a professional account for institutional traders.

Note, Admiral Markets is a market maker and does not use an ECN model across any of its retail accounts.

Admiral Markets Trading Hours

Admiral Markets follow standard market trading hours. Specific opening and closing hours depend on the instrument traded but usually run from Monday to Friday, although cryptocurrency is traded in decent volumes over the weekend.

The Admiral Markets Group does run a reduced schedule during certain bank holidays. Changes to trading hours, including respective time zones, are published on the broker’s website.

Customer Support

Admiral Markets customer support team is contactable via:

- Email address – global@admiralmarkets.com

- Telephone support number – +442035041364

- Live chat – chat logo found at the bottom of the broker’s website

- Feedback form – online query form available on the ‘contact us’ page

You can normally get through to a customer service representative via live chat or telephone within a couple of minutes. The multi-lingual support team can deal with most account and technical queries, including requests to close or delete an account.

Keep up to date with the latest news from the Admiral Markets Group on social media:

Security & Safety

User security at Admiral Markets is strong. The website uses encryption software to keep client data secure. Also, one-time password authorization is available on the MetaTrader platforms while dual-factor authentication via SMS or Google Authenticator is used to secure the Traders Room.

In addition, negative balance protection is provided.

Admiral Markets Verdict

With comprehensive trading tools and educational content, Admiral Markets is one of the top forex and CFD brokers. Offering both the MT4 and MT5 trading platforms, plus zero spread accounts, the broker is a good fit for beginners and seasoned traders.

FAQs

Is Admiral Markets A Good Or Bad Broker?

Admiral Markets is a good all-round online broker. They are regulated in multiple jurisdictions, offer competitive trading fees, and a broad range of CFD and forex assets.

What Trading Platforms Does Admiral Markets Offer?

Admiral Markets has teamed up with MetaQuotes, the company behind the MetaTrader 4 & 5 trading platforms. On top of MT4 and MT5, clients can also use the MetaTrader Supreme Edition and MetaTrader WebTrader.

How Much Capital Do I Need To Trade At Admiral Markets?

The minimum deposit at Admiral Markets is $100. The minimum position size is 0.01 lots, although stake requirements do vary among instruments. Overall, the low capital requirements make them a good option for traders starting out.

Does Admiral Markets Offer A Demo Account?

Admiral Markets offers a demo account with $10,000 in virtual cash. Just a few basic details, such as an email address, is needed to open a practice account. Users can then test the MetaTrader platforms and the broker’s various trading products.

Is Admiral Markets Regulated?

Admiral Markets is regulated by the UK Financial Conduct Authority, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC). The online broker is also regulated by the Estonian Financial Supervision Authority, where its headquarters are located.

Is Admiral Markets Good For Day Trading?

Admiral Markets is a good broker for day trading, offering tight spreads from zero pips. The brokerage also executes 90% of orders in less than 150 milliseconds. Add in powerful trading tools designed for day trading and scalping like SteroTrader, plus 5000+ assets, and day traders have ample opportunities to make intraday profits.

Best Alternatives to Admiral Markets

Compare Admiral Markets with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Admiral Markets Comparison Table

| Admiral Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3.6 | 4.3 | 3.6 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs, bonds, spread betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 |

| Minimum Trade | 0.01 Lots | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA, CySEC, ASIC, JSC, CMA, CIRO, AFM | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | MT4, MT5, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:30 (EU), 1:500 (Global) | 1:50 | 1:200 |

| Payment Methods | 11 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Admiral Markets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Admiral Markets | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | No | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | Yes | No | Yes |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | No | Yes |

Admiral Markets vs Other Brokers

Compare Admiral Markets with any other broker by selecting the other broker below.

The most popular Admiral Markets comparisons:

Customer Reviews

4.5 / 5This average customer rating is based on 2 Admiral Markets customer reviews submitted by our visitors.

If you have traded with Admiral Markets we would really like to know about your experience - please submit your own review. Thank you.

Admirals is probably the best MetaTrader broker I’ve used and I’ve tried a lot. It’s one of the only firms I’ve come across to offer a load of extras for MT. It can take Admirals a couple of days to review your application for StereoTrader but the perks are great if you place a lot of short-term trades like me. You get a new MetaTrader panel that lets you do things like place groups of orders in one click and get much better historical data for testing. I know Admirals are regulated in the UK too so they aren’t one of these rogue operators based in some remote island which gives me peace of mind.

wonderful put up, very informative. I wonder why the opposite experts of this sector do not understand this. You should continue your writing. I am sure, you’ve a great readers’ base already!