Turbo Warrants

Turbo warrants, also known as turbo certificates or callable bull/bear contracts, are a form of derivative, mainly traded in Europe and Hong Kong. In this tutorial, we explain what a turbo warrant is, how they work, their pricing, pros and cons, example strategies, plus steps to get started trading. We also list the best brokers for trading turbos in 2026.

Turbo Warrant Trading Brokers

This is why we think these brokers are the best in this category in 2026:

- Swissquote - Established in 1996, Swissquote is a Switzerland-based bank and broker that offers online trading on an industry beating three million products, from forex and CFDs to futures, options and bonds. Highly trusted, it has built a strong reputation through innovative trading solutions, from becoming the first bank to offer crypto trading in 2017 to more recently launching fractional shares and its Invest Easy service.

Swissquote

"Swissquote is an excellent choice for active traders looking for a customizable platform, such as its CXFD, which integrates Autochartist for automated chart analysis to aid trading decisions. However, its average fees and steep $1,000 minimum deposit might make it less accessible for beginner traders."

Christian Harris, Reviewer

Swissquote Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Bonds, Options, Futures, ETFs, Crypto (location dependent) |

| Regulator | FCA, FINMA, CSSF, DFSA, SFC, MAS, MFSA, CySEC, FSCA |

| Platforms | CFXD, MT4, MT5, AutoChartist, TradingCentral |

| Minimum Deposit | $1,000 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:100 (Retail), 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, ZAR, TRY, SEK, NOK, CHF, HKD, SGD, PLN, AED, SAR, HUF, THB, QAR, MXN |

Pros

- Swissquote supports powerful platforms for day trading, such as MetaTrader 4/5 and its own CFXD (previously known as Advanced Trader) which impressed during testing with customizable layouts and access to advanced charting tools and technical indicators.

- Swissquote is highly trusted owing to its position as a bank, its listing on the Swiss stock exchange, and authorization from trusted bodies like FINMA in Switzerland, FCA in the UK, and CSSF in Luxembourg.

- Swissquote is built for fast-paced trading strategies like day trading, scalping and high-frequency trading with 9ms average execution speeds, a 98% fill ratio, and FIX API.

Cons

- Unlike brokers such as eToro with social trading features, Swissquote lacks tools for community engagement or copying successful traders, limiting its appeal for those who value peer-to-peer learning.

- Analysis shows Swissquote’s fees are on the high side, with forex spreads starting at 1.3 pips on Standard accounts, compared to 0.0 pips at brokers like Pepperstone or IC Markets. Transaction fees for non-Swiss stocks and ETFs can also add up for frequent traders.

- Swissquote primarily caters to pro and high-net-worth clients, with high minimum deposit requirements (eg $1,000 for Standard accounts), making it less suited for smaller traders who can find higher leverage at the growing number of brokers with no minimum deposit.

Turbo Warrants Explained

A turbo warrant is a leveraged security and type of barrier option. Similar to other types of options, if the value of an asset moves in the speculated direction by expiry, a pre-determined payout is issued. Importantly, the price of a turbo warrant matches the value of the underlying financial asset, for example, a stock.

Turbo contracts typically have high leverage, low volatility, and a built-in knock-out level where the asset’s price at purchase (spot price) has to hit a certain value (strike price) to terminate and void the turbo. Turbo warrants are primarily used for going long or short and for hedging.

How Turbos Work

Turbo warrant trading works by buying a transferrable security based on the value of an underlying asset. This means you take a position on an asset’s price either increasing or decreasing. Traders use their market knowledge and experience to preempt fluctuations.

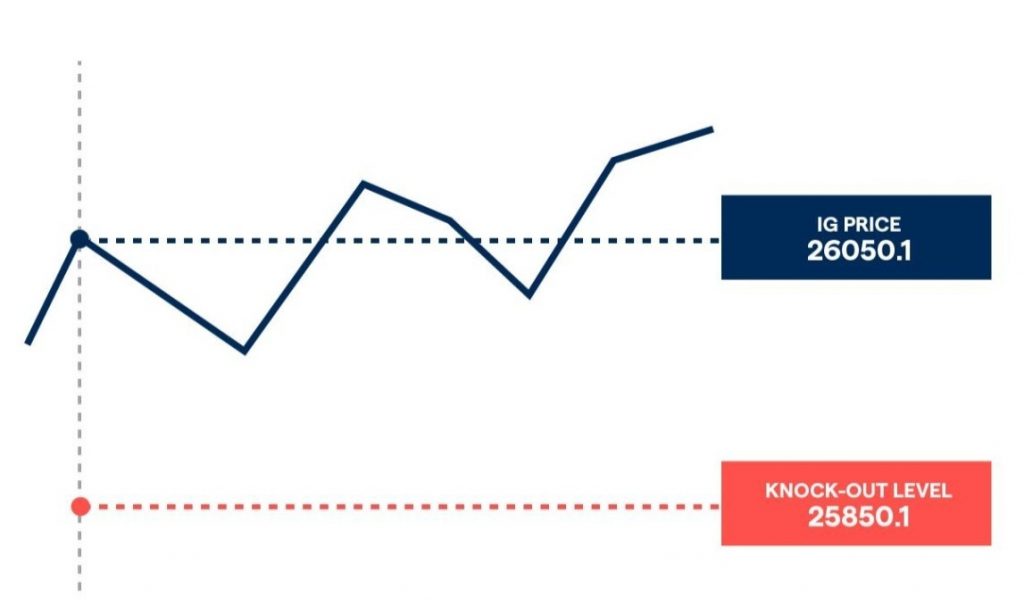

As mentioned above, for every trade you pick a knock-out level. This is the cut-off point where the turbo contract will expire when the strike price is reached. This limits profits for the seller and limits losses for the buyer.

Like other barrier options, turbo warrants are path-dependent. The price has to decrease to reach their barrier or knock-out level which equates to the trader’s strike price. This means that buyers and sellers of turbo warrants have opposing expectations.

There are two main types of turbo warrants:

- Long turbos – A trader that thinks the price of the underlying asset will rise if they buy a long turbo. Long turbo warrants have a knock-out level below the underlying asset’s current market price to protect traders from the market falling.

- Short turbos – A trader that believes the price of the underlying asset might fall will buy a short turbo. Short turbos have a knock-out level above the underlying asset’s current market price to protect traders from the market rising.

Pricing

The knock-out level dictates the price of a turbo warrant and your total leverage, as it is mainly based on the difference between the underlying market price and the selected knock-out level. This price will be your maximum loss. This cost is paid in full upfront and enables traders to put an absolute cap on their losses and control their risk.

The lower the price of a turbo warrant, the higher the typical leverage. Greater leverage means that any movement in the underlying price will amplify your profit or loss. Importantly, this means all costs are built into a turbo warrant.

When exiting the same day and avoiding a knock out the full cost will be refunded plus or minus your profits or losses. Some extra charges occur when holding a position over 24 hours but these are billed via small changes to the knock-out level, meaning that traders don’t have to keep adding money to their trading account to maintain a position.

Typically, turbo warrant pricing is lower than regular warrants because the knock-out level in a turbo exposes the holder to additional risk. This means that if the underlying price moves in an adverse direction to the holder’s predetermined strike price the two will expire and no profits will be made.

Example Trade

Below is an example trading scenario…

- An investor wants to trade Amazon stocks currently valued at $100 in the underlying market

- They expect the price to rise, so they buy a long turbo warrant

- They pick their knock-out level at $80 (remember for long turbos this must be below the spot price) making the cost of the turbo $20 ($100 – $80). This is the initial payment and the maximum potential loss

- The price of Amazon stock rises by $20 to $120. The turbo follows this price increase and is now valued at $40 ($120 – $80).

- The trader takes 100% profit on the $20 outlay

Pros & Cons

Like any other form of trading, it is important to consider the benefits and risks of your chosen financial instrument.

Pros

- Low volatility – A turbo warrant’s price is less affected by the implied volatility of the stock market, for example

- High leverage – Investors only have to give a fraction of the full cost of their position meaning trading turbo warrants is cheaper than directly trading the underlying asset. This can provide access to larger positions and magnify returns

- Built-in stop-loss – The knock-out level of turbo warrants means that once the strike price is reached the turbo expires. This also means that there aren’t unlimited losses so traders can control their risk.

- 24/5 trading – Turbo24 is a turbo warrant listed and traded on Spectrum which provides 24-hour access to financial markets from Monday to Friday, even when the underlying market is closed. They are offered by IG and several other brokers.

Cons

- Complex instruments – Turbo warrants have complicated components and complex payoffs that require a strong level of trading expertise to create profits

- Risk of high losses – Despite knock-out levels, the leverage used when trading turbo warrants means there is a risk of losing money rapidly

- Limited access to all assets – Although turbo warrants do provide access to a number of different markets, they are restricted to those that are highly liquid, such as major forex pairs and popular equities

Trading Strategies

Turbo warrants are typically traded on venues with fully available order books so investors can base their thoughts on market trends and plan their strategy. For example, many investors use turbo warrants like options as a cheaper way to hedge against losses. Due to the high leverage of turbos, the hedge is cheaper than buying a regular option.

Also, investors in Turbo24 can use their overnight trading as a neat way to overcome a knock-out. This is because if the turbo is knocked out when the underlying market is closed it doesn’t expire until the market reopens at which point the trader has more time for the market to move in their favour.

How To Get Started

Now you understand all things turbo warrants – we’ve listed the steps to get started trading alongside the pitfalls to avoid:

Choose A Broker

Firstly, you will need to open an account with an online broker. It is important to select a brand you trust, so check their regulatory status, levels of customer support and fees. Reliable brokers that offer turbo warrants include IG.

Analyse The Market

Make sure you have a thorough understanding of how the price of your chosen asset is expected to fluctuate. Trading turbos is speculation, but studying data and trends in the market can strengthen your position.

Select Your Market & Position

If you anticipate the cost of gold to fall choose a short turbo warrant, while if you think the value of Apple stock is set to rise, buy a long turbo.

Choose Your Order & Expiry Type

You can choose from a range of market, limit and stop orders with different expiry options. These will be detailed by your broker.

Decide Your Trade Size

The trade size is the number of turbos that you would like to buy. The size of your position will help to decide the outlay which equates to your maximum loss. Make sure you practise sensible money management.

Decide Your Knock-Out Level

Remember that the closer the knock-out is to the spot price of the underlying asset the higher the leverage of your turbo warrant. This can inflict higher losses.

Monitor Your Position

It is important to watch the market after you’ve bought your turbo warrant. If not, you may miss out on an early exit and incur more losses if you fail to observe contradictory movements. Also be careful when holding your position overnight as this can change your knock-out level.

Exit Your Position

You can manually exit your position to receive profits or limit losses. But if your knock-out level is hit, your position will expire and the turbo warrant will be voided automatically.

Final Thoughts

Turbo warrants can be an excellent addition to a traditional portfolio. Their complexity and risk are compensated for in potentially high returns. Investors should be wary of market movements as leverage creates the possibility for larger losses. However, their built-in knock-out system is a great benefit for any trader because no matter the risk you always know what you stand to lose.

FAQs

How Long Have Turbo Warrants Been Available To Trade?

Turbo warrants have been available across international stock markets for two decades, having first appeared in late 2001. Since then, they have grown in popularity especially across Europe, for example in Germany, half of all derivative trades are turbo warrants.

Can I Go Long Or Short With A Turbo Warrant?

Yes – you can go both long and short when trading turbo warrants. When you think the market is rising, buy a ‘long turbo’, and when you foresee the market falling, buy a ‘short turbo’.

Is My Money Safe When Trading Turbo Warrants?

Turbo warrants are risky products. With that said, choosing a regulated and trusted broker can help to ensure your funds and transactions are safeguarded. We also advise thorough research before trading, using a demo account and maintaining sensible attitudes toward money management.

What Markets Can I Trade With Turbo Warrants?

Turbo warrants are available to trade across various markets. These include equities, European indices, currency pairs and commodities like gold.

What Does Down And Out Mean In Turbo Warrants?

Down and out means that the spot price (the price of the underlying asset at purchase) starts above the barrier level/ knock out level and has to decrease in value to be knocked out. So turbo warrants have to move down to be knocked out.