Tradier Brokerage Review 2025

Pros

- 401k solutions

- Commission-free stock and ETF trading plus low commissions for options

- Takeover queues

Cons

- Complex platforms that aren't best for beginners

- No cash management accounts

- High IRA and mutual fund fees

Tradier Brokerage Review

Tradier Brokerage specializes in equities and options trading. The US-regulated broker offers access to an unrivalled list of trading platforms and investing tools. Our 2025 review of Tradier Brokerage weighs up its fees, products and account types, plus its customizable API offering and access to third-party modules. Find out if the Tradier Brokerage Group is right for you along with sign-up details.

Tradier Brokerage Headlines

Founded in 2012, Tradier Brokerage Inc. is a cloud-based brokerage company located in Charlotte, N.C. The broker has active accounts in over 120 countries, servicing individual traders, developers, advisors and finance providers.

The company is privately owned and has several investors, including FPRIME, the private investment branch of Fidelity. At the time of writing, Tradier Brokerage has raised $6.1 million in funding.

In March 2021, the firm also acquired Rho, a commission-free trading platform. The company’s CEO is Dan Raju.

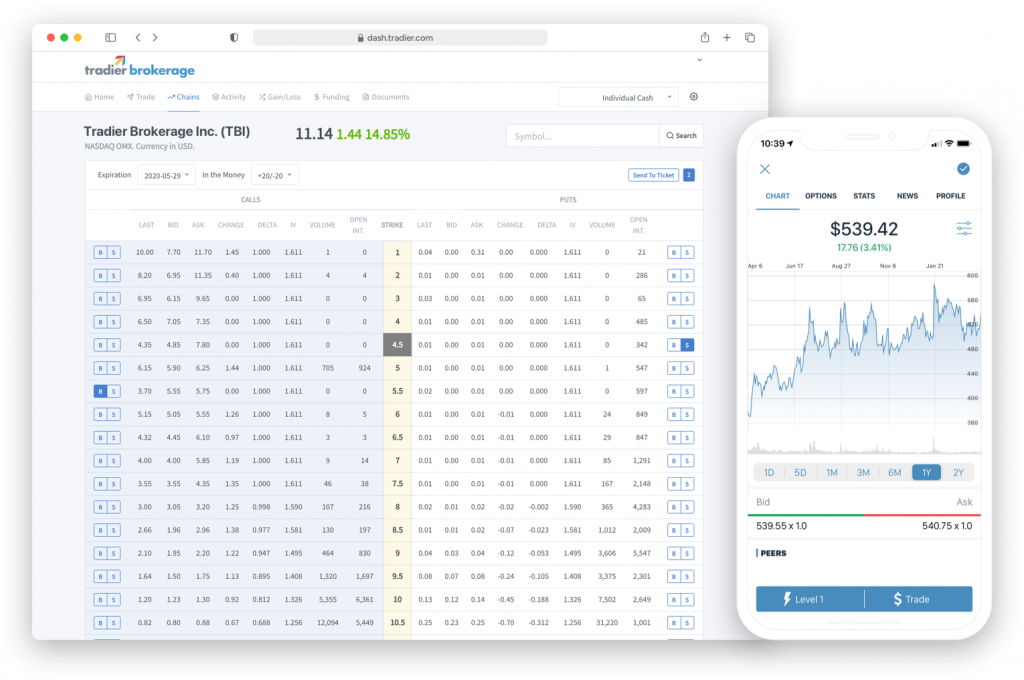

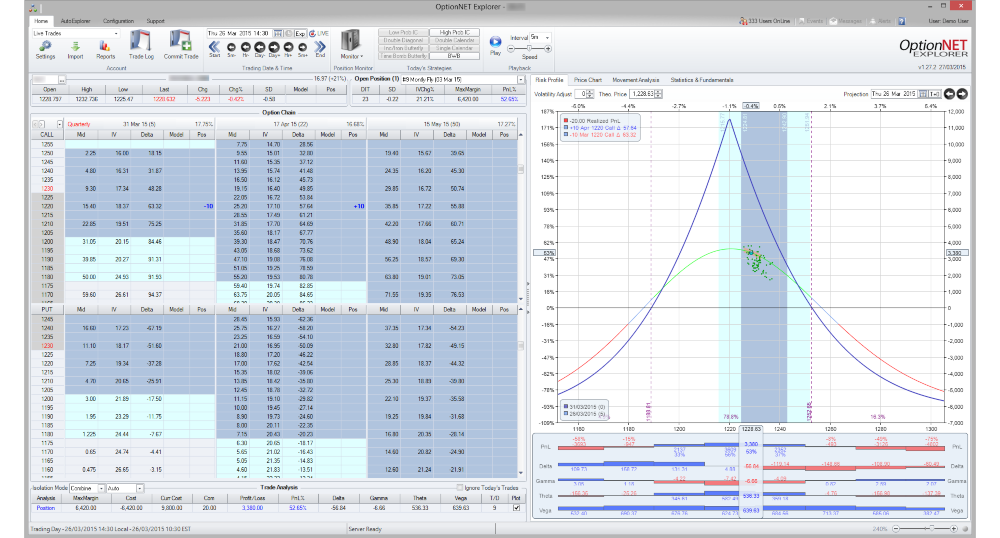

Trading Platforms & Technology

If there is one area where Tradier Brokerage shines, it is partnerships with trading platform providers. Multiple platforms and tools can be integrated via an API plug-in so you can develop and customize your ideal trading terminal.

Tradier Brokerage Group works with dozens of platforms that give traders access to 22 stock exchanges and 14 options markets. The partner platforms all have different specialities and features. For example, MotiveWave specializes in advanced trading tools. This includes Elliott Wave, Fibonacci, and ratio analysis, ideal for technical traders.

Another partner, Track ’n Trade, is designed for more visual traders. It merges charting and trading onto a single platform, making it easier to respond to market activity during periods of high volume and volatility. The straightforward charting interface also offers decent customization capabilities.

Traders can also opt for the broker’s own front-end platform, Tradehawk, for a $10 monthly subscription. This is suited to individual investors who want to trade directly with Tradier Brokerage instead of using APIs to external platforms. TradeHawk has excellent functionality:

- Order entry and management

- Risk analysis and simulation

- Educational video library

- Trading tools and charting

- Portfolio management

- Spread logs

Tradier Brokerage’s basic platform offers an easy-to-use interface, multiple investing tools as well as trade tickets to help build a variety of multi-leg strategies. Still, for active traders, capitalizing on Tradier Brokerage’s integrated and customizable third-party platforms is one of the key attractions.

Assets & Markets

Tradier Brokerage specializes in trading:

- Options

- Stocks

- ETFs

- Bonds

- Mutual funds

With that said, partner platforms also offer access to additional markets:

- Forex

- Futures

- Penny stocks

- Fractional shares

Note, trading bonds and mutual funds is only permitted via phone calls – not through third parties.

Trading Fees

Active traders can keep costs down with Tradier Brokerage. The broker offers commission-free trading on several products, alongside a $0 minimum deposit and free electronic statements. Tradier makes its money through the following charges:

- Account Opening Fees – The broker charges $10 when customers open an account.

- Advisory Fees – For broker-assisted trades, the company charges $10 per trade.

- Security Reorganisation Fees – For voluntary security reorganization Tradier Brokerage charges $50.

- Payment Transfers – The trading brand charges $30 for wire transfers and $75 for automated customer account transfers.

- Integrated Platform Fees – Traders who use third-party platforms will incur additional fees. For example, full access to Track ’n Trade costs $99 a month. Charges vary between providers.

- Product Fees – Individual Retirement Accounts (IRAs) have a $30 annual fee and a $60 closure fee. Mutual fund trades cost $30. For options exercise or assignments $9 is charged per order.

- Paper Statement and Confirm Fees – The online brokerage charges $6 per paper statement and $3 per paper confirmation.

- Inactivity Fees – Tradier Brokerage charges an annual inactivity fee of $50 when Equity and Options accounts with $2,000 or less make fewer than two trades per year. A monthly fee is also charged to international Equity and Options accounts if they make fewer than two trades a month.

Mobile Apps

Tradier Brokerage offers a mobile app available on iOS and Android devices. The application has an easy-to-navigate interface and provides the same features available on the desktop platform. Tradehawk has a separate mobile app.

The firm also launched an additional online trading application called Tradier Dash, exclusive to Tradier Brokerage account holders. This provides further portfolio management tools and investing features.

Payment Methods

Tradier Brokerage supports several payment solutions:

- ACH transfer

- Check deposit

- Bank wire transfer

- Automated customer account transfer (moving funds from one broker to another)

Most payments are processed within a couple of working days. Bear in mind that you may need to provide proof of ID and address before withdrawals can be completed.

Deals & Promotions

You won’t find any type of bonus offer, gift card, 50% off promo code or other trading incentives at Tradier Brokerage. With that said, some promotions are offered on the platforms they are partnered with. Most promos are typically based on the size of the initial deposit. For example, partner Option Alpha offers several promotions for integrating trading with Tradier Brokerage Inc:

- $50 cash bonus for funding your account

- $100 cash bonus for funding at least $5k

- $300 cash bonus for funding at least $100k

Regulation & Licensing

Tradier Brokerage is a legitimate government-regulated broker. It holds a license with U.S. Securities and Exchange Commission (SEC) and a voluntary membership to the Financial Industry Regulatory Authority (FINRA). Together, these regulatory bodies ensure Tradier Brokerage follows strict conduct rules that protects its users and investors.

Account Types

Tradier Brokerage offers two main accounts: Subscription and Equity & Option.

Both offer ETFs and commission-free stock trading. As the name suggests, the subscription account charges $10 a month. This monthly fee grants commission-free options trading on top of stocks and ETFs, though it doesn’t include single listed index options which retain a $0.35 fee per contract.

Equity and Option account holders are charged a fixed $0.35 fee per options trade. No monthly fees are charged. There is also no ticket charge or minimums while simple or complex options orders are accepted.

Margin Accounts

Tradier Brokerage also offers margin accounts. These require a $2,000 minimum balance and interest is charged when there is an outstanding debit balance. An interest rate of 5.25% is applied to margin accounts, not exactly 0% APR but competitively priced versus alternative brokers. Interest is charged on the 15th of each month.

Demo Accounts

Tradier Brokerage offers a demo account through ‘The Sandbox’ module. Here you can use up to $100,000 in virtual funds to practise trading strategies. Paper trading is free using the 60-day trial. This allows traders to test the tools and platform customizations before investing their own capital.

Trading Hours

Tradier Brokerage’s main trading hours are from 9:30 am EST to 4:00 pm, however, options on some securities (for example SPY) trade until 4:15 pm EST. The brand also permits trading outside its regular hours of operation. Pre-market trading times are from 7:00 am to 9:24 am EST. After-market trading is from 4:00 pm to 7:55 pm EST.

Customer Support

Tradier Brokerage provides customer service via:

- E-mail – service@tradierbrokerage.com

- Phone number – (980) 272-3880

- Fax – (980) 229-4715

If you have a question or problem like the Tradier Brokerage platform keeps crashing, the customer support team are available Monday to Friday 8 am to 5 pm EST. Importantly, multiple customer reviews report efficient response times. For email queries, responses can take up to one day.

It could also be a good idea to follow Tradier Brokerage on their social media platforms like Twitter and Facebook to keep abreast of platform and product updates.

Trader Safety

Tradier Brokerage facilitates secure and safe transactions. The broker also holds a membership with the Securities Investor Protection Corporation (SIPC), which grants $500,000 insurance cover if the firm declares bankruptcy. In addition, the trading platforms and website use high-tech encryption to secure personal data.

Tradier Brokerage Verdict

Tradier Brokerage offers advanced financial services to retail and institutional traders. The firm is built for experienced investors who require sophisticated tools and market analysis features. Active clients also benefit from low fees when trading equities and options, plus competitive margin rates. With that said, for investors interested in IRAs or mutual funds, fees are fairly high.

Overall, Tradier Brokerage is an excellent choice for established traders interested in speculating on stocks and options through various third-party platform providers. Their list of platform partners is virtually unmatched.

FAQs

Who Can Open A Tradier Brokerage Account?

Tradier Brokerage is available in all 50 US states so whether you’re based in Tucson, Arizona or Albany, you can open an account. International clients from Europe and elsewhere can also open accounts. Importantly, to login you must be at least 18 years old.

What Registration Information Does Tradier Brokerage Require?

New traders will need to provide the following details: Name and contact details, date of birth, form of ID (passport, drivers license etc), employment status and annual income, social security number (for US citizens), net worth, trading experience and investment goals.

Is Tradier Brokerage Available In Canada?

No – Tradier brokerage is unable to do business in certain countries, including Canada. Clients from the UK and Australia are also unable to open a live trading account.

What Are Tradier Brokerage’s Pattern Day Trading Rules?

Tradier Brokerage follows the pattern day trading (PDT) rule that applies to margin accounts. If you’re flagged as a pattern day trader, you must start each day with at least $25,000 equity. If your account drops below $25,000 then the brokerage will restrict trading activity until the account value returns to $25,000.

How Do I Send A Cheque To Tradier Brokerage Group?

Cheques can be sent directly to Tradier Brokerage’s headquarters. The address and zip code: 11016 Rushmore Drive, Suite 350, Charlotte, N.C., 28277.

Top 3 Alternatives to Tradier Brokerage

Compare Tradier Brokerage with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Firstrade – Firstrade is a US-headquartered discount broker-dealer with authorization from the SEC. The company is also a member of FINRA/SIPC. With welcome bonuses, powerful tools and apps, plus commission-free trading, Firstrade Securities is a popular and top-tier online brokerage. It is also quick and easy to open a new account.

Tradier Brokerage Comparison Table

| Tradier Brokerage | Interactive Brokers | eToro USA | Firstrade | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 3.4 | 4 |

| Markets | Stocks, ETFs, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto | Stocks, ETFs, Options, Mutual Funds, Bonds, Cryptos, Fixed |

| Demo Account | Yes | Yes | Yes | No |

| Minimum Deposit | $0 | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $100 | $10 | $1 |

| Regulators | SEC, FINRA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA | SEC, FINRA |

| Bonus | – | – | Invest $100 and get $10 | Deposit Bonus Up To $4000 |

| Education | No | Yes | Yes | Yes |

| Platforms | eSignal | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader | TradingCentral |

| Leverage | – | 1:50 | – | – |

| Payment Methods | 3 | 6 | 4 | 4 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

eToro USA Review |

Firstrade Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tradier Brokerage and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tradier Brokerage | Interactive Brokers | eToro USA | Firstrade | |

|---|---|---|---|---|

| CFD | No | Yes | No | No |

| Forex | No | Yes | No | No |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | No | No |

| Oil | No | No | No | No |

| Gold | No | Yes | No | No |

| Copper | No | No | No | No |

| Silver | No | No | No | No |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | Yes | Yes | No | No |

| Options | Yes | Yes | Yes | Yes |

| ETFs | Yes | Yes | Yes | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | Yes | No |

Tradier Brokerage vs Other Brokers

Compare Tradier Brokerage with any other broker by selecting the other broker below.

The most popular Tradier Brokerage comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Tradier Brokerage yet, will you be the first to help fellow traders decide if they should trade with Tradier Brokerage or not?