TMS Brokers Review 2024

Awards

- Best FX Broker 2020 - Invest Cuffs

- Forecast Accuracy Ranking Q1 2019 - Bloomberg

Pros

- Choice of MetaTrader 5 or proprietary platform

- Transparent fees with spreads from 1 pip

- Regulated by Poland's KNF and a member of the Polish Compensation Scheme

Cons

- Weak support for non-Polish speakers

- Financial education tools are very limited for English speaking customers

- Connect Professional account fees and rates are not as transparent

TMS Brokers Review

TMS Brokers is an award-winning Polish broker with offices across Europe. They offer trading on a range of markets including forex, indices, commodities and cryptocurrencies, via the TMS Smart Trading app or MT5 platform. In this article we review TMS Brokers’ app, demo account, spreads and more.

TMS Brokers Details

TMS Brokers S.A. is a Polish brokerage established over 20 years ago. It is regulated by the Polish Financial Supervision Authority and provides services to over 9,000 investors.

As of 2015, an associated company called TMS Brokers’ Europe Limited (Ltd) also existed in Malta. However, this company has now been dissolved and TMS Brokers S.A. supplies customers across Europe, with offices in Poland, Latvia, Russia, Spain and Lithuania. A deal was struck in September 2020 for Canadian firm Oanda to acquire TMS Brokers S.A.

Trading Platforms

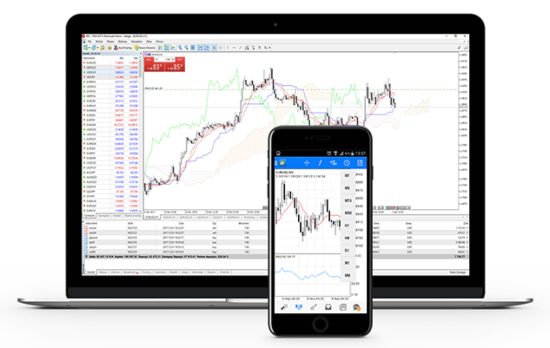

MT5

The brokerage offer the latest version of the MetaTrader platform, MT5, which allows customers to trade multiple assets from their web browser, tablet or smartphone. The industry recognised MT5 is the successor to the popular MT4 trading platform, offering additional technical analysis and programming functionality.

MT5 offers three customisable chart types, with 21 timescale options (ranging from a minute to a month) and over 80 analytical tools, enabling advanced technical analysis of markets. Colour schemes and analytical objects applied to graphs can be saved as chart templates.

MT5 also offers automated trading capability using trading robots known as ‘Expert Advisors’. These robots can analyse quotes or execute trades on forex and exchange markets. Users can develop their own Expert Advisors using the MQL5 coding language, download free algorithms from the MQL5 codebase, or order paid-for custom robots from professional programmers.

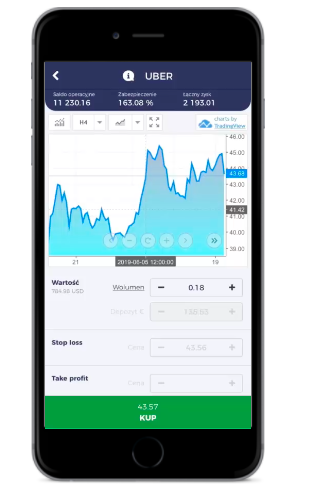

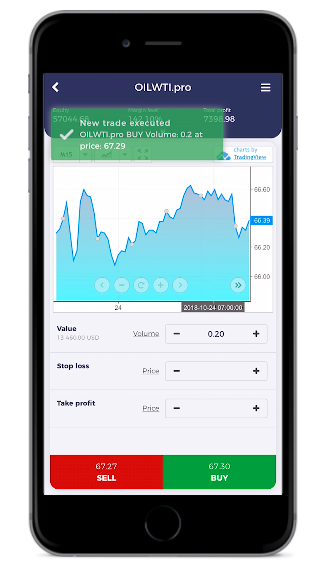

TMS Smart Trading Platform

TMS Brokers also offers their proprietary TMS SmartTrader platform, which is accessed via a mobile app. From this, traders can access the entire spectrum of TMS investments, in addition to economic news. Customers can analyse markets through 6 types of interactive charts, with timescales from a minute to a day, and 12 indicator types to select from.

Assets

TMS Brokers offers trading across a range of instruments:

- 18 indices

- 42 currency pairs

- 123 stocks across US, German, UK, Spanish and Polish markets

- 19 commodities including gold, silver and crude oil

- 5 cryptocurrency CFDs based on future contracts including Bitcoin, Ethereum and Ripple

- 40+ ETF contracts with shares from markets such as healthcare, raw materials or the biotechnology sector

Customers should note that TMS Brokers predominantly operates as a market maker.

Spreads & Commission

The brokerage offers reasonable spreads, especially considering that there is no minimum deposit. A comparison of TMS Brokers vs competitor XTB showed that both brokers offer a spread of 1 pip for EUR/USD.

The company is transparent regarding current and historic spreads for all instruments traded using the TMS Connect account. From the asset list on their website, customers can open interactive charts showing up to 1 month of spread history offered by TMS Brokers, in addition to 6 months of price history for the market they are interested in.

The company does not charge a commission fee on currencies, indices, commodities or cryptocurrencies for Connect accounts. Commission starting from 5USD is applied to stocks.

Note, a commission fee is applied to some market types for professional accounts, so customers should check the professional fees and commissions table on the broker’s website for specific details.

Leverage

The leverage available to customers varies depending on the instrument:

- Up to 1:20 leverage for forex, indices and commodities

- Up to 1:2 leverage for cryptocurrencies

- Up to 1:5 leverage for stocks

Leverage allows customers to increase their position for a given outlay, although they aren’t particularly generous and sit below the limits imposed by the Polish Financial Supervision Authority. However, customers should be aware of the risks involved in using leverage, which can result in higher losses as well as increased returns.

Mobile Apps

TMS Brokers has its own Android and iOS compatible Smart Trading mobile app, which is highly rated and available to download from the App Store and Google Play. Traders are able to analyse and trade on all TMS markets, as well as access information on which markets are hottest, based on other traders’ activity. The app is responsive, intuitive and allows for customisable dashboards.

Additionally, the MT5 platform offers an app where users can execute trades and perform market analysis on the go. Clients are also able to set up trade alerts via email or push notifications on the app, which is designed for smartphone and tablet use. The integrated chat forum lets users connect with the trading community to share strategies and insights.

Payments

TMS Brokers offer deposits via credit and debit card (Visa and Mastercard) and bank transfer.

Credit and debit card deposits are usually instant, but a deposit limit of 15,000 EUR applies.

Trustly can be used for instant bank transfers and supports major banks in Estonia, Finland, Spain, Poland, Sweden and Denmark. Deposits should be instantly credited to trading accounts, but can take up to one working day in some cases. Funds can also be deposited by regular bank transfer using banks in the Single Euro Payments Area (a list of member states can be found on the SEPA website). Deposits take between one and three working days using this method.

TMS does not charge any fees for these deposit services, although fees may apply for bank transfers. All methods require deposits to be in Euros, otherwise conversion costs may apply.

While there are no minimum deposit requirements, TMS Brokers recommends that clients deposit at least 100 EUR to avoid the 20 EUR fee charged for withdrawals below 100 EUR.

Demo Account

Clients have the option to open a demo account via the SmartTrader mobile platform, where they can practice trading with 50,000 EUR in virtual funds. This account provides all the functionality of a live account, in addition to a starter training package with five short lessons. These include details of how to set up your dashboard, open your first trade and close or modify a trade.

TMS Brokers Bonuses

TMS Brokers does not currently have any promotions or sign-up deals in place. However, previously they have offered promotions where customers could double their trading profits, or receive 20 EUR trading credit in exchange for phone number verification. Customers should therefore look out for promotions on TMS Brokers’ website.

Regulation Review

TMS Brokers is regulated by the Polish Financial Supervision Authority (KNF). Additionally, the company participates in the Polish Compensation Scheme (KDPW), which ensures protection of customers’ assets in the case where TMS Brokers declare bankruptcy. The scheme covers 100% of clients’ funds up to 3,000 EUR, and 90% of funds up to 22,000 EUR.

TMS Brokers provide additional protection with negative balance protection, which prevents clients losses exceeding their balance. Customers should be aware that their entire capital is still at risk, however.

Further details of TMS Brokers’ company status can be found on the Polish National Court Register, KRS number 0000204776, NIP 526.27.59.131.

Additional Features

TMS Brokers has a website section dedicated to education, offering free eBooks and webinars on topics such as trading strategies and specific markets. Videos are also available on the broker’s YouTube Channel. However, English language resources are very limited, with only two eBook offerings.

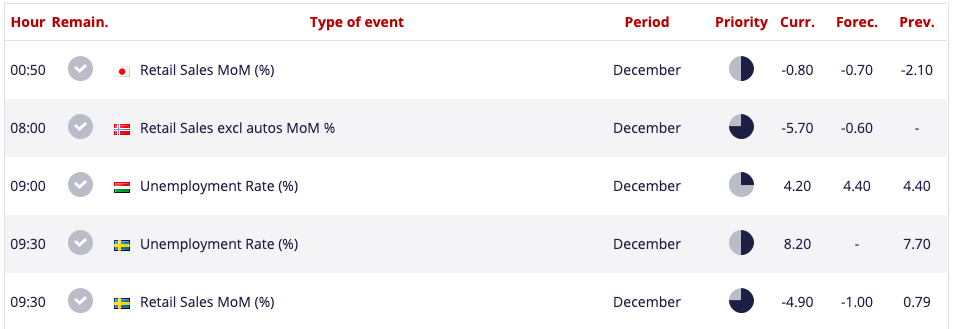

TMS Non Stop is a financial news source available on the company website and SmartTrader app. A live feed provides blog entries for a range of markets as well as an economic calendar that provides financial updates affecting forex, indices and commodities.

Trading Accounts

TMS Brokers offers the Connect account to retail clients, and Connect Professional account to professional clients. The standard Connect account offers full market access, no minimum deposits and competitive floating spreads.

To be eligible for the professional account, traders must meet at least two of the following criteria:

- Total assets of the entrepreneur amount to at least 20,000,000 EUR

- Revenues from sales achieved by the entrepreneur amount to at least 40,000,000 EUR

- Equity or own funds of the entrepreneur amount to at least 2,000,000 EUR

Professional accounts come with different margin rates and minimum trade volumes, but have a lower level of protection. Clients should refer to the relevant Financial Instruments Specification and Table of Fees and Commission documents for details of each, as fees, rates and volumes vary between markets.

Trading Hours

Forex trading hours are 24/5, however other market hours vary. TMS Brokers provides details of trading hours for every available asset on the ‘Where to Invest’ section of their website.

Customer Support

TMS Brokers has a Facebook messenger chat option embedded on their website, where customers can contact the customer service team using their Facebook login or as a guest. In addition, a telephone number and email address are provided for each office:

Telephone

- International / Poland: +48 222 766 200

- Lithuania: +370 5 203 4495

- Latvia: +371 66 334 410

- Russia: +371 66 334 410

- Spain: +34 911 12 00 29

- International: contact@tmsbrokers.com

- Lithuania: tms@tmsbrokers.lt

- Latvia: tms@tmsbrokers.lv

- Russia: tms@tmsbrokers.lv

- Spain: contact@tmsbrokers.es

TMS Brokers’ registered address is ul. Złota 59, 00-120 Warsaw.

Security

TMS Brokers confirms that personal data is collected in accordance with GDPR. We were also reassured to find that TMS only works with PCI-DSS Level 1 certified service providers, which is the highest level of compliance for companies that process credit card data.

TMS Brokers Verdict

TMS Brokers is a regulated provider, offering decent spreads, no minimum deposit and zero commission fees on forex, commodities, cryptocurrencies and indices with the Connect account. Customers can trade through the industry-leading MT5 platform or the highly-rated SmartTrader app. Leverage offerings aren’t particularly high but TMS Brokers offers a decent standard of security and is part of the Polish Compensation Scheme.

Top 3 Alternatives to TMS Brokers

Compare TMS Brokers with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

TMS Brokers Comparison Table

| TMS Brokers | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | Polish Financial Supervision Authority (KNF) | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:20 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by TMS Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| TMS Brokers | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

TMS Brokers vs Other Brokers

Compare TMS Brokers with any other broker by selecting the other broker below.

FAQ

Where is TMS Brokers regulated?

TMS Brokers is regulated by the Polish Financial Supervision Authority (KNF) under KPWiG-4021-54-1 / 2004. They also participate in the Polish Compensation Scheme (KDPW).

Are TMS Brokers on social media?

Yes, TMS Brokers have Facebook (TMSBrokersCOM) and Instagram (@tmsbrokers) accounts, with the Facebook account providing regular economic updates.

Do TMS Brokers offer a demo account?

TMS Brokers offer a demo account with 50,000 EUR of virtual funds, which can be accessed via their SmartTrader app.

What leverage do TMS Brokers offer?

TMS Brokers offer up to 1:20 leverage on forex, indices and commodities, up to 1:5 leverage on stocks, and up to 1:2 leverage on cryptocurrencies.

How much capital do I need to trade with TMS Brokers?

There are no minimum deposit requirements to trade with TMS Brokers. However, they recommended a minimum deposit of 100 EUR to avoid the fee charged for withdrawals below 100 EUR.

Customer Reviews

There are no customer reviews of TMS Brokers yet, will you be the first to help fellow traders decide if they should trade with TMS Brokers or not?