Tiger.Trade Review 2024

Pros

- Access to a good range of markets for paying customers

- A decent variety of linked brokers and exchanges allows trading on a range of assets

- History Player service works like a demo account

Cons

- The monthly fee can be off-putting when many competitors don’t charge a subscription fee

- The Demo History Player account charges a monthly fee, unlike many other demo accounts

- The iOS app offers limited chart settings and indicators

Tiger.Trade Review

Tiger.Trade offers multi-asset trading through a slick platform and a copy trading app. The Swiss-regulated fintech company also develops trading software for other crypto, forex and stock providers. In this 2024 review of Tiger.Trade, our experts unpack account options, app downloads, chart settings, minimum deposits, and more. Our tutorial also explains how to use the Tiger.Trade software.

What Is Tiger.Trade?

Tiger.Trade is a Swiss-based firm that has been building trading software since 2015 and has over 180,000 users.

The company’s motto is to ‘work smarter not harder’, and it allows traders to do just that if they sign up with the Tiger.Trade copy trading app. The firm also offers an investing platform that can be used to access various markets, including stocks, cryptos, forex, and futures.

Tiger.Trade is a registered Binance broker, allowing for simple and streamlined crypto trading through its platform. The company is also linked with 12 more exchanges, brokers and finance companies, including US giant Interactive Brokers and platform developer MetaTrader.

The company has made big strides since its launch and has been especially busy in 2022 when it stepped up its copy trading app, gained regulation by the Swiss financial authorities, closed in on launching its Mac trading platform and secured former MMA champion, Conor McGregor, as a brand ambassador.

Similar Firms

Note, traders should take care when seeking out Tiger.Trade, since there are a few companies with similar sounding names or products.

Firstly, look out for Sharekhan, the Indian online investing company owned by the French banking group, BNP Paribas. The trading platform available for download by Sharekhan customers is called Trade Tiger, but has nothing to do with Tiger.Trade.

Even more easily confused with Tiger.Trade is the proprietary trading terminal offered by Singapore-based, Chinese-owned online brokerage Tiger Brokers. This software is called Tiger Trade.

To avoid confusion, visit the Swiss company’s website directly through its address or use our ‘visit’ button above.

Trading Platform

The fully functional platform is available on Windows operating systems, with a full version of Tiger.Trade’s iOS platform coming soon.

Testing the iOS terminal, our experts found that it was easy to download and install by following a few straightforward steps on the company’s website. Simply navigate to Tiger.Trade, open the page for the full Windows version or the iOS beta, and download. Then all you need to do is install the software.

Tiger.Trade’s full Windows version allows users to access either:

- A free solution for trading cryptocurrencies on seven exchanges: Binance, Bybit, BitMEX, Bitfinex, OKX, and Deribit.

- A subscription package offering paying customers the crypto service plus stock, futures and forex trading on NYSE, NASDAQ, CME, ICE, CBOT, COMEX, NYMEX, MOEX, SPBEX and EUREX exchanges.

- A ‘History Player’ demo account that allows users to practice their trading strategies using historical data for a monthly fee.

The iOS beta version currently only allows users to connect to the Binance exchange for free crypto trading.

Setting Up The Tiger.Trade Platform

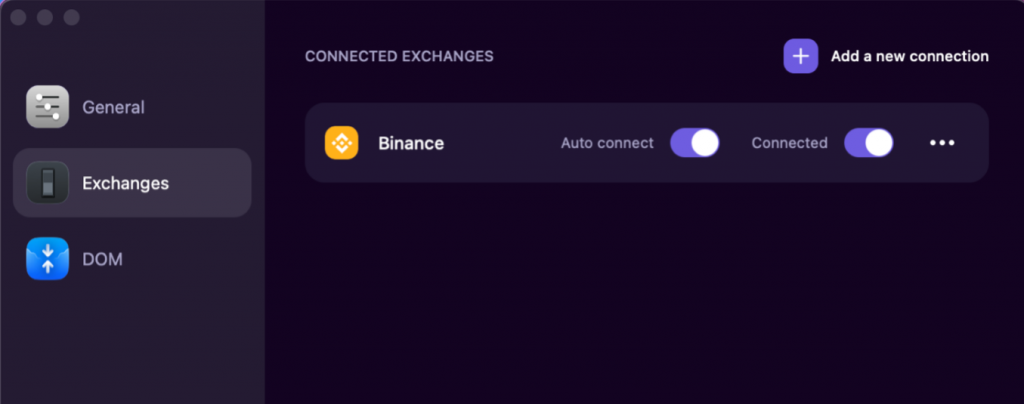

Tiger.Trade’s app quickly and easily connects to the Binance exchange. On startup, the app will display a window as seen below.

Traders can open new windows to display charts and depth of market data through this interface. Alternatively, they can use it to connect their Tiger.Trade platform to the exchange of their choice.

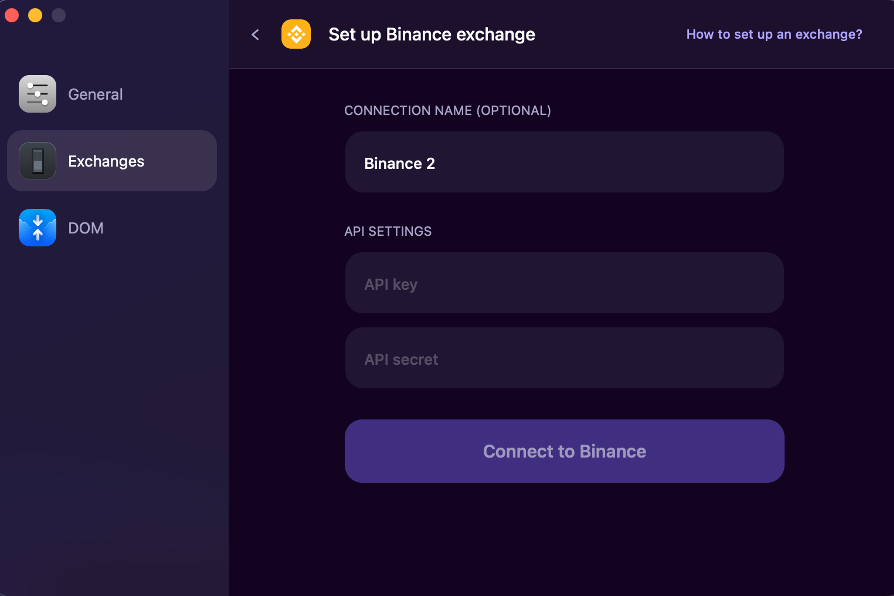

To connect your Binance account to Tiger.Trade, click ‘add a new connection’. This will navigate the app to the screen below.

The only thing required to complete the connection process is to input an API key and secret code. This can be acquired from your Binance account by logging in, opening the API management tab and clicking the ‘Create API’ button. Once you have successfully created the API, a screen will display the required codes, and you can simply copy-paste these into the Tiger.Trade app.

This process works similarly on Tiger.Trade’s Windows app, though the exact steps to connect may vary depending on the terminal or exchange in question. Detailed instructions for each of the 13 available connections are available on the Tiger.Trade website.

Findings

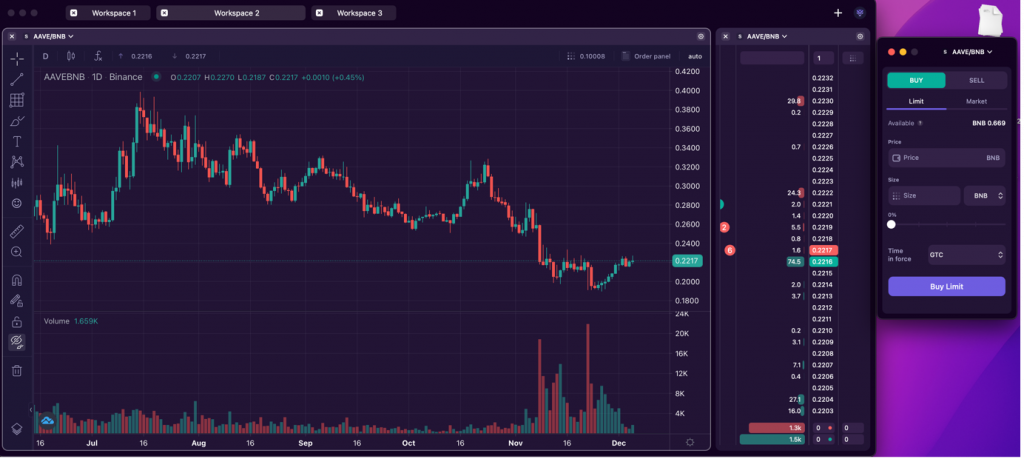

Our experts tested the iOS beta platform, which used a version of the TradingView terminal with some handy features including indicators, drawing tools, and side panels for depth of market analysis and to place orders.

The indicators offered on the beta app were relatively limited – some of the most commonly used, such as Bollinger bands, Keltner channels and oscillators, were not immediately evident. Additionally, the application’s menu bar does not currently include any options for adding indicators or uploading any other data to the platform.

However, when the Windows app has been fully released and updated, we would expect that it boasts more complete features and added customizability as a result.

Copy Trading App

Tiger.Trade’s other main product is a copy trading app that allows users to find and copy professional investors through a straightforward process.

The Tiger.Trade copy app is available for Android and iOS mobile devices through the Apple or Play store. Once the app is installed, all users need to do is register with an email address and choose a PIN, and they will be able to instantly access the application.

Setting Up The Tiger.Trade Copy Trader App

Part of the first step of creating and topping up your account will involve account verification, since this is necessary to deposit and withdraw funds. The verification process involves providing personal information and a source of ID.

Once the user completes this process, goes through login and deposits at least $100, they can begin automatically copying one of Tiger.Trade’s professional traders.

Traders come in two tiers, requiring an average annual profit of at least 20%, 6-month trading history and trading in high liquidity pairs to earn the higher ‘verified trader’ badge. But all Tiger.Trade traders are required to have a proven trading history and are forbidden from scalping and high-frequency trading.

Finding a trader is simple – just open the traders tab on the app and scroll through the list. The recent performance of each trader is clearly displayed as you scroll, making comparing traders easy. By clicking through to the trader’s page, you can get more detailed information, including the amount of commission they charge. Our experts found that the typical fee was 10% of profitable trades.

There is nothing more to Tiger.Trade’s system – once you have selected a trader or investors and deposited funds, all the actual trading will be handled automatically. This means that the only thing to worry about is monitoring your portfolio and keeping tabs on the performance of your traders.

Findings

Altogether, Tiger.Trade Copy is an intriguing app which has potential as a way for amateur traders to benefit from professionals’ experience.

However, it is also relatively new, as there is only around 1,000 downloads on the Android store with no user reviews. This may put some traders off initially, though the app is certainly one to keep tabs on.

Tiger.Trade Fees

Tiger.Trade’s iOS Beta Platform is free to use – though bear in mind that it only allows trading through Binance, which may apply its own fees to your trades.

The Tiger.Trade Copy App works with a commission system as described above, with most of the company’s professional traders charging users 10% of the profits from successful trades. Additionally, users will need to pay a $3.20 withdrawal fee if they wish to withdraw funds from the app.

Tiger.Trade’s Windows app is available in various tiers, including a free application that allows cryptocurrency trading, including Bitcoin, for all users without any subscription charges.

The Full Version of Tiger.Trade’s Windows app can be paid for in various ways:

- Monthly: $55

- 3 Months: $124 (save 24%, or $41)

- Annual: $399 (save 39%, or $261)

- Lifetime: $1500

Demo Account

Tiger.Trade also offers users the History Player – a kind of paper trading account which comes packaged with the full version free of charge and allows the use of historical data to test strategies using virtual funds.

Non-subscribers can sign up for the History Player for $15 per month.

Regulation & Licensing

Tiger.Trade’s regulation by the Swiss Financial Market Supervisory Authority (FINMA) is a selling point for the company, and it assures traders that all of its products comply with the appropriate Swiss regulations.

Customer Support

Tiger.Trade advertises a 24/7 live chat to resolve users’ issues.

However, there is no evidence of an online chat feature on the website. Rather, users can get in contact by submitting a ticket to the support@tiger.trade email address or enter details of their issue through the company’s site.

There is also a community forum section, which features some swift answers from staff members. There were only a few posts on the forums, though, so it is difficult to appraise how active the support staff are on this channel.

Alternatively, traders can find the broker on social channels, including Twitter.

Tiger.Trade Verdict

Tiger.Trade is an interesting platform in its own right, and since it is Swiss-regulated and has built up a decent customer base, there is little downside in trying out the free cryptocurrency platform. The fintech company also has plenty of scope for improvement in the future, with its iOS app in development and a copy trading application just taking off.

Some users may wish to hold off for a while to see whether Tiger.Trade’s platforms build up some momentum and amass more users and positive reviews, but in any case, they can easily download a free version of the trading software to check out its features.

FAQs

How Do You Download Tiger.Trade’s Trading Platform?

All of Tiger.Trade’s software can be easily downloaded from the official website or the Google Play or Apple App stores. The fully functional trading platform is available on Windows, as well as a beta version on iOS that can hook up with users’ Binance accounts – as long as they login and provide the necessary API key codes.

Traders who want to benefit from the knowledge and experience of professionals can do so using the Tiger.Trade copy trading app, which is available on mobile devices. See our user guide and review to get started.

Is Tiger.Trade Safe And Reliable?

Since Tiger.Trade is Swiss-regulated, it is among the safer brokers and fintech companies that you will come across. Some users might prefer to sign up to a company that has a longer track record with more users, though.

Does Tiger.Trade Have A Demo Account?

Tiger.Trade users with a full subscription can benefit from the company’s History Player feature, which lets them practice their strategies using historical data. However, this feature is not available to everyone for free – if you do not have a full Tiger.Trade trading platform account, you will need to pay a $15 monthly subscription charge.

How Does Tiger.Trade’s Copy Trading App Work?

Tiger.Trade’s Copy app is easy to use – all you need to do is sign up, complete a login and verification process, and deposit funds of at least $100. Then, find a professional trader on the app whose profile catches your eye and turn over the decision-making to them. All you will need to do is monitor your portfolio to ensure your chosen traders are performing well.

Usually, the professional traders you match will charge a commission of 10% of each profitable trade. You will also need to pay a withdrawal fee of $3.20 whenever you withdraw funds from the Tiger.Trade Copy app.

Is Tiger.Trade Legit?

Tiger.Trade is a legitimate operation, with around 180,000 users on its macOS, iOS, Windows and Android trading platforms and other apps. Additionally, it is overseen by trusted regulators in Switzerland and partnered with some giants of the finance and brokerage world, including MetaTrader, Binance and Interactive Brokers.

Is Tiger.Trade Free?

Anyone can download free versions of the Tiger.Trade desktop trading platform app for their Windows computer or MacBook, as well as the company’s apps for phones and other mobile devices like an Android tablet or iPad. However, the fully functioning app, currently only available on Windows, requires a subscription fee.

You can also download the Tiger.Trade Copy app and check out its features without having to pay a cent. However, bear in mind that you will need to verify your account and deposit funds to make use of this app’s features. You will also need to pay the professional traders you copy a commission per profitable trade, and you will need to pay a $3.20 withdrawal fee when you want to take money off the app.

Top 3 Alternatives to Tiger.Trade

Compare Tiger.Trade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Tiger.Trade Comparison Table

| Tiger.Trade | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| Rating | 3 | 4.4 | 4.3 | 4.5 |

| Markets | Stocks, Forex, Cryptos, Futures, Options | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | TradingView | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:50 |

| Payment Methods | 3 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by Tiger.Trade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Tiger.Trade | IG | Interactive Brokers | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Tiger.Trade vs Other Brokers

Compare Tiger.Trade with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of Tiger.Trade yet, will you be the first to help fellow traders decide if they should trade with Tiger.Trade or not?