ThinkMarkets Review 2025

Awards

- Best CFD Provider 2021 - City of London Wealth Management Awards (COLWMA)

- Best Value Broker in Asia at the 2020 - Global Forex Awards

- Best Forex Trading Experience 2017 - UK Forex Awards

- Best Forex Trading Innovation 2017 - UK Forex Awards

- Best Customer Service 2013 - UK Forex Awards

Pros

- Unique Traders' Gym simulation tool for testing out strategies on real historical data, with multiple timeframes and custom features

- Reliable 24/7 multilingual support via telephone, email or live chat

- Free VPS hosting available for MT4 and MT5, ideal for traders using Expert Advisors (EAs)

Cons

- $500 minimum deposit for ThinkZero account

- Not many payment methods available for UK traders

- Limited bonus offers, refer-a-friend schemes or trading competitions

ThinkMarkets Review

ThinkMarkets is a trustworthy broker offering trading in forex and CFDs. Users can choose between MT4 and MT5, plus the broker’s ThinkTrader platform. This, along with low trading fees and over 4000 instruments makes the ThinkMarkets group an attractive proposition. Our review will unpack the login process, client portal features, and more.

71.89% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

ThinkMarkets Overview

ThinkMarkets was founded in 2010 by CEO – Nauman Anees. The group has headquarters in Melbourne and London and forms part of Think Capital Limited, a company registered in Bermuda.

Since 2010, the online broker has expanded its trading operations, attracting 550,000 users in 180 countries, including Indonesia, Egypt, the UAE, and Bulgaria. In 2018 ThinkMarkets made the news for allowing Australian investors to invest in an emerging financial technology market with a £100 million initial public offering (IPO) on the ASX.

The broker is regulated by the Australian Securities & Investments Commission (ASIC), the UK’s Financial Conduct Authority (FCA), South Africa’s Financial Services Conduct Authority (FSCA) and the Financial Services Authority (FSA) Seychelles.

Additionally, the broker has obtained two additional regulatory licenses; the Cyprus Securities and Exchange Commission (CySEC) in Europe as well as the Japanese Financial Services Agency (JFSA).

Trading Platforms

Three trading platforms are available; the broker’s own ThinkTrader, MetaTrader 4 (MT4), and MetaTrader 5 (MT5).

ThinkTrader

The broker’s proprietary ThinkTrader platform is slick and intuitive. Users get over 125 indicators, 50 drawing tools, plus 20 different chart types. Clients also benefit from close to 200 free cloud-based notifications. Direct chart trading is also available, along with standard risk management tools and multiple order types.

We’re also pleased to see that ThinkMarkets has bolstered its web platform by integrating TradingView, providing a powerful charting package for serious day traders. Users can track 8 charts simultaneously, create custom views, set up shortcuts for a smoother trading experience, and adjust settings across multiple charts in one click.

Additionally, ThinkMarkets bolstered its ThinkTrader platform in 2024 by introducing spread betting on popular markets, including currencies, stock indices, metals and energies. The desktop, web and mobile platform now offers a complete trading environment for serious spread betters.

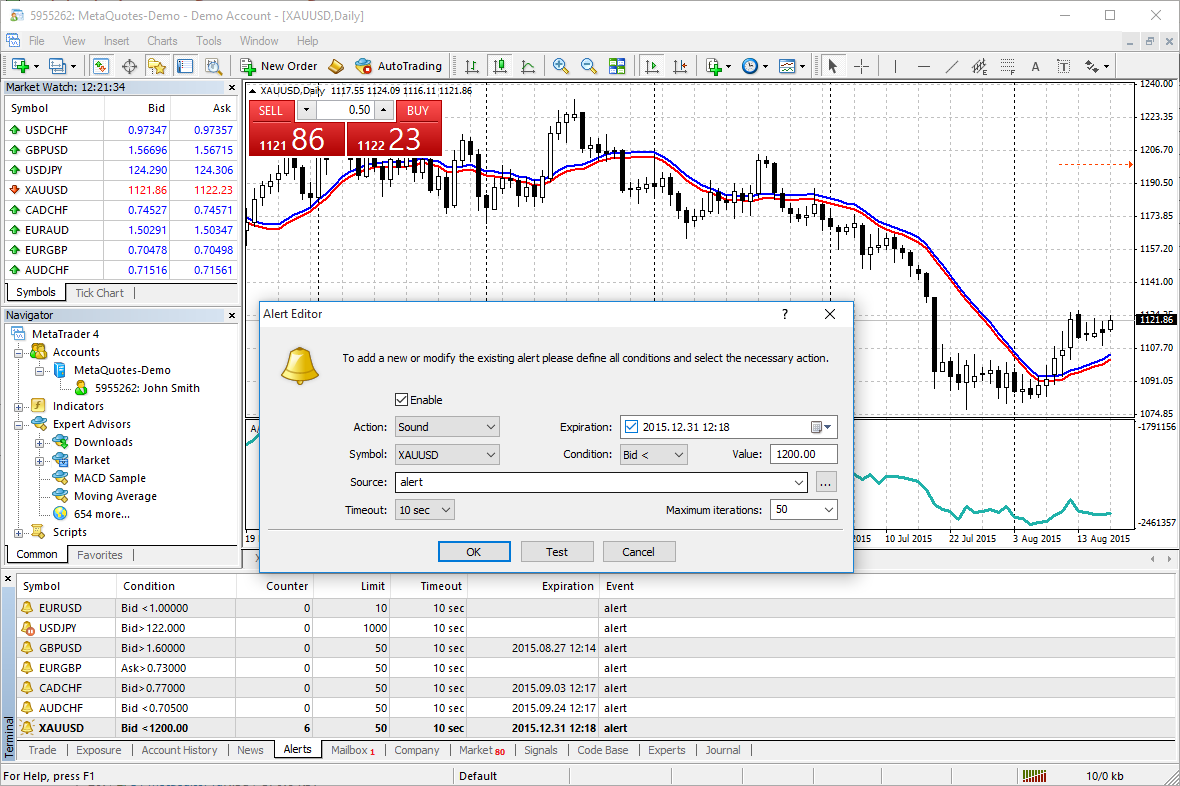

MetaTrader 4

The MT4 platform can be downloaded to your PC free of charge. The platform promises fast trade execution, over 100 indicators, and one-click-trading. The MT4 system also comes with a host of superb apps and additional features, including free access to Trading Central, a VPS, and FXWirePro.

MetaTrader 5

The MT5 platform is the latest version of the popular MT4 software. It appeals to seasoned traders, in particular, offering more advanced trading tools and analysis features. Users benefit from additional technical indicators and timeframes, plus an enhanced strategy tester for EAs, as well as a built-in economic calendar.

TradingView

ThinkMarkets joined the TradingView party in 2024, fully integrating with one of the world’s leading charting platforms and social trading networks.

Fast, intuitive and easily accessible through web browsers, TradingView offers advanced charting tools, notably 20+ chart types, 400+ indicators, and 110+ drawing tools, plus backtesting capabilities and custom indicators and tools programmable through Pine Script.

Where it really excels though is its social trading network. You can share ideas and insights with a budding network of 70 million aspiring traders.

ThinkMarket went one step further in 2025, integrating spread betting directly in the TradingView platform for a superior trading experience, packed with TradingView’s advanced charting and analysis capabilities.

Platform Options:

- MT4: Mobile (Android, iOS, iPad), MT4 Web, MT4 Desktop download for Windows and Mac.

- MT5: Mobile (Android, iOS, iPad), MT5 Web, MT5 Desktop download for Windows.

- ThinkTrader: Mobile, Tablet, Desktop, ThinkTrader Web.

- TradingView: Mobile, Web.

Markets

ThinkMarkets has a 3500+ list of tradable instruments, covering:

- Forex – 46 majors, minors, and exotics

- Stocks – 3500+ shares & ETFs available

- Indices – 15+ global indices

- Commodities – Oil, gas, & agricultural

- Precious metals – Gold, silver, platinum & copper

- Cryptocurrencies – 20+ including Bitcoin, Ethereum, Dash & more

(As per regulation Crypto CFDs are not offered to retail traders in the UK) - Futures – 10+ including BRENT, WTI and COTTON

Spread betting is also available for UK clients only.

Spreads & Commissions

ThinkMarkets scored highly in terms of trading fees. Spreads are variable and start from zero pips on major FX pairs, such as the EUR/USD and GBP/USD.

With the ThinkZero spread account, there is a $3.5 commission per side of 100,000 (£2.5 units per side in the UK). This commission applies to FX and Metals only and ThinkZero accounts are available on MetaTrader 4 and MetaTrader 5 platforms.

ThinkMarkets reserve the right to charge an inactivity fee.

Traders will be pleased to see there are no swap rates.

Leverage

The maximum leverage available depends upon the type of account (retail /professional) and the ThinkMarkets entity.

- Forex – leverage up to 1:500

- Indices – leverage up to 1:200

- Commodities – leverage up to 1:200

- Cryptocurrency – leverage up to 1:10

To avoid a margin call, make sure you have enough capital in your account.

Note, due to regulations, the maximum leverage available to traders from Europe, the UK and Australia is 1:30.

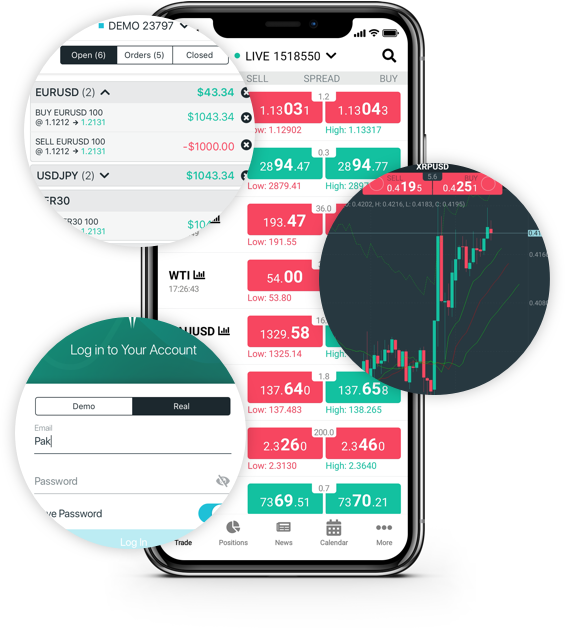

Mobile App

ThinkMarkets offer a full-service mobile app called ThinkTrader, which is available to download for iOS and Android devices. Previously Trade Interceptor, ThinkMarkets has enhanced the platform to provide a superior mobile trading experience. The app has since been rated five stars by over 15,000 users.

The award-winning mobile program offers thousands of markets, in-app chat support, plus a breadth of analysis tools and technical indicators.

Payment Methods

Funding your account is available via several deposit methods (which may vary depending on the client’s country of residence and the ThinkMarkets entity):

- Bank transfer – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: 1 – 3 business days

- Credit & debit card – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: instant

- Skrill – available currencies: AUD, GBP, EUR, CHF, USD. Estimated processing time: up to 10 minutes

- Neteller – available currencies: AUD, GBP, USD, JPY, EUR. Estimated processing time: up to 10 minutes

- Bitpay – available currencies: Bitcoin, Ethereum and Bitcoin Cash. Estimated processing time: up to 10 minutes

- Google Pay & Apple Pay – available currencies: USD, EUR, GBP, AUD. Estimated processing time: up to 10 minutes

ThinkMarkets also enhanced its funding options for traders in the MENA region in 2024, making local cards, Apple Pay and Google Pay available with deposits in Qatari Riyal (QAR), Emirati Dirham (AED), Saudi Riyal (SAR), and Omani Rial (OMR).

There is no minimum deposit with the Standard account, but the ThinkZero account requires a minimum deposit of $/£500.

For security reasons, the withdrawal and deposit method must be the same. Withdrawals are normally processed within 24 hours but may take up to seven working days. For withdrawals via bank transfer, the minimum withdrawal amount is $/£100. There are no deposit or withdrawal fees at ThinkMarkets.

Demo Account

ThinkMarkets offers a demo account with $/£25,000 in practice cash. Users can refine strategies and test the MT4, MT5, and ThinkTrader platforms while getting familiar with the available instruments.

Demo accounts on MT4/MT5 will expire after 90 days of inactivity and demo accounts on the ThinkTrader platform do not expire but ThinkMarkets do reserve the right to close them.

Welcome Bonus & Promotions

ThinkMarkets do not currently have any active promotions or offers.

Regulation & Licensing

TF Global Markets UK Ltd is FCA registered while the group also holds licenses with the Australian Securities & Investments Commission (ASIC), South Africa’s Financial Services Conduct Authority (FSCA), Cyprus Securities and Exchange Commission (CySEC), Japan’s Financial Services Agency (JFSA) and the Financial Services Authority (FSA) Seychelles.

The broker offers negative balance protection to stop clients from losing more than their deposits. Also, ThinkMarkets has a £1 million insurance protection plan.

Overall, we’re satisfied the broker is highly regulated and trustworthy.

Additional Features

ThinkMarkets has a pretty good library of educational resources. For beginners, there are free video tutorials and a trading glossary. Tutorials aimed at intermediate and advanced traders are also available. Additionally, trend PDFs, market news, and blogs from industry experts can be found on the broker’s website.

Our favorite solution is the partnership with Signal Centre. This provides actionable trading signals directly into the broker’s platforms. Traders can receive up to 40 signals each day spanning popular financial markets, including forex, equities, commodities and indices.

The multitude of tools are all designed to help traders boost revenue and minimise losses.

Account Types

ThinkMarkets has two popular retail accounts:

- Standard account – Average FX spread is 1.2 pips, no commission or minimum deposit, and maximum trade size is 50 lots. The Standard account has VPS access available via MT4 and MT5 but no access to an account manager.

- ThinkZero – Average FX spread is 0.1 pips, $3.5 / £2.5 unit commission per side, $/£500 minimum deposit, and maximum trade size is 100 lots. ThinkZero is best suited to traders looking for zero spreads and large position sizes.

Islamic trading accounts and joint accounts are also available.

Note the broker does not use an ECN model and is primarily a market maker.

Trading Hours

ThinkMarkets trading hours follow standard opening and closing times of respective markets. So, for forex and indices, most trading will take place Monday to Friday. Contract specific opening hours can be found on the broker’s website.

Customer Support

2.3 / 5ThinkMarkets multilingual customer support team is available 24/7. They can be contacted through:

- Email – support@thinkmarkets.com

- Telephone – UK: +44 203 514 2374, AUS: +61 3 9093 3400 Italy: +39 023 057 9033, Spain: +34-911829975, South Africa: +27 10 446 5933

- Live chat – chat support available on the website and mobile app

A self-service FAQ client portal and online query form are also available on the broker’s website.

Use ThinkMarkets social media channels to keep up to date with the latest product and promotional news:

ThinkMarkets have global offices in London, Chicago, Melbourne and South Africa.

Security

The ThinkMarkets website is secured using industry-standard encryption protocols. Also, the MetaTrader platforms use a one-time-password to provide an additional layer of security.

ThinkMarkets Verdict

ThinkMarkets is an excellent forex and CFD broker. A choice of trading platforms, thousands of instruments, and low fees make the group suitable for beginners and veterans. The broker is also highly regulated with a long list of positive reviews from customers worldwide.

Top 3 Alternatives to ThinkMarkets

Compare ThinkMarkets with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

ThinkMarkets Comparison Table

| ThinkMarkets | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| Rating | 2.8 | 4.3 | 3.6 | 3.9 |

| Markets | CFDs, Forex, Stocks, ETFs, Futures, Commodities, Crypto, Spread Betting (UK Only) | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FCA, ASIC, CySEC, FSCA, JFSA, FSA, DFSA, FMA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | ASIC |

| Bonus | – | – | 10% Equity Bonus | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | ThinkTrader, MT4, MT5, TradingView, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:500 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 10 | 6 | 11 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by ThinkMarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| ThinkMarkets | Interactive Brokers | Dukascopy | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | Yes | No | No | No |

| Volatility Index | No | No | Yes | No |

ThinkMarkets vs Other Brokers

Compare ThinkMarkets with any other broker by selecting the other broker below.

The most popular ThinkMarkets comparisons:

- ThinkMarkets vs Pepperstone

- ThinkMarkets vs XM

- IC Markets vs ThinkMarkets

- Exness vs ThinkMarkets

- Eightcap vs ThinkMarkets

Customer Reviews

5 / 5This average customer rating is based on 4 ThinkMarkets customer reviews submitted by our visitors.

If you have traded with ThinkMarkets we would really like to know about your experience - please submit your own review. Thank you.

Submit Your Own Review of ThinkMarkets

FAQ

What instruments can I trade at ThinkMarkets?

Tradable assets at ThinkMarkets include forex, CFDs on metals, indices, equities, cryptocurrencies, commodities and futures, and for UK residents – spread betting.

What is the minimum deposit at ThinkMarkets?

With the Standard trading account, there is no minimum deposit. However, the ThinkZero account comes with a $/£500 minimum deposit requirement.

Does ThinkMarkets have a demo account?

ThinkMarkets offers a demo account with $/£25,000 in virtual cash.

Traders can try the MT4, MT5, and ThinkTrader platforms. Note, the demo account on MT4 / MT5 will expire after 90 days of inactivity.

Is ThinkMarkets a trustworthy broker?

ThinkMarkets is a highly regulated and trustworthy broker. The company holds licenses with some of the most respected regulatory bodies, including the UK’s FCA. Customer reviews also show the broker can be trusted.

Who is the ThinkMarkets owner?

ThinkMarkets was founded in 2010 by Nauman Anees, following years of experience in financial services. Nauman is still the CEO today.

They have great support service and platform is good. Also regulations and licenses…………………..

ThinkMarkets is according to my own research, the CFD broker with the lowest spreads for the DAX and BTC/ETH. Also the customer service is really good. Always on and helpful. I can recommend ThinkMarkets.

ThinkMarkets has been an exceptional partner in navigating the financial markets. Their insightful analysis, low fees, and dedication to client support have made them stand out. A brilliant broker overall!

I’ve been day trading with ThinkMarkets for about a year and it’s a reliable broker. ThinkZero account has very low spreads. Order execution is fast and reliable. The charting tools are great. Traders’ Gym is also good for testing day trading strategies. I did have to deposit $500 for the ThinkZero account though which is pretty steep.