Trading Taxes in India

Trading taxes in India can be complex. Rules can vary depending on how your trading activity is classed and what it is you are trading, be it stocks, forex, or options.

This article will break down the key information for online traders, as well as explain the benefits and drawbacks associated with trading tax rates in India.

This page is not trying to offer tax advice. Therefore, it is always advisable to seek professional guidance before filing your tax returns.

Key Takeaways

- The Central Board of Direct Taxes (CBDT) in India is the statutory authority within the Income Tax Department responsible for administering local tax rules.

- The CBDT oversees the Income Tax Department, whose officers (from the Indian Revenue Service – Income Tax) administer and collect direct taxes, including those payable by traders.

- There are four classifications for determining one’s tax status: long-term capital gains, short-term capital gains, speculative business income, and non-speculative business income.

- Traders who fall under the business income brackets will have some challenges to consider, including the potential for 30% taxes and auditing requirements.

- The process of collating taxes at the end of the year can be made easier using a reputable broker, although there may be some brokerage taxes to consider.

Best Brokers In India

Our experts recommend these 4 brokers for Indian traders:

Trading Classifications

Intraday trading tax in India will depend on which classification you fall under. India’s Central Board of Direct Taxes (CBDT) breaks trading taxes into four distinct categories.

1. Long-Term Capital Gains

If you hold listed equity shares or equity-oriented mutual fund units for more than 12 months, any profit is treated as long-term capital gains (LTCG).

For securities sold on or after 23 July 2024, LTCG on listed equity/equity-oriented funds above ₹1.25 lakh in a financial year is taxed at 12.5% plus applicable surcharge and cess, provided the trades are carried out on a recognised stock exchange, and Securities Transaction Tax (STT) is paid. LTCG on listed equity is no longer exempt under section 10(38).

Tax treatment of long-term capital gains depends on the type of asset, where it is listed, and specific sections such as 112 and 112A. The earlier blanket exemption for listed equity under section 10(38) no longer applies, regardless of whether the shares are sold on Indian or foreign exchanges.

However, as a short-term trader, you are unlikely to fall into this category.

2. Short-Term Capital Gains

If you sell listed equity shares or equity-oriented mutual fund units within 12 months and STT has been paid, the gains are usually taxed as short-term capital gains under section 111A. For sales before 23 July 2024, STCG is taxed at 15% plus surcharge and cess. For sales on or after 23 July 2024, STCG is taxed at 20% plus surcharge and cess.

However, your delivery of shares must go into your demat account. Indian equity markets now operate on a T+1 rolling settlement cycle, meaning trades are settled on the next working day. For a subset of large-cap stocks, an optional T+0 (same-day) settlement window is also available.

It is worth noting that if your total taxable income is within the basic exemption limit and/or you are eligible for the section 87A rebate, your overall tax liability can be zero. However, gains taxed at special rates (such as certain STCG/LTCG) may not fully benefit from these rebates, so short-term trading profits can still trigger tax even at relatively low income levels.

3. Speculative Business Income

This category mainly concerns intraday equity trading and other transactions that fall within the definition of “speculative transaction” in section 43(5) of the Income Tax Act. In simple terms, if you buy and sell the same equity share on the same day without taking delivery in your demat account, the profit or loss is usually treated as speculative business income.

These speculative profits are added to your other taxable income and taxed according to your slab rate. This means the effective tax is progressive and depends on your total income at year-end.

However, futures and options (F&O) trades on recognised exchanges that meet the conditions in the proviso to section 43(5) are not treated as speculative, even if squared off intraday – they fall under non-speculative business income.

So, this is a progressive tax, and the total value of your obligations will depend on your total profits at the end of the tax year.

4. Non-Speculative Business Income

This category primarily covers derivative trading, such as equity, commodity and currency futures and options executed on recognised exchanges that satisfy the conditions in the proviso to section 43(5) (for example, routed through a recognised exchange/clearing house and, where applicable, subject to STT). Such trades are treated as non-speculative business income, even if they are intraday.

By contrast, intraday equity trades (without delivery) generally remain speculative and are not covered by this non-speculative category.

This means your profits will be added to your total income, and you will pay in accordance with your tax slab. However, as this income is considered business income, you can offset it against business expenses you have incurred. That means advisors’ fees, internet bills, software charges and more can all be offset. So, many view option trading tax in India as rather appealing.

Pros & Cons Of Business Income Tax

Those considering registering for business income tax for trading in India, there are some benefits and drawbacks to be aware of:

Pros

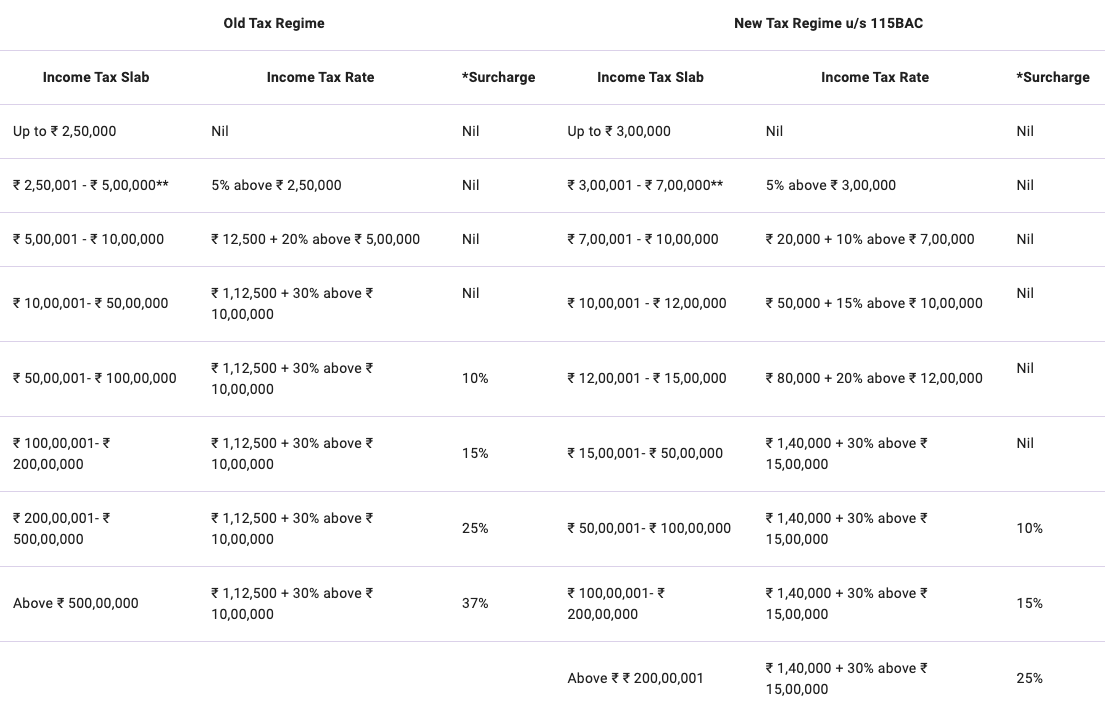

- Relatively low tax – Exact slabs change over time and differ between the old and new regimes. Broadly, in the old regime, income up to ₹2.5 lakh is exempt, with 5% and higher slabs above that. In the new regime (the default), the basic exemption limit was ₹3 lakh for FY 2024-25 and has been raised to ₹4 lakh from FY 2025-26, with multiple slabs above that and a generous Section 87A rebate that can make income (from eligible sources) up to ₹12 lakh effectively tax-free under the new regime. Always check the latest slab and rebate tables on the Income Tax Department website before filing.

- Expenses – With capital gains, only charges on your contract note other than STT are allowed to be claimed for. However, with business income tax, you can claim on everything from brokerage charges and statutory taxes whilst trading, to books and depreciation of electrical devices.

- Offset losses with gains – If you incur any non-speculative losses, you can offset them against any of your income that isn’t salary.

- Carrying forward F&O losses – If you have any net loss (non-speculative F&O + income apart from salary), and you file your returns before the due date, losses can be carried forward for eight years. During those eight years, you can offset the loss against any other business gain. Let’s say you had a net loss of Rs 400,000 and you carried it forward. If next year you made Rs 3,000,000, you could offset last year’s loss and pay taxes on just Rs 2,600,000.

- Carrying forward intraday equity losses – Speculative or intraday equity losses can be offset against other speculative gains. You can carry forward these losses for four years as long as you file your returns on time. Let’s say you’re an equity trader who lost Rs 25,000 this year, and then the next year you made Rs 75,000 profit. You could use last year’s loss to offset this year’s gain. The balance of the loss would be Rs 50,000, which could be carried on for the next three years.

Cons

- Potential for high taxes – If you find yourself in the 30% tax slab, you could pay up to 30% on all your trading profits in tax.

- Audit – You must keep detailed records of all trades and accounts. A tax audit under section 44AB is generally mandatory if your business turnover exceeds ₹1 crore. However, if at least 95% of your total receipts and payments are through banking or specified digital modes, the audit threshold is relaxed and becomes ₹10 crore. Above ₹10 crore, a tax audit is required regardless of the digital-payments ratio.

- ITR forms – Most individual and HUF traders who treat trading as a business, especially in F&O, must file ITR-3. ITR-4 (Sugam) is only for small taxpayers using presumptive schemes like section 44AD/44ADA and is generally not suitable for active F&O traders.

Application

Your initial task will be to determine which of the above categories best describes your trading activities.

If you are unsure and require further clarification on Indian day trading tax rules, you should seek professional tax advice.

‘Tax Slab’

Active day traders whose profits fall under the business income tax rules will have to pay in accordance with their tax slab. If total earnings are above the minimum income slab, traders may be obliged to pay something.

The proportion of people who actually pay income tax is relatively low in India compared to many developed countries, but exact percentages vary by year, by definition (filers vs actual taxpayers), and by data source.

Tax Example

Below is an example of what share trading tax implications in India could look like.

If your total taxable income is within the basic exemption limit and/or you are eligible for the Section 87A rebate, your overall tax on normal slab-rate income can be reduced to zero (subject to the regime and year-specific thresholds).

However, gains taxed at special rates, for example, short-term capital gains under section 111A or long-term capital gains under sections 112/112A, are calculated separately and may not fully benefit from the Section 87A rebate under the new tax regime in some years. As a result, short-term trading profits can still create a tax bill even where your salary or business income alone would fall in the “zero-tax” range.

Collating Your Taxes

It is important to keep track of all your profits and losses, so you can total them up at the end of the tax year.

Many reputable brokerages also offer capital gains/tax statements at the end of the financial year, so it is worth looking out for these to avoid hassle.

Brokerage Taxes

There may also be taxes imposed by your broker to take into account. You should consider several factors in your tax calculations:

- Many Indian discount brokers now charge either a very low percentage brokerage or a flat fee per order (often up to ₹20) for intraday trades, which can be significantly cheaper than 0.05% per side, especially on larger trade sizes.

- GST at 18% is levied on the sum of brokerage, exchange transaction charges and SEBI turnover fees.

- The STT tax depends on the product. For equity delivery, STT is about 0.1% on both buy and sell, and for equity intraday, it’s about 0.025% on the sell side. For equity derivatives, there are lower rates on futures and options premiums/settlement.

- Stamp duty on securities is charged at standardised rates only on the buy side, and the percentage varies by product (for example, roughly 0.015% on delivery equity and around 0.003% on intraday equity), rather than a flat 0.02% on total turnover.

- Exchange transaction charges are around 0.003% of turnover for equity trades, while SEBI turnover fees are only ₹10 per ₹1 crore of turnover (0.0001%). The combined “regulatory” cost is generally well below 0.004% for most equity trades today.

Final Word

Day trading tax rules in India are complicated, but for many active traders, they can be competitive compared to other major markets, especially when you factor in the ability to treat trading as a business and offset expenses and carry forward losses.

The first hurdle is deciding which of the categories above your trading activity fits into. Whilst you will probably fall under the ‘business income tax’ umbrella, it is important to be aware of the benefits and drawbacks.

Recommended Reading

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com