SpeedTrader Review 2024

Pros

- Access a range of US stocks, options, bonds and mutual funds, plus extended hours trading available from 4am to 8pm EST

- Two powerful platforms with level 1 price data, live news streams, advanced charting and more

- Heavily regulated in the US by FINRA, plus SIPC compensation coverage up to $500,000

Cons

- Not suitable for beginners with a $30,000 minimum deposit

- Mobile trading is limited to iPhone and iPad users

- Only US stocks available, with no forex, commodities or cryptos

SpeedTrader Review

SpeedTrader is an online brokerage aimed at active clients. Users can trade US stocks and options through a high-speed web platform and mobile app. This review covers the broker’s trading services, including demo and margin accounts, regulatory status, and fee structure.

SpeedTrader Details

SpeedTrader is a New York-based online broker established in 1999. The company is part of Mint Global Markets and is registered with FINRA & SIPC.

Aimed at experienced traders, the broker offers competitive fees and powerful trading tools. In return, clients must meet hefty minimum deposit requirements and receive minimal hand-holding in terms of educational resources.

Trading Platforms

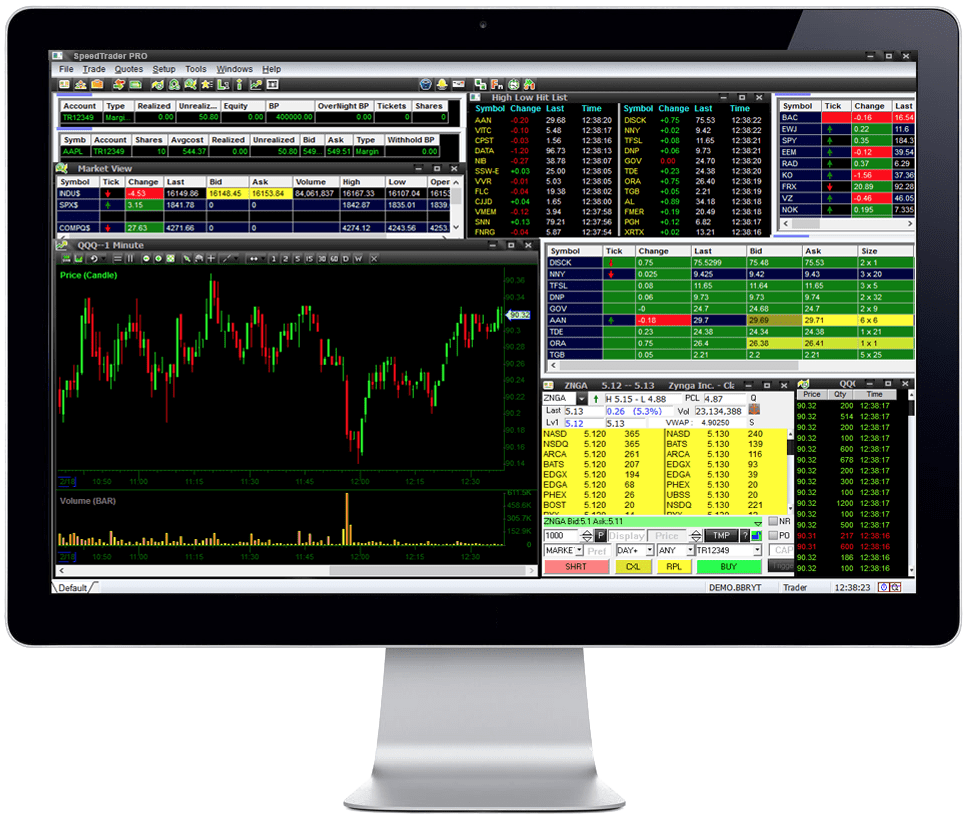

SpeedTrader PRO

SpeedTrader PRO is a powerful, desktop-based trading platform. The software promises advanced trading options, account management tools, and real-time streaming.

The interface is laid out so that features are easy to find and use on both Mac and Windows devices. Traders get access to stock scanners, 25 routing options, and 100 hotkeys. There’s also a decent level of customisation so users can find a look and feel that works for them. Reviews of the platform are generally positive and it will meet the needs of experienced traders.

ActiveWeb

ActiveWeb is a browser-based HTML5 trading platform packed with market data, options chains, live streaming news, and real-time level 1 quote data. The easy-access program also offers a suite of risk management tools, multiple screen support, and comes with a built-in Twitter feed. ActiveWeb ticks the box if you’re looking for a hassle-free direct market access platform.

Assets

SpeedTrader has a relatively narrow product range with users only able to trade US stocks, options, bonds, and mutual funds. Clients looking to trade forex, futures, cryptocurrency, or commodities will be disappointed. With that said, it does means tools and resources are focussed on the few asset-types that are available.

Popular Alternatives To SpeedTrader

-

1

FOREX.comActive Trader Program With A 15% Reduction In Costs

FOREX.comActive Trader Program With A 15% Reduction In Costs

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$1000.01 Lots1:50NFA, CFTCForex, Stocks, Futures, Futures OptionsMT4, MT5, TradingView, eSignal, AutoChartist, TradingCentralWire Transfer, Credit Card, Debit Card, Visa, Mastercard, Skrill, Neteller, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, PLN -

2

NinjaTrader

NinjaTrader

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Stocks, Options, Commodities, Futures, CryptoNinjaTrader Desktop, Web & Mobile, eSignalACH Transfer, Debit Card, Wire TransferUSD -

3

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro USAInvest $100 and get $10https://www.daytrading.com/ is not an affiliate and may be compensated if you access certain products or services offered by the MSB and/or the BD.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$10$10SEC, FINRAStocks, Options, ETFs, CryptoeToro Trading Platform & CopyTraderACH Transfer, Debit Card, PayPal, Wire TransferUSD -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States.

Ratings/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5/ 5

$00.01 Lots1:50NFA, CFTCForex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA)OANDA Trade, MT4, TradingView, AutoChartistWire Transfer, Visa, Mastercard, Debit Card, ACH TransferUSD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD

Commissions & Fees

SpeedTrader’s commission structure permits clients to choose between a per trade or per share charge. Per-trade pricing begins at $2.95, per-share at $0.0025, and options pricing at $0.30 per contract. An inactivity fee of $30.00 will also be charged to accounts if fewer than 15 trades are executed per quarter.

See the Commission Fees section of the website for further details.

Leverage

Leverage up to 1:400 is available and 1:200 on overnight trades. Leverage provides an opportunity for greater exposure with minimum equity, but whilst it can earn big returns, it does carry risk. Leverage levels are flexible and there are potential discounts on margin interest rates. Contact the customer support team to negotiate a leverage package that works for you.

Note, as per PDT rule, any margin account identified as belonging to Pattern Day trader should have a minimum balance of $25,000.

Mobile App

SpeedTrader offers a mobile app for trading on-the-go. The app offers all the features of the desktop experience including level 2 data, advanced charting, options chains, order management tools, news updates, and more. The app is only available to download on iOS devices.

Payment Methods

Funding your SpeedTrader account can be done via wire or electronic transfer. Domestic transfers (US) will take up to 24 hours to clear, and international transfers up to 48 hours. The minimum deposit is $30,000 and the maximum daily deposit permitted is $50,000.

Withdrawals can be requested via electronic transfer or check. Electronic transfers are free of charge while checks may be charged an overnight delivery fee of $40.00. Overnight delivery cannot be made to international addresses.

Demo Account

SpeedTrader offers users a 14 day free trial of the PRO platform. The paper trading account is a great way to explore trading software, market simulators, plus advanced charting tools and stock scanners. No credit card is required and the demo account registration and login processes are quick and easy.

Deals & Promotions

There were no welcome deposit bonuses or other sign-up offers at the time of writing. However, the broker has been known to offer $100 of free trades to new clients in the past, so it’s worth checking their website for offers before you open an account.

Regulation & Licensing

SpeedTrader is authorised by the US Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Client funds are insured up to $500,000 and the company’s clearing policy provides additional coverage of up to $24.5 million per client as outlined by SIPC. Accounting for both coverage policies, clients are protected up to a total of $25 million, including up to $1 million for cash balances.

Note, SpeedTrader isn’t available in Canada but does offer services to foreign countries, including the UK, Australia, and Europe.

Additional Features

SpeedTrader offers additional resources in the form of webinars, a blog, and a Short List tool that locates specific tickers that may be eligible for shorting. The broker also offers a rebate on a market intelligence tool – Trade Ideas, plus a discount on Ticker Tocker, an intuitive trading platform that offers an algorithm builder, amongst other features.

The additional resources available are targeted towards experienced traders, so beginners may find the education tools limited.

Account Types

SpeedTrader offers two account plans for stocks and options trading – COR and ETC. The COR account offers per trade and share options. The ETC account offers only per-share trade options. The price structure on the ETC account starts at $0.0039 per share. Fees on the COR account begin at $3.95 per trade and $0.00039 per share.

Regardless of account type, platform and routing fees are an additional cost passed onto the trader. Account login can be found in the top right corner of the broker’s homepage.

Trading Hours

SpeedTrader platforms are available to view 24/7, however trading hours follow general market opening and closing times. Standard US trading hours are from 09:30 to 16:00 local time, Monday through to Friday. The only exception to this is a reduced schedule over holiday periods, details of which the broker will publish on their website.

On the SpeedTrader blog, users can find information on pre-market and after-hours trading.

Customer Support

Customer support is located in the bottom right of the homepage. Help is available via:

- Email – info@speedtrader.com

- Phone number – 800-874-3039

SpeedTrader also offers a live chat function. Live chat is available from 08:00 through to 17:00 ET, Monday to Thursday, and 08:00 to 16:30 ET on a Friday.

Users can also find SpeedTrader on Facebook and Twitter, as well as helpful videos on YouTube.

Trader Security

Trading platforms, payment methods and information shared over customer support are all secured using industry-standard measures, including firewalls and SSL protocols. SpeedTrader provides a safe trading environment for its clients.

SpeedTrader Verdict

If you take SpeedTrader vs the likes of Lightspeed, Interactive Brokers, Suretrader, or eToro, it’s clear the broker can hold its own in terms of market access and trading fees. For active traders seeking a high-speed platform and access to US markets, SpeedTrader is a credible option. Beginners or intermediates not willing to put up $30,000 to open an account may want to consider alternatives.

Top 3 Alternatives to SpeedTrader

Compare SpeedTrader with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

SpeedTrader Comparison Table

| SpeedTrader | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| Rating | 3 | 4.3 | 4.4 | 4.5 |

| Markets | Stocks, options, bonds, mutual funds | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Stocks, Futures, Futures Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $30,000 | $0 | $0 | $100 |

| Minimum Trade | 1 Share | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FINRA, SIPC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 2 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by SpeedTrader and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| SpeedTrader | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | No |

| Futures | No | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

SpeedTrader vs Other Brokers

Compare SpeedTrader with any other broker by selecting the other broker below.

FAQ

Where is SpeedTrader regulated?

SpeedTrader is registered with the US FINRA and SIPC. Traders can open an account in the knowledge that the broker may be subject to sanctions if it acts inappropriately.

Does SpeedTrader offer a demo account?

Yes, SpeedTrader offers a 14 day free trial of the SpeedTrader PRO platform. Prospective clients can test the range of trading tools and instruments available.

How much capital do I need to trade with SpeedTrader?

The minimum account requirement is $25,000. This is significantly higher than the amount needed to create an account at other brokers, which may deter less-experienced traders.

Is SpeedTrader a trustworthy broker?

SpeedTrader has a credible reputation and is subject to regulatory oversight from the US FINRA and SIPC. With that said, there are always risks involved with day trading, so users should only invest what they can afford to lose.

Does SpeedTrader accept foreign accounts?

Yes, SpeedTrader does accept clients from outside the US. Clients from Europe are advised to speak to customer support about creating an account. Note, clients from certain countries, including Canada, are not able to open a SpeedTrader account.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of SpeedTrader yet, will you be the first to help fellow traders decide if they should trade with SpeedTrader or not?