Saxo Bank To Provide Trading Infrastructure To HSBC Singapore Clients

HSBC Singapore is partnering with Saxo Bank to bolster its online trading platform for retail banking customers. The integration will help HSBC provide a seamless, user-friendly experience for its local and overseas consumers. The news comes as Saxo announced a 24 percent increase in client onboarding at its Singapore entity in the first half of 2021.

Saxo OpenAPI

The consolidation of trading infrastructure is made possible through Saxo’s OpenAPI service. By leveraging the retail broker’s software intermediary, HSBC can cut its costs and operational complexity to provide a top-tier client experience. This includes a seamless end-to-end user experience, plus enhanced equity trading capabilities.

Saxo’s APAC CEO, Adam Reynolds, commented: “Singapore will be the first in HSBC to adopt our trading platform, and we are excited to be combining natural synergies from both companies to deliver an enhanced trading and investment experience for HSBC customers.”

Head of Wealth and Personal Banking at HSBC Singapore, Anurag Mathur, added: “To meet our customers’ need for best-in-class digital banking and wealth solutions, we need to work with like-minded partners to scale up our digital capabilities at pace.”

HSBC is focussing efforts on its Asian division after selling a large part of its US retail trading business. Separately, Saxo is also concentrating on its trading operations in the region. 2021 saw the introduction of crypto trading services for its clients from Singapore and Australia.

About Saxo Bank

Saxo Bank is headquartered in Denmark and offers more than 40,000 trading products spanning forex, CFDs, stocks, bonds, options, cryptos, ETFs, and mutual funds. Leverage is capped at 1:30 in line with regulatory requirements and traders can sign-up for a live account with a $500 minimum deposit.

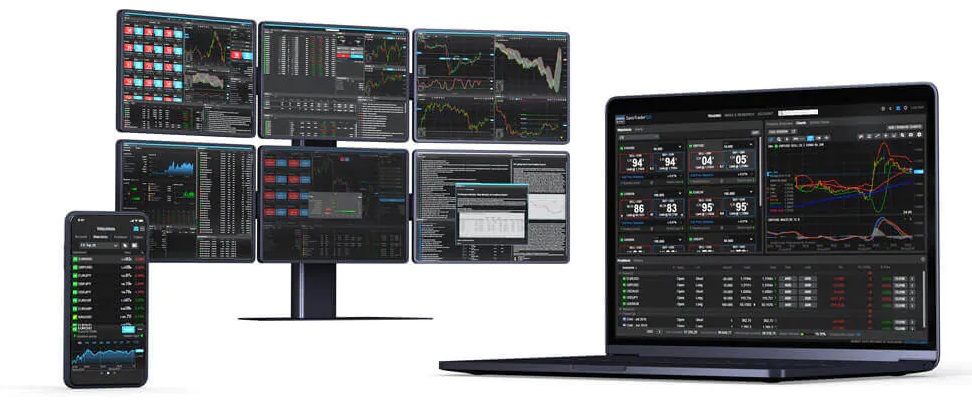

The multi-regulated broker offers its own bespoke trading software – SaxoTrader. The browser-based platform is compatible with desktop and mobile devices and offers slick navigation along with multiple order types and advanced analysis tools.

Saxo Bank is an award-winning international broker and its latest partnership with HSBC will help increase its presence in Asia. It’s also a promising sign that its current digital capabilities are being well received by active traders.

Sign-up today using the link below.