S.A.M Trade Review 2024

Pros

- Tier-based rewards program based on trading volumes

- In-person training course and tips from S.A.M Trade experts

- Proprietary copy trading terminal and analysis tools

Cons

- Basic educational resources

- Limited deposit and withdrawal methods

- No live chat or telephone support

S.A.M Trade Review

S.A.M Trade offers leveraged CFDs on a range of markets including forex, indices, commodities, and cryptocurrencies. Day traders can access the MetaTrader 4 (MT4) terminal alongside proprietary tools created by the brokerage including a copy trading platform and a portfolio management system. This review will cover the pros and cons of signing up with S.A.M Trade, as well as deposit and withdrawal methods, pricing, and login security.

Company Details

S.A.M Trade is an online CFD broker, founded in 2015. The brokerage is primarily aimed at Chinese and Southeast Asian traders, though it has 200,000 clients worldwide.

Previously named Samtrade FX, the company rebranded to reflect the fundamentals of the firm; S for synergy, A for adaptability, and M for motivation. Its mission remains the same; to provide traders of all experience levels with secure, easy-to-use, and price-competitive access to the financial markets.

S.A.M Trade is incorporated in Saint Vincent and the Grenadines and is a member of The Financial Commission. The Aussie entity is also registered with the Australian Securities & Investments Commission (ASIC).

Trading Platforms

S.A.M Trade offers MetaTrader 4 (MT4) alongside a proprietary copy trading platform; CopySam™.

The MT4 terminal can be downloaded to Windows, Mac, or Linux devices or used as a web trader. You can access the broker’s automated copy trading platform directly through the client dashboard. We outline the features of both terminals below.

MetaTrader 4

A globally established platform, MT4 offers a wealth of technical analysis features and core trade functions suitable for both beginners and experienced day traders.

- Nine timeframes

- One-click trading

- Fully customizable charts

- 30 built-in technical indicators

- Four pending order types and three execution modes

- Expert Advisors and the functionality to build your own algorithms

How To Place A Trade

- Login to the MT4 web platform or download the software to a desktop device

- Find the asset you wish to trade using the drop-down menu (right-hand side) or search bar

- Select ‘new order’ or initiate a trade directly from the chart

- Input the trade details including volume, order type, and stop loss

- Select ‘buy’ or ‘sell’

- Confirm the order

CopySam™

CopySam™ is a copy trading terminal providing access to ‘expert’ knowledge. Retail traders can follow and copy the trades of experienced traders, with no prior knowledge of the market or asset classes required.

The platform has been awarded the Collective Investment Platform Certification by the Financial Services Commission.

- $100 minimum investment

- No maximum investment

- Start or stop copying at any time

- Profit sharing of 10% to 40%

- Leverage between 1:10 to 1:500

- View the performance of master traders including their profitability, strategy, and preferred asset class

How To Get Started

- Open a live S.A.M Trade account

- Spend time researching ‘expert’ investors by viewing their performance history and previous trades

- Follow traders that are of interest

- Select a trader to copy and enter the amount you wish to invest

- The platform will then get to work automatically

Assets & Markets

Retail investors can trade CFDs on the following assets:

- Commodities – Trade two spot metals and three energies including Gold, Silver, and Natural Gas

- Indices – Speculate on 17 of the world’s largest stock indices such as the FTSE 100 and Dow Jones 30

- Currency Pairs – Trade 30+ major and minor forex pairs including EUR/GBP, GBP/USD, and USD/CAD

- Cryptocurrencies – Open crypto positions across 20 digital currency USD crosses including BTC/USD, DASH/USD, ETH/USD, XRP/USD

Traders can also access futures contracts on popular instruments such as the Volatility Index, 10-year US Bond, US Oil, and the Russell 2000 Mini Index.

Spreads & Fees

All account types, except the ECN profile, offer commission-free investing. The broker does not provide account/instrument-specific spreads, however, average prices are available. The EUR/USD currency pair, for example, is offered at a typical spread of 1.7 to 2 pips. GBP/USD is offered at 2.4 to 2.6 pips. Crude Oil and Natural Gas can be traded with an average spread of 5.0 cents.

The ECN account offers the tightest spreads, however, a $5 commission applies per round lot turn. S.A.M Trade uses an STP/ECN model to offer competitive spreads and direct access to liquidity providers.

Swap charges apply for positions held overnight.

A profit-sharing plan of 10% to 40% applies when using the services of CopySam™.

It is free to open a live trading account with S.A.M. Trade and there are no account management fees.

Leverage

S.A.M. Trade offers leveraged trading opportunities up to 1:1000. However, any requests for leverage over 1:200 must be approved by the brokerage.

- 1:25 leverage ratio, 4% margin requirement

- 1:50 leverage ratio, 2% margin requirement

- 1:75 leverage ratio, 1.33% margin requirement

- 1:100 leverage ratio, 1% margin requirement

- 1:150 leverage ratio, 0.67% margin requirement

- 1:200 leverage ratio, 0.5% margin requirement

All accounts have a 100% margin call level and a 50% stop-out level.

Mobile App Review

When we used S.A.M Trade, we were disappointed to see that the copy trading platform is not available as a mobile-compatible app.

Nonetheless, the MT4 terminal can be used on mobiles and tablets. The application is user-friendly, with all the features and functions found on desktop devices. This includes customizable charts and graphs, asset search navigation, watchlist creation, and more. You can also set handy price notifications and alerts.

Payment Methods

Deposits

The list of accepted payment methods at S.A.M Trade is short:

- Tether (USDT) – Up to one working day

- Bank Wire Transfer – One to four working days

- Visa & Mastercard Credit & Debit Cards – Within one hour during weekdays

The majority of S.A.M Trade live accounts have a minimum deposit of $10. However, the accepted payment methods all require a minimum of $20 or equivalent currency (or USDT 50).

The broker does not charge any fees for deposits, however, third-party charges are the responsibility of investors.

You can deposit money in any currency though you will be liable for currency conversion fees to USD. This will be at the prevailing interbank rate.

Withdrawals

The broker accepts withdrawals from the same deposit methods. A minimum withdrawal amount of $20 or USDT 50 applies.

Processing times are typically between one to four working days for bank transfers and credit/debit cards, but all withdrawals are processed by the broker within 72 hours. Tether payments can be processed in one working day.

Similar to deposits, the broker does not charge withdrawal fees however third-party charges may apply.

S.A.M Trade Demo Account

The broker offers a free demo account with access to flexible leverage and virtual funds. This is ideal for beginners to get comfortable with the trading platform and practice trading risk-free.

The S.A.M Trade demo profile expires after one month.

Deals & Promotions

The broker runs a SamRewards™ program, which rewards retail investors based on trading volumes. You can earn ‘points’ by making your first deposit of $500, trading 1 standard FX lot, or making a successful referral. Points can be exchanged for luxury prizes including electronics.

S.A.M Trade also occasionally offers a ‘Traders’ Challenge’. Clients can win up to $2000 and 1,000 SamPoints based on performance within the allocated month.

Regulation & Licensing

S.A.M. Trade is incorporated in Saint Vincent and the Grenadines under company number 25290 IBC. The broker is also a member of The Financial Commission with a compensation fund of up to €20,000 for disputes or business insolvency. Additionally, day traders are protected under insurance from the WikiFX Assurance Center, with up to $7,000 in compensation.

The brokerage consists of several global entities:

- S.A.M. Trade (Asia) Pte Ltd – Publicly traded on the OTC Markets in the USA

- S.A.M. Trade – Regulated by the Financial Transactions and Reports Analysis Center of Canada (FINTRAC) under the Money Services Business (MSB), registration number M19977589

- S.A.M. Financial Group (Australia) Pty Ltd – Regulated by the Australian Securities & Investments Commission (ASIC), ASFL license number 338674

Note, the previous trading entity, Samtrade FX Limited, and its related subsidiaries are not licensed by the Monetary Authority of Singapore (MAS), and have been placed on MAS’ Investor Alert List since July 2021. Suspicions of irregular trading activities without a suitable capital markets license are being investigated.

The broker does not offer services to residents in the USA.

Additional Features

SamTracks™

SamTracks™ is one of the broker’s proprietary tools. The portfolio monitoring system can analyze your trading performance and asset allocations from a simple-to-navigate interface.

It is a complimentary service for all S.A.M Trade live account holders and can be accessed directly via the client portal.

Trading Signals

Day traders can access a small selection of free, third-party technical indicators and signals that can be downloaded to the MT4 terminal. Partners include; The Master FX Free Signal, PIPSFIX Forex Trading Signal, and the Master Naked Chart Free Signal.

These can help indicate the best time to buy or sell a security.

Education

While using S.A.M Trade, we found basic educational resources. The content is not particularly user-friendly, with no step-by-step guides, integrated video content, or imagery.

Materials are aimed at beginners with topics including what is forex trading, what are commodities, and how to use leverage.

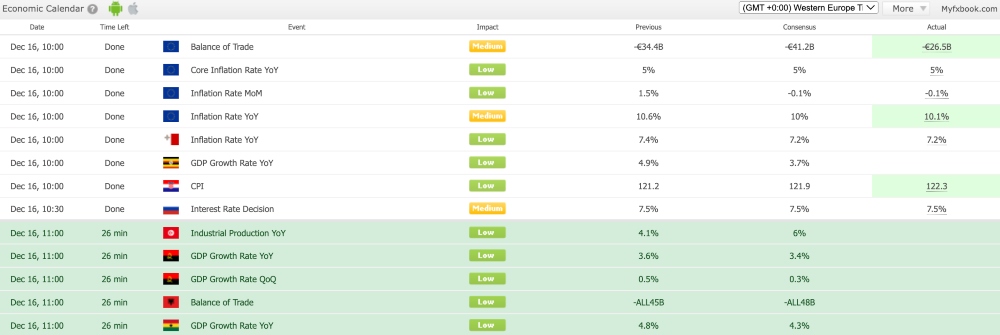

There are no learning resources for more advanced investors, though an economic calendar and market news are published on the website.

Trader’s Club

An exclusive membership program with guidance and market analysis. Hosted by expert trainers, registered clients benefit from the latest market news, fundamental research, and a results-driven approach to trading.

There is a one-off membership fee of $10,000 which provides access to eight sessions (every Friday evening for eight weeks) and one Bootcamp (10 sessions over three weekends).

S.A.M Trade Accounts

Our experts found that S.A.M. Trade offers four account types, suitable for varying levels of experience and tailored to investment goals; Standard, VIP, ECN, and Islamic.

All profiles have a USD account denomination, a minimum order size of 0.01 lots, and a maximum trade size of 100 lots.

Standard Account

- 24/5 support

- Daily trade call

- Commission-free

- $10 minimum deposit

- Leverage up to 1:1000

- Standard floating spreads

VIP Account

- Daily trade call

- Commission-free

- Priority 24/5 support

- Tight floating spreads

- $10 minimum deposit

- Leverage up to 1:1000

ECN Account

- $5 commission

- Daily trade call

- Tightest spreads

- Priority 24/5 support

- Leverage up to 1:200

- $100 minimum deposit

Islamic Account

- Swap-free

- 24/5 support

- Daily trade call

- Commission-free

- Leverage up to 1:500

- $10 minimum deposit

- Standard floating spreads

How To Open An Account

- Select ‘Open Live Account’ (orange logo, top right of the webpage)

- Choose an Individual, Joint or Corporate profile

- Complete the online registration form

- Select your account within the client area

- Make a deposit

- Start trading

The broker complies with AML protocols so you will be required to upload identity verification and address details.

Trading Hours

You can view trading sessions by instrument in the Contract Specifications section of the trading platform. This includes Monday 00:00 (GMT +1) to Friday 23:00 (GMT +1) for forex trading. Cryptocurrency can be traded 24 hours a day, seven days a week.

Customer Service

All registered clients benefit from 24/5 customer support. However, contact options are limited. Our experts were only presented with an online contact form or an email address (support@samtradefx.com). It is a shame to see no live chat option or telephone number.

The S.A.M Trade FAQ section on the website is fairly helpful, however. It offers answers to popular questions such as how to implement the 2FA security code to log in, how to deposit and withdraw funds, and the minimum requirements to use the CopySam™ tool.

Security & Safety

When investing with S.A.M. Trade, retail investors can be assured of a secure trading environment. The broker offers segregated client funds and negative balance protection.

The broker also offers two-factor authentication (2FA), implementing PIN verification or one-time passwords for extra login security.

S.A.M Trade Verdict

S.A.M Trade is a decent multi-asset broker with a low minimum deposit and bespoke tools. The choice of trading accounts alongside the copy trading platform will also appeal to beginners. On the downside, the limited selection of payment methods and regulatory concerns may put off some traders.

FAQs

What Is The Minimum Deposit For A S.A.M Trade Live Account?

S.A.M Trade minimum deposit requirements start from $10 for the Standard, VIP, and Islamic trading accounts. The ECN profile has a minimum funding requirement of $100.

What Leverage Does S.A.M Trade Offer?

S.A.M Trade offers leverage up to 1:1000. This is flexible and can be amended within the client area. Note, leverage above 1:200 must be approved by the online broker.

What Payment Methods Does S.A.M Trade Offer?

Deposits to a S.A.M Trade account can be made through debit/credit cards (VISA & Mastercard), bank wire transfers, and Tether (USDT).

What Trading Platforms Does S.A.M Trade Offer?

S.A.M Trade offers retail clients MetaTrader 4. However, a proprietary copy trading platform is also available to retail investors; CopySam™.

Does S.A.M Trade Accept Residents Of The USA?

S.A.M Trade services are not provided to residents of the USA. Other restricted jurisdictions include Canada, Japan, South Africa, Spain, and Zimbabwe.

Top 3 Alternatives to S.A.M Trade

Compare S.A.M Trade with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

S.A.M Trade Comparison Table

| S.A.M Trade | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 3.5 |

| Markets | CFDs, Forex, Indices, Commodities, Futures, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Indices, Commodities, Stocks, Crypto |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $100 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSC, ASIC, FINTRAC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | ASIC |

| Bonus | Cash Rebates | – | – | – |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:500 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

DNA Markets Review |

Compare Trading Instruments

Compare the markets and instruments offered by S.A.M Trade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| S.A.M Trade | IG | Interactive Brokers | DNA Markets | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | Yes | Yes | No | Yes |

S.A.M Trade vs Other Brokers

Compare S.A.M Trade with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of S.A.M Trade yet, will you be the first to help fellow traders decide if they should trade with S.A.M Trade or not?