ROI: ROC vs. ROA vs. ROE

Return on Capital (ROC), Return on Assets (ROA), and Return on Equity (ROE) are metrics that assess a company’s ability to turn capital into profit.

Each ratio, using distinct metrics, offers a different perspective on a firm’s financial efficiency.

ROC (Return on Capital)

ROC, which is sometimes termed ROIC (Return on Invested Capital), offers insights into a company’s efficiency in leveraging both its equity and debt to produce profits.

It’s calculated as:

ROC = Net Income ÷ Total Capital (Equity + Debt)

By observing this ratio, stakeholders can understand how well a company deploys all available capital – both owned (equity) and borrowed (debt) – to earn profits.

ROA (Return on Assets)

When investors or stakeholders wish to understand how a company employs its assets, from cash and inventory to property, to create profits, they look at the ROA.

The formula for ROA is:

ROA = Net Income ÷ Total Assets

ROA provides a bird’s-eye view of how resourcefully a firm is operating with what it owns or controls.

ROE (Return on Equity)

ROE zeros in on a company’s proficiency in using shareholders’ equity for profit generation.

It showcases how effectively the money invested by shareholders is being used.

The formula for ROE is:

ROI = Net Income ÷ Shareholder Equity

Especially pertinent for leveraged firms, this ratio indicates the efficiency with which shareholders’ contributions are turned into earnings.

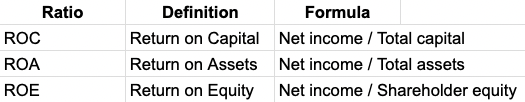

Table: ROC vs. ROA vs. ROE

Which Ratio Is Best?

Though it’s tempting to seek one overarching metric, the relevance of ROC, ROA, or ROE depends on the context.

ROC, due to its encompassing nature, is often considered the most holistic profitability measure, given it considers both equity and debt.

ROA’s ability to compare firms across diverse sectors makes it valuable.

And for businesses with higher leverage, ROE reveals how they capitalize on shareholders’ funds.

Practical Applications of ROC, ROA, and ROE

Whether you’re a trader or investor scouting for efficient companies or an analyst comparing businesses across verticals, these ratios serve as tools to help better understand financial efficiency.

For instance:

- A trader/investor might weigh the ROC of two firms within the same sector to discern which utilizes its capital more effectively.

- Analysts can use ROA to juxtapose the profitability metrics of firms from varied industries.

- Lenders may rely on ROE to gauge a potential borrower’s creditworthiness.

Conclusion

ROC, ROA, and ROE are barometers of a company’s financial health.

For a rounded analysis, they should be used in conjunction with other financial metrics. This will offer a nuanced understanding of a company’s financial health and efficiency.