Revenue vs. Profit

Revenue vs. Profit: What’s the Difference?

As a trader, investor, business owner or manager, it’s important to understand the difference between revenue and profit.

Revenue is the total amount of money that your company brings in from sales.

Profit, on the other hand, is the amount of money that your company has left after all expenses have been paid.

In this article, we explore the difference between revenue and profit and why it matters for your business.

Revenue vs. Profit: The Basics

Revenue is the total amount of money that your company brings in from sales of products or services. This number includes both one-time and recurring revenue streams.

For example, if you sell a product for $100 and make 10 sales in a month, your revenue for that month would be $1,000.

Profit is the amount of money that your company has left over after all expenses have been paid.

Expenses can include things like the cost of goods sold, marketing costs, employee salaries, rent, and utilities.

Let’s say your total expenses for the month are $500.

This means that your profit for the month would be $500 ($1,000 in revenue – $500 in expenses).

Why Does It Matter?

Understanding the difference between revenue and profit is important for two main reasons.

1) Company’s financial health

It gives you a better understanding of your company’s financial health: If you only focus on revenue, you might think that your business is doing great because you’re bringing in a lot of money.

However, if you’re not making a profit, then your business is actually losing money.

Understanding both revenue and profit will give you a more complete picture of your company’s financial health.

Startups often pursue growing their revenue over profits because they’re trying to grow into their market.

They’ll then focus on economies of scale, which means effectively growing into a profitable company through favorable unit economics and selling a quantity to exceed their fixed costs.

Breakeven Example

Take a business that has the following characteristics:

- Fixed cost of $1,000 per month

- Revenue of $100 per sale

- Costs of $50 per sale

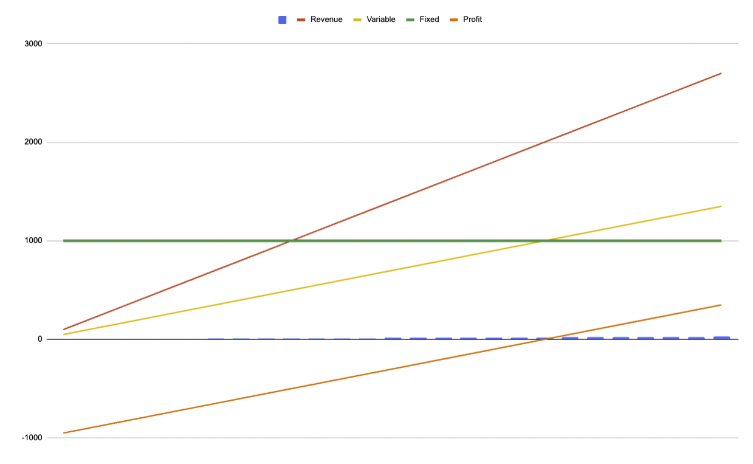

The chart below shows this business.

The green line shows fixed costs. The yellow line shows variable costs, the red line shows revenue, and the orange line shows profits.

Breakeven Example

2) Better decision on where to invest your resources

It helps you make better decisions about where to invest your resources: If you want to grow your business, you need to reinvest some of your profits back into the business.

However, if you don’t have any profits because all of your revenue is going towards expenses, then you won’t have anything to reinvest.

This is why it’s so important to focus on both revenue and profit when making decisions about where to invest your resources.

It’s important to not just grow for growth’s sake. For a business to be sustainable, it will need to be profitable.

Revenue vs Income – Difference Between Revenue and Income

FAQs – Revenue vs. Profit

What is the difference between revenue and profit?

Revenue is the total amount of money that a company brings in from its sales of goods or services.

Profit, on the other hand, is the total amount of money that a company has left over after it pays all of its expenses.

What is an example of revenue?

An example of revenue would be if a company sold $100 worth of goods or services. The company’s revenue would then simply be $100.

What is an example of profit?

If the same company that brought in $100 of revenue had expenses totaling $80 to generate that revenue, then its profit would be $20. ($100 in revenue – $80 in expenses = $20 in profit.)

Why is profit important?

Profit is important because it is the money that a company can use to grow and expand its business.

Without profit, a company would not be able to invest in new products or services, or hire new employees organically. It would need to tap debt or equity financing, which is a claim that needs to be paid back in the future.

A business, in the long run, is not sustainable if it cannot generate profit or at the very least break even.

What are some ways to increase profit?

There are a few key ways to increase profit:

- Reduce expenses

- Increase revenue

- Or simply improve the differential between the two

Reducing expenses can be done in a number of ways, such as cutting back on advertising or renegotiating supplier contracts. Increasing revenue can be done by expanding into new markets or selling higher-priced items.

And finally, improving margin can be accomplished by selling more high-margin products or increasing prices.

What are some risks associated with being focused on profit?

There are a few risks associated with being too focused on profits, such as:

- Compromising quality or service in order to cut costs

- Pricing products too high and losing customers

- Not reinvesting enough back into the business, which can lead to a decline in growth or market share

What is the difference between revenue and income?

Income is a term that’s used differently by individuals and companies.

Individuals usually describe what they take in as income, similar to what companies call revenue.

Companies often use the term net income to describe their profits. These are also known as earnings.

Revenue is the total amount of money that a company brings in from its sales. This can come from selling products, services, or both.

Income is the total amount of money that an individual or a company has after taxes and other deductions have been taken out. For individuals, this usually refers to their salary or wages. For companies, it’s their net income.

Conclusion – Revenue vs. Profit

Revenue and profit are two important financial metrics for any business.

Revenue is the total amount of money that your company brings in from sales while profit is the amount of money that’s left after all expenses have been paid.

It’s important to understand both metrics so that you can make informed decisions about where to invest your resources and grow your business.