Market Research Process

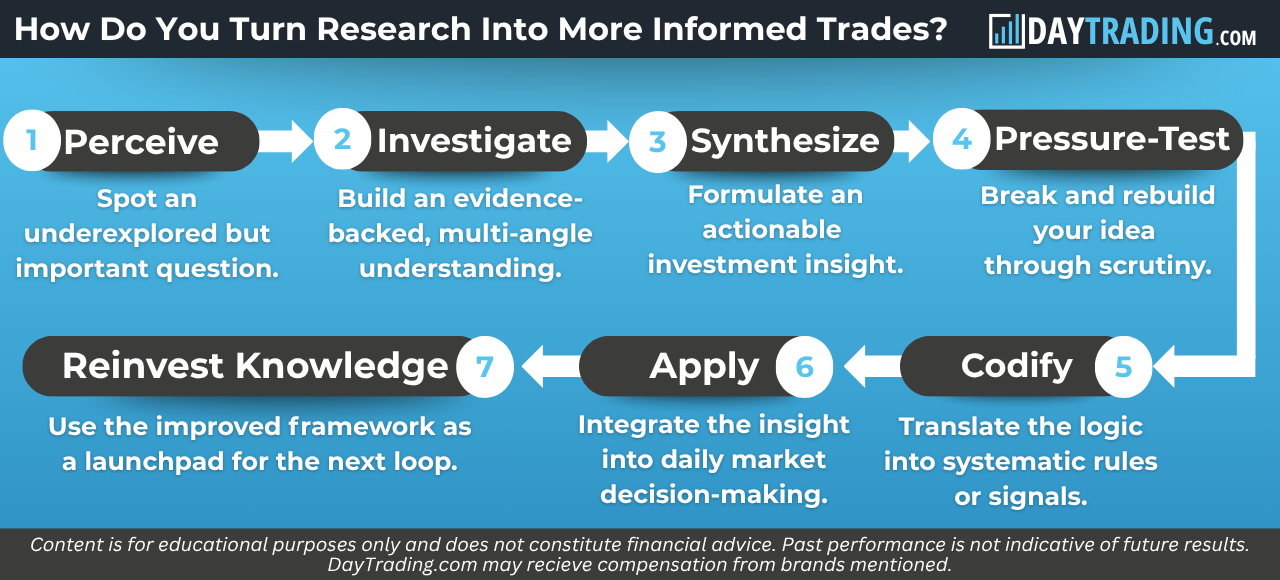

Here’s a structured, step-by-step breakdown of the market research process, focused on the systematic development of durable trading or investment insights, from first perception to codified application.

Our goal here is to reflect institutional workflows, but it can be used by anyone serious about building their market understanding.

Step-by-Step Process of Market Research and Investment Insight Development

Step 1: Generate a Sharp Perception

Start With a Focused Question

Every research loop begins with a question or observation; something that feels materially important to the market but not yet fully understood.

- Examples:

- How will generative AI reshape earnings for the S&P 500?

- What happens to real asset valuations if long-term real rates structurally shift higher?

- Will nearshoring create a multi-decade industrial capex boom in North America?

What to Look For

- Emerging anomalies or shifts in data

- Macro changes

- Structural changes (e.g., demographic, technological, geopolitical)

- Misalignments between narrative and actual market positioning

Step 2: Launch an Investigation

Go Deep, Not Wide

Once a perception is identified, move into targeted investigation to test its validity and implications.

- Study both point-in-time conditions (What’s happening now?) and longitudinal patterns (How did similar setups behave in the past?).

- Use both quantitative and qualitative research.

Techniques to Use

- Regression analysis, historical analogs, and cross-sectional comparisons

- Policy tracking, earnings calls, capex guidance, macro indicators

- Expert interviews, academic literature, policy documents

Your Goal

Build a multidimensional understanding that can stand up to scrutiny and evolve over time.

Not a hot take, but a tested thesis.

Step 3: Synthesize the Insight

Connect the Dots into an Investment Idea

This is the moment where raw understanding becomes trading/investment insight.

- Ask: “What market dynamic is at play?”

- Turn cause-effect relationships into clear tradeable logic.

- Propose a thesis: “We believe X leads to Y, and therefore Z should happen in the markets.”

Example Synthesis

“We believe that rising AI infrastructure demand will pressure energy grids and cause regional natural gas shortages, which makes US nat gas futures structurally underpriced.”

Step 4: Pressure-Test the Thesis

Subject the Idea to Challenge

No thesis survives first contact unchallenged.

- Revisit your data – Is your logic watertight or selectively chosen?

- Play devil’s advocate – What assumptions would need to fail for this to break?

- Seek structured feedback – Others should try to disprove the idea.

What This Looks Like in Practice

- Debate your assumptions

- Walk through your historical analogs

- Model scenario sensitivity

- (e.g., What if interest rates don’t fall? What if margins compress faster?)

A good idea doesn’t just survive questions, but improves because of them.

Step 5: Codify and Systematize the Logic

Turn Thought Into Repeatable Systems

If the idea holds up under scrutiny, it’s time to industrialize it – i.e., so it becomes part of your permanent market approach.

- Translate qualitative insight into if/then statements, formulas, or systematic indicators.

- Codify it so your model or decision process incorporates this logic automatically in future conditions.

- Ideally, if possible, put it into literal code/automated form so it can do its job without you

Example

If industrial capex as % of GDP crosses 3.5% and energy intensity per dollar of output begins rising → then overweight domestic steel and gas-heavy utilities.

Step 6: Embed Insight Into Daily Process

Let the Machine Run

Once codified, the insight shouldn’t live in a notebook. It should operate daily in your decision engine:

- Included in portfolio construction logic

- Used in signal generation

- Used as part of your risk framework

- Logged in your knowledge base or second brain for retrieval and re-use

This is done so your thinking compounds, not resets with every new question.

Every day you won’t feel motivated. You probably won’t feel 100% most days. You’ll be busy. There’s too much in the world you won’t be aware of.

The signal-to-noise ratio is poor, and fatigue dulls intuition.

That’s why you build systems – so your best thinking shows up even when you don’t/can’t. Consistency of execution beats bursts of inspiration every time.

Step 7: Repeat the Loop with a Better Base

The Research Loop Never Ends

- Each new idea rests on the strength of past ideas.

- Each round should refine your worldview and increase your understanding of how the system behaves.

The real advantage comes not from one good forecast, or from executing a series of trades that exclusively come from your own thinking, but from building a machine that consistently gets the intended results.

Related