Plum Review 2026

See the Top 3 Alternatives in your location.

Pros

- Regulated by the FCA

- Bill provider analysis

- Interest rates on uninvested cash are competitive up to 4.21% AER

Cons

- Narrow product portfolio compared to alternatives

- The app is only available in European regions

- Limited price analysis features such technical indicators and custom charting for experienced traders

Plum Review

Plum Fintech is a multi-faceted personal finance app that is predominantly focused on savings and uses AI to optimise your savings, investments and personal expenses, whilst ensuring that personal data is kept safe. The mobile app monitors personal daily spending and automatically sets money aside that the user won’t need. Plum also has a trading feature whereby you can invest in several funds with varying risk, rates of return and commissions.

Plum Headlines

Plum Fintech Ltd. is a developer of personal savings assistant solutions for customers. It has created its own app, which is a multifunctional finance platform that uses AI to monitor your daily spending and save money and can also be used for investing in funds. Founders Alex Michael and Victor Trokoudes established Plum Fintech on February 1, 2016. Victor Trokoudes is also the CEO of the company and is in the process of expanding the business by attracting investment and funding.

Plum Fintech Limited doesn’t have a public valuation or net worth and, as a private startup, doesn’t have a share price (or any shares). However, the firm is registered on Companies House and has a stream of investors and has raised a total of $23.5 million in funding over seven rounds, by 14 investors. Information on the company’s latest round of investment can be found online.

Plum Fintech Ltd. has its headquarters address in London in the UK. The company also has offices in Athens, Greece and Nicosia, Cyprus.

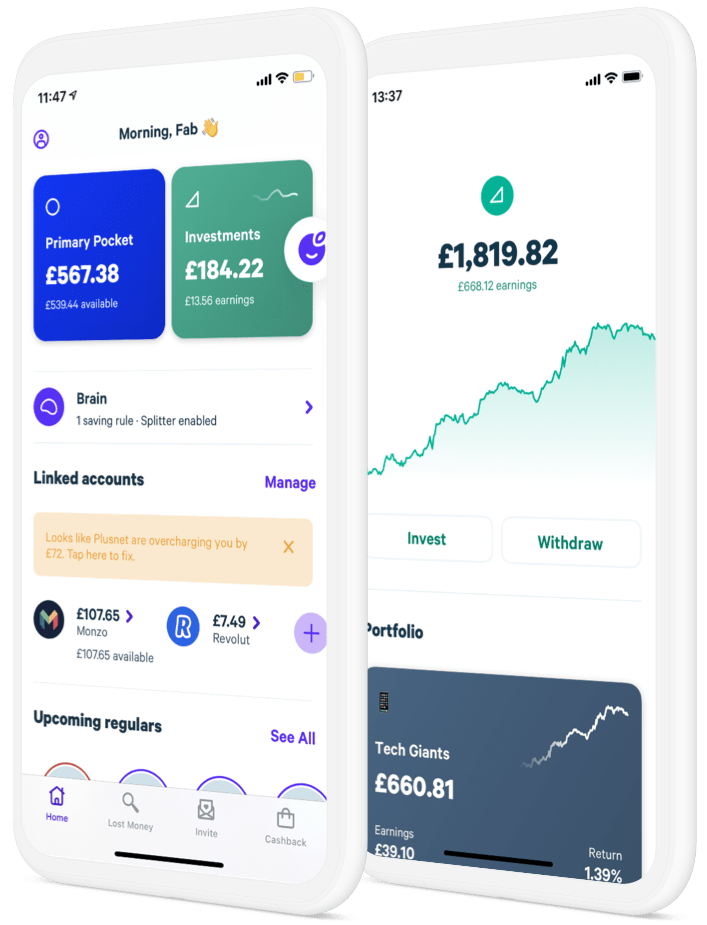

Trading Platform

Plum’s platform is simplistic and sleek, offering clients the ability to invest in several ready-made portfolios and mutual funds quickly and easily. The app does not support any advanced charting or analysis features, though it does have breakdowns of fund performance, targeted yields and risk factors.

Assets

Plum clients can invest their savings into a range of funds and investment portfolios. There are 12 options to choose from, each of which has its own risk level, targeted annual growth and fund management fee. These can help inform you of each fund before you take your pick. There are ‘safer’ funds designed for less growth but more consistent and riskier funds that aim for high levels of growth but are more likely to see losses.

The funds cover different areas of the global financial markets, from tech giants to rising stars and from ethical-focused baskets to top UK companies. Plum outsources its clients’ investment capital to mutual fund providers, who invest your money into a combined portfolio of stocks, shares and bonds.

Clients are given full control over how they split their capital between straight savings and investments in the various funds available. Once you have invested, your funds are held by Gaudi Regulated Services Ltd., an FCA regulated custodian firm.

Trading Fees

Plum’s most basic package is free but only allows for saving services to be accessed. For investments, the minimum cost is £1 per month. Each fund also has its own management fees, ranging from 0.06% to 0.90%.

On top of this is a product provider fee of 0.15%, charged by the custodian company, which increases to 0.45% for SIPP accounts.

For pensions and investments, all fund management and provider fees are billed annually, charged monthly and immediately reflected in your investment portfolio.

Leverage

Plum does not support margin trading, so no leverage rates are available and clients can only invest using capital they already have.

Mobile Apps

Plum Fintech can only be used as a mobile app, though both iOS and Android (APK) versions can be downloaded from the Apple App Store and Google Play Store, respectively. The app receives good customer reviews on Trustpilot and both stores.

The mobile savings and investment platform is intuitive and simple to use, with a clear interface and friendly colours. From the app, clients can move money, change savings settings, invest in funds and open new accounts. The cashback, diagnostics and true balance features are only available on the iOS application.

Payment Methods

Plum customers can deposit up to £20,000 in an ISA each tax year and there is no limit for a GIA or SIPP.

Plum Fintech deposits are made via bank wire transfer and must be between £2 and £5,000 each time. Processing times are usually within four working days, though there is a ‘Faster Deposits’ option that takes only a few hours.

Withdrawals are done via the same method, bank transfers, and take less than a day to be processed from a savings account. Withdrawals from investments take 5-7 working days.

Demo Account

Plum does not support a demo trading account as its services are investments rather than CFDs and intraday trading. That is, clients simply pick a fund to invest in, rather than implementing frequent strategies based on technical analysis.

However, Plum does offer a one-month free trial for its Plus account, though an investment of £1 is required. Moreover, the basic package is completely free and provides access to any saving and budgeting functions, though not investing.

Regulation & Licensing

Plum Fintech is authorised on the Financial Conduct Authority (FCA) register, number (FRN: 836158). The company is regulated by the FCA as a Registered Account Information Service Provider to carry on payment services activities under the Payment Services Regulations 2017.

By law, any complaints that are not resolved within three days will be escalated to Resolution Compliance Limited for further investigation. Plum has a comprehensive Privacy Policy to protect your data.

Saveable Limited, another subsidiary of Plum Group, provides Plum Fintech with its investment and switching services. This company is also authorised and regulated by the Financial Conduct Authority (FRN: 739214).

After you invest in any of Plum Fintech’s funds, your capital will be held by Gaudi Regulated Services Ltd, an FCA regulated custodian. The firm has also been appointed as a distributor of electronic money on behalf of PayrNet Limited, which is authorised by the FCA as an Electronic Money Institution (FRN: 900594).

Additional Features

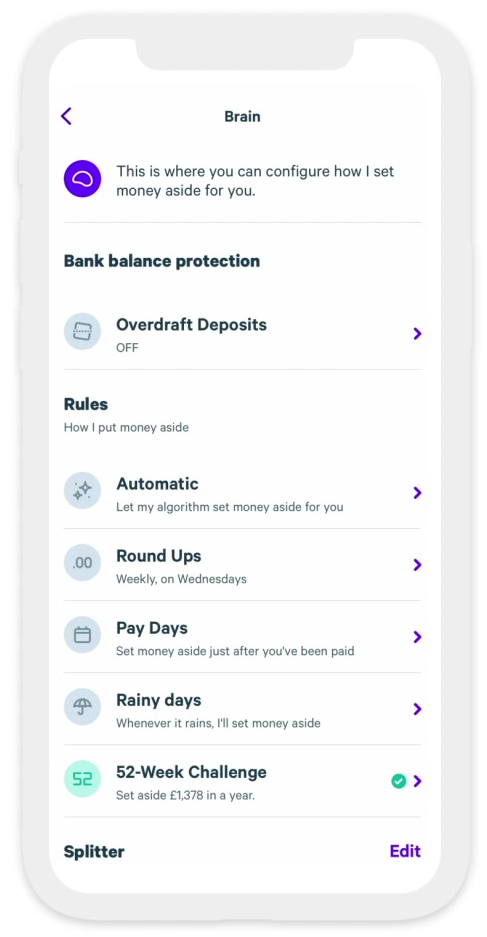

AI-Analysis

Plum Fintech can be linked to your bank account to automatically analyse your daily transactions, income/revenue and spending, calculating the optimum amount to invest. The AI-backed algorithm also runs analyses every few days to identify where best to save money. The tool can automatically put aside money for you, though you can adjust the extent to which it does this.

The Money Maximiser feature on the Ultra account also helps you budget, considering balances, salary, subscriptions, bills and more to calculate your spending money for you.

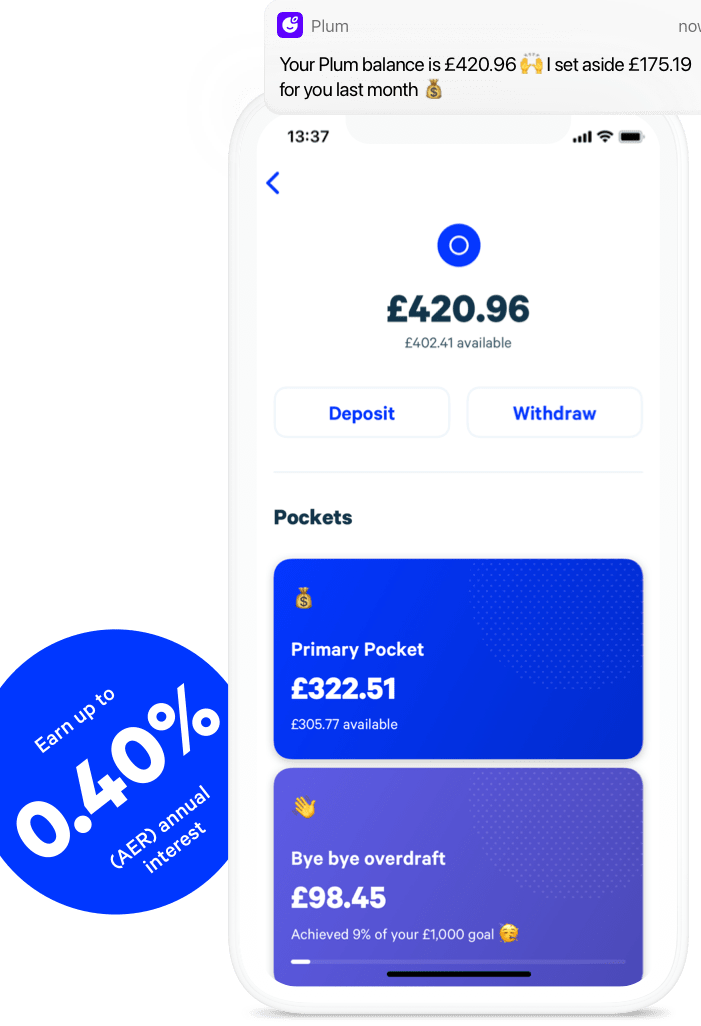

Savings Accounts

Opening savings accounts can earn you some passive interest on any money put aside manually or automatically by the Plum app. Interest rates are 0.4% for Plus, Pro and Ultra members, while Basic account holders can only access 0.25%.

All savings are covered by the financial services compensation scheme (FSCS) and accounts are provided by Investec Bank.

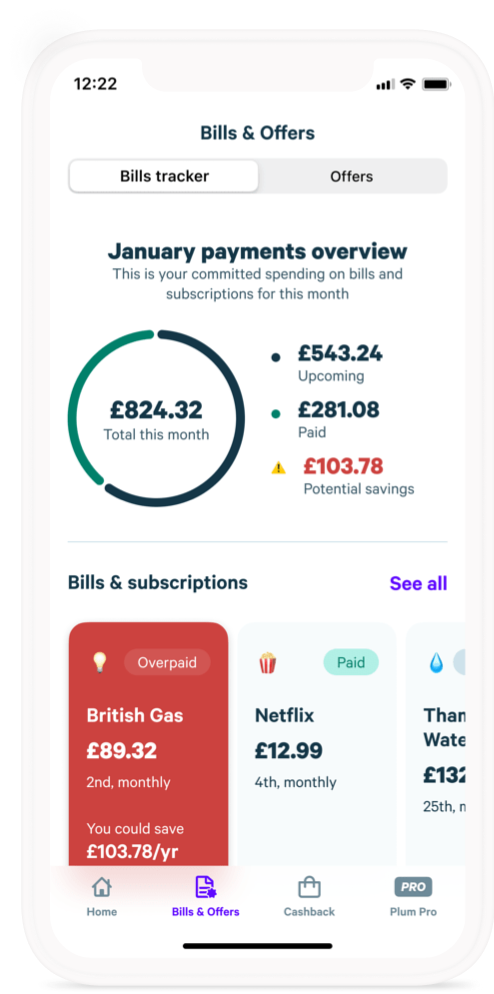

Compare Bills & Switch Suppliers

Plum Fintech can let you know if you are overpaying on major bills like gas, electricity, broadband or insurance. The company scans major providers to see if you could save money by switching suppliers.

Plum also has a dedicated financial products marketplace, stocked with options for loans, credit cards and more.

Account Types

Plum clients have three main savings account options that they can access, a stocks and shares individual savings account (ISA), a general investment account (GIA) and a self-invested personal pension. ISAs allow clients to invest in the specified fund in a tax-free way, with a maximum investment of £20,000 each year. No capital gains tax or income tax is payable on any earnings or dividends from these investments, though there are limitations to the number of ISAs one may open and invest in each year (Plum or not).

The Plum GIA is a slightly different account that still supports investment into the specified funds. These do not fall under the same tax protection as ISAs, so you must pay capital gains tax and income tax on any profits and dividends. However, there are no limits on the amount of capital you can invest in a GIA and withdrawals can be made relatively quickly and easily.

Plum SIPPs are slightly different, designed specifically for pension investment. An SIPP allows you to consolidate any existing policies into one place for simpler management. These accounts come with income tax relief of up to £40,000 each year. Investments can either be made in the funds discussed above or in any of Plum Fintech’s three bespoke, risk-managed portfolios, targeting global growth, future planet and sustainability and specific retirement dates, respectively.

Membership Levels

Plum Basic – Free

- Paydays

- Round-ups

- Automatic savings

- Withdraw as much and as often as you like

- Compare household bills and switch suppliers

- Free easy access interest pocket for 0.25% AER on savings

Plum Plus – £1 Per Month

- 0.4% AER cash savings account

- Everything offered by Plum Basic

- Invest in the funds offered on the investment platform

Plum Pro – £2.99 Per Month

Plum Pro gives access to all features included on Plum Plus and more:

- Split accounts into 16 pockets

- Specify goals for each Plum pocket

- Safe spending calculations for budgeting assistance

- Up to 11% cash back on purchases with partner brands

- Advanced diagnostics with monthly reports that contextualise spending

Plum Ultra – £4.99 Per Month

- Improved cashback rates

- Access to Money Maximiser for improved, automated budgeting

Benefits

- Cashback

- Bill provider analysis

- Several account types

- Automated savings features

- Automated budgeting features

- Financial services marketplace

- Simple fund investment system

Drawbacks

- No demo account

- Simplistic platform

- Limited payment methods

- Limited trading opportunities

Plum Trading Hours

The site is open for trading 24/7. However, when you invest, the company instructs the product provider to buy the fund units during the next trading cycle.

Customer Support

The best way to get in touch with Plum is through the chat function within the app. Response times are reportedly slow but you don’t have to remain on the app to receive a response; as soon as someone has responded you will be notified.

Plum Fintech can also be contacted via email and telephone at the details below. The customer support team is available from 09:00 to 17:00 GMT on weekdays and 10:00 to 16:00 GMT on weekends. The company also has a social media presence on Twitter, LinkedIn, Instagram, Facebook and YouTube.

- Email Address: hello@withplum.com

- Phone Number: +44 (0) 20 3393 1340

Safety & Security

Plum Fintech is part of the FSCS, which means all funds held by the company are insured for up to £85,000. All deposits are held externally as e-money by PayrNet.

The firm also follows know-your-customer (KYC) processes, requiring photo identification of its clients before approval is granted.

The Plum App itself supports biometric security (fingerprint and face ID). Any sensitive data held is stored using symmetric cryptography (AES). The company also uses 256-bit TLS encryption to communicate with its servers. The firm never shares personal data with third parties without given consent.

Plum Verdict

Plum is an innovative savings and investments tool that helps to simplify budgeting and saving for its clients. The app is simple and easy to understand yet comes with lots of functionality and helpful features. The AI-backed tools are great for those who want a simple way to save or need help with budgeting and the range of savings and investment accounts, mutual funds and extra features are great for those looking for long-term growth. The company is also FCA regulated and backed by the FSCS, which should help you rest easy.

FAQs

How Can I Contact Plum?

Plum’s customer service team can be contacted via the email and telephone details provided above. Alternatively, you can use the in-app live chat service to ask any questions and you will be notified of a response, even if you close the application.

Is Plum Fintech Safe?

Plum is regulated by the FCA, a reputable financial watchdog, and implements a range of security features, including biometric login, data encryption and KYC policies. The firm is also part of the FSCS, ensuring client funds for up to £85,000.

Is Plum A Good Online Broker?

Plum is very good at what it does, which is simplified, long-term investing and savings services. If you are looking for intraday trading in a range of assets from forex to crypto to CFD commodities, you may be better off looking for alternatives.

How Much Capital Do I Need To Trade With Plum?

The minimum investment amount is £1, on top of the £1 already needed to access the Plum Plus account, though this does have a one-month free trial. There is a free Basic membership program but clients cannot invest in any funds.

Does Plum Offer Mobile Trading?

Yes, Plum offers mobile trading support on Apple (iOS) and Android (APK) devices through the App Store and Google Play Store, respectively.

Best Alternatives to Plum

Compare Plum with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

Plum Comparison Table

| Plum | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| Rating | 3 | 4.3 | 3.6 |

| Markets | Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | £2 | $0 | $100 |

| Minimum Trade | £1 | $100 | $1 (Binaries), 0.01 Lots (Forex/CFD) |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | – | – | 100% Anniversary Bonus |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | – | 1:50 | 1:200 |

| Payment Methods | 1 | 6 | 10 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by Plum and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Plum | Interactive Brokers | Dukascopy | |

|---|---|---|---|

| CFD | No | Yes | Yes |

| Forex | No | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | No | Yes |

| Gold | No | Yes | Yes |

| Copper | No | No | Yes |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | Yes | Yes | Yes |

| Bonds | No | Yes | Yes |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Plum vs Other Brokers

Compare Plum with any other broker by selecting the other broker below.

The most popular Plum comparisons:

Customer Reviews

4 / 5This average customer rating is based on 1 Plum customer reviews submitted by our visitors.

If you have traded with Plum we would really like to know about your experience - please submit your own review. Thank you.

I’ve been a Plum user for a number of years and seen the platform and features grow. Its a great app for the beginner, or someone looking to get a handle on their finances. I started using it to help track my spending and the automating saving features. About a year ago started using Plum for investing and have steadily built up a fair sized portfolio. Still some features to add, hence only a 4/5, but on the whole a very good and reliable app