PU Prime Review 2025

See the Top 3 Alternatives in your location.

Pros

- Industry-recognized MT4 and MT5 platforms and mobile apps

- Good range of assets with nearly 1000 instruments over six asset classes

- Demo account with virtual funds

Cons

- No tier 1 regulatory oversight

- Standard account spreads are mediocre

- Relatively high $40 minimum withdrawal and handling fee for withdrawals under $100

PU Prime Review

PU Prime is a globally established online broker offering over 800 instruments and copy trading. Our 2025 review will cover its regulation, account types, fees, customer support options, and more. Find out whether to open a live account with PU Prime today.

Who Is PU Prime?

PU Prime, an award-winning CFD broker, is trusted by over 400,000 traders globally, offering nearly 1000 products at industry-leading trading costs.

The company’s commitment to top-notch customer service and values that make trading accessible to all have fueled its rapid growth in just a few short years. With multilingual services and a support team of over 300 employees offering 24-hour support, the broker has been recognized by the industry for its outstanding performance.

PU Prime has won awards such as Fastest Growing Broker, Best Mobile Trading App, and Best Global Online Broker in 2022. More recently, the company was honored with the titles of Best Trading Account for Beginners and Excellent Trading Resources Online Broker LATAM in 2023, in line with its aim to be a beginner-friendly broker.

The broker operates a no dealing desk model resulting in superior pricing, fewer outages, and a great depth of liquidity. PU Prime is authorized and regulated by the Financial Sector Conduct Authority of South Africa (FSCA), and the Seychelles Financial Services Authority (FSA).

In 2025 PU Prime announced they are also now regulated and authorized by ASIC in Australia, another tier 1 global regulator.

Trading Platforms

PU Prime’s main platform is its mobile app, which combines full dealing functionality and charting tools with an easy-to-use interface. PU Prime’s mobile app also allows customers to access account management features, promotions, and trading insights like news and analysis.

PU Prime also offers both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) terminals. Both are globally recognized platforms available for free download to desktop and mobile devices. The broker also hosts the Web Trader terminal, meaning clients can trade directly via all major web browsers without the need for software download.

Features of the platforms include:

PU Prime Mobile App

Compatible with Android and iOS

- Full dealing functionality

- Risk management tools including stop loss/take profit, limit and stop orders

- Charting tools and indicators including RSI, BB, MACD, KDJ and more

- 9 timeframes

- One-tap trading

- Exclusive in-app promotions

- Weekly summary of trading history

- Intuitive interface

- News and analysis

- Account management

Web Trader

Compatible with Windows, MAC, and Linux

- 3 chart types

- 9 timeframes

- One-click trading

- Real-time quotes

- Online support 24/7

- 30 technical indicators

- Reliable data protection

- Advanced market depth

- Supports all trading operation types

- Netting and hedging accounting systems

- 24 graphical objects for technical analysis

MetaTrader 4

- 3 chart types

- 9 timeframes

- One-click trading

- Live price streaming

- 4 pending order types

- 24 analytical charting tools

- Instant access and execution

- MQL4 programming language

- Access to expert advisors (EAs)

- User-friendly, multilingual interface

- 50+ preinstalled technical indicators

MetaTrader 5

- 8 order types

- 21 timeframes

- One-click trading

- Real-time market news

- Sophisticated trading bots

- 80+ built-in technical indicators

- Sentiment and economic calendar

- Set stop loss and take profit levels

- Customizable charts, view up to 100 simultaneously

- 4 pending order types including pending, stop, and trailing stops

Products

PU Prime offers close to 1000 assets to trade across global markets:

- Commodities – Speculate on energies, agriculture, and precious metals like gold

- Indices – Trade global indices, including the Dow Jones, Nasdaq, and S&P 500

- Forex – 40+ currency pairs, majors, and minors, including EUR/USD and USD/JPY

- Shares – Hundreds of share CFDs of the world’s top companies, including Amazon, VISA, Tesla, and IBM

- ETFs – Diversify your trading with exchange-traded funds

- Bonds – Trade sovereign bonds including US Treasury notes and UK Gilts

Fees

Fees are variable between account types. The Prime and ECN solutions offers the tightest spreads, with quotes directly from major liquidity providers. During particularly liquid times, spreads can be as low as 0 pips. Major forex pairs including EUR/GBP and USD/CAD were offered at 1.9 pips on the Standard account and 0.4 pips on the Prime account respectively.

Gold was offered at around 1.5 pips on the Prime account. A full list of spreads by instrument can be found on the broker’s website or within the trading platform interface.

There is no commission applicable on any trades executed under the Pacific Union Standard account. A $7 commission per side applies across the majority of trading instruments under the Prime account. For the ECN account, a $1 commission per side applies; however, the ECN account has a minimum deposit of $10,000.

It is good to see the broker does not charge an inactivity fee, account opening fees, or deposit fees. However swap rates for positions held overnight apply.

Leverage

PU Prime’s available leverage varies by initial investment and trade size. The maximum leverage available on most account types is 1:500.

The Pro account goes up to 1:1000. This is extremely high, so we would recommend implementing risk management strategies if using this rate. The higher the leverage used, the larger the trade size an investor can control.

A breakdown of leverage availability is below.

- 100% margin required – 1:1 leverage available

- 10% margin required – 1:10 leverage available

- 2% margin required – 1:50 leverage available

- 1% margin required – 1:100 leverage available

- 0.2% margin required – 1:500 leverage available

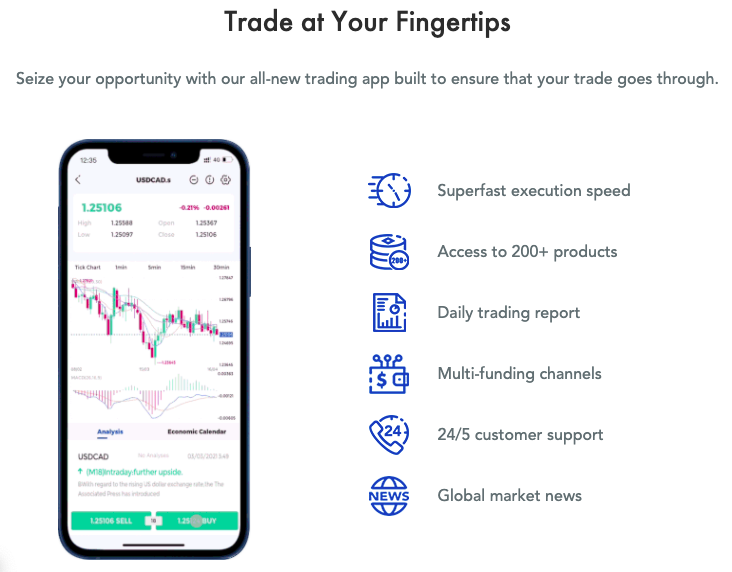

Mobile App

PU Prime offers a proprietary mobile application, available for free download to iOS and Android devices. The simple, user-friendly design and advanced functionality allow investors to access full trading features while on the go.

Fast execution speeds, global market news, multi-account management, 24/7 customer support, and trading reports are all available.

MetaTrader 4 and MetaTrader 5 are also both available as mobile apps. Access the full trading features of the desktop platform, analytical tools, and customizable charts and graphs wherever you are.

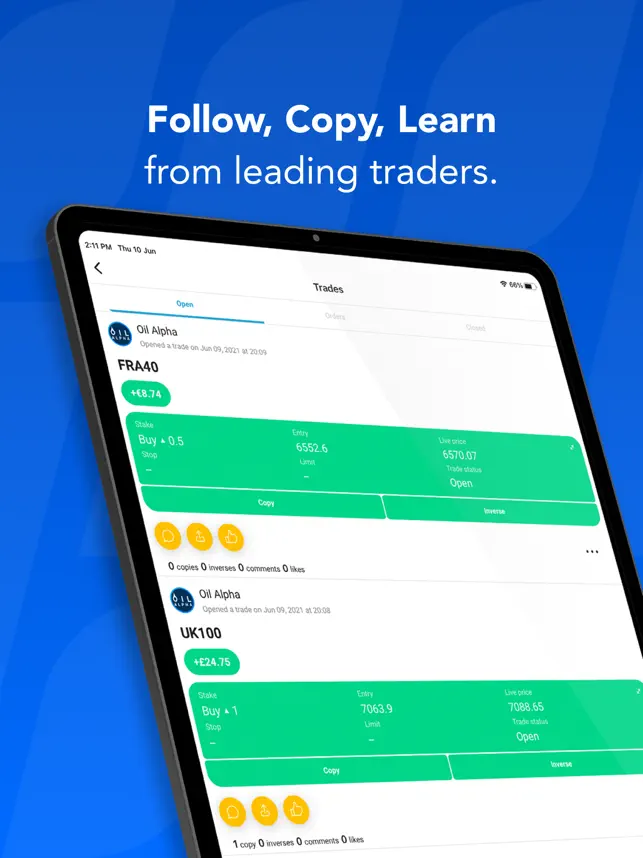

PU Social

PU Prime released a proprietary social trading application in 2022. Available from the App Store and Google Play, clients can follow the positions and strategies of the broker’s top traders. This is a particularly enticing proposition for newer traders looking to learn about different assets and investment techniques.

PU offers a string of insights to help beginners find the right Master Trader for their needs, including details of monthly returns and markets traded. In addition, traders maintain flexible control over trading parameters, including position sizes and amending live orders.

For seasoned traders, the PU Social application could provide a second revenue stream. Master Traders can choose to charge a subscription or a commission on profitable trades. Investors simply need to hold a live account and download the broker’s copy trading application from the relevant app store to get started.

PU Prime Payments

Deposits

Prime provides traders with flexible deposit options and multiple base currencies. The broker does not charge a fee for any account funding methods, however third-party charges may apply. The good news is PU Prime offers up to a $20 rebate for any charges that third parties like banks might impose.

A $50 minimum deposit applies, with varying maximum limits. Top deposit methods include:

- UnionPay – CNY only, 50,000 CNY maximum limit, processing within 30 minutes

- Fasapay – USD/IND only, $75,000 transaction per day, instant processing

- Cryptocurrencies – BTC/USDT only, no maximum limit, instant processing

- Local payments – Varying currencies and maximum limits, processing within 1 hour

- Bank Wire Transfer – All currencies, no maximum limit, 2-5 business day processing time

- Credit/Debit Cards – Includes VISA and MasterCard, all currencies, instant processing

- Electronic Payments – Includes Skrill/Neteller/Bitwallet/Sticpay/Astropay/Fasapay, all currencies, instant processing

Withdrawals

With PU Prime, the majority of withdrawal methods are free, however some do incur a small charge. This is an external fee charged by the payment service provider rather than being set by the broker. For example, Neteller charges a 2% transaction fee for all withdrawals. Skrill withdrawals will incur a 1% charge.

The minimum withdrawal amount across all methods is $40, however, these limits do vary by type. Withdrawals of less than $100 will be subject to a handling fee of $20 or equivalent currency. Bank wire transfers are subject to the longest processing time for funds to be withdrawn at two to five business days.

Credit/debit cards and electronic payment time may vary depending on the processing time of the card issuer/receiving bank.

Demo Trading

A free demo account is available via Pacific Union’s website in 10+ base currencies. These accounts are a good way to practice execution, navigate platform features, and test strategies risk-free.

PU Prime traders can access up to $100,000 of virtual funds and experience real-time trading conditions and prices on the MT4 or MT5 trading terminals. Leverage up to 1:500 can also be selected when opening a paper trading account. Sign up is required to open an account via a simple online registration form.

Note, these accounts expire automatically after 60 days.

Deals & Promotions

Deals & Promotions

At the time of writing, PU Prime was promoting several financial incentives. This included a $50 no deposit bonus and a 50% Credit Bonus up to $10,000 (50% on the first $1000 and 20% thereafter). As the broker is not regulated by a European Union authority, there are no limitations on promotions.

A refer a friend scheme is also accessible, where traders can earn up to $150 for each friend that opens a live account and meets the eligibility criteria.

However, always review bonus terms and conditions before opening an account as there may be restrictions on withdrawals.

Regulation

PU Prime (Previously Pacific Union) operates under full regulation from the Seychelles FSA, as well as the FSCA and SVGFSA.

Full ASIC regulation was also announced in 2025, giving traders the confidence of using a brand regulated by multiple tier 1 financial bodies.

Similar to the key benefits provided by top-tier authorities like the FCA, PU offers negative balance protection and segregated client funds.

In the extremely rare case of business insolvency, your capital will be safeguarded. In addition, the broker uses leading financial institutions to provide customers with the highest interbank liquidity and employs stringent corporate governance compliance audits.

PUPrime Regulators;

- FSA (Financial Services Authority of Seychelles)

- FSCA (Financial Sector Conduct Authority)

- SVGFSA (Financial Services Authority St Vincent & The Grenadines)

- ASIC (Australian Securities and Investments Commission)

Additional Features

Our review was pleased to see PU prime offering various analysis tools and educational content. This includes daily news posts, market reports, and technical analysis of instruments. Plus, market research is available in daily video posts.

The education is varied, topics are suited towards beginners, but there are also advanced articles for the more experienced. Themes include trading psychology, mitigating risk, an introduction to markets, and understanding indicators. Supporting video content is also posted with visual tutorials of key topics.

It is also good to see online webinars led by industry experts can be accessed, and a wide array of useful tools, including an economic calendar, currency converter, and keyword glossary.

Live Accounts

PU Prime’s Available Account Types

Currently, PU Prime offers 5 account types: like most brokers, they offer a Standard account with only a $50 minimum deposit that’s ideal for all trader types; a Prime account with low spreads and a $1000 minimum deposit and that’s for experienced traders; and a Cent account with a $20 minimum deposit that is perfect for testing strategies and new traders.

In addition, PU Prime also has several special account types: a Pro account where users can trade with up 1000 times leverage (max leverage for the other account types is 500 times) on certain products including FX, gold, and crude oil.

Finally, for the most experienced traders with high trading volumes, they have the PU Prime ECN account, where traders can access raw spreads directly from the interbank market. Spreads for the ECN account can hit 0.0 pips in times of high liquidity, and opening positions only costs $1 per side, per lot. However, PU Prime’s ECN account will require a minimum $10,000 deposit to get started.

For Muslim traders, PU Prime offers the option to open an Islamic variation on their Standard, Prime, and Cent accounts. Islamic accounts are structured to be compliant with Sharia law, and do not charge nor accrue overnight interest on positions. Instead Islamic Accounts are charged an administrative fee for overnight positions determined by the broker’s liquidity providers.

The minimum deposits for opening each PU Prime account type are as follows:

- Standard Account: $50

- Prime Account: $1000

- Cent Account: $20

- Pro Account: $50

- ECN Account: $10,000

It is quick and easy to open a live account with PU Prime. Customers must complete an online registration form and are required to provide identification verification documents, such as proof of residency under Know Your Customer (KYC) compliance.

PU also offers an Islamic trading account. This swap-free version can be upgraded from a live account pending approval from the brokerage. Administration fees apply for open position account management.

Trading Hours

The brokerage follows 24-hour trading times Monday-Friday, however, these vary by instrument. Note that server times and charts operate GMT +2 or GMT +3 according to MT4 times. Full timings by instrument can be found on the broker’s website plus upcoming market holiday dates.

Customer Support

PU prime offers the following customer support 24/7:

- Live chat

- Online contact form

- Global address finder

- Email – info@puprime.com

- Telephone – +248 4671 948

Security

The trading area and portal access are password protected. All personal data between client terminals and the platform services are encrypted via an SSL certificate. The MT4 and MT5 trading terminals offer secure login features, industry-standard data privacy, and dual-factor authentication.

PU Prime Verdict

PU Prime offers a strong trading environment on a direct-to-market execution model. Flexible leverage is available, with low fees making it customizable to suit any trading strategy. We enjoyed the offer of established trading platforms, various customer service options, a demo account, and low minimum deposit options.

Although the chosen regulatory authority isn’t as well regarded in the financial industry, the negative balance protection and segregated client funds should provide some reassurance to clients.

FAQs

Is PU Prime Regulated?

Yes, PU Prime (previously Pacific Union) is authorized and regulated by the Seychelles Financial Services Authority. In 2025, PU Prime also became authorized by ASIC in Australia and the firm does provide negative balance protection and segregated client funds.

What Trading Platforms Does PU Prime Offer?

PU Prime offers the industry-established MetaTrader 4 and MetaTrader 5 terminals. Both provide advanced trading features, including technical indicators, customizable interfaces, plus sophisticated graphs and charts. A mobile app is also available.

What Are The Minimum Deposit Requirements To Open A PU Prime Account?

The minimum deposit requirement to open a live trading account with PU Prime is $50 or equivalent currency. Note that minimum deposits may vary by account funding method and are subject to changes from the owner and management team.

What Customer Service Options Do PU Prime Offer?

PU Prime offers multilingual customer support available 24/7. This includes a live chatbot, telephone on +248 4671 948, and email at info@puprime.com.

What Account Types Does PU Prime Offer?

PU Prime offers several live account types with direct-to-market execution. This includes Standard, suitable for a new investor, and Prime with advanced trading features plus a higher minimum deposit requirement. The broker also offers an ECN account, Cent account, Pro account (leverage up to 1:1000), and an Islamic trading account.

Best Alternatives to PU Prime

Compare PU Prime with the best similar brokers that accept traders from your location.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

PU Prime Comparison Table

| PU Prime | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| Rating | 4.2 | 3.6 | 4.3 |

| Markets | Forex, Commodities, Cryptocurrencies, Stocks, Indices | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $50 | $100 | $0 |

| Minimum Trade | 0.01 Lots | $1 (Binaries), 0.01 Lots (Forex/CFD) | $100 |

| Regulators | ASIC (Australian Securities and Investments Commission), FSA (Financial Services Authority of Seychelles), FSCA (Financial Sector Conduct Authority), SVGFSA (Financial Services Authority St Vincent & The Grenadines) | FINMA, JFSA, FCMC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | $50 No Deposit Bonus | 100% Anniversary Bonus | – |

| Platforms | MT4, MT5 | JForex, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:500 | 1:200 | 1:50 |

| Payment Methods | 10 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | Dukascopy Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by PU Prime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| PU Prime | Dukascopy | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | Yes | Yes | No |

| Silver | Yes | Yes | No |

| Corn | Yes | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | No | Yes |

| Options | No | No | Yes |

| ETFs | Yes | Yes | Yes |

| Bonds | Yes | Yes | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | Yes | Yes | No |

PU Prime vs Other Brokers

Compare PU Prime with any other broker by selecting the other broker below.

The most popular PU Prime comparisons:

Customer Reviews

5 / 5This average customer rating is based on 4 PU Prime customer reviews submitted by our visitors.

If you have traded with PU Prime we would really like to know about your experience - please submit your own review. Thank you.

PU Prime is the best copy trading app I’ve messed around with to date (even better than eToro which I know everyone likes to tout as the top dog). It takes seconds to download and you’ve got thousands of signal providers which you can easily filter. I also appreciate how easy it is to STOP copying traders in one click. Obviously I use the list of ‘highest annual returns’ but there’s a ‘low risk & stable return’ board too. If you want a user friendly app that doesn’t overcomplicate what should be a sraightforward process to copy more experienced traders, then PU Prime is worth a punt based on my experience.

The proactive support from my account manager has been key in helping me grow my profits. PU Prime personalized approach is absolutely worth it.

I’ve tried many brokers, but what sets PU Prime apart is their 24/7 support. The team is reliable and genuinely cares about providing assistance. I’m really impressed with their service!

I’ve been trading gold with PU Prime for over a year now, and honestly, PU Prime has been great here in Canada. With so few brokers offering high leverage, PU Prime really stands out.

Overall, the leverage is solid, and the withdrawal process is smooth. The only area I think could use some improvement is the customer service—it could be a bit more responsive, eh?