Orange Juice Brokers 2026

Orange juice trading has grown significantly across the planet since the first orange juice futures contracts were traded in the 1960s. Today, the refreshing drink is also an attractive commodity due to its short-term volatility and long-term trends, and thousands of retail and institutional investors trade orange juice every day using a range of financial products including futures, options and CFDs.

This guide will cover the basics of trading orange juice, why day traders should consider this soft commodity, how they can get involved, the major influences on its price economics and more. Use our list of the best orange juice brokers in 2026 to get started.

Top Orange Juice Brokers

These are the 4 best brokers for trading Orange Juice:

Orange Juice Trading Basics

Orange juice is a popular commodity across the globe, with trading volumes continuing to increase – orange juice futures have climbed drastically in price over the last few years, reaching levels significantly above 200 USD/Lbs in 2023.

Orange juice is one of a list of soft commodities, such as cocoa, wheat, and coffee, that regularly take a place in investment and trading portfolios. They are commonly traded with financial derivatives, notably futures and forward contracts, as well as options and CFDs.

Essentially, this means that traders can speculate on the price of orange juice without taking ownership or possession of the commodity.

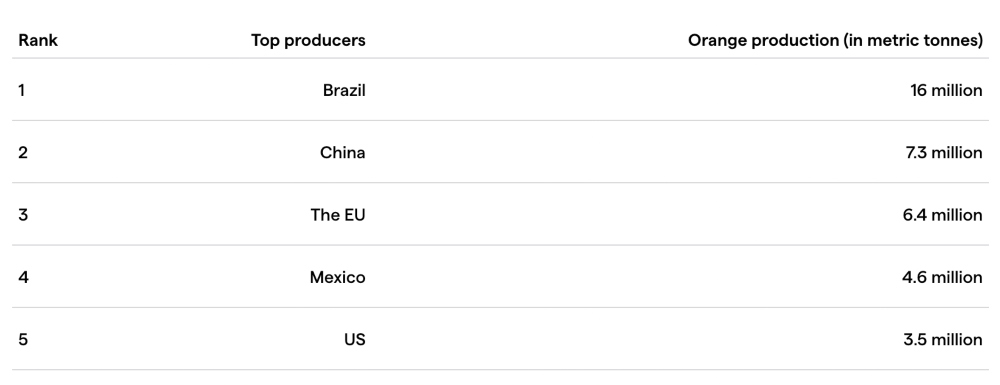

While orange juice is consumed the world over, the major consumers are the USA, Germany, Canada, France and Australia. Key producing locations include Brazil, the USA, the European Union, China, and Mexico. Of these, 85% of the world market is split between Florida and Sao Paulo.

History

People have been making juices from oranges in various places throughout history, but large-scale production only became practical over the last century. Freezable orange juice from concentrate was first developed in the 1940s by Cedric Donald Atkins. This, coupled with the rise of household refrigeration, led to a massive spike in the popularity of frozen concentrated orange juice (FCOJ).

Widespread speculative orange juice trading began in the 1960s, when the first futures contracts for orange juice were established on the New York Coffee and Sugar Exchange. Since then, trading orange juice has become an integral part of the agricultural commodity markets.

Orange juice futures contracts are used today by traders, investors, and agricultural companies to profit through speculative trading or to hedge their orange juice exposure.

Reasons To Trade Orange Juice

There are many social and economic factors that can be used to predict the price action of orange juice, making it a prime trading commodity.

Common factors include betting on emerging market demand, war, global warming, and natural disasters.

Live Price Chart

What Influences The Price Of Orange Juice?

Those looking to trade orange juice need to understand both the supply-side and demand-side factors that affect orange juice consumption. Here, we will look at some of the most influential factors.

Weather

Orange juice is predominantly produced in Brazil and the USA. Orange trees need to be kept in very specific climates to maximize their yield, and both countries have excellent conditions for this type of agriculture.

As such, traders can gain an edge by carefully following the weather forecasts in these regions. Extreme weather could seriously impact the production of oranges, thus reducing the supply of orange juice and causing price inflation. Alternatively, perfect weather could lead to increased orange yields, increasing supply and lowering the price.

Global Warming

Global warming’s effects on the climate of orange-growing areas could have a heavy impact on the production of orange juice over decades. Hedging against the effects of global warming could be a viable long-term investment strategy for those interested in trading orange juice.

Market Demand

Recent demand for orange juice has been declining in the West, particularly in the USA and Germany. This could be down to several cultural factors, such as the declining emphasis on breakfast meals or health trends moving away from high-sugar products.

However, many emerging markets, including Brazil and China, are seeing a rise in demand for orange juice. This could be because higher disposable incomes allow for increased food and drink consumption or cultural influence from developed countries.

Investors will have to decide which they think is the more prominent effect to predict how orange juice prices will move over the long term.

Brazilian Real Value

Brazil is the largest producer of orange juice in the world. As such, fluctuation in the Brazilian Real (BRL) can have an impact on the price of orange juice.

For example, if the currency weakens, countries with strong currencies will be able to take advantage of their increased purchasing power and import larger quantities of the juice drink. This will impact your orange juice trading strategy.

Food Safety & Health

The more developed countries of the world have seen an increase in the importance of health. This has led to a greater focus on ensuring dangerous chemicals are not used in food and drink production.

Orange growers that have used certain pesticides and chemicals have received bans from being able to export to certain countries, thus reducing supply and increasing the price of orange juice.

Diseases

There have been several notable occasions when a rise in orange tree diseases heavily affected the supply of orange juice, pushing the price up. The severity of the disease and whether a cure can be quickly found and applied will determine the disease’s effect on the price.

War & Geopolitics

Wars or other geopolitical issues can lead to embargos, reduced agricultural capacity, reduced consumption, and other factors affecting both demand and/or supply of orange juice. Again, this can all impact an orange juice trading strategy.

Paying attention to the geopolitical climate, particularly between heavy producers and consumers of orange juice, can have a large impact on predicting the price of orange juice.

How To Trade Orange Juice

There are several financial instruments that can be used to trade orange juice. These include futures, options, CFDs, ETFs and stocks.

CFDs

Contracts for difference (CFDs) are derivative instruments that allow traders to speculate on the price of FCOJ. This enables traders to trade orange juice without having to purchase the commodity – you are simply speculating on the price.

One feature of CFDs that is popular among day traders is the ability to make leveraged trades on orange price movements. This allows traders to greatly increase their trading positions using borrowed funds, meaning they can make larger profits from even small price movements. However, leverage also multiplies losses, making strict risk management a necessity.

ETFs

Exchange-Traded-Funds (ETFs) are baskets of commodities that are tradable just like shares on exchanges. ETFs compile the prices of multiple commodities, meaning that the overall price of the ETF is affected by all those assets.

There are no ETFs that specifically focus on orange juice, but investors in agriculture-focussed funds may have some exposure to the market. As such, since most ETFs are not dominated by orange juice, the value cannot be predicted purely by orange juice price predictions.

Futures

Futures contracts are derivative instruments in which traders enter into an agreement to buy or sell a fixed amount of orange juice on a set date at a pre-determined price. Investors do not need to pay upfront or own any of the underlying asset to be able to open a futures contract.

FCOJ-A futures contracts can be traded on the ICE (Intercontinental) exchange. The settlement of one contract equals 15,000 lbs of orange juice solids (delivered in drums or tanks). The contract series is through January, March, May, July, September and November.

Options

Options for orange juice have the FCOJ-A futures contracts as the underlying asset. Successful options contracts give the buyer of the option the right to enter into a buy (long) or sell (short) FCOJ-A futures contract.

The main advantage of trading options is that if the price moves against you, your losses are limited to the premium paid for the options contract, protecting you from large, unexpected price swings. Of course, traders pay a fee for this privilege.

Shares

You could also trade the shares of orange juice-producing companies to capitalize on predicted prices. However, this is quite difficult as most orange groves are privately owned.

Orange Juice Trading Strategies

Much like other financial assets, you can employ several different trading strategies depending on the time frame, the familiarity you have with the commodity and your risk appetite. Orange juice is not only volatile in the short term but can hold trends in the long term, giving traders more freedom in how they want to trade the commodity.

Fundamental Trading

News and forecasts can have a huge impact on the price action of orange juice. Keeping yourself up to date on related news stories and articles, as well as knowing when key forecasts and prediction reports are due to be released, will help you predict the price action of orange juice before the market has time to fully react.

An example of something worth looking out for is extreme weather forecasts. Florida is prone to adverse weather conditions, like hurricanes or sudden cold snaps, that can affect the orange juice supply.

Support & Resistance

By analyzing price charts, traders can identify support and resistance levels in an asset’s price action. Using these levels, you can predict when price trends will stop and reverse.

Typically, if the price approaches a resistance level, you should sell. If the price approaches a support level, you should buy.

Breakout Strategy

Breakout strategies use support and resistance levels to help determine when the price action will reverse. Traders will look for levels that the commodity is unable to move beyond. The trader will then wait for the level to be broken through, placing a trade expecting the price to now continue beyond the breakthrough. You are essentially trying to predict the start of a new trend and open a position accordingly.

Orange juice traders will typically try making a prediction about global supply for the next year using this strategy.

How To Start Orange Juice Trading

Choose A Financial Product

First, you need to choose which financial instrument you want to trade. The most common in the orange juice market are futures, options, or CFDs.

- CFDs allow traders to open considerable trading positions with a smaller amount of capital, and you don’t need to physically own the underlying commodity.

- Futures allow you to directly trade the underlying asset. Traders should take care as some exchanges require the buyer to take physical possession of the orange juice stock at the end of the contract. Many traders prefer to choose cash-settled futures for this reason.

- Options give you more choices when it comes to the exercise date, allowing you to settle in the future, trade it or carry it over. Options are also useful for limiting traders’ risk as a trade that does not pay out cannot cost more than the contract premium.

Choose A Broker

One of the most important factors in successfully trading orange juice is choosing the right broker. Luckily, there are multiple brokerages online that allow investors to trade orange juice assets. For example, IG offers the trading of CFDs and spread bets with orange juice as the underlying asset. Other top-rated brokers providing access to orange juice markets include CMC Markets and VT Markets.

Most traders prefer brokers that:

- Support powerful third-party or proprietary trading platforms, such as MetaTrader 4

- Are licensed and overseen by a reputable regulator such as the CySEC or FCA

- Support a good range of deposit methods including e-wallets and bank cards

- Have a fair pricing structure with tight spreads and low to zero commissions

- Execute trades quickly with no re-quotes or slippage

- Support a mobile trading app

Finding an orange juice trading broker that ticks most of these boxes will ensure you have the best investing experience.

Open A Trading Account

Once you have chosen a suitable broker, you will need to open an account. Different orange juice brokers require different things when opening a live profile. Many require ID verification through government-issued documentation. Some will allow you to begin trading right away.

We recommend opening demo accounts (if available) first to get yourself accustomed to the trading platform and the broker’s fee structure before risking capital.

Build A Risk Management & Trading Strategy

Having an effective and consistent strategy is one of the most important factors in becoming a successful trader, especially when dealing with volatile assets like orange juice.

Make sure you calculate the risks, know how much you can afford to lose, and stick to your plan to ensure you trade without letting emotions interfere. Also employ stop losses and alerts to limit your losses.

Open A Position

Follow your orange juice trading strategy and open a position based on your analysis.

Monitor your position using the trading charts or graphs provided and be sure to keep up to date with news that could influence the price.

Close Your Position

While some assets automatically exercise at the exercise time (such as options), others will need to be manually closed (like CFDs).

Follow your plan and close the position in accordance with it.

Pros Of Trading Orange Juice

- High volatility, meaning high profit potential

- Range of tradable instruments, including CFDs, ETFs, futures and options

- Portfolio diversification and low associations with other financial assets

- Leverage trading available in CFDs, among other instruments

Cons Of Trading Orange Juice

- The complexity of commodities, lots of different terms and variations of contracts can be daunting for new traders

- Unpredictable factors, the effects of weather can have major impacts on the price and are arguably less predictable

Trading Hours

Many commodities can be traded 24/5, with the markets closed only on Saturday and Sunday. This is also the case for most soft commodities, including orange juice.

The Intercontinental Exchange does have specified times for its FCOJ-A futures and options contracts. Trading hours are 13:00 – 19:00 UTC.

Final Word On Orange Juice Trading

The short-term volatility and long-term trends present in the orange juice commodity offer traders the opportunity to make large profits. As a popular commodity, orange juice is regularly traded using a range of financial products, from short-term options and CFDs to long-term futures contracts. The increase in the orange juice commodity price over the last 3 years demonstrates that more than just a fruit drink, orange juice is an interesting opportunity for investors with the right skills and knowledge.

Head to our ranking of the top orange juice brokers to start day trading.

FAQs

Why Is The Orange Juice Commodity Price So Volatile?

Orange juice prices are incredibly sensitive because of how easily demand and supply for the commodity change. Bad weather, changing health trends and trade embargos all affect the price of orange juice, making it a volatile asset to trade.

How Can I Trade Orange Juice?

There are several financial instruments that can be traded to profit from orange juice price action predictions. The most traded are the FCOJ-A futures contracts, options on these futures, and CFDs.

What Are The Best Brokers For Orange Juice Trading?

The best orange juice broker differs from trader to trader. Some investors like to trade based on their technical analysis and so will look for brokers with trading platforms that allow for detailed analysis. Others trade based on fundamentals, and so will be looking for brokers that provide stronger news data streams. Finding the broker best suited to your needs will require research. Alternatively, use our list of the best orange juice trading brokers.

What Affects The Orange Juice Commodity Price?

There are many factors that affect the price of orange juice. Some important factors to consider are the weather conditions in regions where oranges are predominantly grown, geopolitical tension between orange juice-producing and consuming countries, health trends, and emerging market demands. See our full guide to trading orange juice for more details.

What Are The Orange Juice Futures Trading Hours?

Orange juice futures (FCOJ-A) are traded on the Intercontinental Exchange (ICE). The listed trading hours for FCOJ-A are 13:00 – 19:00 UTC with pre-open at 01:00 UTC. See our full guide for other places that trade orange juice.