My Top Picks For Natural Gas Stocks And Funds

Written By

Dan Buckley

Written By

Dan Buckley

Updated

Jun 25, 2025

Below are my top picks for natural gas and stock funds.

Direct Exposure – Producers

- EQT Corp (EQT) – The largest natural gas producer in the Appalachian Basin, with significant Marcellus-field reserves.

- Cheniere Energy (LNG) – US’s largest LNG exporter, with expanding export capacity (Corpus Christi Stage 3 now underway).

Infrastructure/Midstream

- Kinder Morgan (KMI) – Operates the largest US nat gas pipeline network, transporting ~40% of domestic gas.

- Enbridge (ENB) – Owns 24,000 mi/38,000 km of gas pipelines across North America and is a stable toll-based utility play.

Funds & ETFs

- United States Natural Gas Fund (UNG) – A popular vehicle for direct exposure to natural gas futures.

Latest Trends in the Natural Gas Market

- Geopolitical volatility – Middle East tensions around the Strait of Hormuz are pushing LNG spot prices higher, Asia LNG spot index at ~$14/mmBtu, with European prices up ~20% in a week.

- Strong US production – EIA signals record-high US output in 2025 (~105 Bcf/d), with rising LNG export capacity. Pipeline bottlenecks remain an issue.

- Tight formidables – Global demand back to structural growth since 2024 (2.7% increase in 2024), but inventories are low and Europe is competing for LNG cargoes.

- Thermal coal substitution – Some countries shifting toward coal due to elevated LNG prices (~$14 vs ~$12 for coal).

- US storage dynamics – Henry Hub July futures at $3.71. EIA lowered average 2025 price forecast to $4.02/mmBtu.

2025 Outlook for Natural Gas

Upside Triggers

- Geopolitics – Any disruption in the Strait of Hormuz could spike prices

- Export bottlenecks – US prices may rise if LNG export capacity scales slower than demand.

Downside Risks

- Mild weather reduces demand and cools spot prices.

- Coal rebound – Cheaper coal options may dampen future gas demand in Asia and Europe.

- Subdued global demand – China’s LNG demand could decelerate due to softer economic growth.

Investor Takeaway

Expect a volatile trading range (it’s traditionally ~3x as volatile as US stocks).

Structural tailwinds remain from LNG demand and US-export buildout, but expect 2025 average prices to hover in the $3.50–$5 range, higher if geopolitics are a bigger factor.

Investment Strategy by Profile

- Value-oriented producer investors – Consider EQT and LGN for leverage to higher nat gas prices.

- Yield/midstream investors – Kinder Morgan and Enbridge provide stable distributions with less price sensitivity.

- Speculative traders – UNG can be used tactically, but beware of roll yield and futures curve risks.

- Diversified exposure – Explore low-cost nat gas ETFs.

Price Forecast

EIA: ~$4.02/mmBtu average in 2025, with current spot in the high-$3’s.

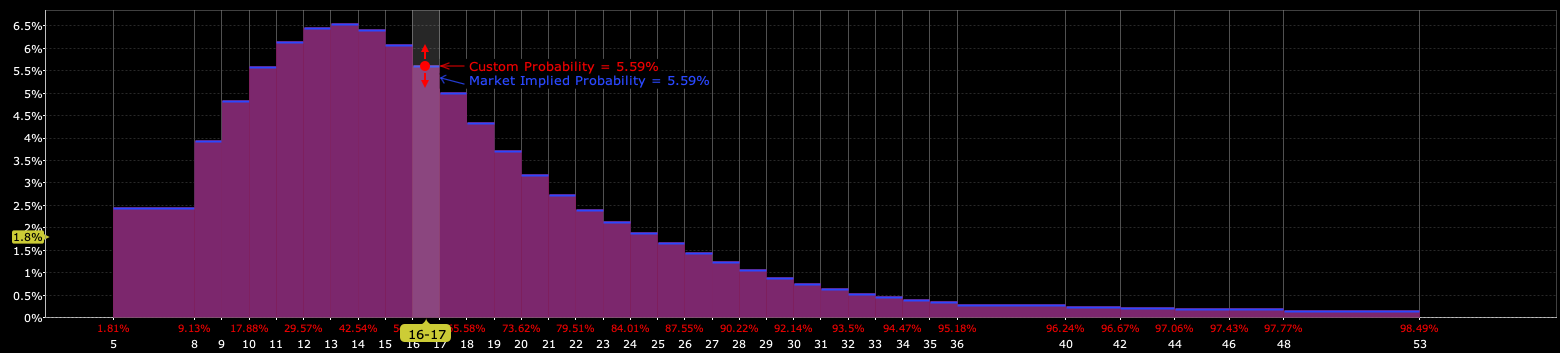

When thinking about nat gas prices in terms of a probability distribution, typically there’s a skew where there’s a long upper tail to the price range, but the most common outcomes in the distribution sit below the market price. For example, the attached image is a price distribution on UNG using the January 2026 options.