Operating Leverage

What Is Operating Leverage?

Operating leverage is a financial ratio that measures the percentage of fixed costs in relation to variable and overall total costs.

It is commonly used to calculate the break-even point, and is a key metric in determining a company’s profitability.

The operating leverage ratio can be expressed as:

Operating Leverage = (Total Fixed Costs / Total Costs)

In a low operating leverage scenario, this means that a large proportion of the company’s sales come in the form of variable costs, so it only incurs these costs when a sale occurs.

In this case, the company will earn a smaller profit on each incremental sale it makes, but it also means it doesn’t have to generate much sales volume in order to cover its lower fixed cost base.

A company’s level of operating leverage can be affected by many factors, including its business model, industry, and stage of growth.

For example, companies that have high upfront investment costs, such as in R&D or in manufacturing, will typically have higher operating leverage than companies with lower upfront costs.

Startups and early-stage companies also tend to have higher operating leverage than more established companies. This is because they often have high fixed costs but low revenue, as they are still in the process of ramping up their operations.

Operating leverage can be a double-edged sword. On the one hand, it can lead to higher profits when sales increase.

However, it can also magnify losses when sales decline. This is why it is important for investors to understand a company’s operating leverage before investing.

Examples of Operating Leverage

Software companies tend to have high operating leverage.

This is because their costs are heavily in development and marketing. There are not high variable costs tied to each sale like there is in manufacturing.

If a software company makes a high number of sales, then it can be very profitable. This tends to be true with many digital businesses, in general.

Another example of operating leverage is in retail. Stores have high fixed costs, such as rent and staff salaries.

However, their variable costs are low because they only need to buy inventory when it is sold. This means that a small increase in sales can lead to a large increase in profits.

The downside of this is that a small decrease in sales can also lead to a large decrease in profits. This is why many retailers go out of business during economic downturns.

Operating Leverage and Profits

Operating leverage is a key driver of profits. The higher the ratio, the greater the potential for profits.

However, it is important to remember that operating leverage also increases risk. This is because a small decrease in sales can have a disproportionately large effect on profits.

Thus, investors need to carefully consider a company’s operating leverage before investing. They should also monitor a company’s sales closely to ensure that they are meeting expectations.

Operating Leverage and the Break-Even Point

The break-even point is the level of sales at which a company neither makes a profit nor a loss.

It is calculated by dividing fixed costs by the contribution margin (sales minus variable costs).

Operating Leverage Formula

The operating leverage formula is:

Operating Leverage = (Total Fixed Costs / Total Costs)

To calculate the break-even point, we need to know two things: fixed costs and variable costs.

Fixed costs are those costs that do not change with sales volume, such as rent and insurance.

Variable costs are those costs that do tend to change with sales volume, such as raw materials and labor (e.g., commissions, bonuses, how much help is needed).

The contribution margin is the difference between sales and variable costs.

It represents the portion of each sale that is available to cover fixed costs and contribute to profits.

Thus, the break-even point can be calculated as:

Break-Even Point = Fixed Costs / Contribution Margin

For example, let’s say a company has fixed costs of $100,000 and a contribution margin of 20%.

This means that for every $1 of sales, the company has $0.20 available to cover fixed costs and contribute to profits.

To calculate the break-even point, we simply divide the fixed costs by the contribution margin:

Break-Even Point = $100,000 / 20% = $500,000

This means that the company must generate $500,000 in sales in order to break even.

Any sales above this amount will result in profits, while any sales below this amount will result in losses.

Breakeven Example

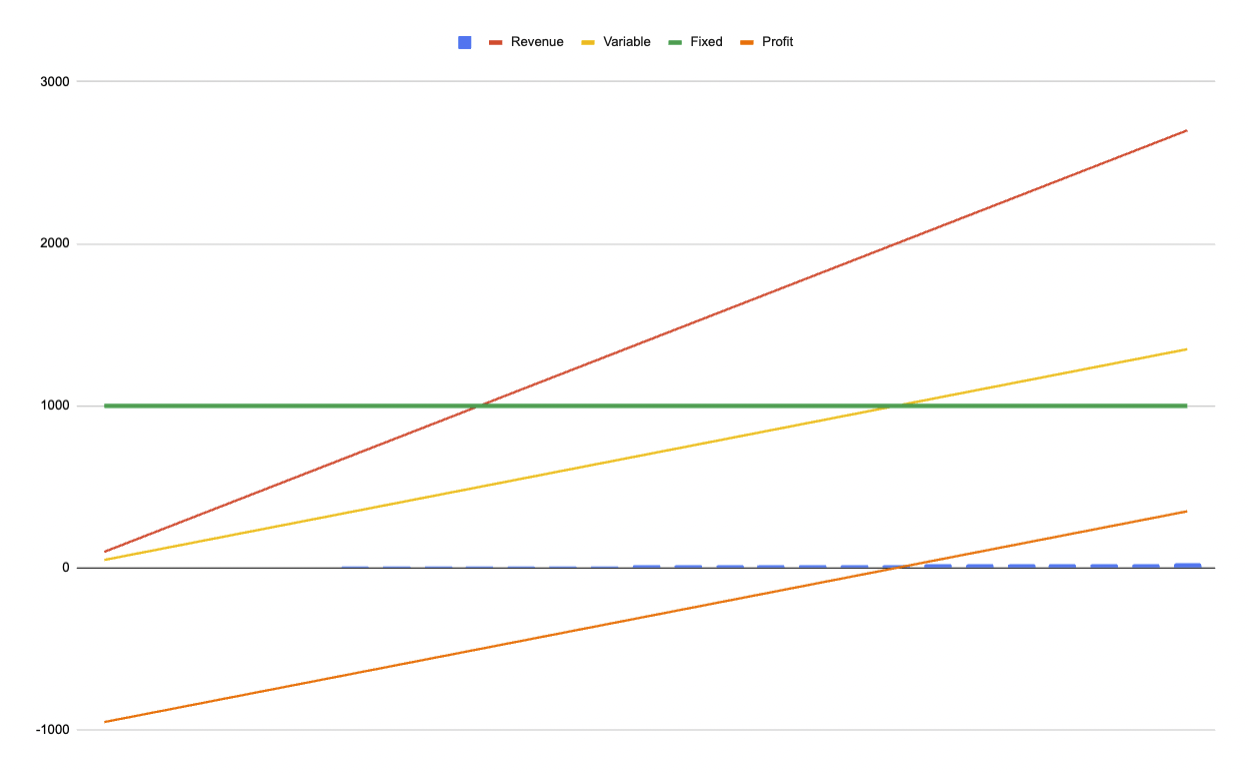

Take a business that has the following characteristics:

- Fixed cost of $1,000 per month

- Revenue of $100 per sale

- Costs of $50 per sale

The chart below shows this business.

The green line shows fixed costs. The yellow line shows variable costs, the red line shows revenue, and the orange line shows profits.

Breakeven Example

Based on these economics, the business will be breakeven by the 20th sale, as the revenue (20 * $100 = $2,000) will exceed the sum of fixed costs ($1,000) and variable costs (20 * $50 = $1,000).

When business managers talk about “scale” they are generally talking about a business that does enough sales volume to exceed its non-variable and variable costs.

For a media business, for example, the costs are generally content creation costs and marketing. So “scale” in this case means getting a certain number of views to produce enough revenue such that it exceeds the total costs.

Importance of the Break-Even Point

The break-even point is important for two reasons.

First, it tells us the minimum level of sales that a company must generate in order to avoid losses.

Second, it provides a goal for managers to strive for.

If a company is currently below its break-even point, then management knows that they need to take action to increase sales.

On the other hand, if a company is already above its break-even point, then management knows that they are on the right track and can continue with their current strategy.

In either case, the break-even point is a helpful tool for managing a business.

What Can Operating Leverage Tell You About A Company’s Risk?

Operating leverage is a key driver of profits, but it also increases risk.

This is because a small decrease in sales can have a disproportionately large effect on profits.

Thus, investors need to carefully consider a company’s operating leverage before investing. They should also monitor a company’s sales closely to ensure that they are meeting expectations.

Degree of Operating Leverage (DOL)

The degree of operating leverage (DOL) is a measure of how much a company’s operating profits will change in response to a change in sales.

It is calculated by dividing the percentage change in profits by the percentage change in sales. It is approximately equal to the change in EBIT divided by the change in revenue.

A higher DOL means that a company’s profits are more sensitive to changes in sales.

Accordingly, a high DOL is generally considered to be riskier than a low DOL.

However, it is important to remember that a high DOL can also lead to higher profits if sales increase, so it cuts both ways like the term “leverage” suggests.

FAQs – Operating Leverage

What is the difference between operating leverage and financial leverage?

Operating Leverage is a measure of how much a company’s profits will change in response to a change in sales.

Financial Leverage is a measure of a company’s output or equity value in relation to its amount of debt.

What is the degree of operating leverage (DOL)?

The degree of operating leverage (DOL) measures how much a company’s operating profits will change in response to a change in sales.

It is calculated by dividing the percentage change in profits by the percentage change in sales.

A higher DOL means that a company’s profits are more sensitive to changes in sales.

Why is the break-even point important?

The break-even point is important because it tells us the minimum level of sales that a company must generate in order to avoid losses.

It also provides a goal for managers to strive for. If a company is currently below its break-even point, then management knows that they need to take certain actions to increase sales.

On the other hand, if a company is already above its break-even point, then management knows that they are on the right track and can continue with their current strategy.

In either case, the break-even point is a helpful tool for managing a business.

Summary – Operating Leverage

Operating leverage is a measure of how much a company’s sales change in relation to changes in its cost of goods sold (COGS) and other variable costs.

The higher the operating leverage, the more sensitive a company’s profits are to changes in sales. In general, companies with high operating leverage should be treated with appropriate caution by investors because they are riskier.

Therefore, companies with higher operating leverage typically command higher costs of capital and lower valuations, holding all else equal.

Operating leverage is calculated by dividing a company’s sales by its COGS. The resulting number is then multiplied by the company’s operating margin. This number indicates how much sales need to increase or decrease in order for the company to break even.

For example, if a company has an operating leverage of 2 and its sales decrease by 10 percent, then its profits will decrease by 20 percent. Conversely, if its sales increase by 10 percent, then its profits will increase by 20 percent.

Investors should be aware of a company’s operating leverage before investing. Companies with high operating leverage are riskier and this should be taken into accounting when making trading and investing decisions in the markets.