NAGA Review 2024

Pros

- I like that deposits are fee-free and are available in a range of methods including credit cards, local bank transfers and e-wallets

- NAGA is an established firm with over 1 million traders and a public listing on the Frankfurt Stock Exchange. It’s also reassuring to see CySEC regulation at the European branch

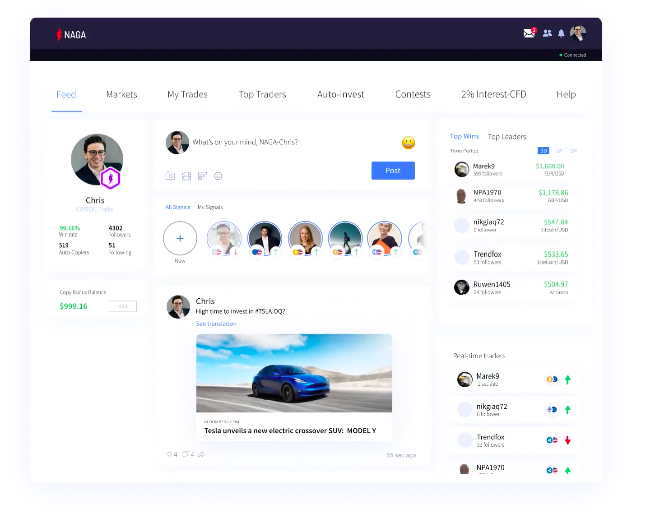

- I enjoyed using the broker’s user-friendly proprietary copy-tading platform and dashboard, especially the live social feed, Academy section and leaderboard

Cons

- Whilst still accessible to beginners, I think the $250 minimum deposit is still a bit higher than average

- I was disappointed to find withdrawal fees for all methods, starting from $5 for basic account holders. The minimum withdrawal amount is also higher than average at $50

NAGA Review

NAGA is a regulated social trading platform that allows clients of all levels to share and copy strategies on 1000+ assets including CFDs on forex, stocks and cryptos. Investors can use the broker’s proprietary copy trading platform or connect to the financial markets using the established MT4 and MT5.

Our review of NAGA unpacks leverage rates, copy trading fees, deposit and withdrawal methods, and more. Find out whether our experts would recommend signing up with NAGA.

About NAGA

NAGA Group AG was founded in 2015 by Yasin Qureshi and Benjamin Bilski. The company conducted an initial public offering in 2017, surpassing $50 million in a few months on the Frankfurt stock exchange.

The brokerage is currently headquartered in Limassol, Cyprus.

NAGA Markets Europe Ltd operates under the NAGA Group AG and is regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA).

How Social Trading Works

Social trading allows investors to interact and share ideas with community members. Traders can also copy and execute the strategies of other users. This method of trading is useful for new starters who want to learn techniques and pick up tips from seasoned investors.

A social trader can choose to subscribe to another trader’s channel where their positions and strategies can be viewed. Users then have the option to automatically copy their trades 24/7.

Importantly, traders can still implement their own risk parameters and monitor portfolio performance in real-time, depositing and withdrawing funds as needed.

How To Copy Trade On NAGA

Follow these straightforward steps to start copy trading on NAGA:

- Head to the leaderboard to find a trader to follow – you can check the number of followers, win rate, and other performance stats

- Click ‘autocopy’ – simply select the ‘autocopy’ button to start mirroring the positions and strategies of your chosen trader

- Monitor and manage – go to ‘My Trades’ to manage your investing activity. You can use a series of tools to set limits on the profit or loss you’re willing to accept

Assets & Markets

The platform offers over 1000 assets including Stocks CFDs, Stocks, Crypto CFDs, Indices CFDs, Forex CFDs, Commodities CFDs and Futures.

All available assets are derivatives except for Real Stocks.

Trading Platforms

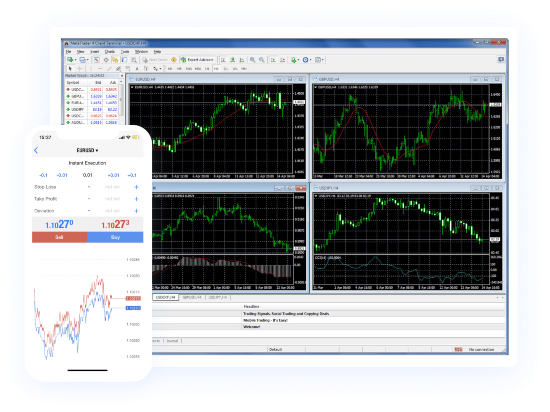

NAGA Web Platform

NAGA Web is the broker’s bespoke platform that allows users to automatically copy trades from other members and configure price alerts directly from a web browser. The platform offers most of the functionality found in MT4 and MT5, alongside a series of additional features:

- Full access to all trading markets

- Messenger for sharing analysis

- ‘Top investors’ leaderboard

- Personal account manager

- Copy trading signals

- Autotrading feature

- Market news feed

The platform is also available as a mobile app on iOS and Android.

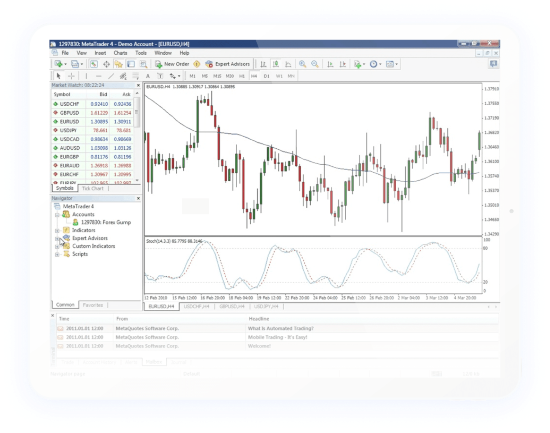

MetaTrader 4

MT4 is a popular forex trading platform that has a user-friendly interface and is suitable for beginners. Features include:

- 4 types of pending orders

- 3 types of instant orders

- Customizable interface

- 30 technical indicators

- 31 graphic objects

MT4 is available to download on Mac, Windows and as a mobile app on iOS and Android.

MetaTrader 5

MT5 is another industry-leading platform, the successor of MT4. It offers advanced features most suitable for established investors. NAGA’s MT5 terminal offers a wider range of instruments compared to MT4, including ownership of physical shares where users can earn dividends. Other features include:

- Ability to transfer funds between accounts

- 6 types of pending orders

- 4 types of instant orders

- 38 technical objects

- Economic calendar

- 44 graphical objects

- 21 timeframes

- Market depth

- Secure login

MT5 is available to download on Mac, Windows and as a mobile app on iOS and Android.

Fees

Spreads are variable with zero commission on most assets. Typical forex spreads are around 1.8 pips with a similar fee on indices (though spreads vary depending on the market). The commission on CFD trades is €2.50 (or currency equivalent) for an in/out transaction.

NAGA charges a flat fee of €0.99 on all trades that are copied. Additionally, 5% is applied to trades with a profit equal to or larger than €10. This transparent fee structure makes it easy to track costs when copy trading.

Leverage Review

While using NAGA, our experts found that members can check their account leverage in the Trading Accounts section. In compliance with regulatory requirements, leverage ranges from 1:1 to 1:30 for retail clients in the EU depending on the instrument.

Retail leverage limits by asset are as follows:

- Commodities (excluding gold) – 1:10

- Major futures indices – 1:20

- Futures commodities – 1:10

- Major forex pairs – 1:30

- Minor forex pairs – 1:20

- Other futures – 1:10

- Major indices – 1:20

- Minor indices – 1:10

- Stocks – 1:1

- Cryptos – 1:2

- Gold – 1:20

- ETFs – 1:5

Note, traders registered with the global entity may be able to trade on higher leverage up to 1:1000.

Deposits & Withdrawals

NAGA offers over 20 deposit and withdrawal methods. However, the options available will depend on the country you’re based in. Methods include:

- Bank wire transfer (Instant)

- Credit/Debit card i.e. Visa, Mastercard and Maestro (Instant)

- Cryptocurrencies i.e. Bitcoin, NAGA Coin or Ethereum (Instant)

- Alternative payment methods i.e. Skrill, Giropay and Neteller (Instant)

All methods require a minimum deposit of $250 or equivalent. Maximum deposit requirements depend on the country you reside in.

Withdrawal requests are processed within the same day or the following day if the request was submitted out of working hours.

While there are no deposit fees, withdrawal charges vary depending on the user level.

Maximum withdrawals depend on the payment method used.

VIP Accounts

NAGA offers a choice of VIP trading accounts:

- Iron – $250 minimum deposit, earn $0.12 per copied trade on all instruments, earn $0.50 per copied trade on premium forex pairs, $5 withdrawal fee, daily 5 trading signals

- Bronze – $2,500 minimum deposit, earn $0.15 per copied trade on all instruments, earn $0.60 per copied trade on premium forex pairs, $4 withdrawal fee, daily NAGA 5 trading signals, PI dashboard

- Silver – $5,000 minimum deposit, earn $0.18 per copied trade on all instruments, earn $0.70 per copied trade on premium forex pairs, $3 withdrawal fee, daily 10 trading signals, PI dashboard, one-on-one tutoring (2 per month)

- Gold – $25,000 minimum deposit, earn $0.22 per copied trade on all instruments, earn $0.80 per copied trade on premium forex pairs, $2 withdrawal fee, daily 15 trading signals, PI dashboard, one-on-one tutoring (4 per month), premium eBooks and contests

- Diamond – $50,000 minimum deposit, earn $0.27 per copied trade on all instruments, earn $1.00 per copied trade on premium forex pairs, $1 withdrawal fee, daily 20 trading signals, PI dashboard, one-on-one tutoring (7 per month), premium eBooks and contests, profile awareness boost

- Crystal – $100,000 minimum deposit, earn $0.32 per copied trade on all instruments, earn $1.20 per copied trade on premium forex pairs, $1 withdrawal fee, unlimited daily NAGA trading signals, PI dashboard, one-on-one tutoring (unlimited), premium eBooks and contests, profile awareness boost

Demo Account

Prospective clients can use a free demo trading account. The test account is made available by default once you sign up to NAGA and comes with $10,000 in virtual cash. The simulator allows you to get acquainted with the NAGA platform and interface while testing out your trading strategies risk-free.

Tools & Education

The brokerage offers a range of free resources available to all traders. Tools include calculators, a blog, eBooks, webinars and a handy glossary.

In the NAGA Learn hub, traders can also access lessons on key trading topics such as forex basics, Japanese candlestick charts and the Metaverse.

For those interested in copy trading, there are a number of resources designed to give a good oversight of what it can offer and how to get started.

Pros

While using the platform, we found there are several benefits to opening a live account:

- Trade alerts

- Crypto trading

- VIP account levels

- Free demo account

- 24/7 social trading

- Good customer support

- FCA and CySEC-regulated

- Premium trading contests

- €0.99 flat copy trading fees

- Leaderboard of traders to copy

- Proprietary web-based platform

- NAGA platform on iOS and Android

- Beginner-friendly educational resources

- Established broker with 1 million+ traders

Cons

Our experts also found several drawbacks to copy trading on NAGA:

- Overnight charges

- $250 minimum deposit (Slightly higher than average)

- Variable withdrawal fees depending on the user level

Customer Support

You can contact customer support through several channels listed below. The team is available Monday to Friday from 9:00 to 20:00 EEST.

- Email – support@nagamarkets.com

- Live chat – Found on the bottom of the website

- Telephone number – +357 25 041410

The broker is also active on social media. Traders can view the latest updates and product announcements on Facebook, Instagram, Twitter, YouTube and LinkedIn.

Security

Client funds are held in segregated accounts with regulated EU banks. This ensures that funds are separated from company capital and helps to ensure they are not misused. The interface is also secured with firewalls and encryption protocols.

All accounts have the option to add multi-factor authentication at login for increased security.

NAGA Verdict

NAGA has a lot to offer. Users can copy trades from experienced investors across more than 1000 assets. The social trading broker offers MT4 and MT5 plus its web-based terminal that comes with a long list of features. Strong regulatory oversight from the CySEC and BaFin also adds to its trust rating. The only major drawback is the relatively high minimum deposit at $250.

FAQ

How Do I Open An Account With NAGA?

Opening an account is straightforward, follow the link below and select ‘Register’. You will need to fill in a short questionnaire, verify your identity and provide proof of residence. Once your account has been verified, you can log in and start trading. The exchange also offers an Islamic swap-free account on request.

Is Trading With NAGA Safe?

The broker offers a high level of client security. Traders’ funds are held in segregated accounts with major EU banks. Additional security features at the login stage also help to provide a robust trading environment. With that said, online trading is risky, especially when investing in leveraged CFDs. Also, there are no guarantees that the strategies you copy on the platform will generate returns.

Is NAGA Trading Legit?

NAGA is a legitimate broker that is regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 204/13. As a result, we’re satisfied the company is a respectable copy trading broker. The online brokerage is also overseen by the BaFin in Germany.

How Does NAGA Trading Work?

NAGA is a social trading network that brings together users to share information and explore strategies. Clients can copy as many trading systems as they want and can view other traders through the leaderboard. Every time a user copies your trade, you will receive payment directly to your account. The copytrade service is available on the NAGA Web platform only.

What Are The Trading Hours On NAGA?

Users can access trading platforms 24/7. However, market operating hours will depend on the specific asset. For example, the forex market is available 24/5. Note, spreads may widen during periods of low liquidity.

Top 3 Alternatives to NAGA

Compare NAGA with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

NAGA Comparison Table

| NAGA | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 4 |

| Markets | CFDs on forex, indices, shares, commodities, cryptocurrencies, real stocks and futures | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, FSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | Yes | Yes | Yes | No |

| Platforms | NAGA Platform, MT4, MT5, TradingView | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 (EU). Leverage also depends on the financial instrument traded and the trader’s location. | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 12 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by NAGA and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| NAGA | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

NAGA vs Other Brokers

Compare NAGA with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of NAGA yet, will you be the first to help fellow traders decide if they should trade with NAGA or not?