N1CM Review 2024

Awards

- Best Forex & CFD Trading Platform 2022

- Best Customer Service 2021

- Best Forex & CFD Trading Platform 2021

- Best Forex & CFD Trading Platform 2020

- Best Forex Execution 2020

- Best Customer Service 2020

Pros

- Low minimum deposit and withdrawal limits

- Both MetaTrader 4 and MetaTrader 5 platforms

- 1:1000 maximum leverage

Cons

- Paper trading only available on verified accounts

- Wide spreads for the classic account

- Not as trustworthy as alternative brokers

N1CM Review

N1CM is a multi-asset broker through which investors can open trades on margin. With low spreads from 0.1 pips, 1:1000 flexible leverage, plus commission-free deposits and withdrawals, Number One Capital Markets is worth considering if you are interested in a new broker.

This broker review will detail the trading platforms on offer, markets you can trade, account types, fees, pros, cons and anything else you should know. Find out if our expert traders recommend signing up with N1CM.

Company Details

Number One Capital Markets, or N1CM, is a CFD broker offering contracts on popular financial markets ranging from forex and cryptos to indices and stocks.

Launched in 2017, the broker is a popular choice with clients in 88 countries. The company has headquarters in Vanuatu with additional offices in London, UK and Istanbul, Turkey.

N1CM is regulated by the Vanuatu Financial Services Commission (VFSC).

Trading Platforms

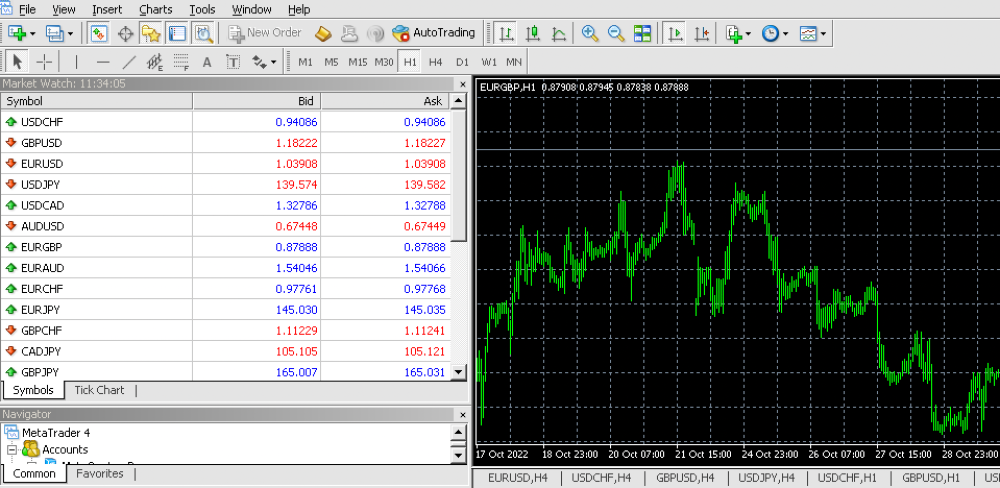

To trade with N1CM, you can use either MetaTrader 4 or MetaTrader 5. Both terminals can be accessed via browsers or through applications on your computer and mobile device.

MetaTrader 4

MetaTrader 4 (MT4) is a user-friendly trading platform created by MetaQuotes. The platform sets the industry standard for technical analysis and trade execution with its customizable charting options. The platform comes with 30 technical indicators and nine-time frames to suit day trading and swing trading.

To help with opening and closing contracts, MT4 offers one-click trading as well as algorithmic bots to automate the entire research and execution process.

If you are in need of new strategy ideas or simply want to follow an experienced trader, you can use the platform’s signals and copy trading service.

MetaTrader 5

Launched five years after MT4, MT5 offers more tools and features.

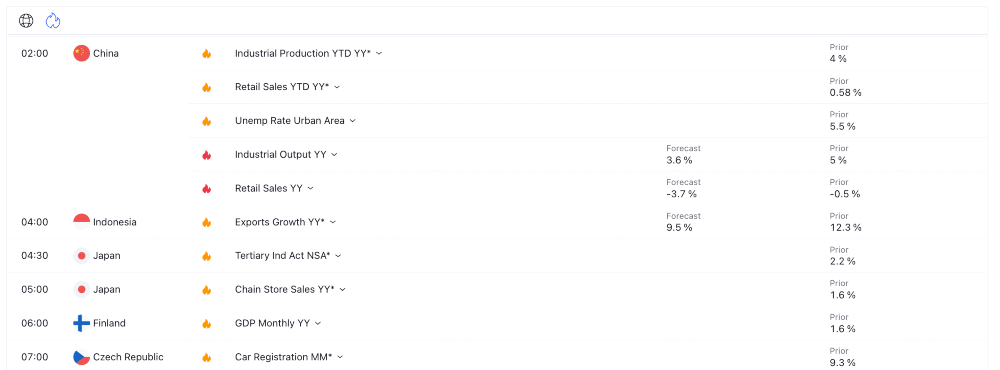

The platform comes with 38 in-built technical indicators to help with analysis as well as 21 time frames. Other additional features compared to MT4 include an economic calendar, more pending order types, an embedded community chat and a multi-threaded strategy tester.

If you want to trade forex, you can use either MT4 or MT5, however if you are opening CFDs on the other available markets you will need to use MT5.

How To Trade

- Sign in to your N1CM account on either the MT4 or MT5 platform

- Select the instrument you want to trade on

- Click the ‘New Order’ button

- Specify the order type

- Input the order size, leverage and side (long or short)

- Confirm the order

Assets & Markets

N1CM supports trading in the following markets:

- Forex – 50 major, minor and exotic currency pairs including EUR/USD, GBP/USD and USD/JPY

- Commodities – Eight commodities including Natural Gas, Brent and WTI Oil, plus five metals

- Cryptos – Bitcoin, Ethereum, Bitcoin Cash, Litecoin and Ripple traded against the US Dollar

- Shares – 26 US and German stocks such as Apple, Microsoft and BMW

- Indices – Nine indices such as the Dow Jones and S&P 500

Fees

The trading commission that Number One Capital Markets charges is linked to the account type and the asset you are trading on. Generally, Classic and Advanced accounts have wider spreads than Elite accounts but they also have the option for commission-free trades on forex, which is $2.5 per lot for Elite. For all indices and commodities, the commission is $6 for Classic and Advanced accounts and then $5 for Elite accounts. Trading on stocks incurs a $5 per lot fee for all three account types.

The broker also charges swap fees on overnight positions. The swap rate is impacted by the side (long vs short) and the asset. For example, N1CM’s swap fee for a short position on EUR/USD is 2 but for a long position, it is -6.

You can see the full list of swap rates on the broker’s website.

N1CM Leverage

Number One Capital Markets supports trading on margin with leverage of up to 1:1000. As the maximum leverage relates to the equity of the contract, this upper limit is only available for contracts where the equity is less than $1,000.

The minimum leverage you can use on a contract is 1:25. The stop out level is 30%.

To see the full breakdown of the permitted leverage per investment size bracket and the required margin to keep the position open, see the broker’s website.

Payment Methods

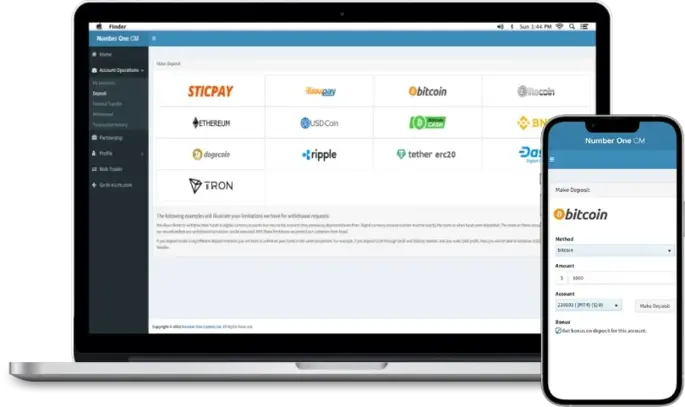

Deposits

N1CM offers several methods for depositing funds into your brokerage account. This includes Visa/MasterCard credit and debit cards, e-wallets such as Perfect Money and cryptocurrencies like Bitcoin and Ethereum.

For the majority of payment options, the minimum deposit is $1, however, some come with greater limits. For instance, both USD Coin and SticPay require at least $5, Payment Asia’s minimum is $15 and debit and credit card deposits must be at least $25.

If you want to make a deposit using a currency other than USD, for example EUR or GBP, you will need to use either Payment Asia or a debit or credit card.

All deposits are processed instantly and incur a fee of $1.

Withdrawals

For withdrawals from N1CM, you can use the same e-wallets and cryptos but debit and credit cards are not available. The minimum withdrawal limits vary according to the method. Most impose a minimum of just $2 but certain methods such as Bitcoin and Sticpay only accept requests of at least $5.

The broker aims to process withdrawals within two hours and requests can only be made in USD.

Note that to request a withdrawal you need to have a verified account.

How To Transfer Funds

- Log into your N1CM account

- Click on the ‘Finance tab from the main dashboard and select either deposit or withdrawal

- Choose your payment type

- Input the account details (for example credit card information) and the amount you want to deposit

- Select the N1CM account from the dropdown list that money is being deposited to or withdrawn from

- Choose a bonus or promotion if applicable

- Confirm the transaction using the ‘Create’ button

Account Types

Number One Capital Markets offer several account options:

Classic Account

- $5 minimum deposit

- MetaTrader 4 only

- No commission trading

- Floating spreads starting at 1.1 pips

Advanced Account

- $2,000 minimum deposit

- No commission trading

- Floating spreads starting at 0.8 pips

- MetaTrader 4 and MetaTrader 5

- Market analysis provided by N1CM

Elite Account

- $10,000 minimum deposit

- Trading commission of $2.5 per side

- Floating spreads starting at 0.3 pips

- MetaTrader 4 and MetaTrader 5

- Dedicated account manager

N1CM also requires its clients to complete an account verification process after registration. This involves submitting proof of identity and proof of address documents for the customer service team to review.

N1CM aims to complete the verification the same day or by the following day if you submit documents after the office has closed.

Demo Account

N1CM also offers a demo account. This is an ideal way to practice trading with N1CM without the risk that comes with using real capital.

While the broker does not charge any money to open a paper trading account, you do need to complete the account verification process.

N1CM Bonuses & Promotions

N1CM runs two promotions deals for deposits. For this first deposit you make, you can receive a cash bonus that is equal to 35% of what you transfer. For every subsequent deposit, N1CM offers a 25% bonus.

For both promos, the maximum bonus you can receive is $5,000.

Mobile App Review

N1CM itself does not have a mobile app however, both MT4 and MT5 do. You can find Google Play Store and Apple App Store download links for both Android and iOS devices through the broker’s official website.

These are ideal for managing your portfolio and monitoring positions while on the go. Both solutions offer in-app price alerts and notifications, charts and drawing tools, one-click trading, plus multiple order types. They essentially replicate the desktop trading experience but with mobile-optimized features.

Regulation & Licensing

N1CM is regulated by the Vanuatu Financial Services Commission (VFSC) with license number 15035.

As part of the VFCS, N1CM must comply with requirements regarding anti-money laundering and financing terrorism.

However, it’s worth noting that the VFSC is not a top-rated financial regulator. This means limited recourse options and legal protections for retail traders.

Security & Safety

N1CM offers several protective measures to help keep client accounts and their funds secure. Firstly, the broker provides two-factor authentication via apps such as Google Authenticator and Microsoft Authenticator. This way, it is more difficult for someone to gain access to your account without permission, even if they have your login details.

The broker also offers negative balance protection, which is important for investors interested in CFD trading. This helps to prevent users from becoming indebted to the broker as contracts are automatically closed once the margin from losing positions is equal to currently deposited funds.

Say you deposit $100 to your broker and using 1:10 leverage, open a long CFD contract worth $1,000. If the asset then drops in value by 10%, your contract will have decreased in value by $100, equal to your deposited funds. At this point, the broker would close the contract on your behalf as any additional losses would be more than the funds currently held in your account.

Customer Support

If you are experiencing issues with N1CM, you can seek help through the following channels. The broker’s customer support team is contactable between 6 AM and 8:30 PM GMT Monday to Friday.

- Live chat on the website

- Call +44 2045 259759

- Message over WhatsApp, Skype or Telegram

- Support centre with FAQs

Additional Features

To help investors to plan out trades and develop a strategy, N1CM offers both analysis and education. On the analysis page, you can see reviews of a range of different assets and markets from the broker’s trading experts. They provide easily digestible information offering a summary of potential upcoming price action.

On the education page, the broker offers free-to-download resources such as eBooks entitled ‘Online Trading 101’. These provide useful information that can help beginners in particular.

Additionally, Number One Capital Markets hosts a free economic calendar on its website.

Trading Hours

The trading hours on N1CM relate to the market you are investing in. Forex, for example, is open 24 hours a day, Monday to Friday.

Indices, however, have their own timetables. For instance, the Dow Jones 30 can be traded between 1 AM and midnight (GMT+3) whereas the FTSE 100 opens at 3 AM.

For trading on shares, you must consider the exchange. German-based stocks such as Adidas start at 10 AM and end at 9 AM whereas US stocks, for example, Amazon, are open between 4:30 PM and 11 PM.

N1CM Verdict

Number One Capital Markets is a good broker that offers trading on several asset classes. Through MetaTrader 4 and MetaTrader 5, investors have access to powerful trading platforms with which they can complete analysis to map out trades. And with the three different account types, all experience levels and trading strategies are accommodated. The only significant drawback is the limited legal oversight.

FAQs

Is N1CM Legit?

Yes, N1CM is a legitimate broker that can be relied on to carry out highly leveraged trades. Through measures such as two-factor authentication and negative balance protection, you can trust N1CM to keep your account secure.

Does N1CM Accept US Clients?

Yes – N1CM does accept clients from the US. The only country that N1CM restricts customers from is Iraq. However, if Iraq-based clients complete certain checks that satisfy the customer service team, they can also register an account.

Does N1CM Offer A Cent Account?

N1CM does not offer a dedicated cent account, however, all three account types offer trading of 0.01 lots. This way, if you are interested in cent trading, you are not restricted to only one account type and only trading small volumes.

How Can I Contact The N1CM Customer Support Team?

If you need help from the N1CM customer support team, you have several options. Firstly, you can message a member of the team either through the website’s live chat function or using a messaging app such as WhatsApp, Skype and Telegram. If you want to speak to someone over the phone then call +44 2045 259759.

If the team is too busy or the office is currently closed, it may be worthwhile looking at the support center with FAQs covering topics such as registration and trading platforms.

Is N1CM Regulated?

N1CM holds a license with the Vanuatu Financial Services Commission. The license number is 15035. Note, this is not a tier-one regulator.

Top 3 Alternatives to N1CM

Compare N1CM with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- DNA Markets – DNA Markets is a forex and CFD broker established in 2020. The broker operates two entities in Australia and the offshore jurisdiction, St Vincent and the Grenadines. Traders can access 800+ markets, with a Standard account for beginners and a Raw account for experienced traders. The reliable MetaTrader 4 and MetaTrader 5 platforms are available, alongside Signal Start.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

N1CM Comparison Table

| N1CM | IG | DNA Markets | Interactive Brokers | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 3.5 | 4.3 |

| Markets | Forex, Indices, Commodities, Shares, Cryptocurrencies, Metals | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | CFDs, Forex, Indices, Commodities, Stocks, Crypto | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $5 | $0 | $100 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | VFSC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | ASIC | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA |

| Bonus | 35% Welcome Deposit Bonus | – | – | – |

| Education | No | Yes | No | Yes |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:500 | 1:50 |

| Payment Methods | 9 | 6 | 10 | 6 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

DNA Markets Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by N1CM and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| N1CM | IG | DNA Markets | Interactive Brokers | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | Yes | No |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | Yes | No |

| Silver | Yes | Yes | Yes | No |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | Yes |

| Options | No | Yes | No | Yes |

| ETFs | No | Yes | No | Yes |

| Bonds | No | Yes | No | Yes |

| Warrants | No | Yes | No | Yes |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | Yes | No |

N1CM vs Other Brokers

Compare N1CM with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of N1CM yet, will you be the first to help fellow traders decide if they should trade with N1CM or not?