MultiBank FX Review 2025

Awards

- Best Gold Broker 2023 - FX Empire

- Best Forex Broker 2023 - Fintech & Crypto Summit Bahrain

- Chairman Of The Year 2023 - Le Fonti Awards Dubai

- Leading Financial Derivatives Institution 2023 - Le Fonti Awards Dubai

- The Most Trusted Broker In The Middle East 2023 - Ultimate Fintech

- Best Broker Of The Year 2022 - Traders Union

- Best Globally Recognized Forex Broker 2022 - Forex Expo Dubai

- Best Crypto Broker Asia & Europe 2022 - Global Brands Magazine

- Best Financial Derivatives Broker Asia & Europe 2022 - Global Brands Magazine

- Best Global Broker 2022 - Pan Finance

- Best Global Forex Chairman Of The Year 2022 - Global Business Review Magazine

- Best New Global Asset Digital Exchange - MultiBank Crypto Exchange 2022 - Global Business Review Magazine

- The 50 Most Influential Figures In Global Financial Markets 2022 - Forex Traders Summit Dubai

- Best Global Crypto Broker 2021 - Forex Expo Dubai

- Bets Global Broker 2021 - Finance Magnates

- Best Broker MENA 2021 - Finance Magnates

- Best Broker Africa 2021 - Finance Magnates

- Best Broker LATAM 2021 - Finance Magnates

- Most Trusted Global Broker 2021 - Global Business Review Magazine

- The 50 Most Influential Figures In Global Financial Markets 2021 - Forex Traders Summit Dubai

- Best FX Service Provider 2020 - International Business Magazine

- Best FX Customer Service 2020 - Forex Awards

- Best Apac Region Broker 2020 - International Financial Awards

- Best Forex & CFD Broker 2019 - Jordan Forex & Expo Awards

- Financial Services Provider of the Year Asia 2019 - Global Brands Magazine

- Best Forex Trading Platform Hong Kong 2018 - International Finance Magazine

Pros

- MAM, PAMM and FIX API access for high-volume or pro traders, plus EAs and VPS hosting for algorithmic trading

- 24/7 multilingual customer support available across all accounts

- Renowned MT4 and MT5 platforms, plus proprietary MultiBank-Plus solutions and social trading

Cons

- $5,000 minimum deposit required to access ECN spreads

- Average education and market research

- $60 monthly inactivity fee

MultiBank FX Review

MultiBank FX is an award-winning forex and CFD broker. Our review covers everything from the group’s products and spreads to leverage and deposit options. We also examine the user experience, including the login process and the broker’s customizable trading platforms.

Read on to see if MultiBank FX are right for you.

Trading Platforms

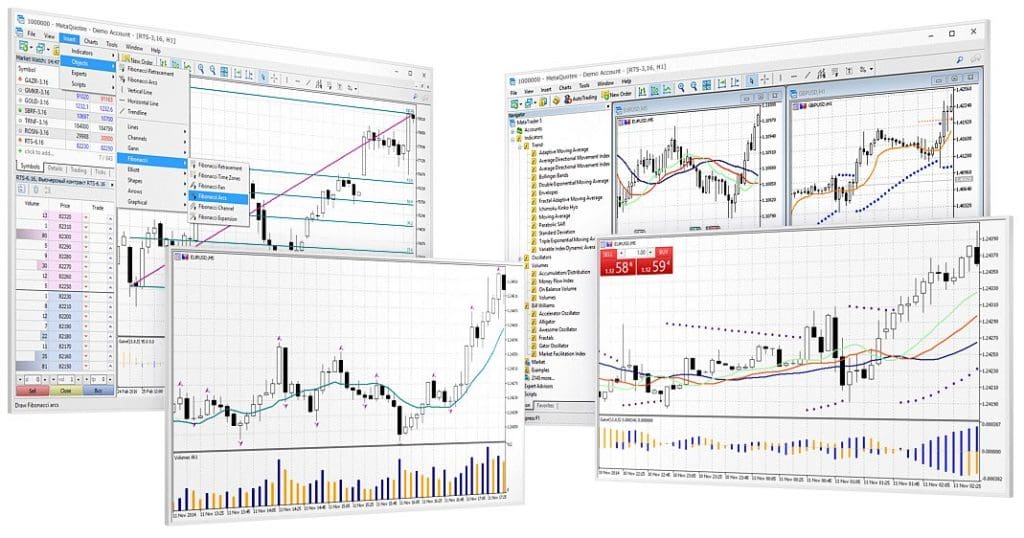

MultiBank FX offers the industry-favorite MetaTrader 4 and MetaTrader 5 platforms. Both can be installed via the download centre on the group’s website. Alternatively, the broker’s web trader solution, MultiBank-Plus, enables investing from any browser and operating system.

MetaTrader 4

Widely regarded as the leading forex trading platform, the terminal is suitable for traders of all skill levels. The platform was released in 2005. Whilst the interface’s design is outdated, the platform boasts key features including:

- Trading history

- Automated trading via APIs

- Advanced interactive charting

- Sophisticated analytical functions

- 30 customizable technical indicators

- 9 timeframes, from one minute to a month

- Instant execution and multiple alternative execution modes

MetaTrader 5

MetaQuotes Software designed MetaTrader 5 as a multi-asset platform for the more experienced trader. Launched in 2010, the solution offers trading in forex, stocks and futures. MT5 promises more advanced trading tools than its predecessor making it a powerful all-round investing solution.

Benefits include:

- DOM Data

- 21 timeframes

- MQL5 language

- Technical support

- Economic calendar

- Additional graphical objects and technical indicators

MultiBank-Plus

MultiBank-Plus was introduced in 2024 and offers an excellent alternative to MT4 and MT5, especially for newer traders seeking a more user-friendly and intuitive workspace.

It still delivers on the charting front with a package from TradingView, featuring 7 different types of charts and over 75 technical indicators.

The other bonus is that it matches the website redesign, providing a uniform trading experience across the broker’s accounts and services.

Assets

The MultiBank Group is primarily a CFD and forex broker with over 1,000 tradable instruments available to traders:

- Metals such as gold and silver

- Forex including majors and minors

- Cryptocurrencies such as Bitcoin and Litecoin

- Shares on major global companies and indexes

- Commodities including oil and wheat

It’s worth noting the group doesn’t offer as many forex pairs or crypto coins as other providers. Also, users can’t trade in binary options or spread betting products.

Spreads & Commission

The MultiBank Exchange Group offers competitive trading fees. Zero-pip spreads are available on the ECN Pro solution while spreads start from 0.8 pips on MultiBank Pro and 1.4 pips on Maximus Pro. Commission fees are reasonable at $3 per lot for forex. Typical spreads across major FX pairs:

ECN

- EUR/USD – 0.1

- USD/JPY – 0.2

- AUD/USD – 0.2

- GBP/USD – 0.3

Pro

- EUR/USD – 0.8

- USD/JPY – 1.0

- AUD/USD – 1.0

- GBP/USD – 1.1

Standard

- EUR/USD – 1.5

- USD/JPY – 1.6

- AUD/USD – 1.6

- GBP/USD – 1.7

Leverage Review

MultiBank FX offers leverage up to 1:500 on currencies, 1:200 on commodities and indices, while shares are offered up to 1:20. These are high leverage rates compared to EU-regulated brokers, for example, that cap ratios at 1:30. Traders should always be wary of the risks associated with leveraged trading.

Mobile Trading

Each account is available on the MT4 and MT5 mobile platforms, as well as MultiBank-Plus in some countries. The apps are easy to use and well-designed. MetaTrader users benefit from a long list of indicators, expert advisors for automated trading, built-in customer support and customizable charts. Traders can also make deposits and withdrawals through the mobile apps. Head to the respective app store to download the mobile applications free of charge.

Company Details

MultiBank FX was established in California, USA, in 2005, and is headquartered in Dubai. The Group caters to over a million clients in over 90 countries, and currently has 25 offices worldwide.

MultiBank FX holds licenses with financial regulators across four continents, including with SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, and VFSC.

Payments

Deposits

The MultiBank Group offers secure deposits processed within 24 hours. The minimum deposit requirement is $50 and traders aren’t charged any fees. The name of the bank account and trading account must match for the deposit to clear. Available deposit methods include:

- Visa

- Skrill

- Swift

- Neteller

- Globepay

- Mastercard

- Bank Transfer

- Perfect Money

- Payment Asia

- ThunderX Pay

Withdrawals

Withdrawals are also free of charge and available through the same methods as deposits. Users can log in to My MultiBank client portal and withdraw their funds within the platform.

Alternatively, you can reach out to cs@multibankfx.com and request a withdrawal. Withdrawals can take up to several working days, depending on the chosen method and country of residence.

Demo Account

You can open a Demo Account with MultiBank Group, and you will get a $100,000 virtual balance to trade in a virtual environment.

Clients can practice their trading strategies online across multiple markets with no real risks. Opening a Demo Account is very straightforward. You can fill in the online from on MultiBank Group’s website and use your credentials to sign up.

MultiBank FX Bonuses

When opening a trading account with MultiBank FX, users can benefit from a 20% bonus of up to $40,000 on top of their deposit.

Regulations

The MultiBank Group comprises a number of financial institutions that are regulated by multiple financial authorities including SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, and VFSC. These reputable regulators ensure the highest levels of safety and security for traders. Over the years, MultiBank Group has maintained an unblemished regulatory record with all its regulators since 2005.

Other features that ensure client protection include negative balance protection, fully segregated client accounts and a trade line of credit which records all activity associated with an account. Additionally, clients under the subsidiary MEX Atlantic are covered with an Excess Loss Insurance Policy of up to $1,000,000 per account.

MultiBank Group has a current paid-up capital of $320 million and custodial bank facilities that further reinforce their reliability. Overall, we’re comfortable the brokerage isn’t running a scam.

Additional Features

MultiBank FX offers a wide range of educational material on their website, suitable for beginners and experienced traders. From introductory courses to E-books and the latest financial news, users have access to valuable resources and information to enhance their trading strategies.

Also, clients can follow MultiBank Group on social media channels, such as LinkedIn, Facebook, Instagram, Twitter, YouTube, and Snapchat.

Social Trading functionality is available on all platforms with MultiBank Group. Clients can subscribe to signals from experienced investors and manually or automatically copy positions into their own accounts. Fees are low and there is a long list of signal providers to choose from.

For those wishing to become signal providers and gain followers, there is a simple three step process to follow:

Trading Accounts

The MultiBank Group offers three different account types for traders to choose from. The three types offer leverage up to 1:500, Social Trading functionality, 24/7 multilingual customer service and MT4/MT5 platforms.

- ECN– The ECN account is the best option for traders who look for raw spreads and instant execution. With a minimum initial deposit of $5,000, the ECN account offers spreads from 0.0 pips.

- Pro – The Pro account offers spreads from 0.8 pips and a minimum initial deposit of $1,000.

- Standard – The Standard account has a minimum initial deposit of only $50, and spreads starting from 1.5 pips.

Additionally, swap-free accounts are available. Users can trade Shares, Indices, Commodities and Cryptocurrencies with no overnight charges.

Note: All clients who trade CFDs on MultiBank FX are eligible for free VPS MAM and PAMM accounts.

Benefits

- Demo Competition

- Competitive spreads

- Excellent customer service, available 24/7

- $50 minimum deposit

- Social Trading

- Free VPS, MAM and PAMM accounts

- No deposit or withdrawal charges

Drawbacks

- $60 monthly inactivity fee after 3 months of zero activity

Trading Hours

MultiBank Group follows standard trading hours, usually Monday – Friday, though they vary slightly depending on the instrument. For more details and regularly updated holiday hours, visit the broker’s website.

Customer Support

4 / 5Customer support is a strength of the MultiBank Group, with 24/7 multilingual assistance available through several channels:

- Email – cs@multibankfx.com

- Live chat – Bottom right of the MultiBank FX website

- Phone number – Contact us page. Call back form also available

- Social media – clients can contact MultiBank Group on social networks such as Facebook, Instagram, LinkedIn or Twitter

Further details can be found in the contact area of MultiBank Group website. It’s worth highlighting that we found support staff responsive and knowledgeable about the broker’s products.

Security

The website is reliable, however, there is no 2-step login process on the web trading platform. It also lacks touch ID and face ID functionality. Still, the MetaTrader platforms do offer industry-standard security protocols and keep data relatively secure.

MultiBank FX Verdict

Tight spreads and low minimum deposits are enticing features of MultiBank FX. This combined with ease of navigation and good customer service make opening a live account attractive. With that said, high inactivity fees may deter some prospective traders.

Overall, MultiBank Group is a reliable, established financial derivatives broker with a strong regulatory framework that provides the latest technology and services. Utilizing top-tier MT4 and MT5 platforms, the company provides a good all-round trading experience.

Top 3 Alternatives to MultiBank FX

Compare MultiBank FX with the top 3 similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

MultiBank FX Comparison Table

| MultiBank FX | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| Rating | 4.7 | 4 | 4.3 | 3.6 |

| Markets | Forex, CFDs, indices, shares, metals, commodities, cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $50 | $1 | $0 | $100 |

| Minimum Trade | 0.1 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | SCA, MAS, CySEC, ASIC, AUSTRAC, BaFin, FMA, FSC, CIMA, TFG, VFSC | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC |

| Bonus | 20% deposit bonus | 100% Deposit Bonus | – | 10% Equity Bonus |

| Education | Yes | No | Yes | Yes |

| Platforms | MultiBank-Plus, MT4, MT5, cTrader | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 |

| Leverage | 1:500 | 1:1000 | 1:50 | 1:200 |

| Payment Methods | 9 | 10 | 6 | 11 |

| Visit | – | Visit | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

Dukascopy Review |

Compare Trading Instruments

Compare the markets and instruments offered by MultiBank FX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| MultiBank FX | World Forex | Interactive Brokers | Dukascopy | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | No | No | Yes |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | No | Yes | No |

| Options | No | No | Yes | No |

| ETFs | No | No | Yes | Yes |

| Bonds | No | No | Yes | Yes |

| Warrants | No | No | Yes | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | No | No | No | Yes |

MultiBank FX vs Other Brokers

Compare MultiBank FX with any other broker by selecting the other broker below.

The most popular MultiBank FX comparisons:

FAQ

What trading platforms does MultiBank FX use?

MultiBank FX offers MetaQuotes MT4 and MT5 trading platforms. Both are available on desktop and mobile devices (Apps).

How much capital do I need to trade at MultiBank FX?

MultiBank FX minimum deposits are low, starting from just $50 on the Standard account. This makes it a good option for beginners who are just starting in the financial markets.

Does MultiBank FX offer a demo account?

MultiBank FX offers a Demo Account with a $100,000 virtual balance and simulated real-time trading. Head to the broker’s website to sign up for the account and practice your trading strategy.

Is MultiBank FX regulated?

MultiBank FX is regulated across four continents by the Australian Securities and Investment Commission (ASIC), Federal Financial Supervisory Authority (BaFin), Financial Management Agency (FMA), British Virgin Islands Financial Services Commission (FSC), Securities & Commodities Authority of the UAE (SCA), Monetary Authority of Singapore (MAS), Tianjin Financial Government (TFG), Vanuatu Financial Services Commission (VFSC) and Cayman Islands Monetary Authority (CIMA).

Does MultiBank FX offer mobile trading?

MultiBank FX offers a mobile trading App available on iOS and Android devices. The App is easy to download and easy-to-use, making trading on the move simple.

Is MultiBank FX a good broker?

MultiBank FX is a reliable broker. The Group is regulated worldwide and offers competitive spreads, interesting bonus offers, and low deposits across a wide range of instruments.

Customer Reviews

There are no customer reviews of MultiBank FX yet, will you be the first to help fellow traders decide if they should trade with MultiBank FX or not?