The Most Common Trading Mistake?

In trading, both at the retail and institutional level, the most common trading mistake is believing that what happened in the past is likely to happen in the future. Too many traders look at what’s worked in the past and assume it will continue to work. On top of that, they leverage that up, creating more risk on top of an already flawed strategy.

A common example is the stocks-bonds hedge. A typical long-term portfolio is 60 percent stocks and 40 percent bonds, or often 50 percent of each. This type of hedge has worked well since the 1990s so traders tend to utilize it. The problem is that if inflation and/or interest rates pick up both of these asset classes will go down. This is one of the lessons from 2018.

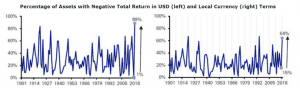

Of all asset categories tracked by Deutsche Bank, 89 percent of USD-based asset classes have gone down in value in 2018. This is an all-time record using dating going back to 1901. (64 percent have gone down in local currency terms, also very high historically.)

With the computer, it is easy for investors to identify what strategies would have worked in the past and which ones haven’t. But investors typically choose not to identify what the fundamental drivers are behind assets and rather go with over-fitted and over-optimized strategies based on historical performance. But when the future is different from the past you will likely run into problems.

In general, when the stock market goes down in a given month, you’ll generally see 70 percent or more of hedge funds lose money depending on the extent of the decline. The average hedge fund in the US is 75% correlated to the S&P 500. And a large number of money managers underperform their particular benchmark(s) if they happen to use one. The issue is that many managers are following strategies that have worked in the recent past and extrapolate things that have worked over the past 5-20 years.

Takeaway

Those who lean more toward holding positions longer term should ideally look at their portfolios and look at what kind of diversification they have.

In October and November 2018, stock markets fell, which created a lot of apprehension among traders. The reality is that these moves have actually been pretty minor. We could have moves that are five times that size or more.

If you are exposed to any given type of environment, there will be rocky periods for your trading and broader portfolio. The key is to achieve balance by trading across a variety of markets and asset classes.