Lirunex Review 2024

Awards

- Fastest Growing Broker Asia 2022

- Fastest Growing Forex Broker Asia Pacific 2021

- Best Trading Service In Malaysia 2021

- Best Trading Service In Philippines 2021

Pros

- A proprietary trading app is available plus MT4

- The brokerage is regulated by the CySEC and LFSA

- Clients can trade with high leverage up to 1:2000

Cons

- Promos, tools and leverage varies by location

Lirunex Review

Lirunex is a forex and CFD broker that offers copy trading and funded accounts. Over 100 instruments are available on the MetaTrader 4 platform with fast order execution. This 2024 review of Lirunex will examine the broker’s no deposit bonus, demo account, license and prop trading conditions. Find out if you should start trading with Lirunex.

Company History & Overview

Lirunex Limited was founded in 2017 with headquarters in Cyprus and Malaysia. The company is authorized and regulated by three financial watchdogs including the Cyprus Securities and Exchange Commission (CySEC). The management team is currently led by Jack Foong Kim Weng, CEO.

The vision of the brand is to become an industry leader based on transparent and trustworthy relationships with clients. Lirunex provides multi-asset trading opportunities via a straight-through-processing model (STP). A decent range of promotions, portfolio management, and VPS services also help separate it from competitors.

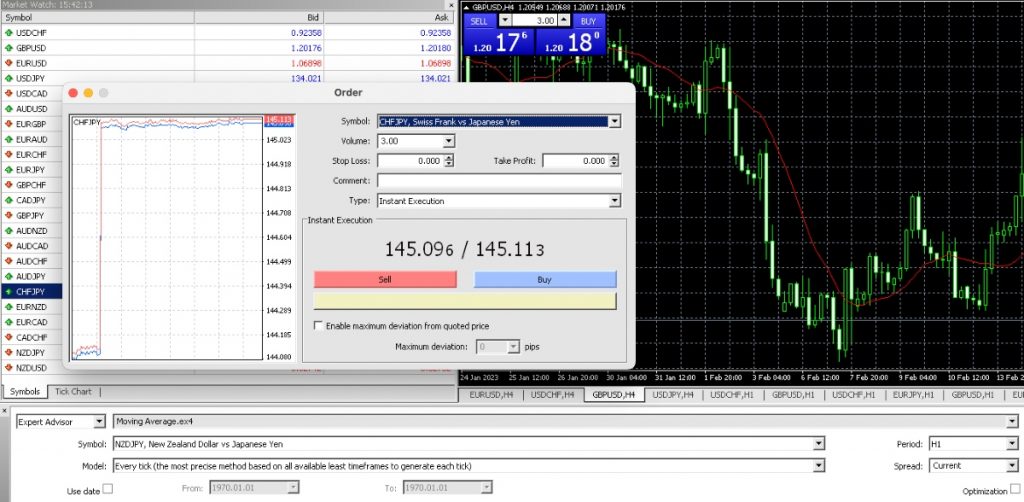

Trading Platform

Lirunex traders are offered MetaTrader 4 (MT4). The platform is popular for its technical analysis capabilities, customization features, automation properties, and mobile app compatibility. It is also available as a desktop download and through a web trader.

MT4 is suitable for both beginners and experienced traders, with sophisticated features on a user-friendly interface. This includes 30+ in-built indicators, four pending order types, 24 graphical objects, and support for up to 99 charts.

How To Place A Trade

- Log in to the MT4 software or web terminal

- Search for and click on an asset using the Market Watch window

- Conduct any technical or fundamental analysis on the interactive chart

- Click on the ‘New Order’ icon in the menu at the top of the screen

- Select the type of order (market execution or pending order)

- Input the volume you want to trade, as well as any stop loss or take profit levels

- Click on ‘Sell’ or ‘Buy’ to open a position

Markets & Assets

Lirunex offers 100+ assets through leveraged CFDs. Whilst not the widest selection of tradable instruments, clients can go long or short on popular global markets:

- Forex – 48 currency pairs including AUD/CAD, EUR/GBP, and USD/JPY

- Indices – 11 global indexes such as the FTSE 100, S&P 500, and US 30

- Cryptocurrencies – 6 popular digital currencies including Bitcoin, Ethereum, and Ripple

- Commodities – 2 precious metals and 2 energies including Gold, Silver, and US Crude Oil

- Shares – 14 US company stocks including Apple, Facebook, McDonald’s, and Netflix

Lirunex Fees

Fees depend on the account type. Lirunex offers accounts with commission-free trading (with higher spreads) or commission-based trading (with lower spreads).

The LX-Standard and LX-Advanced accounts both offer commission-free trading. The LX-Standard account offers floating spreads from 1.5 pips while the LX-Advanced profile offers slightly tighter floating spreads from 1 pip.

When we used Lirunex, the EUR/GBP was offered at 1.9 pips on the LX-Standard account and 1.3 pips on the LX-Advanced profile. The S&P 500 index was available to trade with a 1.6 points spread on the LX-Standard account and 1.4 points on the LX-Advanced profile. These are relatively competitive vs alternative brokers.

The LX-Prime and LX-Pro accounts are commission-based, with raw spreads from 0 pips. LX-Pro offers the lowest commission at $4 per round lot turn, though the minimum deposit requirement is hefty at $10,000. Day traders with an LX-Prime account will pay an $8 commission per lot.

There are no deposit and withdrawal fees charged by the broker. However, a $5 monthly inactivity fee is charged after 90 days of dormancy. In addition, swap fees will apply for positions held overnight.

Leverage

Lirunex offers very high leverage up to 1:2000. However the amount of leverage available depends on your account balance. Leverage may also vary by instrument and registered entity.

Account balance:

- <$500 – 1:2000

- $501 and $2000 – 1:1000

- $2001 and $15,000 – 1:500

- $15,001 and $25,000 – 1:400

- $25,001 and $35,000 – 1:300

- $35,001 and $45,000 – 1:200

- $45,001+ – 1:100

All accounts have a 50% margin call and a 25% stop-out level.

Lirunex App

Our experts were pleased to see that Lirunex offers its own app, available for free download to iOS and Android devices.

The application is sleek, with a modern design and simple user navigation. We were particularly impressed with the chart adjustments for smaller screens, clear menu dashboard, and portfolio analysis. A live news stream and economic calendar are also available within the app. In addition, real-time notifications can be enabled for breaking news bulletins. The broker’s forex signals and copytrade service are also available in the Lirunex app.

Additionally, MT4 has mobile app compatibility. It provides all the powerful tools and functions available on the desktop software. This includes custom graphs and charts, trading signals, and an algo-bot application.

Payment Methods

Deposits

Lirunex supports several payment methods with no charge on the broker’s end.

Deposit requests are processed by the broker within 24 hours from submission, Monday to Friday. The time taken for funds to be available in a live account will depend on the payment method. Requests made after 3 PM (GMT+3) will be processed the following day.

Deposit methods include:

- Bitpay – USD supported. Up to 24-hour processing time. $200 minimum deposit

- Thunderx Pay – LAK, MMK, KHR and THB supported. Instant processing. $25 minimum deposit

- 123 by 2C2P – MYR, THB and IDR supported. Up to 24-hour processing time. $25 minimum deposit

- Bitwallet – USD, EUR, JPY and AUD supported. Up to 24-hour processing time. $200 minimum deposit

- Local Bank Wire Transfer (China) – RMB supported. Instant processing time. $280 minimum deposit

- Credit/Debit Card (VISA & Mastercard) – USD supported. Up to 24-hour processing time. $25 minimum deposit

- Local Bank Wire Transfer (South East Asia) – MYR, THB, IDR, VND, and SGD supported. Instant processing time. $25 minimum deposit

- Bank Wire Transfer (Global Available Upon Request) – USD supported. Three to five working days processing time. $2000 minimum deposit

How To Make A Deposit

- Sign in to the Lirunex client portal

- Select ‘My Wallet’ from the side menu and then ‘Deposit Funds’

- Enter the amount you would like to deposit

- Choose the payment method by clicking on the respective logo

- Click ‘Proceed’

- Enter the relevant details according to the deposit method, for example, card number or bank account details

- Click ‘Submit’

You can view the transfer status by selecting ‘My Wallet’ and then ‘Transfer History’ from the side menu. Here you can also review transaction fees.

Withdrawals

Withdrawals must be made back to the original payment method. Similar to deposits, all withdrawal requests are free and are processed by Lirunex within 24 hours. However, the time taken for funds to clear varies by payment method:

- Bitpay – Up to 24-hour processing time. $20 minimum withdrawal

- Thunderx Pay – One to two working days processing time. $20 minimum withdrawal

- Local Bank Wire Transfer (South East Asia) – One to three days processing time. $20 minimum withdrawal

- Local Bank Wire Transfer (China) – One to two days processing time. $280 minimum withdrawal

- Bank Wire Transfer (Global- Available Upon Request) – Three to five days processing time. $200 minimum withdrawal

- Credit/Debit Card (VISA & Mastercard) – Seven to ten days processing time. $20 minimum withdrawal

- Thunderx Pay – One to two days processing time. $20 minimum withdrawal

- Bitwallet – Up to 24-hour processing time. $20 minimum withdrawal

Demo Account

Lirunex offers a free demo account to prospective traders. Users benefit from unlimited virtual funds, no maximum time limit, and flexible leverage.

New customers can register for a paper trading profile via the Lirunex website or on the mobile app. We were able to register for a demo account in less than two minutes. You will need to provide the following information:

- Name

- Email address

- Phone number

- Virtual balance amount

- Virtual leverage level

Login credentials will be sent to the registered email address. When we opened a Lirunex demo profile, we received a username and password within five minutes.

Bonuses & Promotions

Lirunex stands out for its range of joining incentives and ongoing deals, including a no-deposit bonus, copy trading challenges, and entry to investing competitions.

While using Lirunex, we were offered a 100% deposit bonus of up to $20,000 and access to a premium prize pool if we made a deposit of at least $100.

As with all promotions, always review the terms and conditions before signing up.

Note, investors under the EU entity may not be able to take part in promotions due to regulatory restrictions.

Lirunex Regulation

Lirunex Limited holds several global licenses:

- Cyprus Securities And Exchange Commission (CySEC), registration number 338/17

- Labuan Financial Services Authority (LFSA), registration number MB/20/0050

- Republic of Maldives under the Companies Act

The CySEC is one of the world’s top financial watchdogs with strict joining requirements and stipulations for members. This includes the requirements for brands to provide negative balance protection for retail traders and to segregate client funds.

Lirunex is also a member of the Investor Compensation Fund. The aim of the ICF is to ensure that clients are compensated in case one of the members is unable to fulfill their financial obligations.

On the downside, the non-EU Lirunex entities are not regulated by top-rated financial agencies. This means fewer customer safeguarding measures and access to insurance schemes. Your funds may be at risk.

Account Types

Lirunex.com offers four live accounts to suit different trading styles and objectives; LX-Standard, LX-Advanced, LX-Prime, and LX-Pro. Trading conditions are relatively similar between the different profiles, except for the minimum deposit and pricing structure.

Accounts can be opened in USD only, so a currency conversion fee may apply if you deposit in a different currency, such as EUR.

All accounts offer:

- Leverage up to 1:2000

- 0.01 lot minimum trade size

- 20-lot maximum trade size

- Scalping and hedging permitted

Account features differ in terms of:

- LX-Standard – $25 minimum deposit, floating spreads from 1.5 pips, commission-free

- LX-Advanced – $100 minimum deposit, floating spreads from 1 pip, commission-free

- LX-Prime – $200 minimum deposit, floating spreads from 0 pip, $8 commission per round lot turn

- LX-Pro – $10,000 minimum deposit, floating spreads from 0 pip, $4 commission per round lot turn

PAMM/MAM accounts are also available for traders looking to manage the funds of others.

Islamic Accounts

Lirunex also offers 2 halal, Islamic accounts; Islamic Standard and Islamic Prime. Both profiles are Shariah-compliant with no swap charges.

On the downside, traders get a limited product offering with just 40 currency pairs, 2 precious metals, and 2 commodities.

Islamic Standard

- Commission-free

- $25 minimum deposit

- 0.01 lot minimum trade size

- 20-lot maximum trade size

- Floating spreads from 1.5 pips

Islamic Prime

- $200 minimum deposit

- $8 commission per lot

- 0.01 lot minimum trade size

- 20-lot maximum trade size

- Floating spreads from 0 pips

How To Open A Lirunex Account

Our traders registered for a live Lirunex account in less than two minutes.

- Fill out the basic registration form and the CAPTCHA requirement

- Click the ‘Sign Up’ button

- Complete the onboarding steps by clicking on the icon in the top right of the client area

- Enter details of your educational background, personal finances, and identity documents

- Click ‘Submit’

Clients are required to comply with KYC account verification though this can be completed at a later date. However, online trading and withdrawals are restricted until the onboarding requirements are complete.

Additional Features

Chills

One major advantage of Lirunex is access to the Chills social trading platform. The third-party tool provides signals, strategies, copy trading software, and access to social networking with like-minded investors. The platform is ideal for users with limited trading experience.

The Chills server can be integrated directly with the Lirunex proprietary app and supports real-time order tracking. Other features include:

- No trade limits or restrictions

- Fixed trade sizes or balance proportions

- Access to full portfolio analysis by copy master

- Profit and risk ratings to determine the most profitable providers

https://www.youtube.com/watch?v=h5mGBoqnDUs&list=TLGGbC8lTaGN3lwxNjAyMjAyMw&t=1s

VPS

Our experts were also pleased to see a VPS available to active traders. Investors can run automated trading strategies 24/7 on a dedicated server with no interruptions.

The major benefit of using a Virtual Private Server is to reduce latency and slippage.

Note, access to the VPS may depend on your location.

Prop Trading

Another interesting feature offered by Lirunex is funded trading accounts. The prop firm offers funded profiles up to $250,000 following the completion of a two-step evaluation process. The live trading accounts offer a 70/30 profit split in favor of the online trader.

On the downside, a registration fee applies to participate in the evaluation process, though this is relatively cheap vs other prop trading firms. This includes a minimum deposit of $100 and a one-off fee of $10 to try for the $5000 funded profile. A competitive scaling plan is also available to boost your account size.

Evaluation

Phase One:

- 10% profit target

- 10% maximum drawdown

- Minimum 15 closed trades

- 30-day period with a minimum of 10 trading days

Phase Two:

- 15% profit target

- 10% maximum drawdown

- Minimum 20 closed trades

- 60-day period with a minimum of 15 trading days

How To Sign Up

The easiest way to sign up for the Lirunex prop trading program is via the client portal. You will need to register for a live account and then select ‘Prop Trading’ from the dashboard interface. From here, you can log in with your existing account number and password to enter the prop trading member portal.

Note, access to funded accounts may depend on your location.

Education

Lirunex offers some basic educational resources. These include the basics of trading, including what forex pairs are, abbreviations, and more.

The broker also offers a brief strategy guide, however for new traders, our experts would recommend looking elsewhere for more detailed insights and training materials.

Trading Hours

Lirunex trading hours vary depending on the asset class. Crypto, for instance, is available for online trading 24/7. Indices, on the other hand, are typically available from 22:00 Sunday to 21:00 Friday (GMT).

Upcoming market holidays and closures are published monthly on the broker’s website.

Customer Support

Lirunex offers responsive customer support and several contact methods. This includes live chat, WhatsApp, and email.

- Telephone – +357 2469 4888

- Email – support@lirunex.com

- Online Enquiry Form – Available via the ‘Contact Us’ webpage

- Address – Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands, MH 96960

The live chat service is available Monday-Friday from 10 AM to 5.30 PM (GMT+8).

Security & Safety

Our experts are comfortable that Lirunex provides a safe and secure environment for retail investors. Having said that, the offshore regulatory oversight for some traders is less reliable. Also, there is no option to add two-factor authentication (2FA) to the client portal or trading app.

The MetaTrader 4 platform operates with top-tier security features including fully encrypted transmissions and RSA digital signatures.

Lirunex Verdict

Lirunex offers a good selection of investing services and tools, including prop trading, copy trading, and a VPS. The broker’s mobile app is also reliable and stable. Our main complaints are the relatively limited list of assets and the lack of tier-one regulatory oversight for some traders.

Overall, Lirunex is a good fit for beginners and active traders looking to generate an additional revenue stream through copy trading or the broker’s prop trading service.

FAQs

Is Lirunex Legit Or A Scam?

Lirunex is a legitimate forex and CFD brokerage regulated by several agencies, including the CySEC. It provides 100+ instruments on the MetaTrader 4 platform, alongside various extra tools such as copy trading, a bespoke mobile app, prop trading, and a VPS.

Is Lirunex Safe?

Lirunex is a relatively safe broker-dealer. The company is licensed in various countries of operation and has authorization from the Cyprus Securities and Exchange Commission (CySEC) and the Labuan Financial Services Authority (LFSA). Negative balance protection and segregated accounts are also provided.

Is The Lirunex Mobile App Good?

Lirunex offers an intuitive app available for free download from the Apple App Store and Google Play. The app is suitable for traders of all experience levels, particularly beginners. It provides analysis features, graph views, multiple order types, and price notifications.

Can I Practice Trading With Lirunex Before Opening A Live Account?

Lirunex offers a free demo account to new clients. Day traders can practice trading risk-free with access to unlimited virtual funds and flexible leverage up to 1:2000. A key benefit is that there is no time limit so you can spend time finessing a strategy or learning all the functions of the platform.

Does Lirunex Offer A Good Selection Of Trading Instruments?

Lirunex offers an average range of tradable assets, primarily through leveraged CFDs. With that said, the broker does offer opportunities in popular asset classes, including forex, shares, indices, precious metals, energies, and cryptocurrencies.

Top 3 Alternatives to Lirunex

Compare Lirunex with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Lirunex Comparison Table

| Lirunex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 3.3 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Stocks, Indices, Metals, Energies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $25 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC, LFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | 100% Deposit Bonus | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:2000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Lirunex and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Lirunex | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

Lirunex vs Other Brokers

Compare Lirunex with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Lirunex yet, will you be the first to help fellow traders decide if they should trade with Lirunex or not?