Lead Brokers 2026

Due to its abundance of unique uses in the modern world, lead is a well-traded and potentially profitable commodity. This guide covers the key influences on its price, suitable lead trading vehicles, how to develop a strategy, and tips for beginners. Our traders have also ranked the best lead brokers in 2026:

Top Brokers For Trading Lead

These are the 4 best brokers for trading Lead:

Lead Trading Basics

Lead is a heavy, dense metal that is soft and easily shaped. It is a naturally occurring element and has been used for various purposes for thousands of years. The leading miner of lead is China, which, on average, produces over 2 million metric tons of lead per year.

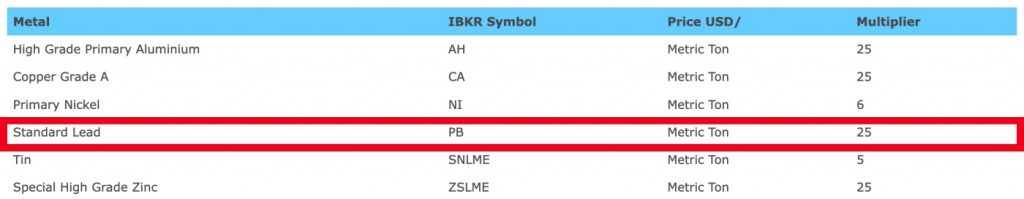

Investment-grade lead is an industry-focused commodity that is traded primarily on the London Metal Exchange (LME) and Chicago Mercantile Exchange (CME).

Investors trade ingots that are over 99.9% pure, due to a thorough refining process. A number of top lead brokers also offer derivatives on the metal, including CFDs.

Use Cases

Several key examples show why lead is an in-demand metal across several industries:

- Lead is the main component of acid-based batteries, which are commonly used in vehicles and backup power supplies. With an increasing market for hybrid or fully electric vehicles, this industry is one of the major consumers of this metal. Lead traders should pay close attention to the growth of the electric vehicle market and its leading proponents, such as Tesla.

- Lead is also used in the production of ammunition and hunting gear, where its weight and density make it an ideal material for bullets. As a result, the price of lead can rise or fall during major conflicts, such as the Russia-Ukraine war.

- In the medical and nuclear industries, lead is used for radiation shielding as it effectively blocks harmful rays. The construction and roofing industries also require this metal, where its malleability and durability make it an ideal component for pipes and roofing materials.

Live Price Chart

Lead Price Determinants

When establishing a lead trading strategy, investors will want to keep in mind the key factors and economics that influence its price and market value:

Energy Costs

While producing lead requires less energy than other commodities such as aluminium, the process of mining, smelting and refining still requires a substantial amount of power. The cost of recycling lead will also be affected by energy costs.

During periods of elevated energy prices or high energy demand, the cost to produce commercially viable lead will be passed on to buyers.

Automotive Industry

The biggest market for lead is in the automotive industry. Whether used for standard car batteries or to power hybrid or fully electric drivetrains, lead batteries are an in-demand resource as the automotive industry transitions from fossil fuels.

However, lead faces competitors such as hydrogen fuel cells and lithium-ion batteries which are threatening to reduce demand for lead trading in the medium to long term.

Regulations

High and continuous lead exposure can lead to significant health issues. In addition, lead is toxic to plants and animals and the refining process can produce harmful fumes.

These factors mean that new regulations are beginning to be imposed on lead, especially in China, which produces as much as 50% of the global lead output. Any additional restrictions may have a significant impact on lead’s future trading price.

Supply & Trade

The supply of lead has been historically stable, with mining and recycling producing consistent output that matches demand.

However, with much of the world’s lead supply coming from China, there is potential for global trade to break down due to geopolitical factors or changes in import and export taxes.

Benefits Of Lead Trading

- In-Demand Commodity – With a range of applications from batteries to construction, lead is a commodity with consistent, high demand. This means that traders can bank on contracts such as options and futures being purchased by genuine buyers.

- Range Of Instruments – With futures, options, CFDs, stocks and ETFs all available to speculate on lead prices, investors have plenty of choices when it comes to trading instruments.

- Stability – Lead has historically been a stable asset in the long term due to its regular supply and high demand. Lead instruments such as stocks and ETFs can provide diversification to a portfolio in times of economic volatility.

Risks Of Lead Trading

- Competition – The primary industry for lead is the automotive sector. Despite short-term demand increasing as new vehicles increasingly rely on electric batteries for power, competing technologies such as lithium-ion batteries and hydrogen may displace lead in the long term.

- Ethical Concerns – There are humanitarian and environmental issues to consider when investing in lead. The process of refining lead can be harmful to the environment, while workers in lead industries with a high risk of lead exposure can face serious health problems such as hearing loss, neurological damage, and reproductive problems.

- Low Returns – Lead has a low return on investment compared to other metals and investment options, making it a less attractive choice for those looking for the highest returns.

How To Trade Lead

Create A Trading Strategy

To create a viable lead trading strategy, investors must first consider several factors. These are the time frame of their trade, the purpose of their trade, their trading capital/margin and their risk tolerance.

There are many lead trading strategies available including scalping, trading the news, patterns trading, fundamental investing and hedging.

Choose A Suitable Instrument

Some instruments will be more compatible with lead trading strategies than others. As a result, it is important to find a product that aligns with your chosen approach.

For example, investors that want to trade based on the long-term fundamentals of lead should not use CFDs. This is because holding a CFD long-term will rack up significant swap fees and may even be closed out of a trade due to short-term volatility.

Lead investors can typically choose from futures, options, CFDs, ETFs and stocks when deciding on their preferred trading vehicle.

Find A Broker

Choosing lead brokers can be difficult due to the number of trading firms out there. Consider the following comparison factors:

- Low lead trading fees, commissions and spreads

- Support for a range of fast, low-cost payment methods such as PayPal

- Regulation from a reputable body such as the FCA or CFTC

- A knowledgeable and accessible customer service team available 24/5

- Support for some of the world’s leading trading platforms, such as MetaTrader 4, MetaTrader 5, or TradingView

Note that fees for trading lead vary depending on the type of investment and the broker or trading platform used. However, spreads may be higher than more popular commodities such as gold and silver.

Decide On Your Trade

Investors should ensure they have done a high level of due diligence before opening any position, with extra care when trading leveraged and derivative products.

We recommend setting stop loss and take profit levels prior to opening a position. This ensures you do not become influenced by emotion in a successful trade or lose more than your personal risk tolerance allows in an unsuccessful investment.

Open Your Position

Find your selected lead asset in your broker’s trading platform and open your trade.

When trading many lead products, you can either use a market order to open a position at the current price level, or a limit order to create your position when a specific price level is reached.

Close Your Position

If your lead trading position is not closed automatically, monitor the market using tools such as price alerts to look for a good place to exit your trade.

To ensure that you do not have to take delivery of large quantities of lead, selling on your position before expiry is key in futures trading.

Further Considerations

As outlined above, there are additional considerations when trading lead. These factors may make ethically oriented investors reconsider lead trading and opt for a less harmful commodity such as aluminium or wheat.

Namely, these are the environmental and humanitarian implications of investing in this commodity. These can be summarized into three key points:

Second-Hand Risks

Lead exposure can cause serious health problems, particularly in children and pregnant women. It can cause damage to the nervous system, brain, and red blood cells, leading to problems such as learning difficulties, behavioural issues, and decreased IQ.

Environmental Risks

Lead is toxic to plants and animals, and pollution can contaminate soil and water, which can enter the food chain and impact wildlife and human health.

Manufacturing Dangers

Workers in industries such as construction, painting, and battery production are at a high risk of lead exposure, which can lead to serious health problems such as hearing loss, neurological damage, and reproductive problems.

Trading Hours

The trading hours for lead depend on the specific instrument.

Lead futures trading hours can extend as long as 18 hours per day on the LME, while CFDs are usually available to trade 24/5.

Final Word On Trading Lead

With several advantages, drawbacks and ethical considerations, lead trading is an intriguing form of investment. With increasing demand from the automotive industry to create batteries and a stable supply, the forecasted lead trading price promises to provide plenty of trading opportunities. The environmental concerns associated with lead may cause carmakers to move away from the metal in favour of hydrogen or lithium-ion technology, which creates further trading opportunities.

Use our ranking of the best lead brokers to start trading online.

FAQs

How Do I Trade Lead?

You will need to sign up with brokers that offer lead trading, open a live account, and make a deposit. You can then open your broker’s platform, select lead from the list of available assets and open a trade. You can go long or short on lead with derivatives like CFDs, futures and options.

What Is The Lead Market Outlook?

There is an increased demand for lead acid batteries in the short term. However, this may transition into lesser demand for the metal in the long term as manufacturers move away from the toxic chemical in favour of more sustainable solutions. This will impact lead trading strategies.

What Is The Lead Trading Price?

Investors can view the current lead trading price through free market tracking solutions like TradingView or via their broker’s trading platform. Alternatively, our lead trading guide contains a live price chart.

Which Are The Best Lead Brokers?

Among the top-rated lead brokers are Interactive Brokers and eToro. These firms offer a range of trading vehicles with low fees, user-friendly tools, and robust regulatory oversight.