JustMarkets Review 2025

See the Top 3 Alternatives in your location.

Awards

- Best Broker Africa 2023 - UFAwards

- Best Broker In Asia 2022 - UFAwards

Pros

- Tight spreads from 0 pips

- Multiple accounts to suit different strategies and experience levels

- Trustworthy and regulated by CySEC

Cons

- Non-forex asset list is light with just 65 stocks plus a handful of indices and commodities

- Limited availability with clients not accepted from the US, UK, Japan, Germany and other countries

JustMarkets Review

JustMarkets, previously JustForex, is a retail FX and CFD broker offering trading opportunities on the MT4 and MT5 trading platforms. The online brokerage caters to all trading styles, including hedging and scalping. This JustMarkets review covers spreads, leverage, account types, and bonuses. Find out whether you should open a real account with JustMarkets.

Company Details

JustMarkets was established in 2012 and is based in Seychelles. The company previously operated under the JustForex brand.

The group functions globally via several entities including Just Global Markets Ltd, JustMarkets Ltd, and Just Global Markets (MU) Limited with varying regulatory oversight, which we discuss below. Nonetheless, the mission of the corporation has remained the same; to generate a convenient and transparent trading environment so individuals can reach their full investment potential.

The broker serves millions of clients from 197+ countries, with a new profile opened every eight seconds. It is one of the most popular brokers in Asia. However, Just Global Markets Ltd does not accept traders from the United States, Japan, and the UK.

Trading Platforms

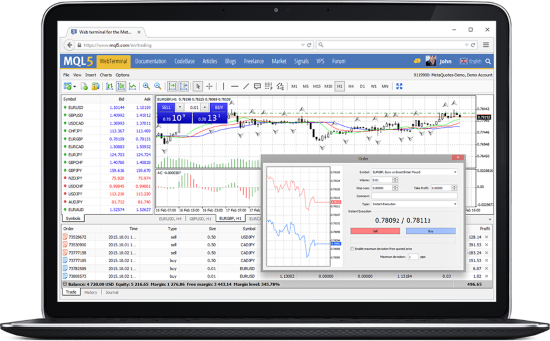

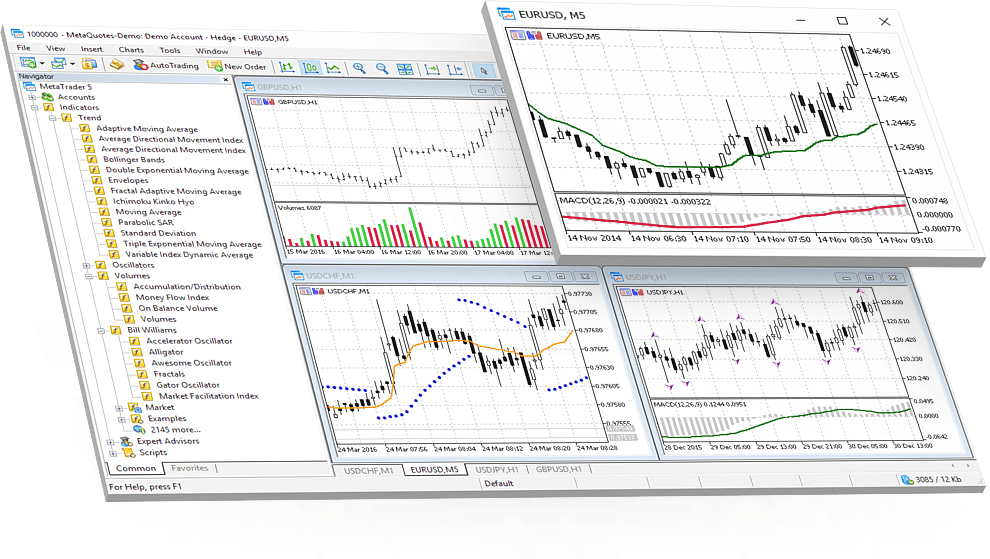

JustMarkets offers the award-winning trading platforms; MetaTrader 4 and MetaTrader 5. The terminals are available for free download to Windows and Mac devices or can also be used as webtrader profiles.

Our experts confirm both platforms are suitable for beginners, though we would recommend using paper trading profiles first to learn the features and functionality.

MetaTrader 4

Clients can trade with the popular MT4 platform, best known for trading on the forex market. The MT4 dashboard supports advanced charting functionality, 30 technical indicators, 9 timeframes, automated trading and other tools for real-time market analysis. The user-friendly platform is great for novice traders.

JustMarkets also recently launched a new MT4 server called JustMarkets-Live2 to expand its technical capacity.

MetaTrader 5

The MT5 platform offers an enhanced trading experience. The platform is better suited to professional traders. The MT5 dashboard supports 38 technical indicators, 44 graphical objects, 21 timeframes, one-click trading, built-in depth of market widgets and an economic calendar. Users can customize and upgrade their dashboard to suit individual needs.

MQL5 Signal Trading also supports social investing on both platforms.

Note, JustMarkets does not allow third-party add-ons.

How To Place A Trade

When we used JustMarkets, the process is relatively similar to place a trade via both MT4 and MT5:

- Register for a JustMarkets live account

- Once verified, fund your profile with an initial deposit

- Download the MT4 or MT5 platform or open the web terminal

- Login with your credentials

- Select an asset using the navigation search bar

- Select the white page icon/add order button to the right of new asset

- Enter your trade parameters including execution mode, trade size, plus stop loss or take profit level

- Review your order

- Select sell or buy to confirm the trade

JustMarkets Assets

JustMarkets offers 170+ global instruments. This is notably less than some alternatives but still provides opportunities on most popular global assets, such as major forex pairs and US equities.

- Stocks – Trade 65+ global company stocks such as Apple, Facebook and Hilton Worldwide

- Cryptocurrencies – Speculate on 14 cryptocurrencies such as Bitcoin, Ethereum and Ripple

- Forex – Trade 65 major, minor, and exotic currency pairs including GBP/USD, EUR/USD and USD/ZAR

- Indices – Trade on 11 of the world’s largest stock indices including NAS100, S&P 500 and FTSE 100

- Commodities – Speculate on the price of three energies and eight precious metals including gold, silver, brent oil and natural gas

Spreads & Fees

When comparing JustMarkets vs other well-known brokers such as Exness, XM, and FBS, our experts ranked the broker’s fees and fixed rates as competitive.

Trading fees vary depending on account type, trading platform and instrument. With the exception of the Raw Spread account, which charges 3 units of the base currency per lot/side, the broker does not charge any commission fees. Spreads apply for all other profiles, though, these are tight and floating.

Spreads on the Standard Cent and Standard accounts start at 0.3 pips, while on the Pro accounts, spreads start at 0.1 pips. Raw Spread account customers enjoy spreads from 0 pips.

Depending on the account type, average live spreads on major forex pairs, such as GBP/USD, were offered at 0.7 pips, while on EUR/USD, we were offered 0.6 pips. Spreads on indices, such as the NASDAQ 100 and Volatility 75 index, were offered at 1.0 point.

Dormant accounts will be liable to a $5 per month fee after 150 days of inactivity. Swap fees also apply for positions held overnight.

Leverage Review

Depending on the account type and your country of residency, JustMarkets offers high leverage up to 1:3000. With that said, EU retail traders can access leverage up to 1:30 while pro traders can access leverage up to 1:300.

This means you can apply various trading strategies without needing to place large deposits. The broker reduces the risk of potential losses by narrowing leverage size as more funds are deposited.

Details on leverage requirements along with a margin calculator are available on the company website.

Mobile App

The broker does not have a proprietary mobile app. However, the MT4 and MT5 mobile apps connect to the JustMarkets server.

While some traders are most comfortable using the desktop versions, the mobile solutions are a great alternative for investors looking to manage trades regardless of location.

When using the mobile apps, traders can manage their accounts, open and close positions, check live global pricing and view charts while on the go. Like the desktop terminal, the mobile app offers the same technical indicators, timeframes and analytical charts.

Download MT4 and MT5 on the App Store (iOS) and Google Play (APK).

Payment Methods

Deposits

Our experts found a good range of international payment methods available to JustMarkets clients:

- Visa/Mastercard – Instant processing

- Bank Wire Transfer – Instant processing

- E-wallets including Perfect Money, AIRTM and Sticpay – Instant processing

- Local wallets including Fasapay – Instant processing

- Local banks such as Malaysia, Indonesia, China, South Africa – Instant processing or up to one working day

- Cryptocurrencies including Bitcoin, BitcoinCash, Ethereum, Ripple, and USD Coin – One to three hour processing time, blockchain network dependant

The minimum deposit requirement varies from $1 to $500 depending on the method. A maximum deposit limit of $10,000 is applicable for the majority of payment methods.

While using JustMarkets, it was good to see all payments are free. Third-party fees may also apply.

Withdrawals

Withdrawal options are the same as deposit methods. All transactions are processed within one to two hours on top of the payment provider’s timelines, which is competitive vs alternative brokers.

There are no fees associated with any withdrawal options.

Minimum withdrawals range from $1 to $500.

JustMarkets Demo Account

JustMarkets offers a demo account, offering up to $5 million in credit. Users can test out strategies in real market situations without risking money. Traders can only open a demo account from the back office homepage.

Once you’ve received your demo account login credentials, you can test the MT4 and MT5 platforms on all account types.

Users are free to open a real live account when they are ready.

Deals & Promotions

JustMarkets is known to offer regular promotions, online trading contests, Christmas rebates and welcome bonuses. For example, traders could win a generous 100% to 200% bonus. Previously, the broker ran a free $30 Xmas welcome bonus with no deposit required. The broker also ran an exclusive promo code for Nigerian clients. Currently, the broker is running a 120% bonus promotion up to $40,000 and a $30 welcome bonus for new customers.

Overall, JustMarkets offers plenty of opportunities to pick up extra trading cash. To participate and claim any bonus, users simply need to sign up on the broker’s Promotions page.

Traders should always read the terms and conditions before claiming.

Regulation & Licensing

JustMarkets is a trading name of the group of companies consisting of:

- Just Global Markets (MU) Limited – regulated by the Financial Services Commission (FSC) in Mauritius under License number GB22200881

- JustMarkets Ltd – authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number 401/21

- Just Global Markets Ltd – regulated by the Seychelles Financial Services Authority (FSA) under Securities Dealer Licence number SD088

The entity in which you are registered depends on your country of residency. Although good to see some retail trader safeguards, including negative balance protection and segregated client funds, the broker is not controlled by top-tier regulators across all subsidiaries. As an offshore broker, you may receive limited support or consumer protection.

Note, Just Global Markets Ltd. does not offer and does not provide services to residents and citizens of certain jurisdictions, including Australia, Canada, the EU and EEA, Japan, the UK and the USA. Refer to the latest licensing information for accepted countries.

Additional Features

When using JustMarkets, clients can access an adequate catalog of educational materials and content. Whilst the information isn’t particularly user-friendly, it is updated with the latest market analysis, daily forecasts and news to support trading decisions. Additionally, the learning center includes access to regular webinars, a forex glossary and educational videos, all of which are useful for new traders.

Occasionally, the broker hosts live and demo contests. Participants don’t have to deposit any money during demo competitions but still gain useful trading experience while having the chance to win prizes. Live forex contests offer a wider range of prizes but require participants to deposit personal capital.

In addition, global traders may qualify for a forex VPS. This allows trading strategies to run 24/7, 365 days a year with no downtime. A VPS can also help reduce exchange communication time between the terminal and JustMarkets servers to less than 1 ms.

A free economic calendar is also available on the broker’s official site.

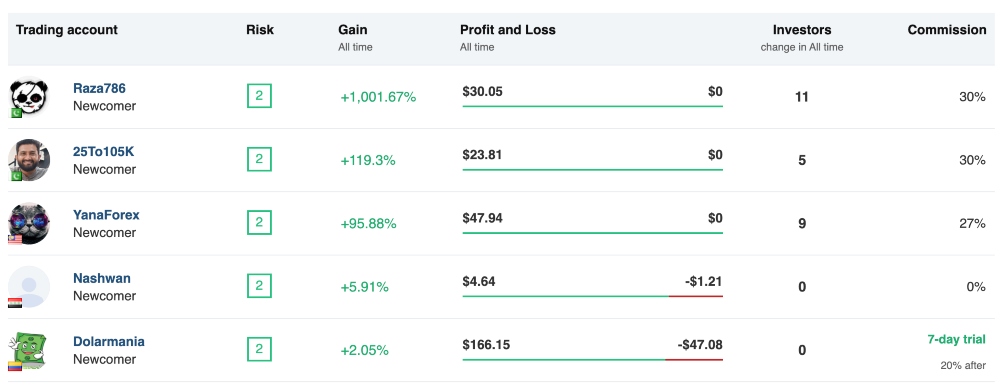

CopyTrade

JustMarkets clients can also access a copy trading service. Copy trading can be an effective way to diversify a portfolio, without needing extensive market knowledge. Commissions are set by individual traders. Remember, profits are not guaranteed and past successes are not necessarily a true indication of future results.

Use our step-by-step guide to get started:

- Create and replenish your Investor Wallet – When using the JustMarkets platform, you can transfer funds to your “Investor Wallet” using an internal transfer if you already have money in one of your JustMarkets accounts.

- Copy a verified investor – Find traders you want to copy and click “Start copying”. Their trades will be duplicated automatically.

- Monitor – Users can copy as many traders as desired to receive an income. Monitor trades through the “Investor area”. You can edit or stop the process at any time.

Account Types

New users have a choice between Standard Cent, Standard, Pro and Raw Spread account options:

- Standard Cent – The Standard Cent account was specially designed for new traders. Offering smaller trade sizes, members can only trade on the MT4 platform. The minimum deposit is $1. Commission-free with spreads from 0.3 pips.

- Standard – The Standard account offers tight spreads from 0.3 pips and no commissions. This account is suitable for all trading strategies and works with both MT4 and MT5 platforms. The minimum deposit is $1.

- Pro – The Pro account is the most popular option. It is designed for experienced and professional traders and offers narrow spreads from 0.1 pips, high leverage and zero commissions. The minimum deposit is $100.

- Raw Spread – The Raw Spread account (upgraded from JustMarket’s ECN Zero account) is the best choice for scalpers. While there is a commission on transactions, spreads are floating from 0 pips. Moreover, this account gives you access to all trading instruments. The minimum deposit is $100.

A swap-free account is also available for Islamic traders. Users can open accounts in a wide range of currencies, including USD, GBP, EUR, IDR, CNY, MYR, KWD, and ZAR.

When opening a JustMarkets live account, ID verification is required and users must pass Know Your Customer (KYC) checks. Once registration is complete, you can login to the back office via the homepage.

Take note of the MetaQuotes user agreement before opening a live account. Terms and conditions can be found on the broker’s website.

Trading Hours

Each market is subject to specific trading hours. Forex, indices, stocks and commodities are typically open 24/5 on Mondays to Fridays. Instrument specific trading hours are available via the JustMarkets website.

Just Markets Customer Support

Responsive customer support is offered in English, Indonesian, Malaysian and Chinese 24 hours a day, 7 days a week. The multilingual support team can deal with most account and technical queries, for example, if you forgot your password, have execution type questions, or come across ‘trade is disabled’ errors. JustMarkets also provides a comprehensive FAQ page.

Contact details:

- Email – support@justmarkets.com

- Live chat – chat log at the bottom of the website

- Messengers – Telegram, WhatsApp, Viber, Skype, Messenger, Line

- Telephone support number – +371 67 881 045 or +44 1418 461237

The broker’s headquarters can be found at Just Global Markets Ltd, Office 10, Floor 2, Vairam Building, Providence Industrial Estate, Providence, Mahe, Seychelles.

Security & Safety

Our experts are confident that the security processes at JustMarkets are legit. All data is transmitted using an SSL secure connection and internal procedures of the company are compliant with the PCI DSS security standard. Additionally, JustMarkets hosts a multilevel system of servers with data backup.

The MetaTrader brand also complies with a high standard of data privacy and client protection. All accounts can be secured with two-factor authentication (2FA) and one-time-passwords (OTPs) for additional peace of mind.

JustMarkets Verdict

JustMarkets is a suitable broker for both beginner and experienced investors. It offers a decent portfolio of trading instruments and competitive spreads from zero pips. The broker also offers the leading MT4 and MT5 platforms across several account tiers. Some may be hesitant to start trading with an offshore broker, however, JustMarkets maintains thorough security measures and receives positive customer reviews and comments.

FAQ

Is JustMarkets A Good Broker?

JustMarkets offers a good range of trading instruments with competitive spreads and low to zero commissions. Both the MT4 and MT5 platforms are available and the firm has strong security processes in place to protect clients. On the downside, global traders do not benefit from robust regulatory oversight.

Is JustMarkets Legit Or A Scam?

JustMarkets follows tight security protocols and offers negative balance protection. Thus, our experts are confident that JustMarkets is not a scam. The EU entity is also regulated by the Cyprus Securities & Exchange Commission (CySEC).

Is JustMarkets Regulated?

Yes, JustMarkets is a regulated broker though consumer protection and accountability varies between global entities. Nonetheless, clients can be assured of negative balance protection and segregated client funds. The brand holds licenses with the CySEC, FSA and FSC.

Does JustMarkets Offer A Demo Account?

Yes, JustMarkets offers a demo account with up to $5 million in virtual credit. To open an account, users must enter basic details such as an email address.

How Much Capital Do I Need To Trade With JustMarkets?

JustMarkets requires a minimum deposit of $1 on Standard Cent and Standard accounts and $100 on Pro and Raw Spread accounts. This makes the brokerage a good option for beginners.

Is JustMarkets Good For Day Trading?

The Raw Spread account from JustMarkets is the best option for day traders. Spreads start from 0 pips with order executions from 0.01 seconds during typical market conditions. The MT5 platform also offers elite analysis tools and a stable interface for active intraday traders.

Best Alternatives to JustMarkets

Compare JustMarkets with the best similar brokers that accept traders from your location.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

JustMarkets Comparison Table

| JustMarkets | World Forex | Interactive Brokers | |

|---|---|---|---|

| Rating | 3.9 | 4 | 4.3 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $1 | $1 | $0 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 |

| Regulators | CySEC, FSA | SVGFSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Bonus | $30 No Deposit Bonus | 100% Deposit Bonus | – |

| Platforms | MT4, MT5 | MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Leverage | 1:3000 | 1:1000 | 1:50 |

| Payment Methods | 11 | 10 | 6 |

| Visit | – | Visit | Visit |

| Review | – | World Forex Review |

Interactive Brokers Review |

Compare Trading Instruments

Compare the markets and instruments offered by JustMarkets and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| JustMarkets | World Forex | Interactive Brokers | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | Yes | No |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | Yes | No |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | Yes | No | Yes |

| Options | No | No | Yes |

| ETFs | No | No | Yes |

| Bonds | No | No | Yes |

| Warrants | No | No | Yes |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

JustMarkets vs Other Brokers

Compare JustMarkets with any other broker by selecting the other broker below.

The most popular JustMarkets comparisons:

Customer Reviews

There are no customer reviews of JustMarkets yet, will you be the first to help fellow traders decide if they should trade with JustMarkets or not?