Best Brokers For IPOs In 2026

Finding the best broker for trading IPOs isn’t just about who lists the most deals. From our extensive tests, we discovered huge differences in how brokers handle allocations, fees, research tools, and platform usability. Some excelled at giving active traders a fair shot at new listings, others stood out when it came to pre-IPO speculation.

Fortunately, we’ve done the leg work – revealing the top IPO brokers with detailed insights from our testing.

Top 2 Brokers For Trading IPOs

Based on our hands-on tests, these brokers stand out if you want reliable access to upcoming and recent IPOs:

Why Are These Brokers The Best For Trading IPOs?

Here’s why we rate these platforms as the top providers for investors looking to trade IPO shares:

- Interactive Brokers is the best IPO broker in 2026 - Interactive Brokers offers an IPO subscription tool right inside its client portal. During testing, we found excellent research integrations, analyst reports, and company filings all tied into IPO listings, making it the most research-rich platform. Execution after shares listed was lightning-fast, with advanced order routing and tight spreads even on volatile launch days.

- TradeUp - TradeUp has a neat ‘one-click IPO subscription’ feature that lets users find and request allocations in dozens of U.S. stock IPOs directly in the app. With predictable, transparent costs and a reliable app during our testing, it’s a good option for fast-paced IPO traders.

How Safe Are The Top IPO Brokers?

Buying into IPOs carries risks as well as opportunities. We reviewed protections and safeguards to see how secure these brokers are for IPO traders:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| TradeUp | ✘ | ✘ | ✔ |

Are The Top IPO Brokers Good For Beginners?

We assessed how beginner-friendly these IPO brokers are, including account setup, education, and ease of accessing IPOs for first-time traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| TradeUp | ✔ | $0.01 | $1 |

Are The Top IPO Brokers Good For Experienced Traders?

IPO investing is not just for beginners - here’s how the leading IPO brokers cater to more seasoned traders too:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| TradeUp | - | ✘ | ✘ | ✘ | - | ✘ | ✔ |

Compare Detailed Ratings Of The Best IPO Brokers

See how the top IPO trading platforms performed in each key testing area:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| TradeUp |

Compare Trading Fees On IPOs

Costs can cut into IPO profits. Compare fees and charges across our top-rated IPO brokers:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| TradeUp | ✘ | $0 |

How Popular Are The Top IPO Trading Platforms?

With IPO trading surging in popularity, we measured user activity at our leading providers:

| Broker | Popularity |

|---|---|

| Interactive Brokers |

Why Use Interactive Brokers For Trading IPOs?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Use TradeUp For Trading IPOs?

"TradeUp is best suited to budget-conscious day traders looking to trade U.S. and global markets with zero commissions on a user-friendly mobile app. Its more than 250 Chinese American Depositary Receipts (ADRs), including Alibaba Group (BABA), also make it suitable for trading Chinese equities."

Christian Harris, Reviewer

TradeUp Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Bonds |

| Regulator | SEC, FINRA |

| Platforms | Desktop, Web, Mobile |

| Minimum Deposit | $0.01 |

| Minimum Trade | $1 |

| Account Currencies | USD, EUR, GBP |

Pros

- TradeUp offers commission-free trading on US stocks and ETFs, and support for fractional shares lets you buy portions of a share for as little as $5.This makes it a cost-effective choice for active day traders who want to minimize trading expenses.

- TradeUp runs an integrated and intuitive financial calendar that helps you track earnings, dividends, and IPOs relevant to your watchlist, enabling you to stay ahead of market-moving events.

- TradeUp’s platforms work smoothly across multiple devices based on our tests, including mobile apps for iOS and Android, a desktop app for Windows and Mac, and a web-based platform. This allows active traders to switch between devices without losing continuity, whether you’re at home or on the go.

Cons

- The platform's technical indicators have limited customization options from our use. On both mobile and web versions, you can't layer multiple indicators on the same chart simultaneously, which restricts more sophisticated chart analysis.

- TradeUp's educational resources aren't kept updated, and were over 6 months old in our latest tests. While there are articles and tutorials aimed at newcomers, the content is somewhat limited and does not cover more advanced trading strategies or deeper topics.

- TradeUp does not support popular third-party platforms like TradingView or cTrader, so traders who rely on those for advanced charting, automation, or community features won't find that flexibility.

How DayTrading.com Chose The Top IPO Brokers

We started by hand-picking only regulated brokers that provide access to IPO stocks for trading. We then carefully evaluated and documented their specific IPO offering by following these steps:

- Account setup: We opened or used existing live accounts with each broker and went through the verification and funding steps. It gave us a feel for how quick and painless (or not) the onboarding process is.

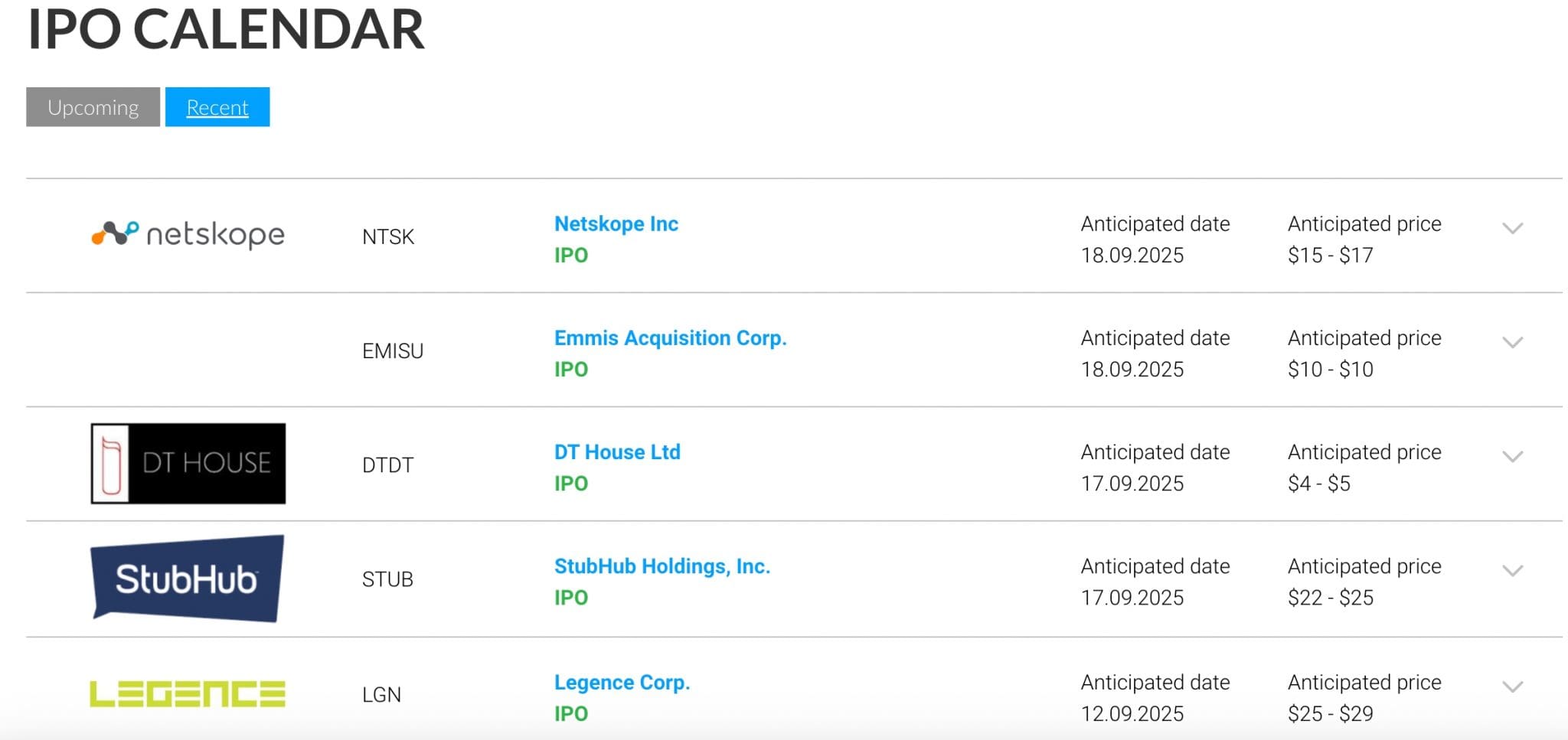

- IPO discovery: We checked where each platform lists upcoming IPOs. Some have dedicated calendars and alerts (which we found far easier to navigate), while others buried the details in their research sections.

- Application process: We submitted test requests for allocations at some. At others, we focused more on grey-market trades linked to IPOs. Where available, we tried the IPO subscription tool in the client portal to see how accessible it really was.

- Mobile vs. desktop: Since many active traders now rely on their phones, we ran through the whole process on mobile apps too. In some cases, IPO-related access was smoother on mobile than on desktop.

- Post-IPO execution: Once the shares listed, we placed trades across the brokers to check execution speed, spreads, and platform stability under the extra IPO hype.

Running these tests showed us where the friction points are. For example, with some, the tech is powerful, but in practice, we found limits on which IPOs we could trade. In other cases, the IPO calendar was helpful, though allocations were hit-and-miss. Elsewhere, other providers were great when it came to grey market and early speculation, but didn’t deliver consistent primary allocations.

Finally, after recording and evaluating each shortlisted broker, we sorted providers on their overall ratings – balancing access to IPOs with the full trading package.

What To Look For In A Broker With Access To Initial Public Offerings

You can boil the key decision making factors down to these five things when picking a broker to trade IPO stocks:

- Primary market access: If you can only buy once the stock lists, that’s not the same as having a seat at the table before the bell rings.

- Fair allocation rules: Brokers must be open about how shares get distributed and any minimum investment requirements.

- Fees and commissions: Platforms shouldn’t sneak in hidden charges specific to IPOs, as these can seriously erode the margins of short-term traders.

- Research and education: An IPO calendar, a clean prospectus library, or analyst insights can make or break your prep.

- Platform usability: It should be easy from beginners up to navigate the IPO portal, apply, and track allocations on both desktop and mobile.

Risks Of Trading IPOs With The Wrong Broker

One thing we learned quickly during testing is that choosing the wrong broker for IPOs isn’t just inconvenient – it can cost you money or opportunity. Across the firms we evaluated, the risks varied depending on the broker’s approach to IPOs and your trading style.

- Allocation risk: Even if a broker advertises IPO access, you may not get your requested shares. In our tests, two brokers sometimes partially allocated orders, leaving us underexposed to high-demand deals.

- Hidden fees or charges: Some brokers have small participation or processing fees tied to IPOs. One firm we evaluated handled this well with no surprise costs, but another occasionally had higher minimums or conditions depending on the market. Testing each step helped us avoid unexpected charges.

- Limited access by region: A couple of providers we evaluated showed us that not all IPOs are available to all clients. You might think you’re set up, but geographic restrictions or regulatory rules can block access entirely.

- Volatility exposure: IPOs are inherently volatile, and if you’re only speculating via grey-market or post-listing trading, you need to be aware that price swings can be fast and unforgiving. This can really appeal to day traders, but our tests highlighted how quickly spreads can widen on launch day.

- Platform usability under pressure: A laggy app or unclear process can make you miss allocations or misprice trades. That’s why testing mobile and desktop platforms was critical for us – we wanted to see how each broker handles high-demand moments.

The main lesson I came away with is this: knowing the broker’s IPO limitations, fees, and platform quirks is just as important as picking the right stock.I avoid surprises by checking allocation rules, fees, and platform reliability before diving into any deal.