IFX Brokers Review 2024

Pros

- IFX Brokers offers 4 account base currencies, ZAR, USD, GBP and EUR, making the broker easily accessible for many clients

- I'm pleased to see both the MT4 and MT5 platforms available for clients, which will serve various strategies and experience levels

- I appreciate the low beginner-friendly minimum deposits starting from $10, plus a Cent account for those looking to trade in smaller volumes

Cons

- IFX Brokers is regulated by the South African FSCA, which is not a top-tier authority (though not the weakest)

- The lack of stock CFDs is also disappointing for me and is a major drawback compared to most competitors

- The total selection of 100+ assets is not competitive and will likely not appeal to most experienced investors

IFX Brokers Review

IFX Brokers is popular in South Africa with the MetaTrader 4 and MetaTrader 5 platforms and over 100 instruments. The broker offers five live account types and various payment methods. This IFX Brokers review will uncover minimum deposits, sign-up bonuses, spreads and commissions, withdrawal times, and more.

Key Takeaways

- Welcome deposit bonuses are regularly offered

- Beginners can get started with a $10 minimum deposit

- There is a limited choice of account currencies and slower withdrawals for global traders

- IFX Brokers is the best fit for traders from South Africa owing to the FSCA oversight and ZAR account

Company History & Overview

International FX Brokers Holdings (PTY) Ltd was established in 2018. The company is based in South Africa with headquarters in Jeffreys Bay, Eastern Cape.

The firm’s mission is to provide a one-stop trading experience for retail investors. With access to a range of markets, straight-through processing, and two of the most popular trading apps, IFX Brokers is well-positioned to meet the needs of novice and seasoned traders.

IFX Brokers is licensed and regulated by the South African regulator, the Financial Sector Conduct Authority (FSCA).

Trading Platforms

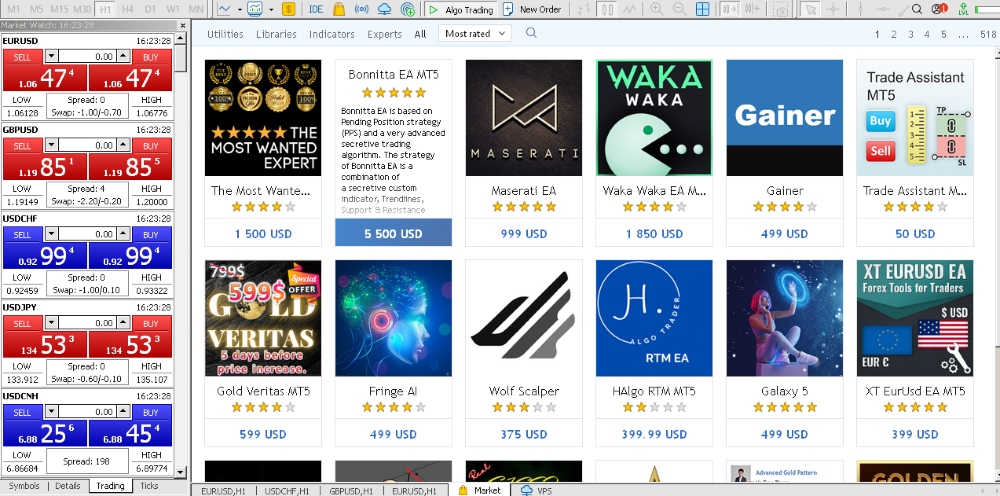

IFX Brokers offers two downloadable third-party platforms; MetaTrader 4 (MT4) and Meta Trader 5 (MT5).

MT4 and MT5 are recognized for their technical analysis tools, customization, automation capabilities, and mobile app support. Both platforms can be downloaded directly from the IFX Brokers website or opened from within the client portal.

Features include:

- One-click trading

- Instant and pending orders

- Signals and copy trading tools

- Charts and indicators including Bollinger Bands, Moving Averages, and Candlesticks

MetaTrader 5 comes with more features than MetaTrader 4, lending itself to experienced traders. Users benefit from more technical indicators, graphical objects, timeframes, pending order types, order fill policies, and more. With that said, the capabilities of both platforms can be enhanced through plugins and code, written in the MQL4 and MQL5 programming languages.

How To Place A Trade

Placing a trade on MetaTrader 4 and MetaTrader 5 is similar:

- Choose which instrument you would like to trade from the Market Watch widget

- Click on the ‘New Order’ button at the top of the trading terminal

- This will open a window that shows the parameters of the trade

- Choose the type of order (market execution or pending order)

- Enter the trade volume in lots

- Set a stop loss and/or take profit level (optional)

- Choose your fill policy (Fill or Kill)

- Click either ‘Sell’ or ‘Buy’

Markets & Assets

IFX Brokers offers a modest range of assets spanning currencies, energies, metals, indices, and cryptos. On the downside, stocks are not provided.

- Indices – 11 indices including the FTSE 100, S&P 500, NASDAQ 100 and Euro Stoxx 50

- Cryptocurrencies – 5 cryptos vs USD including BTC/USD, ETH/USD, and XRP/USD

- Forex – 70+ major, minor, and exotic currency pairs including GBP/USD, AUD/CAD, EUR/NZD, and USD/CHF

- Commodities – 12 energies and precious metals including Gold (Spot), US Crude (Spot), and Silver (Spot)

Trades are executed with pricing from multiple liquidity providers and no broker intervention. Execution speeds start at a competitive 2.5 milliseconds.

IFX Brokers Fees

IFX Brokers is fairly average in terms of trading fees. Floating spreads are available but traders will need a higher-tier account to benefit from truly competitive fees.

- IFX Cent – Spreads from 1.6 pips

- IFX Premium – Spreads from 1 pip

- IFX Islamic – Spreads from 1.3 pips

- IFX Standard – Spreads from 1.3 pips

- IFX VIP – Spreads from 0.5 pips + $6 commission per lot

Swap fees apply for positions held overnight, except for the IFX Islamic profile. Live accounts with no trading activity for over 60 days will also be liable for a $10 inactivity fee.

Leverage

IFX Brokers offers relatively high leverage up to 1:500, which is comparable with other brands that are popular in the region, such as Vantage. IFX Cent account holders can also access leverage up to 1:1000.

Margin call and stop-out levels vary depending on the account:

- IFX Cent – 50% margin call, 30% stop-out level

- IFX Premium – 60% margin call, 20% stop-out level

- IFX Islamic – 50% margin call, 30% stop-out level

- IFX Standard – 50% margin call, 30% stop-out level

- IFX VIP – 40% margin call, 10% stop-out level

Mobile App

Both MetaTrader 4 and MetaTrader 5 are available as free mobile apps, though they are currently only available to download on Google Play due to Apple App Store restrictions.

Both applications provide extensive trading capabilities, including interactive charts, indicators, and the ability to open and close trades in a few clicks. One of the most useful tools is the ability to set price notifications so you can stay in the loop with market changes while away from your computer.

Payment Methods

IFX brokers offer several payment options, most of which are fee-free and offer instant processing. Bank wire transfers are the only exception with a 2.5% fee and up to 48-hour processing time.

Deposits

- Skrill – USD or ZAR

- Neteller – USD or ZAR

- Payfast – ZAR only

- Ozow – ZAR only

- Bank Wire Transfer – ZAR only

- Visa & Mastercard Credit/Debit Card – ZAR only

- Cryptocurrency (BTC, ETH, USDT, XRP) – USD only

The broker also offers a central ‘IFX Wallet’. Money can be transferred into the online wallet and then used to deposit funds into live accounts in real time.

Withdrawals

Withdrawal times are the quickest for South African clients with funds processed within two to four hours. International clients should allow up to five working days for the money to reach a registered bank account. This is a downside for global traders with some alternatives offering same-day payments.

How To Request A Withdrawal

- Log in to the myIFXBrokers client area

- Select the ‘Withdrawal’ icon from the menu

- You will need to add your bank account details for deposit and withdrawal verification

- Once verified, enter the amount you wish to withdraw

- Click ‘Request Withdrawal’

Note, IFX Brokers processes withdrawals during business hours only.

Demo Account

IFX Brokers offers demo accounts on the MetaTrader 4 and MetaTrader 5 platforms. You can learn how to use the platform features and test strategies before implementing them with real funds.

The demo account is available with unlimited virtual funds and leverage up to 1:500. With that said, paper trading accounts will be deleted if the profile has been inactive for more than 14 days.

How To Set Up A Demo Account

When we used IFX Brokers, we could register for a demo account in less than a minute.

You will need to register for an IFX Brokers account before requesting a paper trading profile via the myIFXBrokers client portal. Click ‘Trading Accounts’ from the side menu and then ‘Open Account’. Here you can select a platform, enter the amount of virtual funds and choose your trading leverage.

Bonuses & Promotions

At the time of writing, IFX Brokers did not offer any financial incentives to new customers, including a no-deposit bonus.

However, the broker has offered welcome bonuses to clients in the past. This includes an equity bonus that cannot be withdrawn from a live account. Instead, it can be used to trade and make a profit (which can then be withdrawn).

IFX Brokers Regulation

IFX Brokers is the trading name of IFX Brokers Holdings (PTY) Ltd. The company is licensed and regulated by the Financial Sector Conduct Authority of South Africa, FSP number 48021. The issuance of CFDs is regulated by the Financial Markets Act of 2012.

Although the FSCA is not as well established as the UK Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC), IFX Brokers does offer segregated client funds with daily third-party auditing, plus negative balance protection. The broker also holds Professional Indemnity and Fidelity Insurance.

Additional Features

Education

IFX Brokers offers a few training materials and resources worth mentioning. This includes keyword definitions, glossaries, and general market overviews. However, there are limited in-depth resources that will help beginners get up to speed on popular financial markets and trading strategies.

Having said that, IFX Brokers does have a sister site; ifxacademy.com that provides online trading courses for beginners, intermediates, and advanced traders. These come with a comprehensive study guide alongside interactive assignments and strategy explanations. The educational resources are complimentary for all account holders with a balance of $250 or more.

A free economic calendar is also available to traders.

Account Types

IFX Brokers offers five live accounts: IFX Standard, IFX Premium, IFX VIP, IFX Islamic, and IFX Cent.

Each account gives you access to all the tradable instruments, a minimum trade size of 0.01 lots, one-click trading, and the same server location (London).

IFX Cent is only available with MT5 and supports USD as its base currency. All other profiles have access to both the MT4 and MT5 terminals plus the choice of four base currencies (ZAR, USD, GBP, and EUR).

IFX Standard

- Swap fees

- Commission-free

- $10 minimum deposit

- Spreads from 1.3 pips

IFX Premium

- Swap fees

- Commission-free

- Spreads from 1 pip

- $250 minimum deposit

IFX VIP

- Swap fees

- Spreads from 0.5 pips

- $1000 minimum deposit

- $6 commission fee per lot

IFX Islamic

- No swap fees

- Commission-free

- $10 minimum deposit

- Spreads from 1.3 pips

IFX Cent

- Commission-free

- $10 minimum deposit

- Spreads from 1.6 pips

- Can have/not have swap fees

How To Create An IFX Brokers Account

- Complete the online registration form and ensure the ‘Individual’ account is selected

- Verify your account registration through the confirmation email

- From the dashboard of the client area, select ‘Open Account’

Note, customer onboarding details will need to be provided before a live account can be used. This includes providing proof of identity and address, such as a passport. Details of your previous trading experience must also be shared.

Trading Hours

IFX Brokers is not forthcoming about its opening hours, however, these will typically vary depending on the instrument being traded. For example, indices can only be traded when their respective markets are open, with the S&P 500 available between 9:30 AM and 4:30 PM (EST). Cryptocurrencies, on the other hand, are tradable 24/7.

Customer Support

Each client is assigned an account manager that can be contacted from the myIFXBrokers client portal using a ticket-based system. This will be welcomed by many beginners looking for support as they get started. On the downside, the broker does not offer live chat support.

Contact details:

- Telephone – +27 87 944 72 73

- Email Address – support@ifxbrokers.com

- Postal Address – 79 Da Gama Road, Jeffreys Bay, South Africa

While using IFX Brokers, our experts were pleased to find a comprehensive FAQ portal with questions and answers in six popular categories, including account opening, deposits and withdrawals, plus bonuses.

Security & Safety

Customer data is protected via an SSL certificate and stored on a secure server. The MetaTrader terminals are also renowned for their security features, operating with RSA digital signatures and two-factor authentication (2FA) upon sign-in.

IFX Brokers Verdict

IFX Brokers offers 100+ products on the popular MT4 and MT5 platforms. Retail traders also benefit from fast trade executions via the STP model, a choice of account types with competitive fees, and high leverage up to 1:1000.

However, the list of assets that aren’t forex pairs is limited. There is also no stock trading. The introduction of additional tools, faster withdrawals for global traders, plus a live chat channel for prompt support, would also improve its rating.

Overall, IFX Brokers is the best option for investors in South Africa due to the ZAR trading account and FSCA regulatory oversight.

FAQs

Is IFX Brokers Legit & Trustworthy?

IFX Brokers is regulated by South Africa’s Financial Sector Conduct Authority (FSCA). The broker also offers negative balance protection and segregates client funds. In addition, the company holds Professional Indemnity and Fidelity Insurance. As a result, IFX Brokers is a secure broker, especially for traders in South Africa.

What Is IFX Brokers?

IFX Brokers is a South African broker-dealer. It offers 100+ assets with an STP trading model, meaning prices are sourced directly from major liquidity providers with no broker intervention. Clients can trade leveraged CFDs on forex, indices, commodities, and cryptocurrencies using desktop and mobile trading platforms.

Does IFX Brokers Offer A Stable Trading Platform?

IFX Brokers offers the popular and reliable MetaTrader 4 and MetaTrader 5 platforms. Both terminals have a good reputation and can be operated from desktop and mobile devices. The broker’s customer support team are also on-hand should you encounter technical issues with either platform.

How Can I Make A Deposit To IFX Brokers?

IFX Brokers supports multiple payment methods, including Visa & Mastercard bank cards, cryptocurrency, Neteller, Skrill, and Payfast. There are no commission fees and most methods offer instant account funding.

To make a deposit, login to the myIFXBrokers client portal and navigate to the cashier portal. Choose from the list of payment methods, enter the deposit value ($10 minimum) and follow the on-screen instructions to confirm the payment.

How Do I Sign Up For A Live Account With IFX Brokers?

Complete the simple online registration form, including submitting basic contact details such as an email address. After verifying your email, log in to the myIFXBrokers client portal and register for a live account.

Note, proof of identity and residency is required before trading and deposits are permitted.

Top 3 Alternatives to IFX Brokers

Compare IFX Brokers with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

IFX Brokers Comparison Table

| IFX Brokers | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 3.4 |

| Markets | CFDs, Forex, Indices, Commodities, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $10 | $0 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | FSCA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | VFSC |

| Bonus | – | – | – | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:1000 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 9 | 6 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by IFX Brokers and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| IFX Brokers | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

IFX Brokers vs Other Brokers

Compare IFX Brokers with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of IFX Brokers yet, will you be the first to help fellow traders decide if they should trade with IFX Brokers or not?