HQBroker Review 2024

HQBroker Review

HQBroker is an unregulated online forex provider offering advanced trading solutions. Traders of all levels are catered for across five live accounts and the MT4 and MT5 platforms. Our HQBroker review details the instruments available, the login process and market spreads.

HQBroker Headlines

HQBroker was established in 2017 and has since amassed an international client base from its Hong Kong headquarters. Despite its growth, the broker is currently unregulated. The company is owned and operated by Capzone Invest Limited which is based in the Marshall Islands.

Trading Platforms

MetaTrader 4

The industry-standard MT4 solution is available upon login. Highlights of the popular forex trading platform include:

- One-click trading

- Advanced frame view

- Extensive historical data

- Advanced stop out levels

- Automated trading through APIs

MetaTrader 5

HQBroker also offers the MT5 platform which is more suited to experienced traders. Benefits of the MT5 terminal include:

- 21-time frames

- One-click trading

- Economic news headlines

- Price alerts and trailing stops

- Integrated trading statements

- Historical data and strategy tester

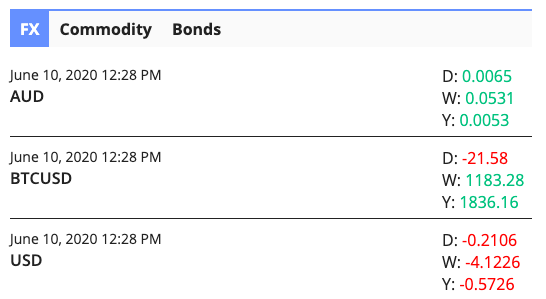

Markets

HQBroker offers 200+ financial instruments across:

- 50+ currencies, including major USD pairs and a range of minor and emerging pairs

- Single stock shares in top global companies, including Amazon and Alibaba

- Stock indices including the FTSE, Dow Jones and NASDAQ

- Metals and energies, including gold, silver and oil

Trading Fees

HQBroker offers reasonable floating spreads with its Starter and Silver accounts. However, for fixed spreads under 1 pip on majors forex pairs, you’ll need to open a Gold, Platinum or Investor account. This will require a minimum $20,000 investment which may be too much for some beginners. Overall though, the broker is fairly competitive when it comes to trading fees.

Leverage

HQBroker offers leverage up to 1:400. This is high and means traders can take serious positions with small capital outlay. This is good news for those with low starting deposits, but it also brings with it the risk of serious losses. European regulated brokers, for example, cap leverage rates at 1:30 to protect traders.

Mobile Apps

HQBroker offers mobile trading on all of its accounts. Both MT4 and MT5 are available for download to mobile from either Apple or Android app stores. Clients can make deposits, request withdrawals and monitor trades from their mobile devices. The apps also allow for risk alerts to be set up and for automated trading programs.

Payments

Deposits

The minimum deposit at HQBroker is $250. Payment methods include:

- Cryptos such as Bitcoin Cash, Litecoin and Ethereum

- Credit and debit cards

- Bank wire transfer

- MPWP

Withdrawals

Withdrawals can be made via wire transfer or credit/debit card. A $50 minimum withdrawal rate applies to wire transfers and transactions take 3-15 days to process, which is longer than most brokers. There is no minimum withdrawal with credit and debit cards, and transactions are processed within 7 working days.

Unfortunately, a number of customer reviews highlight difficulty when it comes to withdrawing profits. This is a serious concern and may indicate a potential scam.

Demo Account

Another drawback to HQBrokers is the lack of demo account. Practice accounts, funded with virtual cash, are a great way for new clients to explore trading platforms and test the broker’s services. The absence of one may deter prospective users.

Bonuses

At the time of writing, HQBroker does not offer any deposit bonuses or promotions. It is common practice among providers not to offer welcome deals however this is subject to change. Traders should check the broker’s website before opening an account.

Licensing

HQBroker is not regulated by a trusted financial authority. Users should proceed with caution when signing up to unregulated brokers as they won’t get the same robust protections afforded by the likes of the FCA.

Despite an office in Hong Kong, HQBroker is not authorised to provide financial services in Hong Kong, France, or the USA.

Additional Features

The broker’s website hosts a number of free resources, including educational videos, ebooks, and news updates. Videos cover topics such as market strategies, trading psychology, and price analysis. HQBroker also offers MT4 tutorials and an economic calendar.

Live Accounts

HQBroker offers five account types to suit different traders. Each option comes with an account manager, full access to instruments and a minimum 0.01 position size. As you move up the account tiers, you benefit from daily market analysis, around the clock support, and fixed, tight spreads.

- Starter – $250 minimum deposit

- Silver – $5,000 minimum deposit

- Golden – $20,000 minimum deposit

- Platinum – $50,000 minimum deposit

- Investor – $100,000 minimum deposit

Benefits

Reasons to sign up with HQBroker include:

- Clients from Canada accepted

- Multiple payment solutions

- Free education resources

- Tiered account levels

- MT4 & MT5 trading

- Low fixed spreads

Drawbacks

Unfortunately this review found several reasons not to open an account with HQBroker:

- Unregulated

- No demo account

- Limited live chat support

- No negative balance protection

Trading Hours

HQBroker follows standard global trading hours. Hours may vary slightly depending on the instrument, details can be found on the broker’s website. Forex trading runs from Monday 00:00 to Friday 23:00 GMT +2.

Customer Support

HQBroker offers 24/5 telephone support in 10 different countries. Trader can also reach the customer service team via:

- Email – support@hqbroker.com

- Email request form – found on the contact us page

- Live chat – found in the top left-hand side of the broker’s webpage

- Telephone call back – found in the top left-hand side of the broker’s webpage

Unfortunately the live chat service didn’t meet expectations upon testing – wait times were long and operators were unhelpful.

Trader Safety

The MetaTrader platforms comes with premium security features including 128-bit encryption and 2FA protocols. Despite this, we would recommend caution before investing money with HQBrokers due to poor customer reviews and the lack of regulation.

HQBroker Verdict

The company offers a straightforward route to forex trading with access to both the MT4 and MT5 platforms. But without accreditation from a reputable regulatory body, plus the lack of a demo account and $250 minimum deposit, HQBroker is not the best option on the market.

Top 3 Alternatives to HQBroker

Compare HQBroker with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

HQBroker Comparison Table

| HQBroker | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 1.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, stocks, commodities | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $250 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | – | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:400 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by HQBroker and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| HQBroker | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

HQBroker vs Other Brokers

Compare HQBroker with any other broker by selecting the other broker below.

FAQ

Is HQBroker regulated?

No, HQBroker is not regulated and therefore is not bound by the same customer capital protection as other brokers. We always recommend caution before signing up with unregulated providers.

How much capital do I need to trade at HQBroker?

The minimum deposit at HQBroker is $250. The minimum position size is 0.01 lots, although stake requirements do vary among instruments.

Does HQBroker offer a demo account?

No – the broker does not provide an accessible demo account. This is a real drawback and means new traders have no way of testing HQBroker’s services before investing money.

What trading platforms does HQBroker use?

HQBroker offers the well-known MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Both terminals can be downloaded to desktop devices or traded through major internet browsers.

Is HQBroker available on mobile?

Yes, all trading platforms are compatible with iOS and Android devices. The MT4 and MT5 mobile apps can be downloaded from the respective app stores.

Customer Reviews

There are no customer reviews of HQBroker yet, will you be the first to help fellow traders decide if they should trade with HQBroker or not?