FXORO Review 2024

Pros

- I was glad to see a wide range of payment methods available during my tests, including bank wire, credit cards and several accessible e-wallet solutions

- FXORO offers a decent range of account types to cater to all traders, including fixed spread, ECN and Islamic accounts

- I'm pleased to see that FXORO offers the reliable MetaTrader 4 platform, which will serve both beginners and experienced traders

Cons

- I was disappointed that FXORO doesn't offer any copy trading tools, which is a feature offered at many competitors

- FXORO's asset line-up is mediocre compared to popular alternatives

- I would have liked to see another platform on offer, as well as some additional analysis tools

FXORO Review

FXORO is a Cypriot-based forex and CFD brokerage offering online trading. With beginner-friendly tools and fixed spreads, FXORO appeals to new traders. This FXORO review will unpack global assets, trading apps, withdrawal fees, plus the pros and cons of registering for an account.

Key Takeaways

- FXORO is regulated by the Cyprus Securities & Exchange Commission

- MetaTrader 4 is available as well as Trading Central

- FXORO offers a choice of pricing models with ECN executions and fixed spreads

- The broker is not transparent about deposit and withdrawal fees

- Customer support is lacking which may deter beginners

Company Details & Overview

FXORO is an online broker founded in 2012 by a solo entrepreneur in Limassol, Cyprus. The mission of the company is to provide a full trading experience through secure and innovative technologies. With this, FXORO uses the tagline ‘anything is possible’.

Traders can invest in 250+ instruments across six asset classes; forex, stocks, indices, commodities, cryptocurrencies, and ETFs. Alongside the firm’s four trading profiles, which include an ECN account and a fixed spread solution, the broker offers Islamic and professional trading accounts.

FXORO is regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 126/10.

Platforms & Tools

FXORO offers two platforms; MetaTrader 4 and Trading Central. These are highly-esteemed third-party platforms offering extensive analysis tools and trading functions. Both offer customizable interfaces with intuitive features, ideal for day traders of all experience levels.

The terminals can be downloaded to desktop devices or used as web traders.

Trading Central

Trading Central is a technical analysis platform that uses artificial intelligence (AI) to scan the markets for trading opportunities across 30,000+ assets. Trading Central has been an industry-recognized research and pattern recognition tool since it launched in 1999. FXORO customers can use Trading Central for no fee.

Features:

- Technical views

- Strategy builder

- Economic calendar

- Fundamental insights

- Free MT4 indicator plugins

- Full instrument panoramic analysis view

- Data visualization market buzz sentiment

MetaTrader 4 (MT4)

Owned by MetaQuotes Software, the MT4 platform is used by millions of traders worldwide thanks to its reliability and simplicity. You can set the terminal to operate in various languages and customize your profile to view exactly what you need for your trading strategy.

Features:

- Custom graph view

- Full trading history

- 24 graphical objects

- Four pending order types

- Automated trading function

- Real-time quotes in Market Watch

- Built-in tick chart feature to determine entry and exit points

- 30+ in-built indicators including Bollinger Bands and Stochastic Oscillator

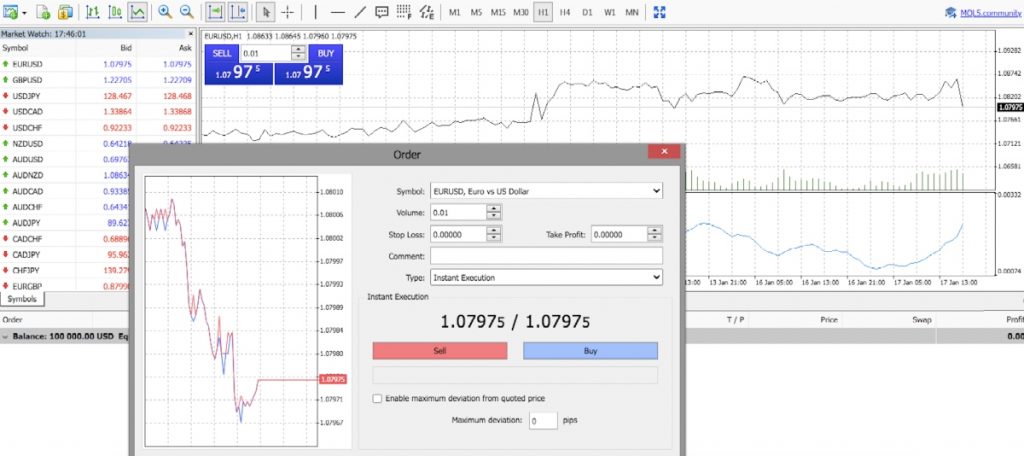

How To Place A Trade

- Register for a FXORO live trading account

- Complete account verification (details further below)

- Open the MT4 WebTrader or download the software to a desktop device

- Choose from the list of available instruments

- Select ‘New Order’ from the top menu

- In the pop-out window enter the trade details including order mode, risk parameters, and trading volume

- Click ‘Submit’

Assets & Markets

FXORO offers a decent selection of trading instruments. Over 250 assets are available:

- Indices – Speculate on 16 global indices including the S&P 500, FTSE 100 and ASX 200

- Commodities – Trade 14 hard and soft commodities including gold, coffee, brent oil, and wheat

- Forex – Access 60+ major, minor and exotic currency pairs including GBP/USD, EUR/USD, and EUR/GBP

- Cryptocurrencies – Trade 16 crypto tokens with USD currency pairs including ETH/USD, BTC/USD, and DSH/USD

- ETFs – Invest in 16 exchange-traded funds (ETFs) including Invesco QQQ Trust, iShares Russell 2000, and SPDR Gold Trust

- Stocks – Trade 70+ leading European and American stocks including Walmart, JP Morgan Chase, Google, and Telecom Italia

FXORO also plans to introduce direct trading in US stocks.

Fees & Costs

FXORO offers a transparent pricing structure with a choice of fixed and floating spreads.

The Fixed Spread profile could be the most suitable if you are just starting out, providing set fees from 2 pips. On the Variable Spread account, we were offered a minimum spread of 1.2 pips on the EUR/USD and 0.6 on the S&P 500 index.

For high-volume traders, the ECN account has tight spreads, though a fixed commission of $6/€5/£4 per lot applies. We were offered an average spread of 0.6 pips on the EUR/USD and 1.0 on the S&P 500 index (+ commission fee).

A $25 inactivity fee applies after three months of zero activity, followed by a $100 per year charge for continuous inactivity. The $100 charge is worth watching out for, as this is steep vs other brokers.

Overnight swap charges apply for positions held between 23:00 and 08:00 (GMT +2).

FXORO Leverage

As a CySEC-regulated broker, FXORO complies with ESMA’s restrictions on leverage trading. This means a maximum margin ratio of 1:30, designed to protect retail investors against significant losses.

ETFs and stocks are offered at 1:5 and cryptocurrencies at 1:2. Major currency pairs are available at 1:30. Indices and minor currency pairs can be traded with 1:20 margin.

For higher leverage, traders will need to sign up with an offshore broker, and while this can be tempting, trading with high leverage increases the chance of large losses.

Mobile App

Our experts were disappointed to see that FXORO does not offer its own trading app. However, both MetaTrader 4 and Trading Central have mobile app compatibility. This means you can use all the features of the desktop solutions on mobile and tablet devices.

Both applications are stable, though smaller screen usage can make some graphs/charts harder to read. Mobile traders can also set price alerts and notifications to stay up to date with the latest trading opportunities.

Deposits & Withdrawals

Deposits

FXORO scores well in terms of the range of payment methods and account currencies available. There is a minimum deposit requirement of $200 for all trading accounts. FXORO accepts USD, EUR, GBP, and CHF base currencies.

- Visa

- Skrill

- Jeton

- Nuvei

- Sofort

- PayPal

- Trustly

- Neteller

- Unlimint

- ecoPayz

- MyBank

- Mastercard

- Maestro

- Przelewy24

- Wire transfer

E-wallet solutions such as PayPal, Neteller, and Skrill are often the quickest funding methods.

Note, the availability of payment methods will vary by location.

How To Make A Deposit

- Log in to the FXORO client area with your registered credentials

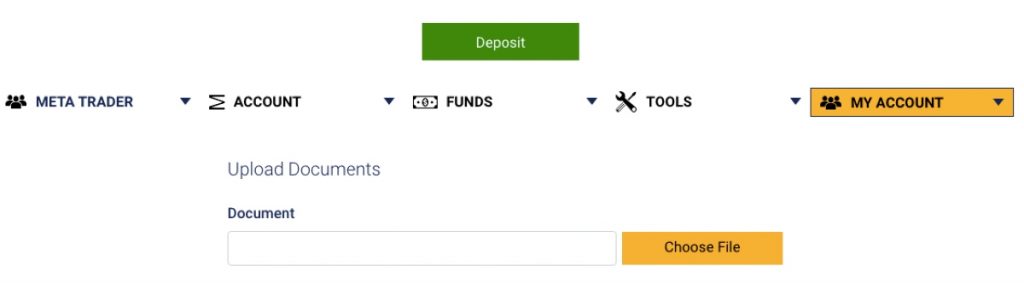

- Complete the KYC account verification step

- Select ‘Funds’ from the top menu and then ‘Deposit’

- Enter the payment details including method, currency, and value

- Select ‘Submit’

Withdrawals

Withdrawals must be made back to the same payment method used for deposits. FXORO aims to approve withdrawals within 48 hours of a request being made, which is in line with most online brokers.

A $25 or equivalent currency maintenance fee applies if a withdrawal request is made before any trading activity is complete. KYC documentation must also be uploaded before a withdrawal request can be made.

Account Types

FXORO offers three trading accounts; Fix, Floating, and ECN. This is good news for aspiring traders, as it means they can find a profile and pricing model that aligns with their trading strategy.

Fix Account

- Commission-free

- Fixed spreads from 2 pips

Variable Spread Account

- Commission-free

- Floating spreads from 1.2 pips

ECN Account

- Raw spreads from 0 pips

- No dealing desk intervention

- $6/€5/£4 commission fee per lot

An Islamic account can also be requested.

How To Open A Live Account

- Use the ‘Visit’ button on this FXORO review to sign up for an account

- Submit personal information about you, such as email address and telephone number

- Choose an account type (Fix, Floating, or ECN)

- Agree to the terms & conditions

- Select ‘Join’

- Login credentials will be displayed on the screen and sent via email

Note, identity verification and proof of residency will need to be uploaded to comply with AML and KYC protocols. You are not permitted to deposit funds or start trading until this is complete. The broker aims to validate verification documents within 24 hours.

It’s worth noting that some brokers offer a smoother and faster account opening process where new investors can sign up and start trading in a matter of minutes.

FXORO Demo Account

A demo account is offered on the MT4 platform only. New users can access unlimited virtual funds and leverage up to 1:100. The practice profile helps navigate dashboard icons, determine the best chart views and run-through how to apply technical indicators.

On the downside, there is no practice profile available for Trading Central. Having said that, there are some useful user guides and simulated demos on the Trading Central website.

How To Open A Demo Account

- Register for a demo account on the Fxoro.com official site

- Log in to the client dashboard with your new credentials

- Select ‘Download MT4’ or ‘Web Terminal’ from the ‘Tools’ dropdown menu

- Select the ‘Demo’ icon in the ‘Connect To An Account’ window

- Add your first name, second name, and email address

- Amend the deposit amount and leverage

- Accept the terms & conditions

- Select ‘Next’ and then ‘Complete’

Bonus Information

FXORO does not offer any bonuses or financial incentives to new or registered customers. This includes a no-deposit bonus or welcome reward.

This is aligned with ESMA’s rules restricting the use of financial deals that encourage traders to sign up and trade in high volumes. It is also the same approach taken by most regulated brokers.

Regulation & Trust

FXORO is a trading name of MCA INTERLFUNDS LTD. The broker is incorporated in Limassol, Cyprus, and is regulated and authorized by the Cyprus Securities and Exchange Commission (CySEC). Our experts verified licensing details, with a registration date in 2010.

This is a well-regarded financial watchdog, with strict rules and compliance guidelines. You can feel assured of a secure investing environment with fund protection measures in place. Standards include segregated accounts in leading banks and negative balance protection, meaning you cannot lose more than you originally invested.

FXORO also complies with the EU’s Markets in Financial Instruments Directive (MiFID II). This framework outlines investor protection necessities and ensures that the financial markets operate with efficiency and transparency.

Additionally, FXORO is a member of the Investor Compensation Fund (ICF). Subject to eligibility, retail investors are entitled to up to €20,000 in compensation if the broker is unable to fulfill its obligations.

Additional Features

Education

Traders can access educational resources and courses, which are categorized into experience levels. The online courses are made up of integrated YouTube videos. When we used the content offered by FXORO, the information was pretty basic, especially for advanced traders. Topics include how to use signals, the basics of social trading, and strategies to maximize profits.

Additionally, there is an Introduction to the Business of Online Trading e-book that can be downloaded to desktop devices. A glossary of key terms and live webinars are also available.

On the downside, there is no peer trader forum.

Market Analysis Tools

FXORO offers several tools to strengthen trading decisions. This includes a margin calculator, an economic calendar, and daily news publications. These are helpful for beginners, but experienced day traders may prefer detailed market insights from expert analysts.

Trading signals are also provided, highlighting potential opportunities alongside a straightforward ‘Trade’ button.

FXORO Opening Hours

- Indices – Varies by market

- ETFs – Monday to Friday 16:30 to 23:00 (GMT +2)

- Forex – Monday to Friday 00:05 to 23:00 (GMT +2)

- Crypto – Monday to Friday 00:05 to 23:00 (GMT +2)

- Commodities – Monday to Thursday 01:00 to 24:00 and Friday 01:00 to 23:00 (GMT +2)

- Shares – US shares Monday to Friday 16:30 to 23:00, and EU stocks 10:00 to 18:25 (GMT +2)

Changes to opening hours will be reflected in the platforms.

Customer Support

The broker offers standard customer support options including email, an online contact form, live chat, and a telephone number. But when our experts tested the live chat service, we did not receive a response to any of our queries. The FAQ section also has limited information which means traders can’t self-serve.

- Email – cs@fxoro.com

- Phone – +357 25 20 5555

- Online Contact Form – Via the ‘Contact Us’ webpage

- Live Chat – Logo on the bottom right of each webpage

FXORO is active on social media sites including Facebook and LinkedIn, with frequent posts.

Security & Safety

Whilst CySEC regulation gives FXORO credibility, it doesn’t definitively mean that the broker isn’t a scam. There are several negative customer reviews online indicating unresponsive customer service, misleading pricing, and poor educational content.

Fortunately, the MT4 platform is highly secure. Traders can be assured that personal IP addresses remain hidden and that all transactions are kept secure with 128-bit encryption. The platform also uses RSA digital signatures.

While using FXORO global, we were not offered biometric or two-factor authentication (2FA) login options.

Final FXORO Opinion

FXORO falls short in its customer support offering and educational content. The introduction of a proprietary app would also improve the broker’s rating. Still, FXORO is regulated by the CySEC, offers fixed spreads, and provides access to the popular Trading Central solution, plus MetaTrader 4.

FAQ

Is Fxoro.com Safe?

FXORO is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC). This is a top-tier financial watchdog with strict standards for members to follow. This includes negative balance protection and segregated client funds, which makes the trading firm safer than most offshore brands.

Does FXORO Offer A Good Selection Of Online Trading Instruments?

Day traders have access to 250+ instruments on six major asset classes. This includes indices, commodities, currency pairs, and ETFs. This is not the largest selection we have seen, but for those getting started with trading, it is adequate. FXORO is also introducing direct shares trading in the future.

Is FXORO A Global Broker?

Yes, FXORO offers broker-dealer services to a long list of countries. Accepted locations include the UK, India, Romania, and Malta. Services are not available in the US, Canada, and Iran. See our full review of FXORO for accepted and restricted countries.

Is FXORO Suitable For Beginners?

FXORO offers three account types to retail investors; ECN, Fix, and Floating. The Fix account is popular with beginners, offering set spreads that allow traders to plan and manage fees, including during periods of market volatility. On the downside, fixed spreads tend to be wider than the fees charged on the broker’s ECN and floating spread profiles.

Is FXORO A Good Or Bad Broker?

FXORO is lacking in some areas. Our experts were dissatisfied with the unresponsive customer service, limited additional tools for experienced traders, plus the lack of transparency regarding deposit and withdrawal fees and processing times.

On a more positive note, the broker is regulated by the CySEC and offers a choice of trading accounts and pricing models. Over 250 assets are also available with plans to introduce direct stock investing.

Is FXORO A Good Broker For Day Trading?

FXORO’s ECN account is the best fit for active day traders. Ultra-tight spreads from 0 pips are available alongside a commission of $6/€5/£4 commission per lot. On the downside, some alternatives offer faster execution speeds and more reliable tools.

Top 3 Alternatives to FXORO

Compare FXORO with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

FXORO Comparison Table

| FXORO | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 3.4 |

| Markets | CFDs, Forex, Shares, Indices, Commodities, ETFs, Cryptos | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $0 | $10 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | CySEC | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | VFSC |

| Bonus | – | – | – | $100 No Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 11 | 6 | 6 | 12 |

| Visit | – | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXORO and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXORO | IG | Interactive Brokers | xChief | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | Yes | Yes | No | No |

| Silver | No | Yes | No | Yes |

| Corn | Yes | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

FXORO vs Other Brokers

Compare FXORO with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of FXORO yet, will you be the first to help fellow traders decide if they should trade with FXORO or not?