FXFlat Review 2024

FXFlat Review

FXFlat is an established broker offering forex, CFDs, futures and cryptocurrencies on the MetaTrader 4, MetaTrader 5 and Trader WorkStation platforms. The broker also offers a range of funding methods, from bank transfer to PayPal. Before you login and deposit, follow this review for more information on demo accounts, mobile apps, pricing and more.

FXFlat Details

FXFlat is a German Market Maker brokerage, established in 1997. The company holds a regulatory license with the Federal Agency for Financial Services Supervision (BaFin) in Germany. Originally a CFD and forex broker, FXFlat now covers a full spectrum of asset classes, operating as a securities trading bank since 2015.

On top of a range of financial instruments, traders can access some of the most popular platforms available. There are also additional trader add-ons to suit various preferences, including AgenaTrader, OptionTrader and SpreadTrader to name a few.

Trading Platforms

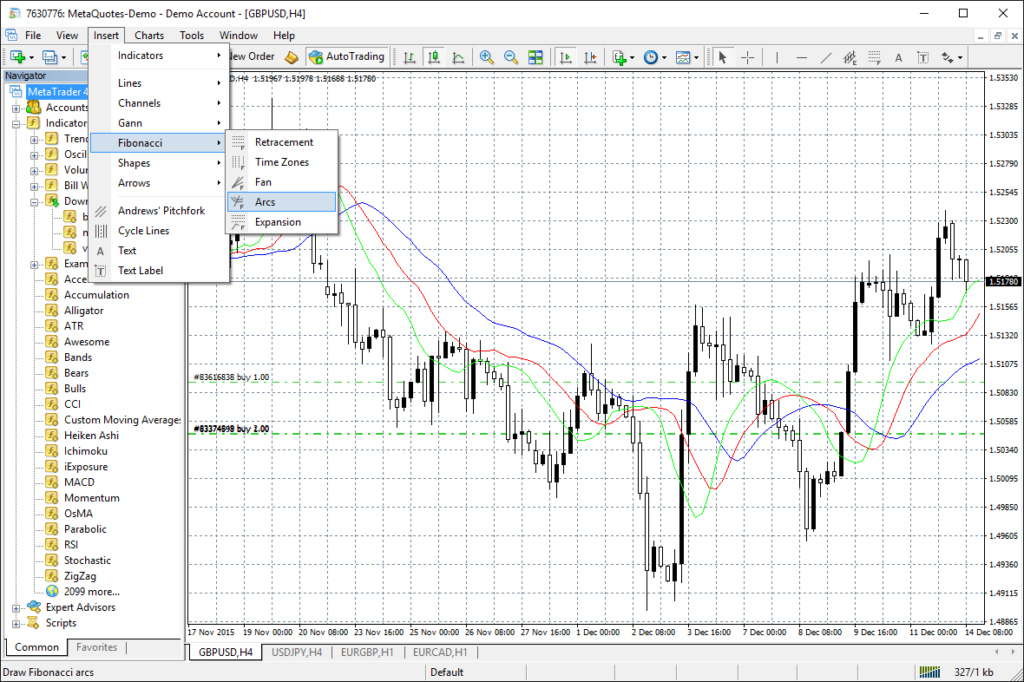

MetaTrader 4

For CFDs and forex trading, the MetaTrader 4 (MT4) platform is ideal for all levels, offering over 300 symbols. The platform supports 30 graphical objects, 9 different time settings, 4 order types and hedging capabilities. Users can also execute automated trading strategies using the vast library of expert advisors.

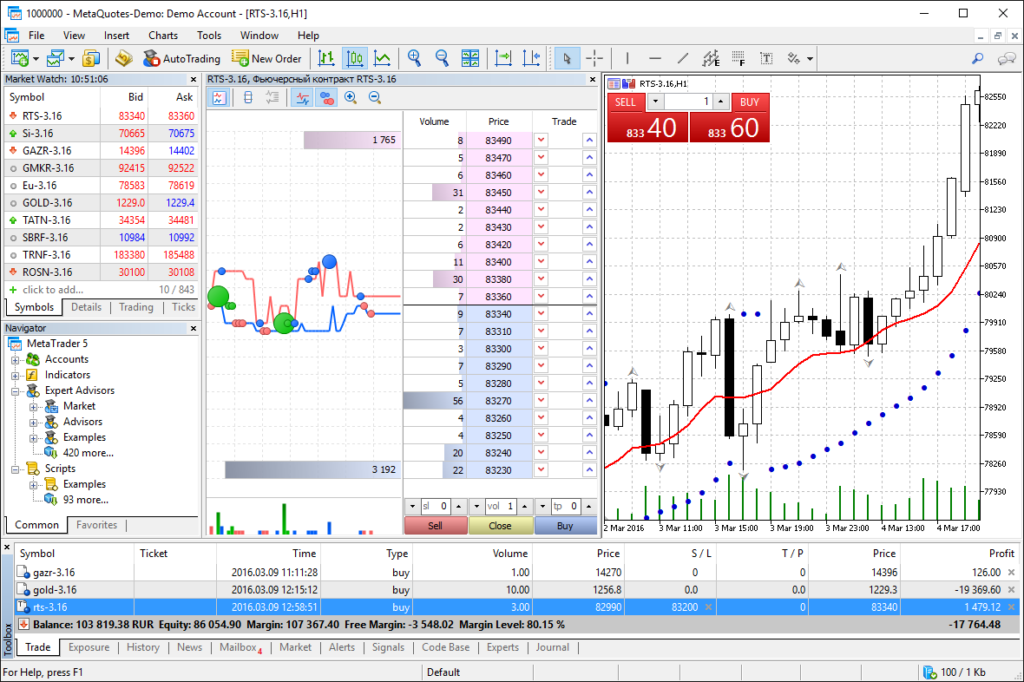

MetaTrader 5

The MetaTrader 5 (MT5) platform offers all the same instruments as MT4, with the addition of futures contracts. With 21 time intervals, 6 order types and 38 graphical objects, traders can execute comprehensive trading strategies and detailed price analysis. There’s also the addition of an economic calendar, Market Depth liquidity view and a built-in community chat.

Both the MT4 and MT5 platforms are available for download on Windows and Mac PCs. You can also access both via their respective web-trader versions, which offer the familiar advanced trading environment without needing to download any applications. The web platforms are equipped with the essential functions and allow traders to easily switch between desktop and browser.

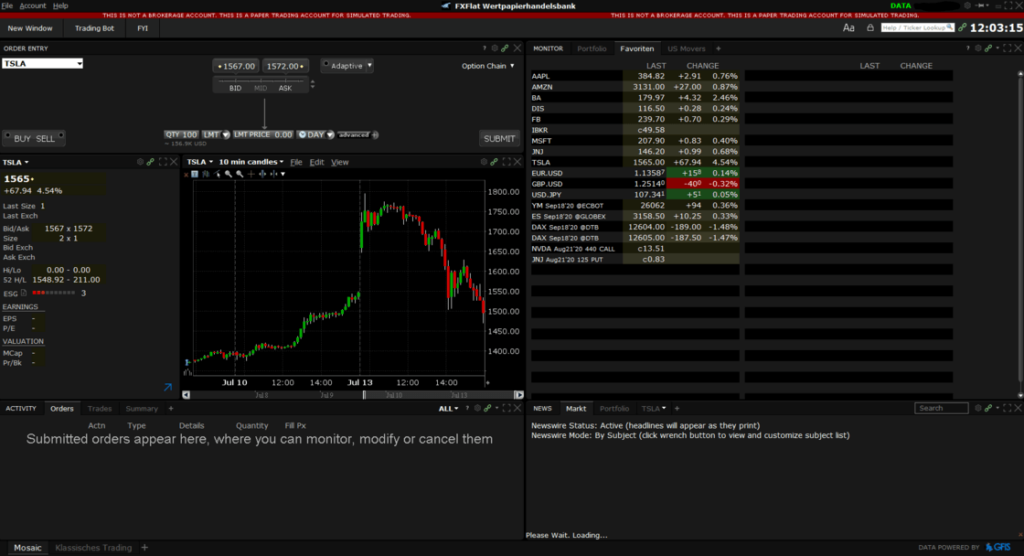

Trader Workstation (TWS)

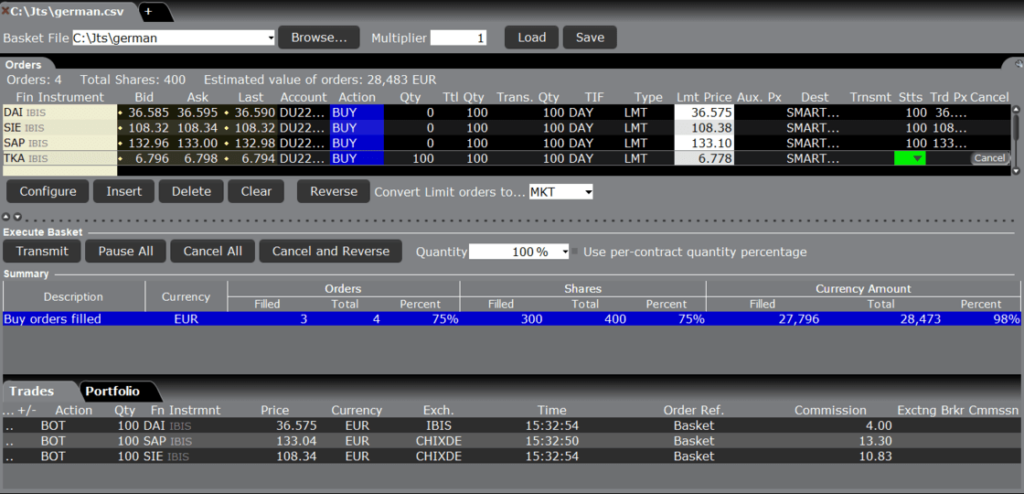

TWS offers a wide variety of instruments to trade, including stocks, options, futures, FX, bonds and funds at over 135 stock exchanges. The system comes in the classic version for more complex algorithmic trading strategies, or the modernised Mosaic version for buildable workspace requirements.

Traders can also benefit from real-time account management, custom watchlists, alerts, risk management tools, plus over 100 order types and algorithms.

TWS is available for download on to Windows, Mac and Linux PCs. Alternatively, TWS is also available as a web trader, a fast and powerful tool which comes with all the features found in the desktop platform.

Markets

FXFlat offers an impressive selection of instruments, including over 50 forex pairs and 11 spot forex pairs. You can also trade over 35 ETFs, 17 index CFDs including DAX and NASDAQ, 12 futures contracts and dozens of equities. There’s also 8 cryptocurrency CFDs, 8 commodities including oil and gold, plus the Euro Bund CFD.

Spreads & Commission

Spreads are fairly competitive at FXFlat, at around 0.8 pips for popular currency pairs such as EUR/USD and EUR/GBP. Indices are around 1 point for FTSE 100 and US 30, whilst spot gold is around 0.3 pips. Overall these are decent, though not as competitive if you compare FXFlat vs CapTrader, Admiral Markets or IG, for example.

Some commissions may also apply on selected instruments and depending on which trading platform you are using. For example, commissions are charged from €1.90 in TWS for DE 30 and US 30 indices, and from €3.50 for EUR/USD.

A swap rate will also apply to overnight positions, which varies depending on the currency pair being traded and the position size.

Leverage

For forex, you can leverage up to 1:30 on major pairs. For gold CFDs and indices, the maximum leverage available is 1:20. Other commodities are available up to 1:10, stock CFDs up to 1:5 and cryptocurrencies up to 1:2. Professional traders can leverage up to 1:200.

All margin requirements, including the recently updated futures margin rates, are provided on the broker’s website.

Mobile Apps

Both the MetaTrader platforms and Trader WorkStation are available as mobile apps at FXFlat. Traders can access the familiar trading environment from anywhere in the world with the iPhone and Android apps.

The apps offer full account history in real-time, plus custom chart windows and a range of technical indicators. You can also utilise the financial news feeds to stay up-to-date whilst on the go. With the TWS mobile app, traders also enjoy SmartRouting technology for optimal price execution.

Payment Methods

FXFlat offers a range of funding methods including bank wirecards, Giropay, PayPal, Skrill and Sofort. Unless you are depositing via bank wire, any deposit or withdrawal requires the completion of a short online form.

FXFlat offers free deposits and withdrawals in the MetaTrader and TWS platforms but note that a minimum amount of €50 applies for each deposit. Withdrawals by bank wire in either platform are processed within 2 working days.

Demo Account

The broker offers MetaTrader or TWS demo accounts for 30 days to test the trading platforms, without any obligation or risk. Demo accounts are a great way for beginners and experts to trial or improve their trading strategies with virtual funds.

FXFlat Bonuses

Due to current EU restrictions, there are no bonus deals or promotions available at FXFlat.

Regulation Review

FXFlat is a brand name of FXFlat Wertpapierhandelsbank GmbH, which is authorised and regulated by the Federal Agency for Financial Services Supervision (BaFin), under license number 109603.

Accounts held at FXFlat are covered by the German compensation institutions of the securities trading companies (EdW), which insures up to a maximum of €20,000 per client. FXFlat also holds client funds in segregated bank accounts, which are regularly monitored by auditors.

Additional Features

FXFlat offers a variety of additional trading tools, including webinars, tutorial videos PDFs, and a client newsletter.

Traders also enjoy several free platform add-ons, including AgenaTrader, an advanced charting system with automated trading strategies and access to external systems such as NinjaTrader. Other add-ons include Forex-Screener, BasketTrader and StereoTrader, which you can download straight from the broker’s website.

FXFlat also offers Tradimo, an online trading academy with extensive YouTube videos and educational resources for traders. The broker also partners with other companies including Algo-Camp, Statistic Trading and Smart Markets. Clients also enjoy virtual hosting via a VPS server if they want to use trading robots 24 hours a day, or copy signals continuously.

Account Types

Traders can choose between a Standard or Professional account at FXFlat, in either a MetaTrader or TWS platform. A MetaTrader account requires a minimum first deposit of €200 and offers access to CFDs, forex and futures. The TWS account requires a €2,000 minimum deposit and provides stocks, options, futures, CFDs, spot forex and more. The margin call is 100%.

Depending on your trading style and experience level, the selection of platform add-ons allow traders to tailor their accounts. For example, hedging is available in the MetaTrader platforms, whilst scalping is also permitted in the StereoTrader add-on. You can get in touch with the broker for any advice or recommendations.

Benefits

Main benefits of trading with FXFlat include:

- MetaTrader 4 & 5, plus Trader WorkStation

- Additional tools and add-ons

- Variety of instruments

- Regulated by BaFin

Drawbacks

Disadvantages of choosing FXFlat include:

- Might be confusing for beginners

- Not the most competitive spreads

- Videos and webinars only in German

Trading Hours

Trading times vary depending on the asset traded. For example, forex CFDs in the MetaTrader platforms are open Sunday to Friday from 11:01 pm to 11:00 pm (GMT). Spot forex contracts are available Monday to Friday 08:00 am to 10:00 pm (CET). All session times can be found in the contract specifications on the broker’s website.

Customer Support

There are several ways you can get in touch with FXFlat, including email, at service@fxflat.com, plus live chat. There are also dedicated German and international hotline numbers for both MetaTrader and TWS platforms, which are listed on the website.

The broker’s headquarters location is: FXFlat Wertpapierhandelsbank GmbH, Kokkolastr, 1, 40882 Ratingen, Germany.

Safety Review

All information exchanged between client computers and FXFlat servers are encrypted for both the MetaTrader and TWS platforms, so data can’t be accessed by anyone else.

Within the client portal, you can set smartphone SMS verification at the login stage. You can also set extra layers of security when you log in to WebTrader, MetaTrader or TWS, by applying two-factor authentication.

FXFlat Verdict

FXFlat offers a vast range of assets, including cryptos, shares and futures on a choice of MetaTrader or TWS platforms. The range of trading tools such as Forex Screener and StereoTrader is particularly impressive. There’s also a good selection of educational resources, including a newsletter, YouTube videos and webinars, though many of these resources are only available in German.

Top 3 Alternatives to FXFlat

Compare FXFlat with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

FXFlat Comparison Table

| FXFlat | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.5 | 4.4 | 4.3 | 4 |

| Markets | Forex, CFDs, indices, shares, commodities, cryptocurrencies, futures, ETFs | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | €200 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | BaFin | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:30 | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 7 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXFlat and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXFlat | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | No | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | Yes | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

FXFlat vs Other Brokers

Compare FXFlat with any other broker by selecting the other broker below.

FAQ

Who owns FXFlat?

FXFlat is a market maker brokerage owned by FXFlat Wertpapierhandelsbank GmbH. The company also owns CapTrader, an online broker offering low-cost stock trading among other tradable assets.

Is FXFlat regulated?

Yes, FXFlat is licensed and regulated by the Federal Agency for Financial Services Supervision (BaFin) in Germany, under license number 109603.

Does FXFlat offer a demo account?

Yes, the broker’s test accounts allow you to practice trading strategies within the MetaTrader or TWS platforms, without risking any real money.

How do I download the MetaTrader platform?

Once you have registered for a live or demo account, you can download MetaTrader 4 or MetaTrader 5 straight from the broker’s website, using your login credentials.

What leverage is available at FXFlat?

Retail traders can leverage up to 1:30, whilst pro traders can leverage up to 1:200.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of FXFlat yet, will you be the first to help fellow traders decide if they should trade with FXFlat or not?