FXDD Review 2026

See the Top 3 Alternatives in your location.

Awards

- Most Transparent Broker in Europe 2022 - ForexRating.com Awards

- Most Trusted Broker - The Forex Expo Dubai 2021 Awards

- Best Forex Broker - The Forex Expo Dubai 2020

- Best Regulated Forex Broker - Saudi Money Expo 2018

Pros

- The broker's Trading Central integration offers daily fundamental market analysis, automated chart pattern software and market insights newsletters

- MAM and PAMM accounts are available for those who want to manage trader portfolios and earn commissions

- The broker offers VPS accounts for algo traders and experienced traders looking to run complex automated strategies

Cons

- Withdrawal fees apply for more than one payment per calendar month, which is particularly punitive for active traders

- The broker's market insights section is outdated and trails leading competitors

- FXDD offers around 150 instruments - a narrow range compared to the hundreds offered at most top brokers

FXDD Review

In this FXDD review, I offer my findings after testing and rating the broker’s major categories, including fees, accounts and regulations. I also compare the key features to other brands to highlight any considerations for potential clients.

Regulation & Trust

FXDD gets a fairly average trust score. Whilst the broker holds a long 20+ year history and good track record, the firm holds licenses with several weak regulators:

- FSC Mauritius (Financial Services Commission)

- LFSA (Labuan Financial Services Authority)

- SBS (Superintendencia de Banca, Seguros)

On the positive side, FXDD’s European entity is authorized and regulated by the Malta Financial Services Authority (MFSA) which does follow more robust EU safety standards, including client fund segregation.

Importantly, the broker operates under the EU’s MiFID II (Markets in Financial Instruments Directive) and is therefore approved to provide services across the European Economic Area.

Users are also covered by the Investor Compensation Scheme, with compensation of 90% of investments up to the value of €20,000, as well as negative balance protection.

Accounts & Banking

Live Accounts

FXDD offers four different account types: Cent, Mini, Micro and Standard. Minimum deposits are $200 and accounts are available in 4 base currencies: USD, EUR, GBP and JPY.

Clients can trade on two pricing models – Standard vs Premium.

I would recommend Standard pricing for beginners. Although spreads will be wider, you get the benefit of paying zero commissions. Other features include:

- No partial fills

- Fill-or-kill execution

- Guaranteed zero slippage on entry orders

On the other hand, active traders will be well-suited to Premium pricing, which offers ultra-low spreads and competitive commissions.

Finally, it’s good to see that scalping strategies and Expert Advisors (EAs) are permitted in both account types.

Deposits & Withdrawals

I was pleased to see that I could deposit funds through the FXDD customer portal with no fees. The broker accepts deposits in several currencies including USD, EUR, and GBP, with a minimum deposit of £1/$1.

Deposit methods vary by region, but typically include:

- Credit cards

- Bank wires

- Neteller

- Skrill

To withdraw funds, clients must complete a redemption form via the customer portal. Redemptions are processed within 24 hours however processing time may vary based on the time the redemption is submitted and the payment method that the client chooses.

The broker covers the cost of the first withdrawal each calendar month. However, $40 is charged for additional withdrawals which is quite steep compared to other brands. Additionally, the minimum redemption for wire withdrawal is $100, any redemptions below this will incur a $25 fee.

Demo Account

FXDD offers a free demo account on all trading platforms. Demo accounts are live for only 90 days, however, I did note that additional time can be requested via customer support.

The demo accounts provide the opportunity to become familiar with the FXDD trading platform software and practice trading instruments such as forex. It is noted, however, that the pricing on the demo accounts, while indicative of live pricing, does differ slightly.

Bonuses & Promotions

FXDD offers active bonus campaigns to clients. What differentiates FXDD from some other platforms is that it gives cash bonuses while others offer bonuses in the form of credits. It is important to note, though, that bonuses are only offered in some jurisdictions.

In addition, I don’t recommend choosing any broker based on their promotional deals.

Assets & Markets

FXDD’s investment offering gets a fairly weak score of 3 out of 5.

Whilst the available asset classes are fairly diverse, including stocks and crypto, the total range of around 150 instruments is far fewer than most brokers, as you can see below.

| FXDD | Eightcap | Vantage | Forex.com | |

|---|---|---|---|---|

| Number of Assets | 150+ | 600+ | 1000+ | 5500+ |

That said, I was impressed with the decent range of currency pairs available, which will serve more serious forex traders.

- Forex – 65+ currency pairs including EURUSD, USDJPY, and GBPAUD

- Company stocks – 20 major stocks including Facebook, Apple, and Amazon

- Commodities – including gold, silver, and energies

- Indices – 13 major global indices, including the UK100 and GER30

- Crypto – including Bitcoin, Ethereum, Bitcoin Cash, Neo, Litecoin

Leverage

The maximum leverage at FXDD is 1:500, though this depends on the jurisdiction and asset type traded. For example, stocks are available with leverage up to 1:25, whilst cryptos can be traded at 1:4.

At the European entity, the maximum leverage is 1:30, in line with MiFID regulations.

Fees & Costs

The broker charges no commission on trades using the Standard account, however, commissions are charged on Premium (ECN) accounts.

Spreads are decent, coming in at 0.4 pips for EUR/USD in the ECN account. That said, this isn’t the lowest we’ve seen among the best ECN brokers. Pepperstone, for example, offers spreads on the same pair at 0.1 pips.

Similarly, the average spread of 1.9 pips for EUR/USD in the Standard account is wider than the 1.0 pips offered by competing brands. You can see how average spreads compare to alternatives below.

| FXDD | Pepperstone | Vantage | |

|---|---|---|---|

| EUR/USD Spread – ECN Account | 0.4 | 0.1 | 0.2 |

| EUR/USD Spread – Standard Account | 1.9 | 1.1 | 1.4 |

The company also charges swap rates for positions held overnight, though these are industry standard.

Platforms & Tools

FXDD offers several trading platforms suitable for different experience levels. All platforms come with a mobile trading app.

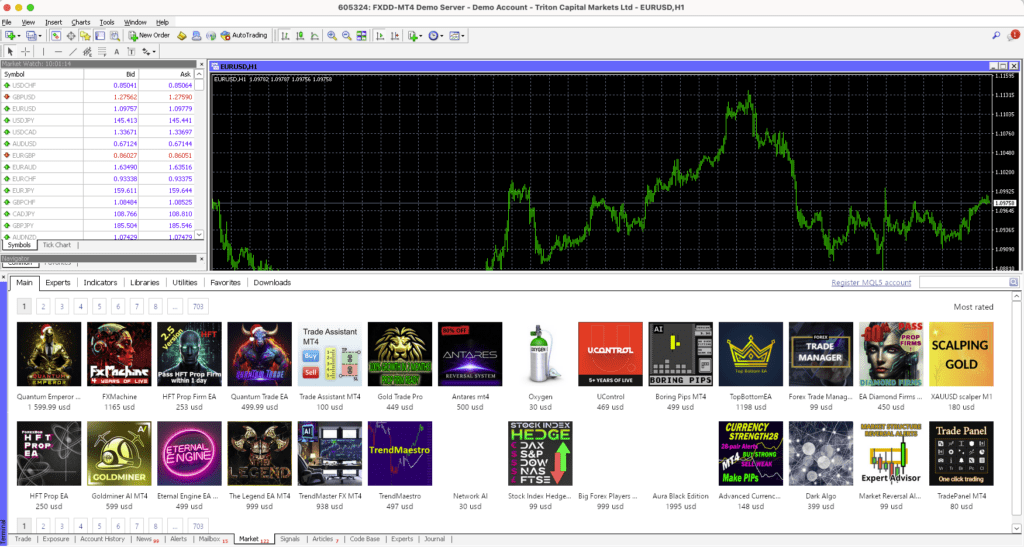

MetaTrader 4

FXDD offers a free MetaTrader 4 download, industry-recognised, but optimised with bespoke technology to provide users with an enhanced trading experience. You can download MT4 to desktop devices or trade through major web browsers.

Some of my highlights of MT4 include:

- Online marketplace

- Video tutorials and guides

- VPS hosting option (for a small fee)

- Expert advisors for automated trading

- Multiterminal to provide access to numerous accounts on a single interface

- Highly customisable interface supported by an unrivalled charting package

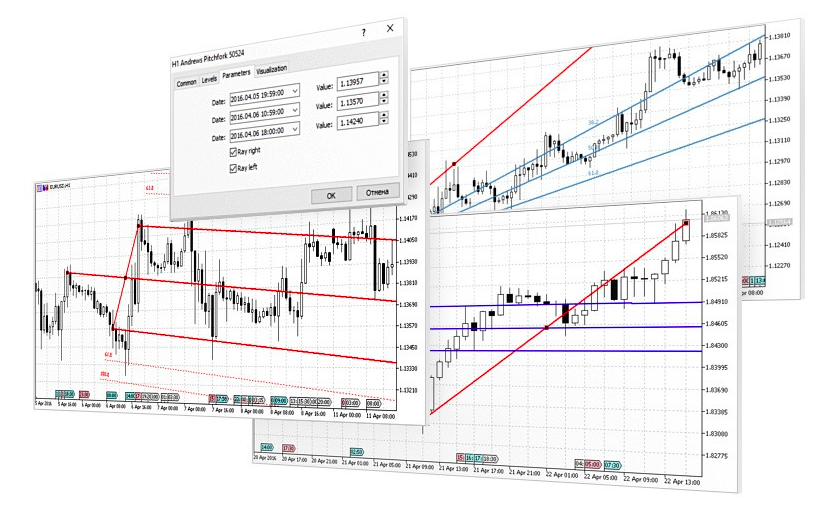

MetaTrader 5

The broker also offers the MT5 platform, available as a free download to desktop devices and through major web browsers.

I’d recommend this terminal for more experienced traders, thanks to the larger suite of technical tools. That said, beginners will find the user-friendly interface virtually identical to MT4.

Highlights of MetaTrader 5 include:

- Enhanced strategy tester

- A range of pending order types

- Advanced graphical trading tools

- Built-in economic events calendar

- MT5 1-minute historical data option to add directly onto charts

- Built-in marketplace to purchase or rent technical indicators or signal providers

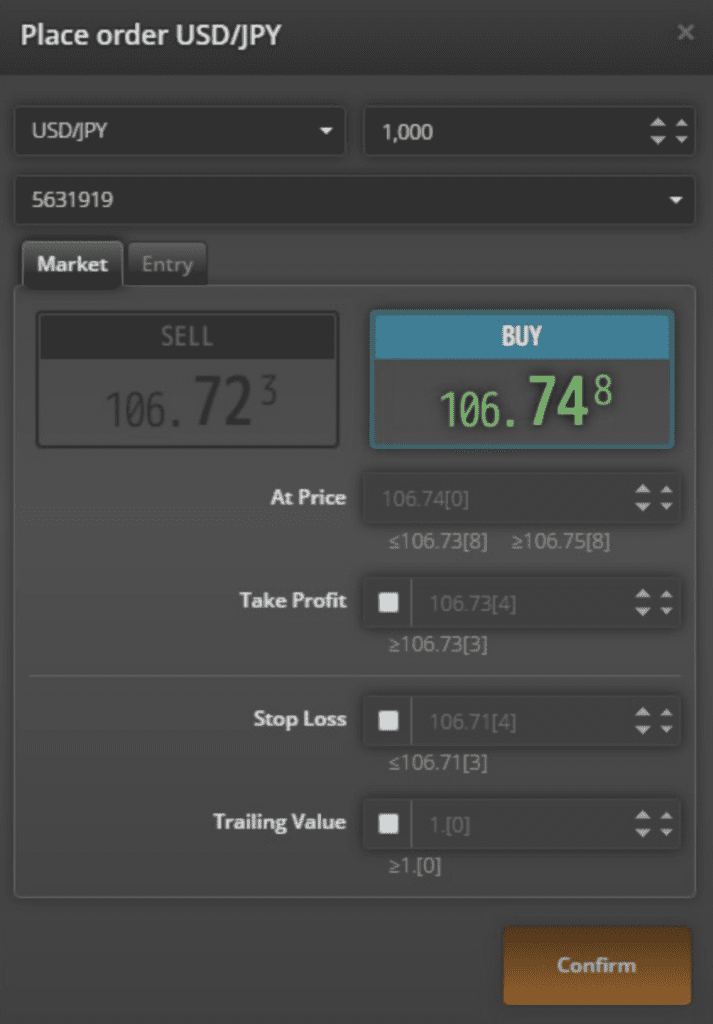

WebTrader

This trading platform is the broker’s proprietary solution, developed over the years with the needs of advanced users in mind.

The terminal offers good customization options, plus the ability to display up to 4 charts at a time.

Highlights of WebTrader include:

- Scripting available

- Position based trading

- One-click order execution

- Detailed market financials

How To Place A Trade

Placing a trade is relatively easy, but not as user-friendly as MT4 or MT5 in my opinion.

- Click on the Bid or Ask price to open the order window

- Choose the asset you want to trade and adjust the lot size

- Set your take profit/stop loss parameters

- Click ‘Confirm’ to place the trade

Mobile App

The MT4 and MT5 platforms are both available for mobile trading, and compatible with iOS and Android devices. The mobile offering supports full charting packages and the trading functionality found on the desktop terminals.

The broker also provides an additional mobile trading application; FXDD Mobile. This app provides users access to analyst views and global news sources in an easy-to-navigate interface while on the move. The application allows traders to utilise data refresh feeds with high-speed server times to manage trades at the click of a button.

Research

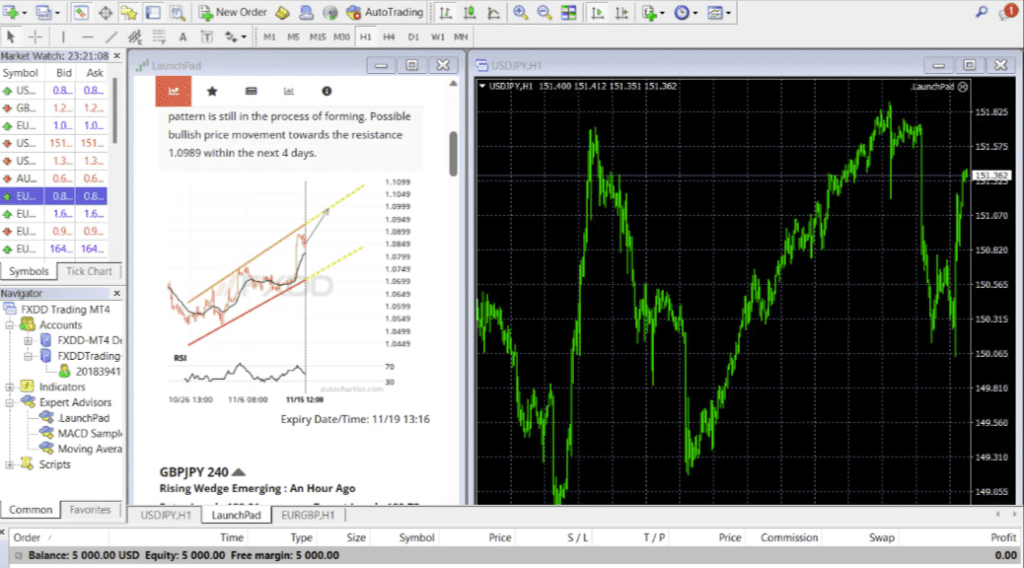

The FXDD website offers a decent range of research tools such as rollover rates, margin calculators, an economic calendar and position size calculators.

I found the daily and weekly market insights via the TraderMade blog particularly comprehensive and should offer some value for experienced traders. For beginners, trader guides are available across several topics, as well as a substantial glossary and an FAQ section.

Additionally, FXDD offers the AutoChartist tool, a market-leading third-party analysis tool which automatically scans the markets for you to uncover potential opportunities. The tool integrates directly into the MetaTrader platforms, so there’s no need to have any separate applications open.

Education

Unfortunately, FXDD doesn’t score as well when it comes to educational resources. Aside from the help center, the broker doesn’t offer any learning materials for beginners looking to learn as they go, or for more experienced traders looking to fine-tune their knowledge.

To compete with top brokers like XM, FXDD should offer more comprehensive resources in a range of formats, including trading guides, webinars, podcasts and tutorials.

Customer Support

FXDD offers multilingual customer support including Chinese, Vietnamese, Hindi, Thai, Malay, Arabic and Spanish, 24/5:

- Email – support@fxdd.com.mt

- Telephone – +356-2013-3933

- Office Address – Triton Capital Markets Ltd, Trident Park, Notabile Gardens, Nos. 6 & 7 – Level 4, Mdina Road, Zone 2, Central Business District, Birkirkara CBD 2010, Malta

The customer contact portal page on the broker’s website also offers a call-back option and live chat engine via the respective logo on the right-hand side of the webpage.

Should You Trade With FXDD?

FXDD offers easy online trading on a range of instruments including forex, commodities, and stocks. Access to the industry-renowned MetaTrader 4 and MetaTrader 5, as well as the broker’s WebTrader platform, means users of all abilities are catered for. Our review was pleased to see legitimate regulation and investment compensation protection.

FAQ

Is FXDD Legit Or A Scam?

FXDD is a legitimate company licensed to operate in the EU and beyond. The broker receives positive customer reviews and is subject to regulatory oversight from two reputable agencies.

Is FXDD Regulated?

Yes, the broker is regulated and licensed by the Malta Financial Services Authority (MFSA), the Mauritius Financial Services Commission (MFSC), Labuan Financial Services Authority (LFSA), and the Superintendencia de Banca, Seguros (SBS).

Is FXDD Good For Day Trading?

FXDD could be a good choice for day traders thanks to the range of sophisticated charting tools on offer. The MT4 and MT5 platforms deliver a vast suite of advanced indicators and bots which are ideal for short-term strategies. With that said, the broker’s fees are not the lowest and the range of assets is light compared to alternatives.

Does FXDD Offer Low Fees?

Fees at FXDD are fairly competitive based on tests, though not the lowest we have seen. For example, EUR/USD spreads come in at around 0.4 pips in the Premium account, whilst competing brands like Pepperstone offer the same pair at 0.1 pips in the equivalent account. Additionally, the $200 minimum deposit to get started is not the cheapest.

What Documents Are Needed To Open A Live Account With FXDD?

The KYC documentation required varies by entity however photo ID and POR are always requested. Clients can verify their identity through the FXDD customer portal.

What Deposit Currencies Are Available At FXDD?

FXDD accepts deposits and withdrawals in USD, EUR, GBP, JPY, CHF and USDT/BTC* depending on the entity.

Best Alternatives to FXDD

Compare FXDD with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- xChief – xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

FXDD Comparison Table

| FXDD | Interactive Brokers | xChief | |

|---|---|---|---|

| Rating | 4 | 4.3 | 3.9 |

| Markets | Forex, CFDs, Indices, Stocks, Commodities | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $200 | $0 | $10 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | MFSA, FSC, LFSA, SBS | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | ASIC |

| Bonus | Available in Mauritius, Labuan, Peru | – | $100 No Deposit Bonus |

| Platforms | WebTrader, FXDD Mobile App, MT4, MT5 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | MT4, MT5 |

| Leverage | 1:500* Leverage varies depending on the region | 1:50 | 1:1000 |

| Payment Methods | 6 | 6 | 12 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

xChief Review |

Compare Trading Instruments

Compare the markets and instruments offered by FXDD and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FXDD | Interactive Brokers | xChief | |

|---|---|---|---|

| CFD | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes |

| Oil | Yes | No | Yes |

| Gold | Yes | Yes | Yes |

| Copper | No | No | No |

| Silver | Yes | No | Yes |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | No |

| ETFs | No | Yes | No |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

FXDD vs Other Brokers

Compare FXDD with any other broker by selecting the other broker below.

Customer Reviews

3 / 5This average customer rating is based on 2 FXDD customer reviews submitted by our visitors.

If you have traded with FXDD we would really like to know about your experience - please submit your own review. Thank you.

What I’ve loved about trading at FXDD is the MetaTrader 5 platform. For technical analysis and short trading strategies it’s the best I’ve used. However FXDD is really only decent for forex trading as there’s barely any stocks in the platform and the commissions will eat into your returns.

FXDD is okay but not one of the best brokers I’ve used. There isn’t much in terms of market research or education compared to firms like IG. The withdrawal fee if you make more than one request a month is also really frustrating. The MetaTrader platforms are good for charting and algo trading, but you can get them elsewhere.