FTX Review 2024

Please see the list of similar brokers or the Best Brokers List for alternatives.

Pros

- Built-in automated trading through Quant Zone

- An official mobile app is available on both Android and iOS

- Lower fees than most other cryptocurrency exchanges, thanks to its tiered system

Cons

- Limited options for currency withdrawals compared to other exchanges

- Country restrictions apply to US citizens

- Major safety and security concerns - you should not deposit with this firm

FTX Review

FTX is a popular crypto exchange, offering services relating to derivatives, options, volatility products and leverage for various tokens. This article will give a review of FTX by covering what tokens the platform supports, what it offers, its mobile and desktop app, fees and more.

What is FTX?

FTX was founded in 2018 by ex-Jane Street and Google employees and, since then, it has secured $900 million for its series B funding from over 60 investors. Its headquarters are based in Hong Kong, whilst its US counterpart FTX.US is based in San Fransisco, US. It is a private company that has not had its IPO yet, though has previously been making news on sites such as Yahoo Finance.

The FTX platform’s founders/owners include Sam Bankman-Fried (CEO) and Gary Wang (CTO), who started the company with the aims of developing a cryptocurrency platform that is both suited for professional trading firms as well as first-time commercial users. Its market valuation (net worth) is estimated to be around $18 billion. The platform had made previous acquisitions of other companies like Blockfolio, a deal worth $150 million. The exchange has also made brand sponsorships for the MLB and YGG.

The platform offers various services, including leveraged crypto trading, token lending, staking and “quant zone”. FTX also provides a comprehensive view of the most popular currencies in a visual style that is representative of a normal index.

KYC Rules

Although some crypto trading platforms do not follow know-your-customer procedures, FTX does. They comply with KYC by requiring every user to submit their legal dates of birth, phone numbers, country of residence, etc. If you wish to have the least number of restrictions placed on your account, then verified government-issued identity cards/passports must be submitted. Therefore, you might not be able to start trading straight away, depending on the level of identification that you wish to provide.

With basic KYC verifications you can withdraw up to 2,000 USD daily and there might be restrictions on being able to trade futures. With full verification, there are no maximum limits to crypto and fiat withdrawals.

Country Restrictions

The FTX exchange platform currently has restrictions on which country’s residents can use it. These restricted jurisdictions/locations include the United States of America (US), Cuba, Crimea and Sevastopol, Iran, Afghanistan, Syria, North Korea, Antigua and Barbuda. For the UK, there is no ban on commercial (personal) or corporate/institutional accounts. These restrictions may change in the future.

Traded Currencies

The FTX exchange allows for the trading of various cryptocurrencies such as Bitcoin, Ethereum, USDT, and other altcoins (alts). It is also possible to trade with government-backed digital currencies like USD, GBP and EUR.

Additionally, FTX offers its own cryptocurrency, FTT, which represents a stake in the platform itself. Users that hold FTT gain benefits like increased referral fee payouts, extra voting power in FTX polls, some waived blockchain fees for ERC20 and ETH token withdrawals.

UK customers should be aware that trading assets in crypto could be subject to income and capital gains tax.

FTX Asset Classes

FTX offers a powerful platform for trading cryptocurrencies, separating different kinds of trades and contracts making it easier to keep track of your positions. In addition, traders can also find a DeFi index, allowing for investment in a basket DeFi currencies without having to purchase any individual tokens.

Futures

The FTX platform allows traders to trade with perpetual cryptocurrency futures, which work similarly to regular futures. These give users the ability to take advantage of short-term price movements within the crypto market, without having to purchase the whole crypto themselves.

Stocks

Along with being able to spot trade, FTX offers the trading of tokenised stocks. The platform features popular stocks such as SpaceX, Amazon, Airbnb and Netflix, as well as the ability to trade quarterly futures on most of the offered stocks.

These tokenised stocks are traded against the USD Stablecoin. Traders are not tied to dealing with whole units of stocks (can buy/sell fractions) and 24/7 market access.

Leveraged Tokens

FTX’s leveraged tokens provide the ability to open margin trading positions without needing to manually calculate and manage margins, collateral and liquidation prices. For example, by purchasing ETHBULL 3x tokens, for every 1% that ETH goes up, ETHBULL goes up 3%.

This kind of margin lending simplifies the trading process, though it does limit the amount of leverage that you can take. There are four kinds of leverage tokens, BULL (3x), BEAR (-3x), HEDGE (±1x) and HALF (±0.5x). This limits your options to those leverage multipliers, rendering you unable to carry out other denominations of leverage like 1:2 or 1:4 with FTX.

The token’s value is backed up by the ability to sell your tokens to FTX for their net asset value. You trade leveraged tokens like you would spot trade any other ERC20 token on the platform.

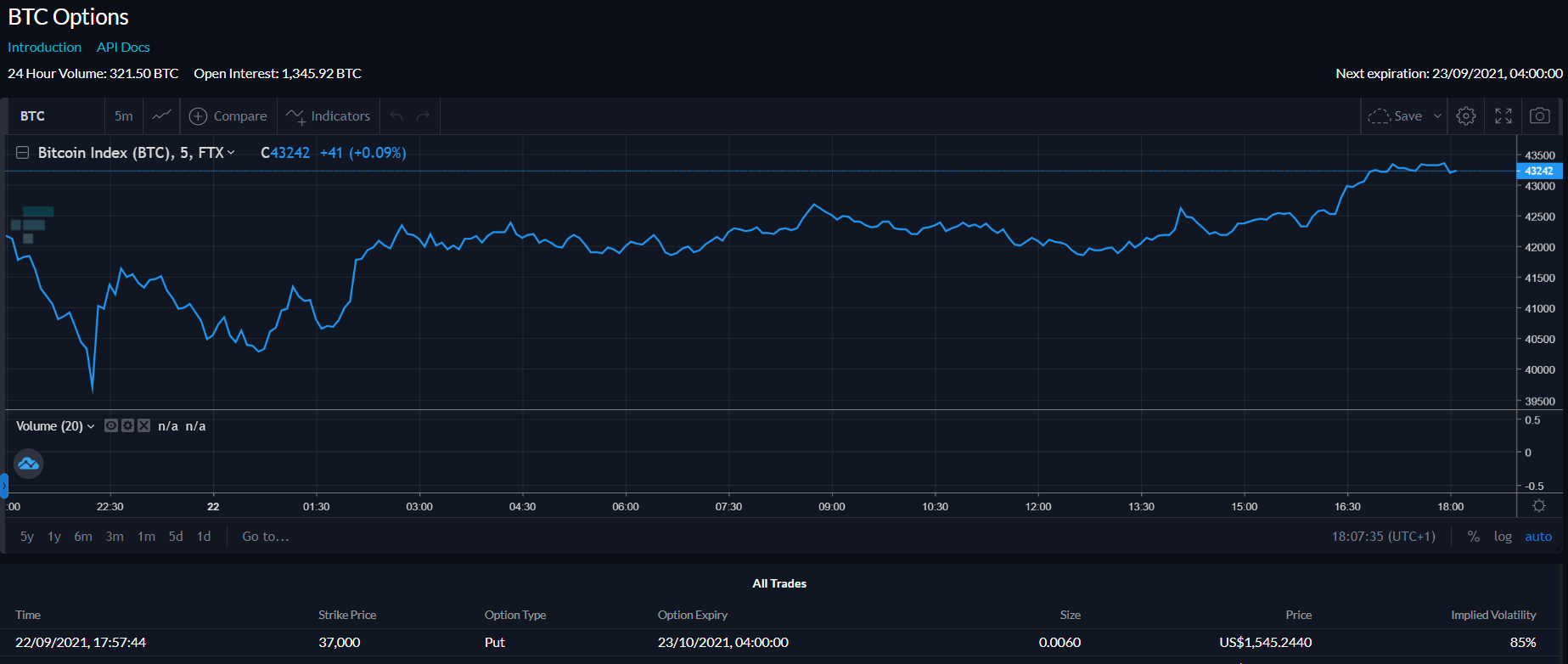

Volatility

Being able to open MOVE BTC volatility contracts is a unique service offered by FTX. MOVE contracts work by speculating on whether the price of Bitcoin will be relatively volatile or stable. Going long would mean that you will see returns if the price moves a lot within the next day in either direction, whilst going short would mean that you will see returns if the price remains relatively stable. Much like futures, the FTX platform allows for leveraged positions to be opened using collateral.

MOVE contracts are split into three types: daily, weekly and quarterly. Instead of expiring to the price of a token, MOVE contracts expire to the amount its price moved. If your total collateral moves below the required maintenance margin, your position will begin to be liquidated.

Prediction

Interestingly, you can speculate on the outcomes of select major events on the FTX platform. The platform features TRUMP2024 and BOLSONARO2022 tokens, to give an example. Upon the outcome of the event being known, the token either expires at $1 or $0, depending on the outcome.

Fiat

In addition to being able to spot trade regular cryptocurrencies and alts, FTX offers trading of government-backed currencies like GBP, EUR and USD. You are also able to buy futures contracts for select currencies.

Spot Trading

As well as allowing traders to purchase futures contracts on crypto, FTX gives a convenient and easy way to spot trade crypto. It offers historical price data of various tokens, as well as the ability to quickly borrow/lend currency.

If you have spot margin trading enabled for your account, you can lend one token on the spot market for another, which is automatically abstracted into net balances. If you have sufficient margin and spend beyond the balance of your account then tokens are automatically borrowed. This is represented as a negative balance on your account, for example, a negative USD balance may be shown if you borrowed USD Stablecoins.

Similarly, if you have lent out any coins, they would show as a positive balance in your account, e.g. if you see a positive USDT balance, then you are lending out that currency.

A positive balance in your account is used as collateral for any negative balance. Therefore, you must still keep a margin to avoid liquidation.

Interest Rates

Every hour on the FTX exchange, borrowers are charged interest and lenders are paid out. When you decide to lend out some tokens, you set out the minimum interest rate for your tokens.

If you wish to borrow tokens, you will be presented with a list of lenders, sorted by lowest quotes (interest rates).

Collateral

On FTX, for collateral, you can use any tokens that are deposited into your account. This means that you can have non-USD collateral set up, comprised of different digital tokens and stable coins. With enough collateral, you can access leverage rates up to 1:50.

Mobile App

FTX clients can access the exchange’s services both from a desktop or mobile device, using the FTX mobile application. Almost all the functionality of the desktop platform is retained in the mobile client, which is available on both Android (APK) and iOS.

FTT Staking

FTT, the FTX platform’s native token, can be purchased and stored in your FTX wallet. The token is backed by Alameda Research and can be purchased on many of the most popular cryptocurrency trading platforms (e.g. Binance, BitMax, etc).

To stake FTT and receive additional rewards through yield farming, you can lock up any number of tokens on the platform. Once you stake a number of your FTT tokes, you will be unable to access them until you decide to unstake. The unstaking process takes around 14 days to complete.

Note, FTT comes with fee rebates for all holders, even those not staking their tokens.

Fees

Interest Fees

The FTX exchange charges fees on any interest payments made. These charges vary slightly and are built into the interest rates shown on the platform.

You can work out the borrow/lending rates using the following formula: (lending rate) * ( 1 + borrower’s spot margin borrow rate).

Similarly, you can work out the spot margin borrow rate with: min(500 * borrower’s taker fee, 1).

Trading Fees

The FTX platform uses a tiered structure for its trading fees for futures and spots. These fees are split up by marker and taker fees. A maker is a user who makes an order, and a taker is a user who takes an order.

The maker fees can be offset by owning some of the platform’s own FTT tokens. FTT stakers receive maker rebates as low as -0.0030%. If you own 25 FTT, then you have 0 maker fees. FTT holders also get a discount on the FTX fees, and the more of a stake you have in FTT the higher the discount is. Note, taker fees cannot be discounted below 0.015%.

Leveraged Fees

On FTX, leveraged tokens have creation and redemption fees of 0.1%, and associated daily management fees of 0.03%.

Deposit & Withdrawal Fees

FTX does not charge any deposit fees (doesn’t matter if your account or wallet is UK based or not) which is standard for most crypto trading platforms. Withdrawal fees only apply to ETH, ERC20 or small BTC withdrawals. It should be noted that users will be charged gas fees when making ETH or ERC20 transfers unless they have a stake in FTT. BTC withdrawals are only charged for amounts less than 0.01 BTC.

The more FTT tokens owned, the higher the number of waived fees you are allowed per day, with a max of 1000.

The speed of deposits and withdrawals vary depending on the token. For example, XRP requires fewer confirmations than ETH before a deposit/withdrawal is confirmed.

Bank Fees

Depositing from/to a bank account into your FTX wallet will incur some fees, as this concerns fiat currency. If withdrawing less than $10000 in fiat currency into a bank account, the transaction will be charged $75. There is no deposit limit unless your bank imposes one. This is the same for withdrawals.

Automated Trading

The FTX platform provides an inbuilt service called Quant Zone, which allows for traders to create rules that automatically execute their trading strategies, which help them trade better. You can provide simple rules like “if BTC price is above $5000, buy x BTC”, as well as much more complex rules that allow for more granular and precise control of your automated trades. The rules define triggers and actions, which you must define to set up rules. Each trigger is checked roughly every 15 seconds.

In addition to using Quant Zone, the platform provides a set of REST APIs and WebSockets that can be utilised to communicate with the exchange and perform actions without having to go through the website’s UI. This method of automated trading requires knowledge of some form of programming languages such as Python, Java or JavaScript. Custom tools such as 3commas are already available to use for automated trading on FTX, which utilise said APIs.

Support Pages

The FTX platform has its own YouTube channel, featuring helpful videos about the exchange and its functionalities, which are useful to traders who are unfamiliar with it.

Security

As FTX is a financial platform that handles large volumes of cryptocurrencies at any one point, the exchange has put in place various security measures to help keep you and your funds safe.

Once you have your account, you can set up two-factor authentication (a.k.a. 2FA). To carry out any trades you must have this set up. The 2FA can be set up using different methods, such as Google Authenticator (using a QR code to generate a pass), or Yubikey to get one-time passwords from a small piece of hardware. 2FA is used on FTX for withdrawals, to prevent any unauthorised liquidation of your account.

In addition, you can set up sub-profiles within your account, which allow you to give out access to others to trade on your account, however with some limitations/restrictions put in place. This helps minimise the risk of insider threats, preventing others from having more access than they should have.

The security features of the FTX exchange are quite powerful, and it makes sense to make the most of what they offer.

Customer Support

It is simple and easy to get support on the FTX exchange through opening support tickets or emailing their official support team. You can get 24/7 support from their communities set up on Telegram, WeChat, Twitter and other social media sites.

How To Open An Account

Registration on FTX is simple and only takes a few details like email and password. After initial account set-up, you will be directed towards setting up 2FA before being able to make most of the features of the site. Further setup in the form of identity verification is required to set up withdrawal functionality. It may take a bit of time before your identity is verified.

FTX Vs Binance & Coinbase

When comparing the fees and features of FTX to other platforms such as Binance and Coinbase, there are several aspects to consider. FTX offers more tokens and products than other exchanges, as well as lower fees thanks to its tiered system. However, other platforms may offer more technical analysis functionality.

FTX Verdict

FTX offers competitive fees and a huge variety of assets to trade. If you are looking for a one-stop platform for most kinds of cryptocurrency investing, lending and derivatives trading, then this exchange may be right for you. Both experienced and beginner crypto traders will be able to make the most of the services offered, especially due to the powerful customisation options.

FAQs

Is FTX A Wallet?

Yes and no. You can use your FTX account as a form of wallet, however, it is recommended that you use other dedicated services for long-term storage.

Is FTX A Good Exchange?

If you are looking for a more general platform, FTX is a good exchange in terms of the wide variety of assets it offers to trade and leverage.

Can I Build My Own Automation System?

Yes. You can use Quant Zone to quickly build rules for your trades, or make your own custom-built solutions using their offered APIs.

Where Can I Buy FTT Tokens?

You can buy FTT tokens on many of the most popular exchanges, such as Binance and BitMax.

Can US Citizens Use FTX?

No. Current location restrictions on FTX prevent US citizens from using the platform. A partner platform specific to the US is available, however, called FTX.US.

Is FTX A Decentralised Exchange?

No, FTX is a centralised exchange platform, which means that there is a governing body for the blockchain, protocol and exchange.

Top 3 Alternatives to FTX

Compare FTX with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- FOREX.com – Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

FTX Comparison Table

| FTX | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| Rating | 0.3 | 4.3 | 4.4 | 4.5 |

| Markets | Cryptos, Futures, Options | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Forex, Stocks, Futures, Futures Options |

| Demo Account | No | Yes | Yes | Yes |

| Minimum Deposit | $1 | $0 | $0 | $100 |

| Minimum Trade | $1 | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | – | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | NFA, CFTC |

| Bonus | – | – | – | Active Trader Program With A 15% Reduction In Costs |

| Education | No | Yes | Yes | Yes |

| Platforms | AlgoTrader | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Leverage | – | 1:50 | 1:30 (Retail), 1:250 (Pro) | 1:50 |

| Payment Methods | 4 | 6 | 6 | 8 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

IG Review |

FOREX.com Review |

Compare Trading Instruments

Compare the markets and instruments offered by FTX and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| FTX | Interactive Brokers | IG | FOREX.com | |

|---|---|---|---|---|

| CFD | No | Yes | Yes | No |

| Forex | No | Yes | Yes | Yes |

| Stocks | No | Yes | Yes | Yes |

| Commodities | No | Yes | Yes | Yes |

| Oil | No | No | Yes | Yes |

| Gold | No | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | No | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | No |

| Futures | Yes | Yes | Yes | Yes |

| Options | Yes | Yes | Yes | Yes |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | No | Yes | No |

| Volatility Index | No | No | Yes | No |

FTX vs Other Brokers

Compare FTX with any other broker by selecting the other broker below.

The most popular FTX comparisons:

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of FTX yet, will you be the first to help fellow traders decide if they should trade with FTX or not?