Freetrade Review 2026

See the Top 3 Alternatives in your location.

Awards

- Best Online Trading Platform 2020 - British Bank Awards

- Best Share Trading Platform 2019 - British Bank Awards

- People’s Choice 2019 - Good Money Guide

- Best New Investment Service 2019 - Consumer Investment Awards

Pros

- Very competitive pricing vs competitors with low fees and zero commissions

- Dividends on stocks

- Earn interest on uninvested cash with competitive rates

Cons

- No leveraged trading

- Competitors have larger selection of assets

- No demo account

Freetrade Review

Freetrade is a UK-based fintech offering low-cost trading on shares and ETFs. With an intuitive mobile app and stock investing from £2, the broker has a lot to offer. Our review explains how to use the mobile app, deposits and withdrawals, along with general investing and ISA accounts.

Who Are Freetrade?

Freetrade was established in 2016 after securing investment through Crowdcube. The brokerage is headquartered in London.

The company founders aim to make owning stocks easy and affordable. Today, its number of users exceeds 1 million. And while their mobile investing services are predominantly available in the UK, the broker has a roadmap with plans to expand into Europe.

The firm is a member of the London Stock Exchange and is regulated by the Financial Conduct Authority (FCA). This is a highly reputable regulator and gives the broker a strong trust rating.

Trading Platform

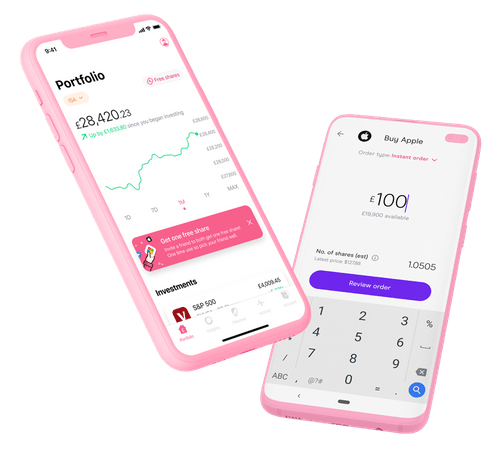

The broker’s bespoke trading platform was developed in-house with simple design features, perfect for investors starting out. The trading terminal is currently only available on a mobile app, downloadable free of charge to iOS and Android devices. The platform’s intuitive dashboard has been designed with the user in mind. However, experienced traders may be disappointed by the lack of comprehensive analysis tools typically found on desktop trading solutions.

Features include:

- Basic charting package

- Interactive stock universe

- Easy to follow share valuations

- Two-step authentication at login

- Instant access to share prices & market data

- Enhanced search functionality including by category, industry, asset class, or popularity

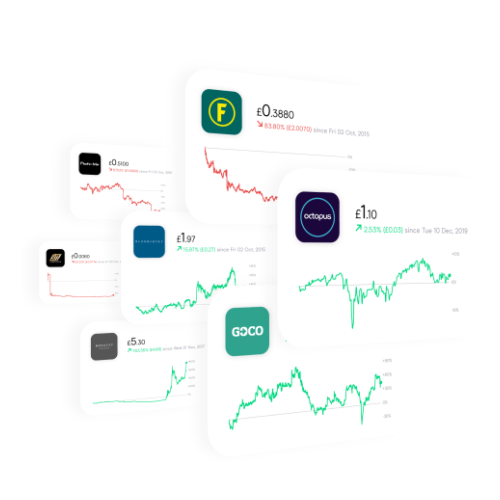

Assets

Freetrade offers clients trading opportunities in the following markets:

- 4,000+ US and UK stocks, including Amazon, Airbnb, S&P 500 and GME

- 200+ ETFs across global index funds and exchanges such as The Gold Producers

- 150 investment trusts across industries to diversify trading portfolios

Fractional shares are also available on US stocks so traders can specify how much cash they want to invest versus how many shares they want to buy. See the broker’s website for a full list of stocks.

The broker is focused on stocks and ETFs, so users looking to invest in cryptos, such as Bitcoin, forex, commodities or binary options will need to look elsewhere.

Trading Fees

Freetrade is an affordable online broker. It’s free to open a share dealing account with zero commissions. There are also no additional charges, such as fees levied on dormant accounts. The only cost to be aware of is the spot charge + 0.45% FX rate. This means Freetrade is a low-cost provider vs alternatives like Revolut, Hargreaves Lansdown, Vanguard, Robinhood, eToro and Trading212.

Note UK investors will need to comply with tax regulations, such as capital gains requirements, depending on investing activity. Visit the broker’s website for more information on tax rules and statements.

Leverage

Freetrade does not offer margin trading accounts. For clients wanting leveraged trading on stocks and shares, this broker is not the right option. The company is more focused on protecting clients from risk. Note, most European and UK regulated brokers offer leverage up to 1:30.

Payments

Deposits

Top-ups are only accepted in GBP and there is no minimum payment requirement. With that said, the minimum order size is £2. The broker offers a couple of online payment solutions with varying timelines:

- Bank Transfer – 2 to 4 business hours, only processed Monday to Friday, includes all UK banks and joint accounts

- Apple Pay – instant, available 24/7

The brokerage could expand its range of payment solutions in line with other providers.

Withdrawals

Freetrade does not typically charge a fee for withdrawals, however, same-day requests incur a £5 fee. Payments are usually processed in 3-5 days. Note, investments are subject to a settlement time before a withdrawal is available. How long it takes to settle an order varies, but typically takes 2-3 working days. Sell orders are available as unsettled cash in your Freetrade account before this.

Demo Account

The broker does not currently provide a free demo account to prospective investors. This is a drawback as a practice account is offered by many competitors. With that said, Freetrade argues that since fractional shares are available from £2, a demo account is not really needed. Still, this review would have liked to see a free simulator so users can test out the broker’s products and services before opening a real account.

Freetrade Bonuses

At the time of writing, Freetrade does not offer any deals for new clients, this includes no deposit bonuses. With that said, a £200 referral scheme is available for existing clients. Traders can pick up a share with a value up to £200 for referring new users to the website.

Regulation

As a UK corporation, Freetrade is licensed by the Financial Conduct Authority (FCA), meaning the broker follows established regulatory practices. As a result, investors benefit from a compensation fund should the firm go under and legal recourse should the company act inappropriately.

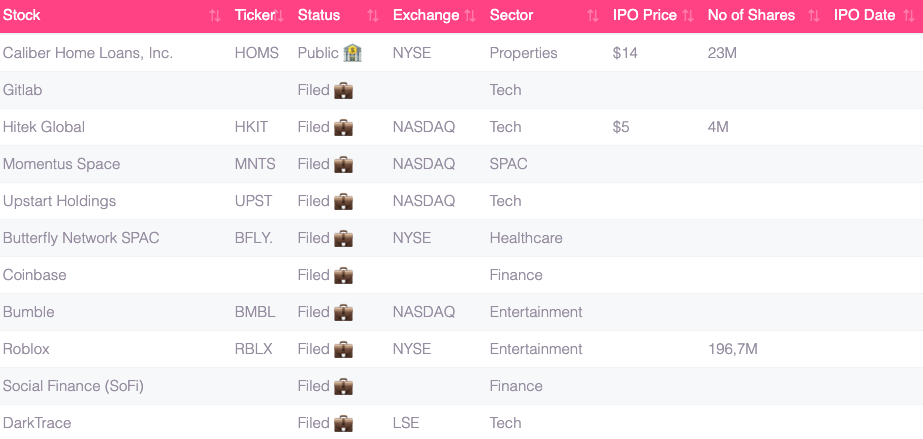

Additional Features

Freetrade offers an Invest Hub with educational tools alongside a supporting YouTube channel. A community forum exists with trading insights that also answers common questions. Additionally, clients benefit from an IPO calendar, a newsletter, and articles explaining a range of topics, from penny stocks and exchange rates to guidance on finding the best stocks to purchase.

Trading Accounts

The broker offers four different account types:

- General Investment Account – basic investing account for standard and fractional shares, along with ETFs

- Stocks and Shares ISA – tax-efficient investing account, £3 monthly fee, zero trading commissions

- Freetrade Plus – premium account with 3% interest on cash, stop loss and limit orders, wider market access, £9.99 monthly fee

- Freetrade SIPP – tax-efficient pension savings with control over contributions, pension consolidations and full account management, £9.99 monthly fee or £7.99 monthly fee for Freetrade Plus members

Currently, accounts can only be opened in the UK and selected countries in Europe. Investors will need to submit their NI number and bank account details for digital verification. The minimum age to open a Freetrade account is 18.

Trading Hours

Freetrade follows standard trading hours. Stock markets are typically open 24/5, Monday to Friday. The mobile app is also available for deposits and withdrawals, alongside general account management over the weekend. Note that queued orders placed outside of opening hours will be executed the following day, in line with security protocols.

Customer Support

You can contact the broker’s customer support team via the following channels:

- Live chat

- Twitter & LinkedIn

- Email – hello@freetrade.io

- Address – Techspace Aldgate East, 32 – 38 Leman St, London, E1 8EW

- Online community forum plus Q&A zone via the help logo on the broker’s website

Note, there is no telephone helpline number.

Security

Freetrade complies with FCA licensing guidelines including FSCS investment protection for customers up to £85,000 and the segregation of client funds. The app offers strong user security with additional authentication at the login stage, including PIN protection and face recognition. All company processes are also audited by an external third party.

Freetrade Verdict

Freetrade offers straightforward access to stocks and shares via a user-friendly mobile app. ISA accounts and pension saving solutions are also available. And what the broker lacks in desktop analytical tools it makes up for with low fees and built-in customer support. Still new, Freetrade is a good broker that has seen significant growth and we’re excited to see what the company will do next.

Best Alternatives to Freetrade

Compare Freetrade with the best similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- eToro USA – eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

Freetrade Comparison Table

| Freetrade | Interactive Brokers | eToro USA | |

|---|---|---|---|

| Rating | 2.8 | 4.3 | 3.4 |

| Markets | Stocks, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Stocks, Options, ETFs, Crypto |

| Demo Account | No | Yes | Yes |

| Minimum Deposit | $0 | $0 | $100 |

| Minimum Trade | £2 | $100 | $10 |

| Regulators | FCA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | SEC, FINRA |

| Bonus | – | – | Invest $100 and get $10 |

| Platforms | Own | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | eToro Trading Platform & CopyTrader |

| Leverage | – | 1:50 | – |

| Payment Methods | 2 | 6 | 4 |

| Visit | – | Visit | Visit |

| Review | – | Interactive Brokers Review |

eToro USA Review |

Compare Trading Instruments

Compare the markets and instruments offered by Freetrade and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Freetrade | Interactive Brokers | eToro USA | |

|---|---|---|---|

| CFD | No | Yes | No |

| Forex | No | Yes | No |

| Stocks | Yes | Yes | Yes |

| Commodities | No | Yes | No |

| Oil | No | No | No |

| Gold | No | Yes | No |

| Copper | No | No | No |

| Silver | No | No | No |

| Corn | No | No | No |

| Crypto | No | Yes | Yes |

| Futures | No | Yes | No |

| Options | No | Yes | Yes |

| ETFs | No | Yes | Yes |

| Bonds | No | Yes | No |

| Warrants | No | Yes | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | Yes |

Freetrade vs Other Brokers

Compare Freetrade with any other broker by selecting the other broker below.

The most popular Freetrade comparisons:

FAQ

Who are Freetrade and how do I invest?

Freetrade is a UK-based stockbroker offering hundreds of shares and ETFs. Just £2 is needed to start investing and the firm offers a free mobile app with integrated support.

How does Freetrade make money?

The firm makes money through its monthly subscription fees. Charges vary depending on the account type, but range from £3 a month with the stocks and shares ISA up to £9.99 a month with the Freetrade SIPP account.

Is Freetrade a safe and legit app?

Yes, Freetrade offers a good mobile app with zero commissions and multiple security features, as well as FCA regulation. User reviews indicate the broker is respected and trustworthy.

Do you get dividends on Freetrade?

Some Freetrade listed stocks and shares companies offer monthly or yearly dividends with funds paid directly into trading accounts. The size of dividends will depend on company performance and the level of investment.

Why was my Freetrade buy order rejected?

Your Freetrade order may be rejected due to several reasons; no valid market quotes or the valuation of the order wasn’t high enough to cover the cost of buying the shares. Note, pricing is subject to a 15-minute market delay.

Do you own the shares on Freetrade?

Depending on whether you buy fractional shares or standard shares, you will own a stake in the company. You can buy and sell your shares through the Freetrade mobile app.

Can I transfer my Freetrade shares between the General Investment Account and ISA?

You cannot currently transfer your shares via Freetrade accounts. However, for cash transfers, contact the stockbroker through the built-in chat support.

Customer Reviews

There are no customer reviews of Freetrade yet, will you be the first to help fellow traders decide if they should trade with Freetrade or not?