Finq.com Review 2025

Pros

- Demo account with access to virtual funds ($10k)

- Bespoke trading platform plus industry-renowned MT4 terminal

- 24/5 customer support

Cons

- Limited security details

- No copy trading tool

- Narrow range of trading tools

Finq.com Review

Finq.com is a multi-asset CFD broker offering trading opportunities on forex, stocks, commodities, indices, cryptocurrencies and more. Trade on the powerful MetaTrader 4 terminal or access the proprietary Finq WebTrader. With tight spreads, a large range of assets, and a minimum deposit of $100, Finq is growing quickly. This review will cover account types, volume bonuses, platform features and more. Find out whether our experts would recommend Finq.

Finq.com Headlines

Finq is a web-based forex and CFD brokerage launched in 2017. Operated by Lead Capital Services Ltd, it is still a relatively new brokerage in the market, but has established itself thanks to its ‘think trading, think Finq’ vision.

A large welcome bonus and a $10,000 free demo account has also made it attractive to beginners. In addition, the online brokerage offers a wide selection of fee-free deposit and withdrawal methods, including Visa, Mastercard, Neteller and Skrill. More than 2100 assets are available to account holders.

Finq has headquarters located in the Seychelles and is regulated by the Seychelles Financial Services Authority (FSA).

Trading Platform

Finq offers two trading platforms to day traders; a proprietary WebTrader and MetaTrader 4 (MT4). The MetaTrader 4 platform is best suited to forex and CFD traders while the WebTrader solution may be a better fit for clients trading equities.

The brand’s web-based platform can be used directly through all major internet browsers. MT4 can be downloaded to Windows and Mac devices or can also be used as a web-based profile. Useful download links are available on the broker’s website. Note, our experts found that it is not possible to trade all instruments through just one platform.

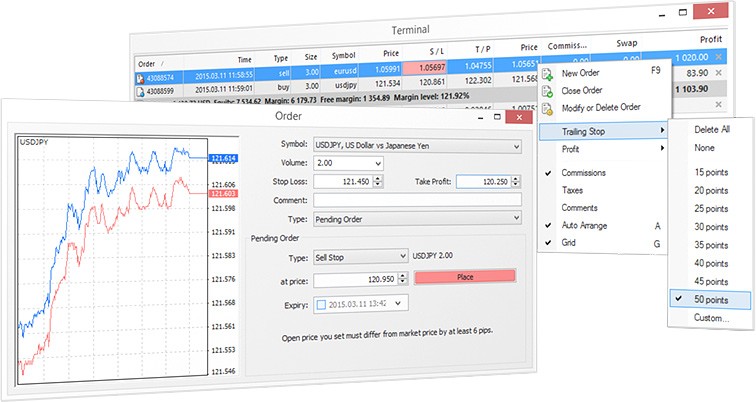

MetaTrader 4

MetaTrader 4 is an established platform developed for trading commodities and FX, among other assets. It is user-friendly and the gold standard in the retail investment industry.

The terminal provides a multilingual interface, 30+ built-in technical indicators, nine timeframes, instant execution, and a comprehensive technical analysis package. It also offers automated trading, with the ability to test strategies using MetaEditor, Strategy Tester and Compiler.

WebTrader

Alternatively, WebTrader offers advanced tools, with a fully customizable trading suite that doesn’t require any computer software installation. It harnesses cutting-edge web technology to provide top-class functionality.

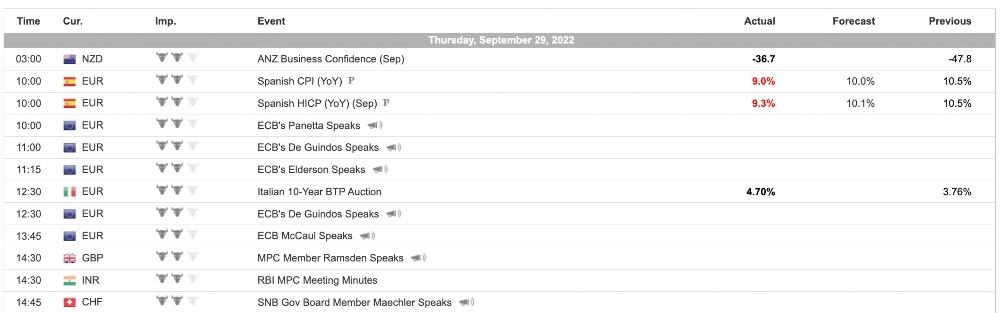

When using the Finq platform, we came across some interesting tools such as the ‘Events & Trade’ function to pinpoint the movement of instruments from the economic calendar. Overall, the platform is basic but ticks most of the boxes for the average retail trader.

Assets & Markets

Finq offers 2100+ global instruments across seven asset classes:

- Bonds – Monitor five of the most well-known Sterling, Yen, Euro and Dollar bonds

- Stocks – Invest in 2000+ global company’s shares such as Apple, Facebook and Alibaba

- Forex – Trade 55 major and minor currency pairs including GBP/EUR, USD/EUR and USD/JPY

- Cryptocurrency – Trade 20+ digital currency coins including Bitcoin, Ethereum, Litecoin and Dash

- ETFs – Trade on 39 Finq exchange-traded funds across a variety of assets including commodities and stocks

- Commodities – Speculate on the price of 19 soft and hard commodities including Gold, Crude Oil and Wheat

- Indices – Covering 28 of the most prominent economic regions including Europe, US and China, invest in major stock markets including the S&P500, NASDAQ100 and FTSE100

Spreads & Commission

The broker offers variable spreads across all assets. When we used the Finq platform we were offered spreads from 0.14 USD on Gold trading, 0.10 pips on EUR/USD and 0.20 pips on GBP/USD, and 1.4 pips on the NASDAQ100 and DAX30.

Accounts will incur a commission fee, including for shares and crypto trading. This is tier-based, with the Silver profile acquiring the highest cost at 0.20%. ECN accounts will also be liable for an $8 per round lot commission fee when trading forex and precious metals. Crypto commissions are 0.50% per side across all accounts.

A monthly inactivity fee of $25 applies to accounts that aren’t used for 90 days or more.

Finq also has an overnight toll, known as a swap fee, for positions held overnight. This won’t affect day traders if positions are closed during market hours.

There are no fees or commissions on deposits or withdrawals, however, third-party charges may apply.

Finq Leverage

As an offshore organization, the broker offers substantial margin trading opportunities due to the limited regulatory restrictions. The maximum leverage offered to day traders is 1:300, though this does vary by asset.

When we used Finq, our experts were offered leverage of 1:200 for indices investments and 1:2 for cryptocurrency trades. The risk increases with higher rates so we would recommend newer traders to stick with lower leverage levels to start with.

Mobile App

If you aren’t able to sit in front of a computer for hours every day and your schedule involves long commutes or time outside the office, Finq.com has a polished and user-friendly mobile application. You can download it from the App Store for iOS devices and the Google Play store for Android. The platform has positive user reviews and over 70% of Finq traders currently already use the mobile app.

When we tested the Finq app, we were pleased with the execution speed and fully functioning asset displays. The interface is intuitive with simple navigation features. Day traders can review a ‘trending now’ asset list and utilize various order types such as Take Profit or Stop Loss.

Additionally, the MT4 mobile app enables retail clients access to the tools, features and functionality found on the desktop terminal. You can check live global pricing, manage your account, open and close positions and view charts while on the go. Similar to the branded WebTrader, user reviews are positive, rated 4.8 out of 5 on the Apple App Store.

Deposits & Withdrawals

It is good to see the broker does not have a deposit or withdrawal fee for any payment method, although third-party charges may apply. Accepted payment methods include; debit/credit cards, bank wire transfers, Neteller, FasaPay and Skrill. You can make withdrawals through the same channel you make deposits.

Processing times vary by method, with bank wire transfers typically taking around two to five working days for funds to clear. E-wallet solutions such as Neteller and Skrill may provide faster deposit times.

The minimum deposit is $100. There is no minimum withdrawal, except for wire transfers, where the minimum is $100.

Finq Demo Account

You can create a demo account with Finq when you first sign up. Users can access $10,000 virtual funds to practise trading risk free. The simulated account currencies you can try are USD, RUB, ZAR, EUR, LKR, INR, CHF.

Traders can also use the introductory wizard, with step-by-step guidance on the trading platforms. You are free to experience the simulated markets in more depth after this.

Bonuses & Deals

Finq offers several promotions:

- Pending Bonus – A volume-based bonus. The more you trade, the more points you accumulate.

- ‘Refer a Friend’ Bonus – Offers investors an extra 20% of their friend’s deposit and can climb as high as 400 USD/EUR/GBP.

- Welcome Bonus – New investors can receive a $50 welcome bonus once a new account has been verified, regardless of initial deposit size.

- First-Time Deposit Bonus – Available to new traders. The reward ranges from 16% to 30%, depending on the amount deposited. The maximum amount of bonus funds is 4000 USD/EUR/GBP. You may withdraw it only after reaching the required trading volume ($20,000 in volume for each dollar of bonus) within 30 days.

Regulation & Licensing

Finq is not as strong as some of its competitors in terms of regulation. This is because it only holds a license with the FSA in Seychelles, which is not one of the most reputable regulators. There are no strict rules and criteria that must be met to obtain a license from the organization, which may be a red flag for some investors. And while this should not alone lead you to conclude that Finq.com is a scam broker, you should be aware that protection may limited vs top-tier regulators such as the FCA or CySEC.

Recommended Alternatives To Finq.com

Finq Accounts

Finq offers various accounts for different types of traders. The classic account profiles (Silver, Gold and Platinum) are suitable for beginner and intermediate traders to access forex, stocks, indices, ETFs, commodities and bonds. The ECN profiles are best suited for high volume or intermediate traders, that prefer to work with low spreads in a direct-to-market environment.

The broker offers six accounts in total, all of which have:

- 24 hour customer service

- Dedicated account manager

- Desktop & mobile platforms

- Daily Analysis & Morning Review – useful for research

Silver Account

- Spreads starting at 0.6 pips

- $100 minimum deposit

- 0.20% commission on shares

Gold Account

- Trading Central

- Spreads starting at 0.5 pips

- Premium daily analysis

- $10,000 minimum deposit

- 0.16% commission on shares

Platinum Account

- Trading Central

- Spreads starting at 0.4 pips

- Premium daily analysis

- $50,000 minimum deposit

- Superior customer support

- 0.12% commission on shares

Exclusive Account

- Trading Central

- Spreads starting at 0.3 pips

- Premium daily analysis

- $100,000 minimum deposit

- Superior customer support

- 0.08% commission on shares

Classic ECN Account

- Spreads starting at 0.4 pips

- $1,000 minimum deposit

- 0.16% commission on shares

Pro ECN Account

- Trading Central

- Premium daily analysis

- Spreads starting at 0.15 pips

- $50,000 minimum deposit

- Superior customer support

- 0.08% commission on shares

Finq also offers an Islamic swap-free account for their clients.

It is quick and easy to register for a new profile. To open an account, visit the ‘Start Trading’ link on the top right of each web page. Complete the online application form. The broker requires a proof of identity such as a utility bill or passport.

To close an account, contact the brokerage via their support email address.

Additional Features

The broker includes an extensive education section on its site, ideal for both new and experienced day traders. When we used the resources on Finq.com, we were pleased withe the selection of video lectures and web tutorials, creating a full, comprehensive online academy.

Traders should also be assured of the step-by-step guidance and detailed FAQ section available for the bespoke WebTrader platform. You can also find an economic calendar and weekly CFD expiration dates.

Trading Hours

Finq trading hours will vary by instrument. The 2100+ assets span 24/5 to accommodate the trading hours of the relevant global exchanges and markets. There is also weekend trading on a number of instruments, including cryptocurrency.

Review the published session timetable via the broker’s terminal interface. This is particularly useful to stay up to date with upcoming market closures.

Customer Support

The broker can be contacted via email (support@finq.com), live chat services or WhatsApp. Alternatively, contact Finq via their head office address; Suite 3, Global Village Jivan’s Complex, Mont Fleuri Mahe, Seychelles.

Help is available 24 hours a day, Sunday 5 PM (EST) to Friday 4PM (EST).

Security

When using Finq, we found limited information regarding client security and safety. Nonetheless, the broker does segregate client funds within top-tier banks and the firm operates a negative balance protection system, meaning you cannot lose more than your initial investment. Data transmissions are fully encrypted using SSL Secure.

We did not find any evidence of additional security settings such as two-factor authentication (2FA) when using the Finq platform, however this is offered as standard by MetaTrader.

Finq.com Verdict

Finq.com offers a well-rounded brokerage for investors who wish to trade a diverse range of assets in CFD form through a market-maker execution model. It is particularly useful for individual stocks and shares, plus ETFs. However, users should proceed with caution as the broker’s financial credentials are not regulated by the most reliable of authorities. This means there is an element of risk that may deter some traders.

FAQ

Is Finq Regulated?

Finq.com is operated by Lead Capital Services Ltd, which is also the website’s primary payment processor. Lead Capital Services Ltd is working on behalf of its parent business, Leadcapital Corp Ltd, which the Seychelles Financial Services Authority classes as a Securities Dealer.

What Is The Finq Trading Commission For Forex And Metals?

Commission fees for forex and metals trading applies to the ECN accounts only. This is at a cost of $8 per lot. All other accounts can trade these assets commission-free.

Can I Trade On Finq From Qatar?

Yes, the broker offers services in Qatar. View our review for a full list of accepted countries.

Does Finq Have A Professional Investment Account?

Finq offers a Pro ECN and an Exclusive account, ideal for experienced or high-volume investors. However, they are not the same as other brokers’ traditional professional accounts and can be opened retail traders. View the account type section in this Finq.com review for more details.

Can You Trade Crypto On Finq?

Cryptocurrencies are a subcategory of foreign currencies on the WebTrader platform, with the primary instruments being Bitcoin, Ethereum, Litecoin, and Dash. Spreads vary from 0.8 pips and leverage is available from 1:2.

Can You Still Trade On Finq.com?

Yes, however Finq.com states the following “We do not establish accounts to residents of certain jurisdictions including the European Union, United States or any particular country or jurisdiction where such distribution or use would be contrary to local law or regulation.”

Top 3 Alternatives to Finq.com

Compare Finq.com with the top 3 similar brokers that accept traders from your location.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- Dukascopy – Established in 2004, Dukascopy Bank SA is a Swiss online bank and brokerage providing short-term trading opportunities on 1,200+ instruments, including binaries. A choice of accounts (JForex, MT4/5, Binary Options) and sophisticated platforms (JForex, MT4/MT5) deliver powerful tools and market data for active traders.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

Finq.com Comparison Table

| Finq.com | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| Rating | 3.8 | 4.3 | 3.6 | 4 |

| Markets | Shares, forex, commodities, indices, bonds, cryptocurrencies, ETFs | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | CFDs, Forex, Stocks, Indices, Commodities, Crypto, Bonds, Binary Options | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $100 | $1 |

| Minimum Trade | 0.01 Lots | $100 | 0.01 Lots | 0.01 Lots |

| Regulators | FSA | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM | FINMA, JFSA, FCMC | SVGFSA |

| Bonus | $50 Welcome Bonus | – | 10% Equity Bonus | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | JForex, MT4, MT5 | MT4, MT5 |

| Leverage | 1:300 | 1:50 | 1:200 | 1:1000 |

| Payment Methods | 8 | 6 | 11 | 10 |

| Visit | – | Visit | Visit | Visit |

| Review | – | Interactive Brokers Review |

Dukascopy Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by Finq.com and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| Finq.com | Interactive Brokers | Dukascopy | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | No | Yes | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | No | Yes | No |

| Silver | Yes | No | Yes | Yes |

| Corn | No | No | No | No |

| Crypto | Yes | Yes | Yes | Yes |

| Futures | No | Yes | No | No |

| Options | No | Yes | No | No |

| ETFs | Yes | Yes | Yes | No |

| Bonds | Yes | Yes | Yes | No |

| Warrants | No | Yes | No | No |

| Spreadbetting | No | No | No | No |

| Volatility Index | Yes | No | Yes | No |

Finq.com vs Other Brokers

Compare Finq.com with any other broker by selecting the other broker below.

Customer Reviews

There are no customer reviews of Finq.com yet, will you be the first to help fellow traders decide if they should trade with Finq.com or not?