SPY Closes 0.145% Lower On September 27, 2024

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

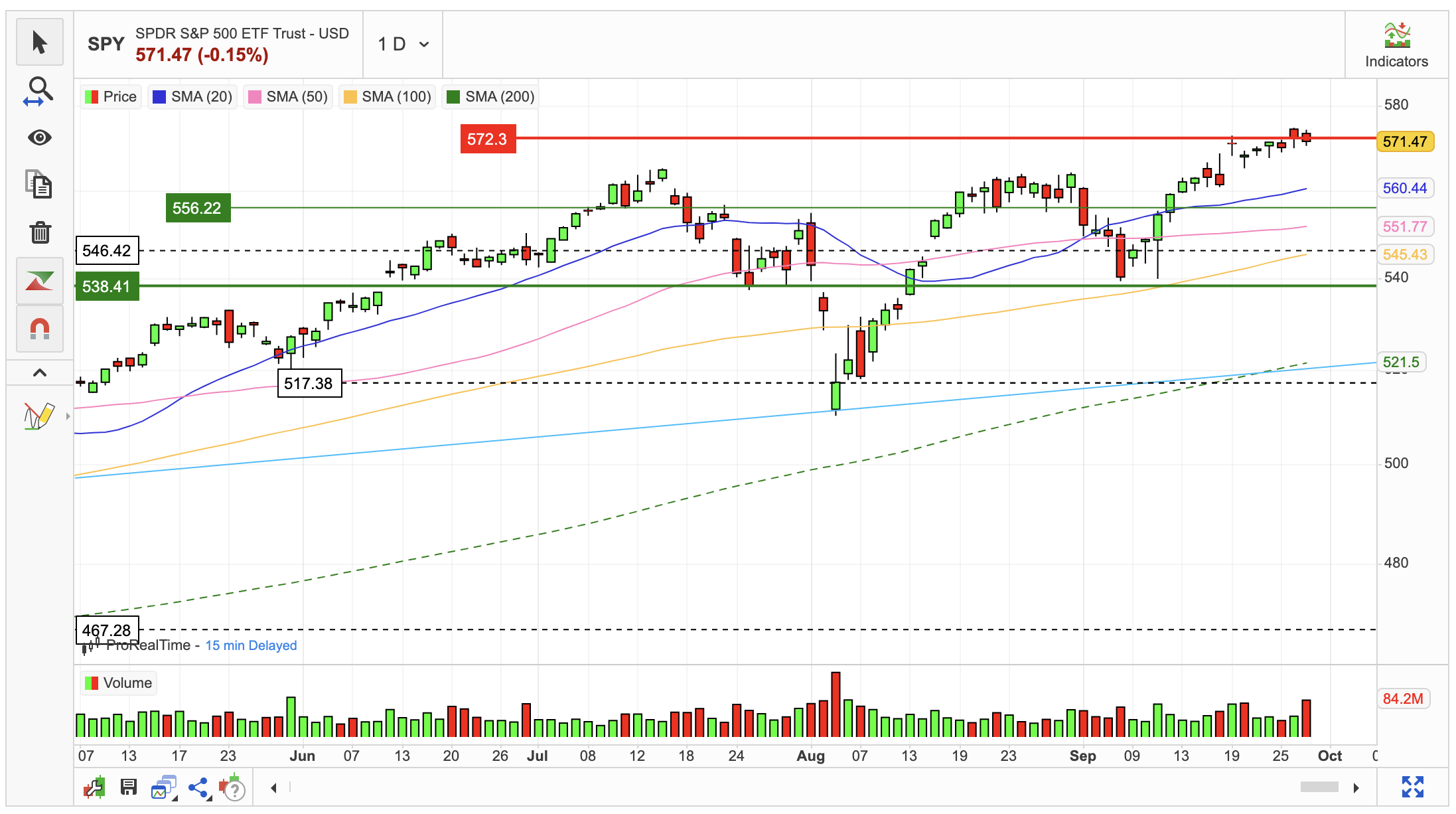

The SPY ETF experienced a minor decline on September 27th, closing at $571.47, a decrease of 0.145% from the previous day’s peak. Intraday trading was volatile, with a range of $570.42 to $574.22.

Over the past two weeks, the ETF has exhibited an upward trend, gaining 1.68%. However, on September 27th, trading volume decreased, which is often seen as a positive sign as it may indicate reduced selling pressure.

In the short term, the SPY ETF seems to be consolidating near the upper boundary of a rising trend. This might offer a potential selling opportunity for short-term traders anticipating a pullback towards the trend’s lower boundary.

A breakthrough above the trendline resistance at $572.30 could signal a more robust upward movement.

Based on the current short-term trend, the ETF is projected to increase by approximately 3.02% over the next three months.

There’s a 90% likelihood that the price will remain within a range of $543.54 to $596.26 at the end of that period.

Data: FactSet, Morningstar, S&P Capital IQ, ProRealTime, MarketScreener, StockInvest