QQQ Summary September 24, 2024

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

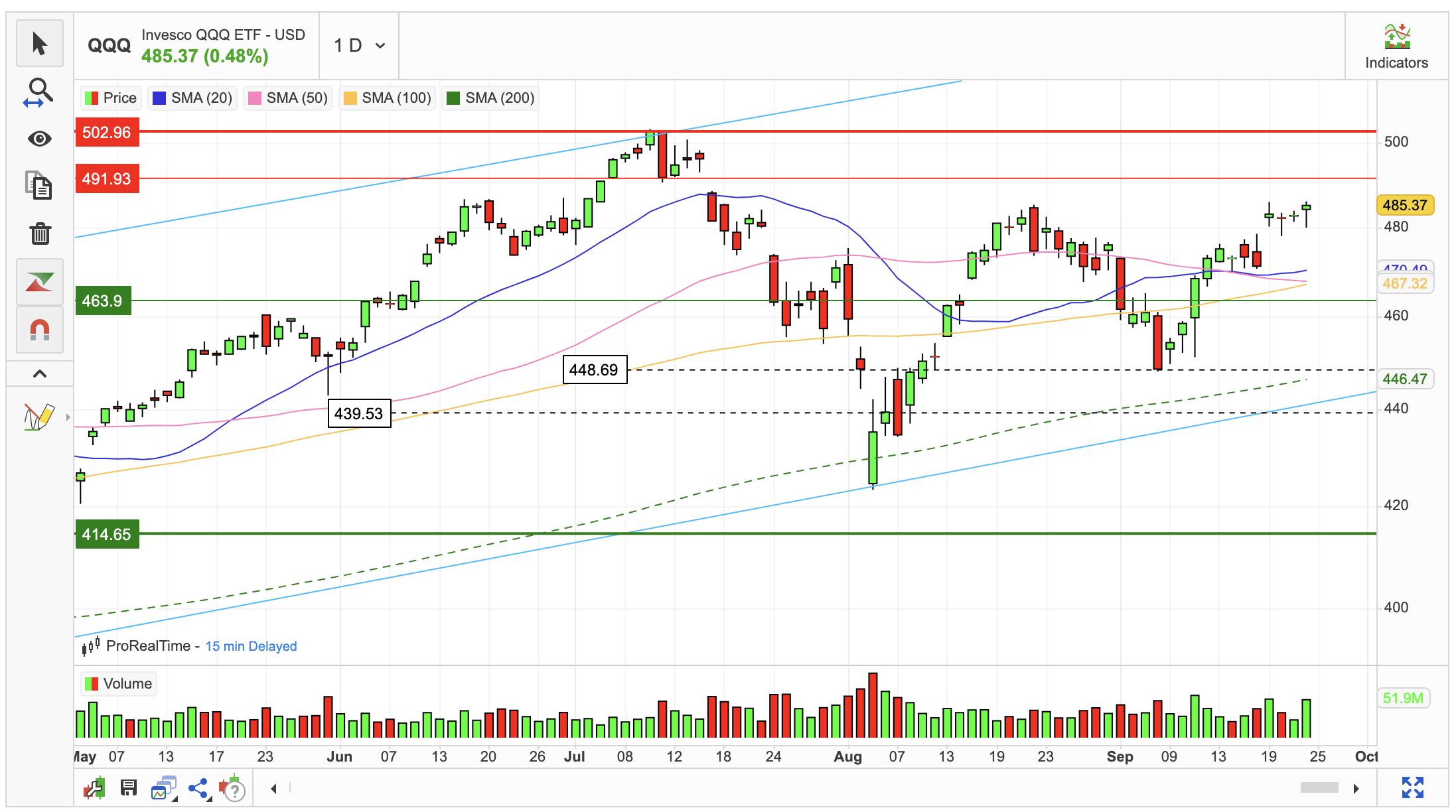

The QQQ ETF, a popular exchange-traded fund tracking the Nasdaq-100 Index, experienced a positive day on Tuesday, September 24, 2024. The ETF closed at $485.37, up 0.482% from the previous day’s closing price of $483.04.

Throughout the trading session, the QQQ ETF price fluctuated between a low of $480.17 and a high of $486.33, resulting in a total daily price movement of 1.28%.

This volatility is relatively normal for an ETF tracking a technology-heavy index like the Nasdaq-100.

Over the past ten days, the QQQ ETF has exhibited an upward trend, closing higher on seven of those days. This positive momentum has contributed to a cumulative gain of 5.82% over the two-week period.

The increased trading volume on Tuesday is a bullish technical indicator, suggesting that more investors are buying the ETF than selling. A total of 26 million shares were traded, representing a turnover of approximately $12.44 billion.

In the short term, the QQQ ETF appears to be consolidating near the upper end of a broad downward trend channel.

While this position may present a potential selling opportunity for short-term traders anticipating a pullback towards the lower end of the channel, a breakout above $491.93 resistance would signal a potential reversal of the downward trend.

However, even a break above this level might not immediately lead to a sustained uptrend.