Expectations of a September rate cut fuel investor enthusiasm

- This topic has 0 replies, 1 voice, and was last updated 1 year ago by .

-

Topic

-

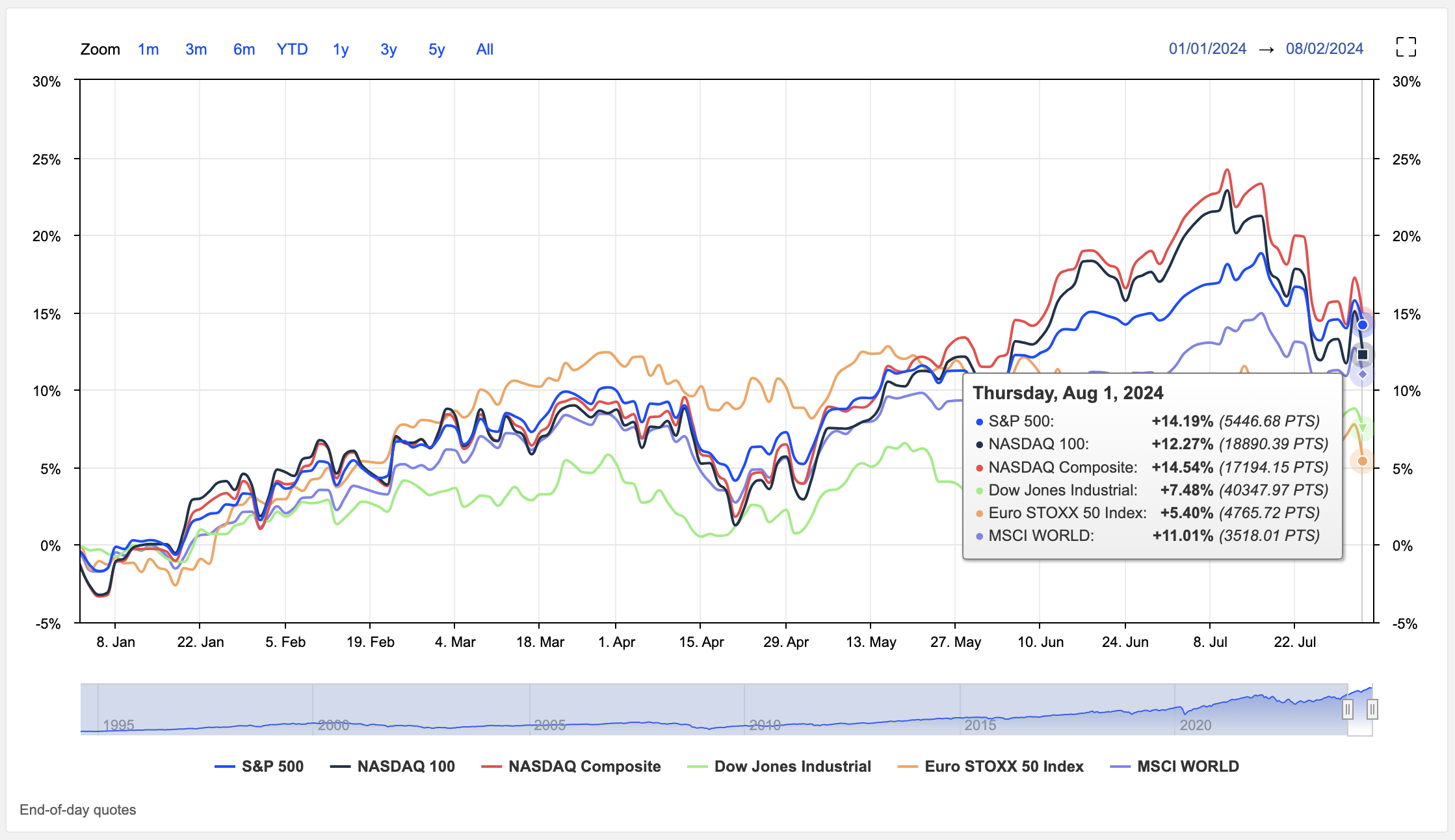

The stock market is poised for further gains following a technology-driven rally spurred by the Federal Reserve’s interest rate decision.

Major market indices indicate a positive open, though investors remain cautious ahead of the crucial non-farm payrolls report.

Strong earnings from Meta Platforms have bolstered market sentiment, but results from tech giants Amazon, Apple, and Intel will be closely watched.

Despite the historically challenging months of August and September, the S&P 500’s year-to-date performance and the proximity to a presidential election year suggest potential for continued growth.

While optimism prevails due to positive tech earnings and anticipated interest rate cuts, investors are adopting a balanced approach. Small-cap stocks continue to outperform amidst rate-cut expectations and attractive valuations.

The allure of US Treasury bonds as safe-haven assets has driven up long-term bond prices amid geopolitical tensions.

The tech sector, led by AMD, remains a market driver, with expectations of a September rate cut fuelling investor enthusiasm. However, concerns persist about certain tech companies, such as Microsoft.