CMC Markets Launches Forex Active With A 25% Spread Discount

CMC Markets has upgraded its trading conditions with its new Forex Active account. Clients can trade on pure price action across 330 pairs with zero-pip spreads on six majors. Let’s find out how it works…

Forex Active

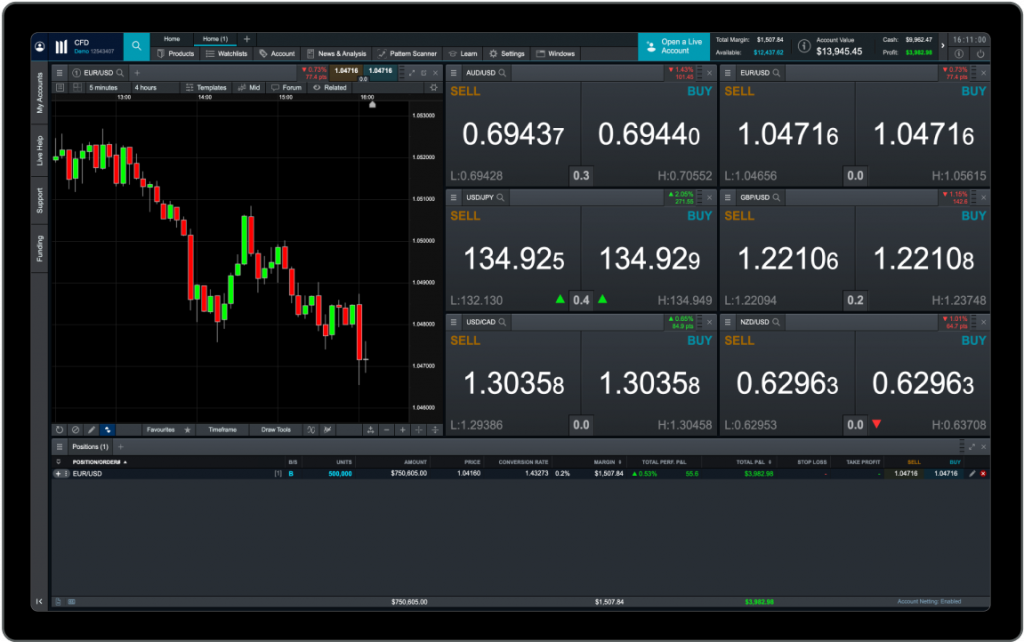

Forex Active offers transparent pricing. Clients benefit from fixed, low commissions at $2.50 per $100,000. Zero-pip spreads are also available on EUR/USD, GBP/USD, AUD/USD, NZD/USD, USD/CAD, and USD/JPY. The broker combines feeds from tier-one banks to provide accurate prices.

Forex Active is compatible with the broker’s in-house platform plus MetaTrader 4 (MT4). Over 330 FX pairs are available on CMC Market’s proprietary terminal while MT4 offers 175 pairs. The CMC platform provides sophisticated security features with advanced market insights and analysis features. MetaTrader 4 is a beginner-friendly trading terminal with algorithmic trading and Expert Advisors.

Ultra-fast, fully automated execution speeds from 0.0030 seconds are also available with Forex Active. Plus, clients can make deposits and withdrawals via Visa, Mastercard and POLi at no charge.

Getting Started

New clients can get started with Forex Active in three straightforward steps:

- Register – Sign up with CMC Markets using the link below or directly on the broker’s website. You will need to choose between CMC’s proprietary platform or the popular MetaTrader 4 terminal.

- Select ‘Forex Active’ – Choose the Forex Active account solution. This will provide access to 330 currency pairs and spread discounts up to 25%.

- Complete the application form – Follow the on-screen instructions to fill out the registration form. The form takes a few minutes to complete.

About CMC Markets

CMC Markets is a long-standing CFD and spread betting provider, launched in 1989. The firm has won various awards over the years and holds licenses with the UK Financial Conduct Authority (FCA), the Australian Securities & Investments Commission (ASIC), the Monetary Authority of Singapore (MAS), and the Investment Industry Regulatory Organization of Canada (IIROC).

As well as forex trading, clients can speculate on indices and ETFs, commodities, treasuries, and stocks. Leverage up to 1:30 is available to retail clients and negative balance protection is offered in line with regulatory requirements.

CMC Markets is particularly popular with mobile traders, offering dedicated spread betting and CFD trading apps that come with mobile-optimised charting, over 40 technical indicators, plus live signals.

Use the link below to open a Forex Active account today.