CloseOption Review 2026

Pros

- Free demo account

- Multiple global payment methods are available

- CloseOption offers weekly trading tournaments with cash prizes

Cons

- CloseOption is not regulated by a well-regarded trading authority

- Binary options are only available on fiat and digital currencies

- Clients need to deposit $50,000+ to qualify for the best payouts

CloseOption Review

CloseOption is a European binary options broker that offers 25+ assets spanning forex and cryptos. Up to 95% payouts are available alongside a beginner-friendly trading platform and weekly contests. This CloseOption.com review will unpack deposits and withdrawals, app availability, demo accounts, and more. Find out what our expert team thought of CloseOption.

Company Details

CloseOption is a Georgian-based binary options broker, founded in 2013.

Retail traders can speculate on the price of forex and digital currencies via a web-based platform and mobile solution. New clients can make a deposit using bank cards, wire transfers, e-wallets, plus popular cryptos like Bitcoin. The minimum trade size is also just $1.

CloseOption is registered with the National Bank of Georgia (license number B2-08/3647). However, it is worth noting that this is not a trusted trading authority.

Markets & Assets

CloseOption offers trading opportunities on a good selection of 25+ forex pairs and cryptocurrencies. However, clients cannot trade binaries on stocks, indices, or commodities which is a drawback vs alternative binary options brokers.

- Forex Pairs – AUD/JPY, AUD/USD, CAD/CHF, EUR/AUD, EUR/CAD, EUR/JPY, EUR/NZD, EUR/USD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, USD/NOK

- Crypto Pairs – BTC/USD, BCH/USD, ETH/USD, LTC/USD, XBT/USD

Payouts

CloseOption offers competitive payouts on its forex assets. However, traders will need to make a large deposit ($50k) to qualify for the highest payouts of up to 95%, which is a notable drawback vs competitors.

Typical payouts on currencies with the Copper (entry) account:

- EUR/USD – 76%

- USD/JPY – 75%

- GBP/USD – 75%

- AUD/USD – 70%

- USD/CHF – 70%

- EUR/JPY – 65%

Due to the volatility of digital assets, lower payouts of 40% are available.

CloseOption Fees

There are no commission fees when trading binaries at CloseOption. There are also no deposit or withdrawal fees.

On the downside, accounts inactive for more than three months will be charged a 0.5% fee based on the account balance. A $10 reactivation fee will also apply to reopen the profile.

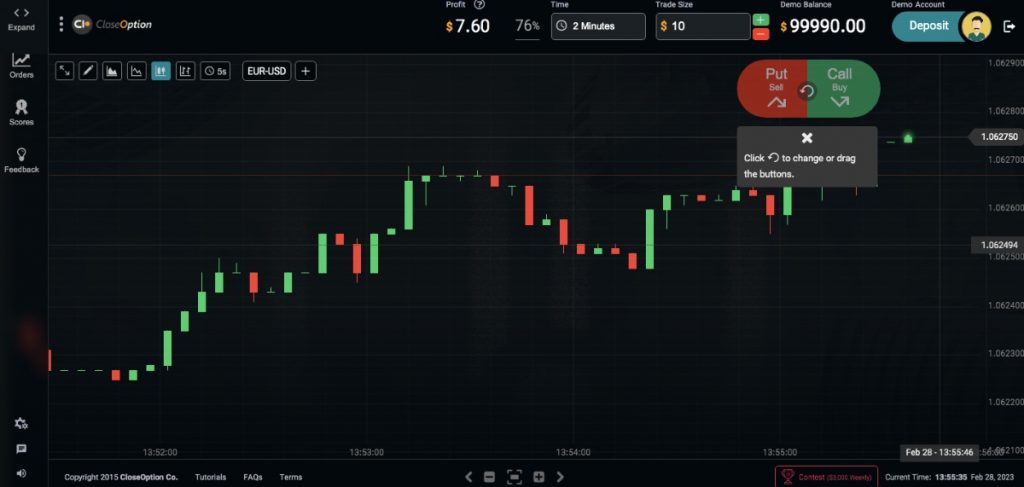

Trading Platform

The CloseOption trading platform is a web-based terminal compatible with major web browsers, including Google Chrome, Internet Explorer, and Firefox.

The platform provides all the basic features you need to analyze assets and trade binaries. This includes multiple charting styles, analysis tools like Fibonacci lines and trend lines, plus full order history. The potential payout is also clearly stated before a position is opened.

Charts can be viewed across four timeframes; 5 seconds, 10 seconds, 30 seconds, and 1 minute. Binary options contracts lengths span 15 intervals, ranging from 30 seconds to 1 month.

On the downside, there are limited advanced tools and features for seasoned traders.

How To Make A Binary Options Trade

When we used CloseOption, we found it quick and easy to open a trade:

- Log in to the client dashboard using your registered credentials

- Select ‘TradeRoom’ from the top right menu

- Click on the ‘Real Trading’ account option

- Choose an asset to trade from the menu above the graph

- Select an expiry time from the top menu (30 seconds to one month)

- Enter the trade size using the ‘+’ and ‘-‘ toggles or input the amount manually

- Review the potential payout available

- Select ‘Put’ or ‘Sell’ to confirm the trade

Mobile App

Unfortunately, CloseOption does not offer a downloadable mobile app. However, the terminal can be used reliably via major web browsers on mobile and tablet devices.

The interface is stable and adapts well to smaller screens. Traders can navigate between assets, add graphical overlays and enter trades with a few swipes and clicks. However, detailed technical analysis is a struggle and is best suited to desktop devices.

Live Account

The binary options broker offers just one live account. The minimum deposit is $5 which is similar to alternatives. There is a minimum trade size of $1 and a maximum trade size of $1000. Traders with a live account can access all benefits and tools including 24/7 customer support and trading contests.

Account levels can also be upgraded with larger deposits, unlocking more favorable payouts. Yet the lower tiers do not offer particularly high payouts compared to other binary options firms and the deposit required for the Gold and Diamond accounts is larger than many traders can afford.

- Copper – Deposit between $0 and $1000, payouts up to 76%

- Bronze – Deposit between $1000 and $2000, payouts up to 77%

- Silver – Deposit between $2000 and $10,000, payouts up to 78%

- Gold – Deposit between $10,000 and $50,000, payouts up to 79%

- Diamond – Deposit between $50,000 and $1,000,000, payouts up to 91%

How To Register For A CloseOption Account

It only takes a few minutes to sign up for a trading account:

- Navigate to the CloseOption website

- Complete the online registration form and click ‘Sign Up’

- Once signed in, click the ‘Trade Room’ icon located in the top right

- Choose a live account or demo profile (your login credentials will work with both accounts)

New users must comply with anti-money laundering and know-your-customer requirements. Traders will need to upload proof of address and identity documents, such as a passport.

To activate your account, click ‘Settings’ from the dashboard interface and select ‘Account Approval’. It can take up to two working days for a new account to be approved.

Demo Account

CloseOption offers a free demo account which can be used alongside a live profile. The brand offers $100,000 in virtual funds so beginners can get familiar with the trading platform and learn how binary options work.

Importantly, all the platform features and functionality mirror live trading conditions including the range of expiry times, forex and crypto assets, plus payouts.

Select ‘Go To Demo Trading’ from the trade room interface to open the paper trading profile.

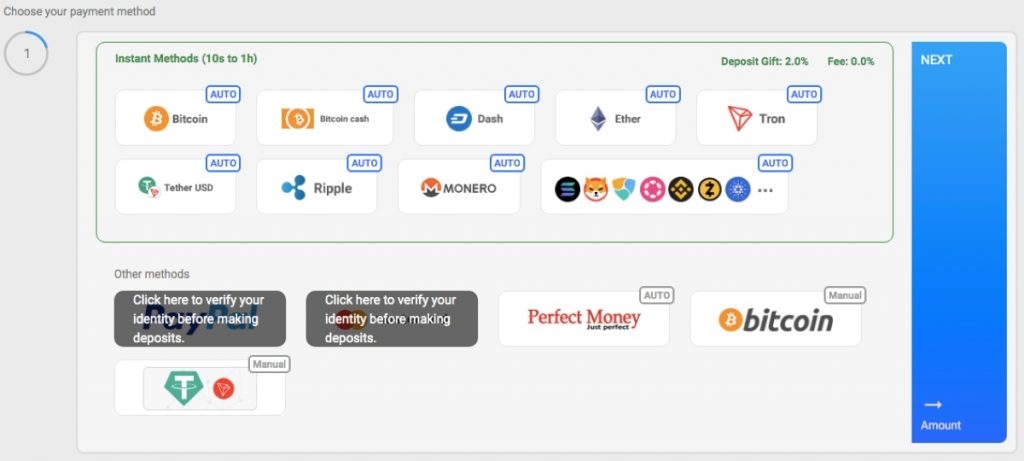

CloseOption Payment Methods

Deposits

CloseOption offers a good selection of payment methods:

- PayPal

- Mastercard

- Perfect Money

- Crypto transfers including Bitcoin, Dash, Ripple, and Ethereum

There is only a $5 minimum deposit which makes it easy for beginners to sign up and start trading binary options.

All payment methods are fee-free except for bank cards that are charged 8.4%, though this charge is often waived as part of promotions. Deposit solutions also provide instant funding, though crypto transfers can take up to 30 minutes.

How To Make A Deposit

Traders can deposit in a few straightforward steps:

- Log in to the CloseOption client dashboard

- Select ‘Deposit’ from the menu on the left

- Choose a payment method from the list and click ‘Next’

- Input the deposit amount and decide if you want to accept a bonus reward (if available)

- Click ‘Next’

- Enter the requested payment details and select ‘Confirm’

Note, PayPal and Mastercard deposits are not accepted until KYC verification is complete.

Withdrawals

In line with other binary options brokers, withdrawals must be made back to the original payment method or via wire transfer.

The minimum withdrawal is low at $1 for Perfect Money and cryptos, while the minimum payment for Mastercard withdrawals is $20. Bank wire transfers have a minimum withdrawal requirement of $500.

There is a maximum withdrawal limit of $10,000 for all methods, though there is no limit on the number of withdrawal requests that can be made each day.

CloseOption processes withdrawals within three working days, regardless of the payment method. This is similar to alternative brands.

Fees do not apply for the majority of payment methods, however depending on the amount, bank wire transfers may be charged $50 to $100. This is a notable drawback and may cut into the profits of account holders.

Bonuses & Promotions

CloseOption scores well in terms of trading promotions. Weekly contests are held using $10,000 in virtual funds. Traders can sign up through the client dashboard, though there is a $5 entry fee. Prizes up to $1000 are available with a total prize pot of $3000 per week and $12,000 per month.

While using CloseOption, our experts also found that a $10 cash gift is available to new clients plus a 44% deposit bonus which can be withdrawn once a 20x transaction volume has been achieved.

CloseOption Regulation

CloseOption states that its trading activities are regulated by the National Bank of Georgia. However, this is a national bank which does not have robust powers to govern binary options brokers and ensure that customers are safeguarded.

With this in mind, make sure you take a sensible approach to risk and money management.

Additional Features

CloseOption hosts a ‘knowledgebase’ education hub with regularly updated content. Topics include developing a trading strategy and understanding technical indicators.

Our traders were also pleased to find platform tutorials with guidance on how to check order history, join a contest, or change the expiry time of a binary options contract.

On the downside, there is no copy trading which is offered by several popular brands, including Pocket Option.

Trading Hours

CloseOption trading hours run from 21:00 UTC Sunday to 21:00 UTC Friday. However, the broker does not offer any weekend trading which is offered by many leading binary options brokers.

Customer Support

CloseOption offers 24/7 customer assistance, which will appeal to beginners and new clients. Round-the-clock support is available via telephone, email, and live chat, though we didn’t get a response upon testing.

- Email – info@closeoption.com

- Phone – +44(20)32902097 or +17068474747

- Online Contact Form – Enquiry message service via the ‘Contact Us’ webpage

- Office Address – Vake-saburtalo district, Al Kazvegi ave. N41 Apt.N19, Tbilisi, Georgia

There is also a detailed FAQ section available on the broker’s website with useful account support and payment guidance.

Security & Safety

Our traders were disappointed with CloseOption’s security measures. We were not offered any additional account verification protection such as two-factor authentication or one-time passwords.

This, alongside the lack of regulation, does pose security concerns. It is also worth noting that once orders are placed, they cannot be canceled.

CloseOption Verdict

CloseOption offers a beginner-friendly platform, 24/7 customer support, and weekly trading contests with cash prizes. However, the broker offers a fairly narrow range of assets with limited regulatory oversight or tools like copy trading. Yet the main drawback is that a large deposit is needed to unlock favorable payouts.

FAQs

Is CloseOption Legit Or A Scam?

CloseOption is a legitimate binary options broker, registered in Georgia. Although the firm is currently unregulated by a reputable trading watchdog, CloseOption does comply with anti-money laundering and know-your-customer policies. Retail investors can speculate on 25+ assets with payouts of up to 95% on a secure platform.

How Much Do I Need To Deposit At CloseOption?

CloseOption has a $5 minimum deposit requirement, which reduces barriers to entry for novice traders. The minimum investment amount is also just $1, which will appeal to those on a budget.

Is CloseOption A Good Binary Options Broker?

CloseOption runs regular trading contests and offers a user-friendly platform with a low minimum deposit. However, traders need to deposit $50,000 for the best payouts and there are no opportunities on stocks, indices, or commodities. Signals and copy trading tools are also not provided.

Does CloseOption Offer Leverage?

CloseOption does not offer leveraged trading, unlike some alternatives that offer multipliers. Instead, all binary options positions must be opened with personal capital.

Does CloseOption Have A Reliable Platform?

CloseOption offers a web-based platform that account holders can use to trade binaries. The platform is reliable and intuitive, with basic analysis features and 15 expiry times. The terminal is compatible with all major web browsers, including Google Chrome and Internet Explorer.

Does CloseOption Have A Mobile App?

No, CloseOption does not offer its own trading app. Having said that, the platform can be accessed via mobile web browsers, with smaller screen compatibility for trade analysis and execution.

Best Alternatives to CloseOption

Compare CloseOption with the best similar brokers that accept traders from your location.

- Videforex – Launched in 2017, Videforex offers access to stock, index, crypto, forex and commodities markets via binary options and CFDs. The proprietary platform, mobile app and integrated copy trading are user-friendly and will suit new and casual traders, and the market analysis tools and trading contests provide good ways to improve your trading skills.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

CloseOption Comparison Table

| CloseOption | Videforex | World Forex | |

|---|---|---|---|

| Rating | 3.8 | 3.5 | 4 |

| Markets | Binary Options on Forex & Cryptos | Binary Options, CFDs, Forex, Indices, Commodities, Crypto | Digital Contracts, Forex, CFD Stocks, Metals, Energies, Cryptos |

| Demo Account | Yes | Yes | Yes |

| Minimum Deposit | $5 | $250 | $1 |

| Minimum Trade | $1 | $0.01 | $1 (Binaries), 0.01 Lots (Forex/CFDs) |

| Regulators | National Bank of Georgia | – | SVGFSA |

| Bonus | 44% Deposit Bonus | 100% Deposit Bonus | 100% Deposit Bonus |

| Platforms | Own | TradingView | MT4, MT5 |

| Leverage | – | 1:2000 | 1:1000 |

| Payment Methods | 9 | 9 | 7 |

| Visit | Visit | Visit | Visit |

| Review | – | Videforex Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by CloseOption and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CloseOption | Videforex | World Forex | |

|---|---|---|---|

| Binary Options | Yes | Yes | Yes |

| Expiry Times | 30 seconds – 1 month | 5 seconds – 1 month | 1 minute – 7 days |

| Ladder Options | No | No | No |

| Boundary Options | No | No | No |

| CFD | No | Yes | Yes |

| Forex | Yes | Yes | Yes |

| Stocks | No | Yes | Yes |

| Commodities | No | Yes | Yes |

| Oil | No | Yes | Yes |

| Gold | No | Yes | Yes |

| Copper | No | Yes | No |

| Silver | No | No | Yes |

| Corn | No | No | No |

| Crypto | Yes | Yes | Yes |

| Futures | No | No | No |

| Options | No | No | No |

| ETFs | No | No | No |

| Bonds | No | No | No |

| Warrants | No | No | No |

| Spreadbetting | No | No | No |

| Volatility Index | No | No | No |

CloseOption vs Other Brokers

Compare CloseOption with any other broker by selecting the other broker below.

Customer Reviews

1.4 / 5This average customer rating is based on 5 CloseOption customer reviews submitted by our visitors.

If you have traded with CloseOption we would really like to know about your experience - please submit your own review. Thank you.

Available in United States

Available in United States

Close option

Close option: The customer service is very good, but the platform itself is incompetent and untrustworthy. Trading without major indicators like:

At least:

– Moving Averages

– Stochastic Oscillator

– Average Directional Index

– Fibonacci Retracement

– Volume, etc.

Charts are limited to a maximum interval of 1 minute, making it nearly impossible to conduct a thorough technical analysis. We’re missing essential time frames like 5-minute, 15-minute, 30-minute, 1-hour, 4-hour, and daily charts. It’s frustrating to see open:” buy, or call ”

“Sell or put” trades ranging from 30 seconds to a month, which showcases a clear double standard. Complete chart reading is critical, yet this option is severely restricted, making it a nightmare for users. It is essentially gambling. I lost $4,500 due to this blind trading system. Unfortunately, it seems that no one within the company has the courage or interest to enhance this platform.

I’ve raised my concerns multiple times, yet I’ve received no adequate response. That’s why I’ve decided to share my experience here. On the other hand, PocketOption is the best broker out there.

CloseOption is fine if you want an easy start up process. I opened an account in literally two minutes and only had to deposit $5. BUT don’t expect a slick trading software – their TradeRoom is a bit basic even if they are adding more indicators and tools which they do a video update on when you go into the platform. The rest of the client area needs a refresh though,. I might try the weekly trading contests because I always see adverts for that. CloseOption are fine for me as a new binary trader, but don’t think I’ll keep using em long term.

Withdrawals won’t be approved.

Been using closeOption.com for about 2 years. Started with 20 and made it grow to $200. Everything was fine until I tried to withdraw. CloseOption.com will purposely deny documents. I have been trying to get my money from them for months. It’s the same process. They claimed my document was not visible, but said my expiration date was expired. I got brand new ID cards and they still refuse to accept them. It’s been 5 months and they still are holding my funds.

Submitted ID cards and Driver License both have barcodes to verify. The files were over 5mb in size so quality isn’t an issue 600 dpi. Also submitted bank statements. All documents had something weird feedback from them. There is no system used for verification, it’s completely manual. No real authentication takes place. No 3rd party involved to check. ITS A SCAM!! It is 3 people in the a “office”. The same 3 people will just saying try again with a different ID or some nonsense.

The company doesn’t have access to any US system to perform the authentication of a document. CloseOption.com is NOT REGULATED by the SEC or any other commonly used regulator.

There is no Registrant Contact, No Technical Contact, or Administrative contact listed on godday whoIS lookup.

Essentially if you/I beat them, they refuse to payout. Also they will message you threats if you post negative comments about them on platforms like this. I have proof of everything.

There is another comment by someone else that is exactly what I described, scroll through the reviews. It is a form of extortion.

Scam withdrawal system. Charts do not use live data. Essentially you are just guessing trades. 5 months of waiting to withdraw $109 still pending.

They move the strike price where they want you to start. Then you are winning the trade and it closing and you lose not even breaking even.