CharterPrime Review 2024

Awards

- Best STP/ECN Broker 2017

- Best Liquidity Provider 2017

- Most Transparent Forex Broker 2017

- Most Transparent Forex Broker 2016

- Best Liquidity Provider 2016

Pros

- I appreciate that Charterprime offers accessible account types with just a $100 minimum deposit, including ECN and swap-free options

- I’m glad to see reliable MT4 integration, plus MAM/PAMM trading facilities and a VPS service for those who require 24/7 uninterrupted connection

- I found a range of free payment methods at Charterprime, including bank wire, credit cards and e-wallets, plus USD, AUD and EUR are supported as account base currencies

Cons

- Charterprime’s primary regulator is located offshore in St Vincent and the Grenadines, with only Australian clients benefitting from ASIC oversight

- It’s disappointing that the minimum withdrawal is $100, plus there is a $40 fee for each withdrawal, which is altogether very steep compared to other brokers

- Unlike most top brokerages, Charterprime doesn’t offer any copy trading solutions for beginners or strategy providers

CharterPrime Review

Established in 2012, CharterPrime is an award-winning global brokerage with a focus on forex trading. With headquarters in Sydney, Australia, the group uses a straight-through-processing system to provide transparent and ethical pricing for clients.

This 2024 review will lay out all you need to know before deciding whether CharterPrime meets your trading needs, covering the assets the broker offers and fees charged, as well as a step-by-step guide on how to use the platform and place trades.

Key Takeaways

- Clients can trade popular markets on the reliable MT4 and MT5 platforms

- CharterPrime is regulated by the ASIC and uses segregated accounts

- The broker has won multiple awards for its liquidity services

- CharterPrime offers a relatively narrow range of investments vs competitors with no cryptos

Company Details & Overview

Registered as an International Business Company of St. Vincent and the Grenadines Financial Services Authority (SVGFSA), CharterPrime began offering trading services in 2012. The company is also regulated by the reputable Australian Securities & Investments Commission (ASIC).

With offices in Sydney, Australia, St. Vincent and the Grenadines, and Hong Kong, the brokerage accepts clients from around the world and has customer support available every day from (GMT+0) 01:00 – 16:00.

The online broker offers more than 40 forex pairs, 3 precious metals, 15 index CFDs, and 2 spot commodities.

CharterPrime Platforms

CharterPrime offers two of the leading retail trading platforms – MetaTrader 4 and MetaTrader 5.

MT4 is the world’s most widely used trading platform and was created specifically with forex traders in mind. MT5 was designed for all types of trading including non-forex CFDs. MT5 also allows for better back-testing of programmed indicators and has a Depth of Market (DOM) functionality which allows clients to see the market liquidity of an asset.

Both trading platforms offer at least 30 built-in indicators and an unlimited number of charts. However, MT4 offers 24 analytical objects whereas MT5 offers 44.

CharterPrime also offers a multi-account management plug-in, enabling PAMM/MAM technology for traders that manage multiple profiles.

How To Place A Trade On CharterPrime

- Open the MT4 or MT5 trading platform on your computer or mobile device

- From the menu select ‘New Order’ or enable one-click trading

- Choose the asset you wish to trade, e.g. EUR/USD

- Fill out information when prompted (the order type, any stop loss or take profit orders, the position size, any comments)

- Place the order

Assets & Markets

CharterPrime offers a relatively narrow list of trading instruments vs alternatives. There is no cryptocurrency or stocks and a limited selection of commodities.

Available assets:

- 45 forex pairs – EUR/USD, GBP/JPY, and GBP/USD, plus exotic pairs, such as USD/HKD and SGD/JPY

- 15 CFD indexes – US Wall Street 30, Australian 100, and UK 100

- 2 commodities – UK Brent crude oil and US Light Sweet crude oil

- 3 precious metals – platinum, silver, and gold

Fees & Spreads

CharterPrime offers low spreads, with its standard offering, the ECN account, supplying spreads from 0.0pips.

However, the lowest minimum spread on a variable account is 1.5 pips for EUR/GBP, 2.4 pips for XAU/USD, 2.7 pips for GBP/JPY, and 1.8 pips for AUD/USD. These are not particularly low spreads vs competitors.

Commissions are not charged on variable accounts but are $8 per lot for ECN accounts and $40 per lot every Wednesday for swap-free accounts.

The minimum deposit for all accounts is $100 and the minimum trade size for all accounts is 0.01 lots.

When hedging, clients are not required to pay a margin fee.

Unfortunately, there are relatively steep payment fees, broken down in more detail further below.

Leverage Review

There is a maximum leverage of 1:100 on accounts offered by CharterPrime Australia, available to wholesale traders only. The specific leverage will depend on the asset you are trading – for example, forex usually has higher maximum leverage than indexes. This is dependent on regulations.

CharterPrime’s international brokerage offers higher leverage rates, with leverage of up to 1:500. Traders will have a choice between 1:50, 1:100, 1:200, 1:300 and 1:400 leverage during the sign-up process.

CharterPrime Mobile App

Both MT4 and MT5 are available to download onto your mobile device. This allows for trading and monitoring your positions on the go. You will have access to all the same features, such as indicators and charts, just on a smaller screen. However, this may limit the number of charts you can view well at the same time.

We liked that CharterPrime also has a QR code on its website so you can download the MetaTrader app with ease.

CharterPrime Accounts

CharterPrime Australia offers individual margin FX and CFD accounts as well as joint, company and trust and superannuation fund accounts.

Traders are given a choice of leverage from 1:10 through 1:25, 1:50 and a maximum of 1:100. They will also be asked to choose the native currency for their account, with USD, AUD, EUR, SEK and GBP available.

Bear in mind that this review focuses on the broker’s original Australian offering, but we will also touch on CharterPrime’s Hong Kong-based branch, which offers some different account options. In this case, users choose between 1:50, 1:100, 1:200, 1:300 and 1:400 leverage at sign-up and may be able to take advantage of a maximum of 1:500 leverage.

They can also choose between an account with a variable spread, an ECN account with a lower spread and an $8 commission per lot, and a swap-free account with a higher spread.

How To Create A Live CharterPrime Account

- Use the “Visit” button at the top or bottom of this CharterPrime account

- Click “Open Live Account”

- Register your personal details

- Disclose your country of tax residence and tax ID number if applicable

- Choose your preferred maximum leverage

- Complete a questionnaire to prove your trading knowledge and experience

- Choose a password

- Review the trading platform agreement, risk disclosure statement and other documents sent to your email address

- Consent to a credit reporting agency check on your personal details

- Enter the PIN sent to your email address to confirm your application submission

Demo Account

While using CharterPrime, we found the broker also offers a demo account, which involves downloading and running a setup file that is compatible only with Windows.

Signing up for a CharterPrime demo account may involve KYC verification (uploading ID and proof) and waiting for your account to be activated, which can take 1 working day.

MT4 and MT5 also offer demo accounts via the MetaTrader website, so if you want to practise using these platforms, you can create a demo account there.

Payment Methods

CharterPrime offers a good range of payment methods. In fact, there are seven ways of making deposits or withdrawals from your live account. These are Bitcoin, Tether, Wire Transfer, Union Pay, Skrill, Neteller, and Local Gateway.

Deposits for all except wire transfers have a processing time of up to 1 day – with wire transfers being 3–5 days. Withdrawals for wire transfers and Union Pay process in 3–5 days. All other payment methods take up to 3 days. The minimum withdrawal for all payment methods is $100.

There are typically no deposit fees for CharterPrime, although you are encouraged to contact your bank regarding fees when using a Wire Transfer to make a deposit.

Withdrawals are free for Bitcoin, Union Pay, and Local Gateway. But on the downside, Neteller charges 2% per transaction to a maximum of $30, Skrill charges 1% per transaction, Wire Transfer comes with a $40 fee, and payment via Tether is accompanied by a 0.5% or $5 fee.

How To Make A Deposit

- Login to the CharterPrime client portal

- Navigate the page to ‘Funding’

- Select your payment method and input your deposit amount ($100 minimum)

- Confirm the deposit and enter any security code prompts

CharterPrime Bonuses

Our experts were not able to find any bonuses or promotions offered by CharterPrime. This is a drawback vs alternative brokers, however, it is also fairly standard among regulated broker-dealers.

Regulations & Licensing

CharterPrime Pty Ltd is regulated by the Australian Securities and Investments Commission ASIC (AFSL #421210) and St. Vincent and the Grenadines Financial Services Authority (SVGFSA) with registration number 22717 IBC 2015.

The ASIC is a trusted regulatory body which implements strict regulations on its license holders. This includes the separation of company and client funds, anti-money laundering policies, and negative account protection for retail traders. ASIC oversight is also a reassuring sign that the brand is legitimate and trustworthy.

Additional Features

Virtual Private Server (VPS)

CharterPrime’s international entity provides a rundown of several different server types that will be of interest to high-frequency, professional or semi-pro traders who require lightning-fast response times from their trading software.

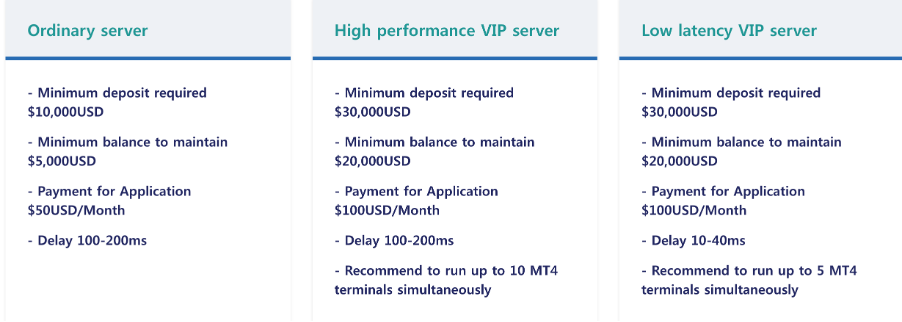

If traders meet the requirement, they can apply for access to the CharterPrime VPS. This is a virtual server open 24/7, for uninterrupted and secure trading. There are three different servers available; ordinary, high-performance VIP, and low-latency VIP.

The ordinary server costs 50 USD monthly and requires a minimum deposit of 100,000 USD, as well as a minimum account balance of 5,000 USD. This is in return for a maximum server delay of 100-200ms.

Both VIP server types have a minimum deposit of 30,000 USD and need to maintain a minimum balance of 10,000 USD. The cost is 100 USD/month.

Client Resources

Traders have access to an economic calendar, market news, and technical insights on the CharterPrime website. Market insights come in downloadable PDFs indicating any extreme highs or lows of assets, or any significant changes.

But while these are useful trading tools, the broker does fall short when it comes to educational materials and training content.

Trading Hours

- Forex: 24 hours a day

- Precious Metals: 22:00-21:00 GMT – subject to daylight savings and global holidays

- CFD Indexes: Dependant on the index and its global market, for example, 00:15-20:00 GMT for Euro STOXX 50 and German DAX 30, 06:00-20:00 GMT for French CAC 40 and Dutch 25, and 22:00-20:15, 20:30-21:00 for all US indexes, including the SPX 500, the US 2000, and US Tech 100

- Spot Commodities: 01:00-22:00 for UK Brent Crude Oil, and 23:00-22:00 for US Light Sweet Crude Oil

Customer Support

Customer services are contactable via email and an online form on the CharterPrime website. However, when we used CharterPrime, we were disappointed not to see any live chat assistance, which is offered as standard by most top trading firms. This is a notable drawback for beginners.

- Working Hours: Sydney AEST 11:00 – 02:00 or (GMT+0) 01:00 – 16: 00

- Email: enquiry@charterprime.com

Safety & Security

As CharterPrime is regulated by the ASIC, you can rest assured that the brokerage is implementing steps to keep your data and money safe.

To maintain extra vigilance, follow basic safety steps such as keeping your password to your trading account to yourself, setting up Face ID or Touch ID verification for trading on your mobile device, and setting up 2-factor authentication on your trading account.

CharterPrime Verdict

CharterPrime is a trusted broker, located in Sydney, Australia and also registered in St. Vincent and the Grenadines. It offers a variety of assets and allows traders to use MT4 and MT5 as their trading platforms. With transparent fees and the chance to use their VPS, CharterPrime is a good broker to create an account with.

However, it’s worth pointing out that the lack of crypto investing and live chat support may deter some budding traders. There are also limited educational tools for new traders.

FAQs

Is CharterPrime A Good Broker For Day Trading?

CharterPrime is a good option for active traders due to the low fees with the ECN account and VPS that allows clients to run strategies around the clock. High leverage and the reliable MT4 and MT5 platforms will also meet the needs of most day traders.

Is CharterPrime Legit Or A Scam?

CharterPrime is a reputable broker regulated by the Australian Securities & Investments Commission (ASIC). On the downside, the global entity is authorized by the St. Vincent and the Grenadines Financial Services Authority (SVGFSA), which is less reputable. Still, our experts found that the brokerage is trustworthy and uses several safeguarding measures, including negative balance protection and segregated accounts.

Does CharterPrime Offer Demo Trading?

CharterPrime does offer a demo account. You need to complete the sign-up process which includes entering your basic details, as well as completing KYC verification and waiting for your account to be activated.

Is CharterPrime Suitable For Muslim Traders?

Yes, CharterPrime international offers an Islamic account in the form of a swap-free account. There will be no swap fees, however, there are higher minimum spreads and a $40 per lot commission every Wednesday for this account type.

Can I Open Multiple Accounts With CharterPrime?

No – clients can only open one account. To enforce this, you are required to complete full KYC verification and upload proof of identity before every account is activated.

Can I Trade With CharterPrime From The UK?

Yes – CharterPrime accept clients from all over the world, including the UK, Australia, and Malaysia. Note, the entity you sign up with will vary depending on your location, along with the regulatory oversight.

Top 3 Alternatives to CharterPrime

Compare CharterPrime with the top 3 similar brokers that accept traders from your location.

- IG – Founded in 1974, IG is part of IG Group Holdings Plc, a publicly traded (LSE: IGG) brokerage. The brand-US offers spread betting, CFD and forex trading across an almost unrivalled selection of 17,000+ markets, with a range of user-friendly platforms and investing apps. For 50 years, IG has maintained its position as an industry leader, excelling in all key areas for traders.

- Interactive Brokers – Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- World Forex – World Forex is an offshore broker registered in St Vincent and the Grenadines, offering commission-free trading with a $1 minimum deposit and 1:1000 leverage. Digital contracts are also available, offering beginners a straightforward way to speculate on popular financial markets.

CharterPrime Comparison Table

| CharterPrime | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| Rating | 2.8 | 4.4 | 4.3 | 4 |

| Markets | CFDs, Forex, Commodities, Metals | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures, Options, Crypto, Spread Betting | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies | Forex, CFD Stocks, Metals, Energies, Cryptos, Digital Contracts |

| Demo Account | Yes | Yes | Yes | Yes |

| Minimum Deposit | $100 | $0 | $0 | $1 |

| Minimum Trade | 0.01 Lots | 0.01 Lots | $100 | 0.01 Lots |

| Regulators | ASIC, SVGFSA | FCA, ASIC, NFA, CFTC, DFSA, BaFin, MAS, FSCA, FINMA, CONSOB | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA | SVGFSA |

| Bonus | – | – | – | 100% Deposit Bonus |

| Education | No | Yes | Yes | No |

| Platforms | MT4, MT5 | Web, ProRealTime, L2 Dealer, MT4, AutoChartist, TradingCentral | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, eSignal, TradingCentral | MT4, MT5 |

| Leverage | 1:500 (Location Dependent) | 1:30 (Retail), 1:250 (Pro) | 1:50 | 1:1000 |

| Payment Methods | 5 | 6 | 6 | 10 |

| Visit | Visit | Visit | Visit | Visit |

| Review | – | IG Review |

Interactive Brokers Review |

World Forex Review |

Compare Trading Instruments

Compare the markets and instruments offered by CharterPrime and its competitors. Please note, some markets may only be available via CFDs or other derivatives.

| CharterPrime | IG | Interactive Brokers | World Forex | |

|---|---|---|---|---|

| CFD | Yes | Yes | Yes | Yes |

| Forex | Yes | Yes | Yes | Yes |

| Stocks | Yes | Yes | Yes | Yes |

| Commodities | Yes | Yes | Yes | Yes |

| Oil | Yes | Yes | No | Yes |

| Gold | Yes | Yes | Yes | Yes |

| Copper | No | Yes | No | No |

| Silver | Yes | Yes | No | Yes |

| Corn | No | No | No | No |

| Crypto | No | Yes | Yes | Yes |

| Futures | No | Yes | Yes | No |

| Options | No | Yes | Yes | No |

| ETFs | No | Yes | Yes | No |

| Bonds | No | Yes | Yes | No |

| Warrants | No | Yes | Yes | No |

| Spreadbetting | No | Yes | No | No |

| Volatility Index | No | Yes | No | No |

CharterPrime vs Other Brokers

Compare CharterPrime with any other broker by selecting the other broker below.

Available in United States

Available in United States

Customer Reviews

There are no customer reviews of CharterPrime yet, will you be the first to help fellow traders decide if they should trade with CharterPrime or not?